In India, accelerated financial inclusion has played a key role in reducing inequalities across the country. By making banking services, digital payments, and affordable credit accessible to millions of people, especially in rural areas, more individuals now have the opportunity to participate in the economy. This shift has empowered previously underserved communities, helping to bridge the gap between the rich and the poor. As more people gain access to financial tools and resources, they can better manage their money, invest in education and businesses, and improve their overall quality of life, contributing to a more inclusive and equitable society.

Tags: GS-3, Economy–Banking Sector & NBFC–Inclusive Growth, GS-2,SelfHelpGroups (SHGs)-E-Governance— Government Policies & Interventions

For Prelims: Financial Inclusion, PMJDY, UPI), DBT, PMSBY, PMJJBY, APY, Payment banks, Small Finance Banks, Microfinance Institutions, Micro, Small, Medium Enterprises(MSMEs).

For Mains: Significance of Financial Inclusion for Inclusive Growth and Upliftment of Vulnerable Sections.

Contents

Context:

- Financial inclusion is vital for economic development, focusing on providing accessible and affordable financial services to all, particularly marginalised and low-income groups.

- In India’s vast and diverse population, achieving universal financial access presents significant challenges and opportunities.

- Beyond just bank accounts, financial inclusion involves services like savings, credit, insurance, and digital payments tailored to various societal needs.

- Over the past decade, India’s financial inclusion efforts, through initiatives like PMJDY and UPI, have transformed its financial landscape, aiming to empower individuals, reduce poverty, and drive inclusive growth.

What is Financial Inclusion?

About:

- Financial Inclusion is the process of providing vulnerable groups, such as weaker sections and low-income individuals, with access to essential financial products and services at an affordable cost, ensuring transparency and fairness.

- It goes beyond merely opening bank accounts, encompassing a comprehensive range of services, including savings, credit, insurance, investments, pensions, payment services, and financial advice, tailored to meet the diverse needs of all segments of society.

Scope of Financial Inclusion: The scope of financial inclusion is broad and includes:

- Banking Services: Ensuring access to basic banking services such as savings and checking accounts.

- Credit Facilities: Providing access to loans and credit products for personal and business use.

- Insurance Products: Offering insurance coverage to protect against various risks.

- Investment Options: Enabling individuals to invest in financial instruments that suit their needs.

- Pension Schemes: Providing retirement savings options.

- Payment and Remittance Services: Facilitating domestic and international payments and transfers.

- Financial Advisory Services: Offering guidance on financial planning and management.

Key Components:

- Access to Financial Services: Ensuring that financial services like banking, insurance, and credit are accessible to everyone, particularly in underserved areas. This includes both physical branches and digital financial services.

- Affordability: Keeping financial products and services priced within reach for all segments of society, especially low-income groups, to avoid financial exclusion due to high costs.

- Financial Literacy: Educating individuals on financial products, services, and effective financial management, empowering them to make informed decisions regarding savings, investments, and credit use.

- Usage: Encouraging the active use of financial services, ensuring that individuals not only have access but also utilise these services for financial stability and growth.

Importance of Financial Inclusion:

- Economic Empowerment: Financial inclusion equips individuals and small businesses with the tools to manage finances, save, and access credit, boosting economic activity and productivity.

- Poverty Reduction: Access to financial services reduces poverty by enabling secure savings and credit for investments in education, healthcare, and small businesses, reducing vulnerability to economic shocks.

- Formalization of the Economy: Integrating more individuals and businesses into the formal financial system reduces the informal economy, enhancing transparency, tax collection, and economic policy implementation.

- Enhanced Financial Stability: A broad base of depositors and borrowers strengthens the financial system by diversifying risks, reducing the impact of economic shocks.

- Improved Government Service Delivery: Financial inclusion ensures efficient and transparent delivery of government services like Direct Benefit Transfers (DBT), minimising leakages and delays.

- Gender Equality: Financial inclusion promotes gender equality by giving women access to financial services, empowering them economically and socially.

- Digital Transformation: Financial inclusion drives digital innovation, enhancing service delivery and spurring broader technological advancements in the economy.

- Social Inclusion: Access to financial services fosters dignity and integration for marginalised groups, promoting social cohesion and reducing inequalities.

Current State of Financial Inclusion in India:

- Overall Progress: Since the launch of Pradhan Mantri Jan Dhan Yojana (PMJDY), financial inclusion in India has seen substantial growth. The proportion of adults with formal financial accounts increased from around 50% in 2011 to over 80% in 2024.

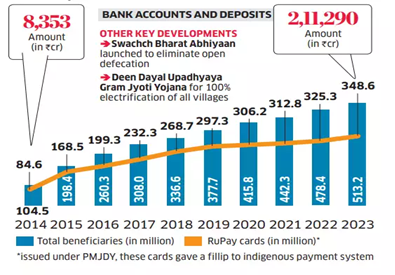

- Account Statistics: As of August 2024, PMJDY accounts have reached 53.13 crore, a significant rise from 14.7 crore in March 2015.

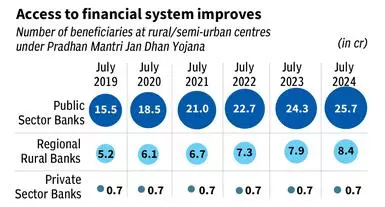

- Banking Sector Involvement: Public sector banks have been pivotal, managing approximately 78% of PMJDY accounts.

- Gender Distribution: Women hold 55.6% of these accounts, amounting to 29.56 crore.

