The Report on Currency and Finance (RCF) 2023-24 provides a comprehensive analysis of India’s economic and financial landscape. This report, published by the Reserve Bank of India (RBI), examines various aspects of the economy, including currency trends, inflation rates, and financial stability. It offers insights into the country’s economic health, highlights challenges, and suggests policy recommendations to ensure sustainable growth. The RCF serves as a valuable resource for policymakers, economists, and anyone interested in understanding the current state and future prospects of India’s economy.

Tags: GS-3, Economy- oath & Development- Inclusive Growth- RCF Report

Contents

- 0.1 Why in the News?

- 0.2 What is the Report