- Rural and Semi-Urban Areas: Around 66.6% of PMJDY accounts are located in rural and semi-urban regions.

- Digital Transactions: UPI transactions grew by 3.95% in July 2024, with a 2.84% increase in transaction value.

Financial Inclusion Initiatives in India

- Pradhan Mantri Jan Dhan Yojana (PMJDY): Launched in 2014, PMJDY provides universal banking access, with zero balance accounts, accident insurance, and overdraft facilities.

- Micro-Insurance and Micro-Pension Schemes: Includes Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Atal Pension Yojana (APY) offering low-cost insurance and pensions.

- Other Financial Inclusion Initiatives: Schemes like Pradhan Mantri Vaya Vandana Yojana (PMVVY), Pradhan Mantri Mudra Yojana (PMMY), and Stand Up India Scheme support financial independence and inclusive growth.

- JAM Trinity: Combining Jan Dhan, Aadhaar, and Mobile, this framework improves financial inclusion, enabling direct benefit transfers and efficient service delivery.

- Expanding Banking System: Payment banks, small finance banks, and priority sector lending extend financial services, supporting broader economic participation.

- Digital Payments and FinTech: Digital innovations like UPI, BHIM, RuPay Cards, and Aadhaar Enabled Payment System (AEPS) drive financial inclusion, enhancing access and efficiency.

- Microfinance Institutions (MFIs) and Self-Help Groups (SHGs): MFIs and SHGs provide credit to underserved communities, especially in rural areas, fostering financial empowerment.

- Financial Literacy Programs: Programs like the Financial Education Programme for Adults (FEPA) and initiatives by the National Centre for Financial Education (NCFE) aim to improve financial literacy and ensure effective use of financial services.

Challenges Associated with Financial Inclusion:

- Digital Divide: India’s vast geography and rural areas suffer from inadequate internet connectivity, limiting access to digital financial services. With internet penetration at only 52%, many rural areas remain underserved.

- Financial Literacy: Low financial literacy, especially in rural and low-income populations, hampers the effective use of financial services, leading to poor financial decision-making.

- Gender Gap: Women face additional barriers to financial inclusion due to social and cultural factors. For instance, only 33% of women use the internet compared to 57% of men, limiting their access to digital financial services.

- Difficult KYC Norms: Stringent Know Your Customer (KYC) requirements create barriers for individuals, particularly migrants and those in the informal sector, who struggle to provide necessary documentation.

- Last-Mile Connectivity: Consistent availability of banking services in remote areas is a challenge, with irregular visits by banking correspondents and non-functional ATMs affecting service quality.

- Credit Access for MSMEs: Micro, Small, and Medium Enterprises (MSMEs) often face challenges in accessing formal credit due to a lack of collateral, credit history, and complex loan application processes.

- Cybersecurity Concerns: The rise of digital financial services has led to increased cybersecurity risks. With a 24.4% surge in cybercrime cases in 2022, digital fraud and limited cybersecurity awareness remain significant challenges.

Way Forward

- Strengthen Digital Infrastructure: Expand internet connectivity through initiatives like BharatNet and public Wi-Fi in rural areas, while encouraging private investment in telecom infrastructure.

- Enhance Financial Literacy Programs: Improve financial literacy to empower users with knowledge of digital financial services and cybersecurity, especially in remote and underserved areas.

- Leverage Technology for Last-Mile Connectivity: Utilise blockchain for secure transactions, AI for credit scoring, and voice-based interfaces to overcome literacy barriers.

- Focus on Women and Rural Populations: Develop gender-sensitive financial products, microcredit, and savings schemes tailored to women and rural populations, and implement targeted policies to bridge the gender gap in financial inclusion.

- Simplify KYC Norms: Introduce video KYC for remote account opening, create a unified KYC system, and develop alternative methods for those lacking traditional documents.

- Strengthen the Banking Correspondent Model: Improve training, incentives, and service offerings for Banking Correspondents, and enhance monitoring to ensure last-mile banking access.

- Credit Histories and Data Sharing: Enhance online credit history systems, enabling individuals to build credit histories and encouraging financial institutions to extend credit to underserved areas.

Conclusion

India’s journey toward financial inclusion is marked by progress and ongoing challenges. Bridging gaps in infrastructure, financial literacy, and access for underserved segments is crucial for achieving true financial inclusion. A continued focus on innovation, tailored solutions, and building trust in the formal financial system will be key to fostering meaningful financial empowerment and driving equitable economic growth.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims:

Q:1 With reference to India, consider the following: (2010)

- Nationalisation of Banks

- Formation of Regional Rural Banks

- Adoption of village by Bank Branches

Which of the above can be considered as steps taken to achieve the “financial inclusion” in India?

- 1 and 2 only

- 2 and 3 only

- 3 only

- 1, 2 and 3

Ans: (d)

Mains:

Q:1 Pradhan Mantri Jan Dhan Yojana (PMJDY) is necessary for bringing unbanked to the institutional finance fold. Do you agree with this for financial inclusion of the poorer section of the Indian society? Give arguments to justify your opinion.(2016)

Source: IE

To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

- Join our Main Telegram Channel and access PYQs, Current Affairs and UPSC Guidance for free – Edukemy for IAS

- Learn Economy for free- Economy for UPSC

- Learn CSAT – CSAT for UPSC

- Mains Answer Writing Practice-Mains Answer Writing

- For UPSC Prelims Resources, Click here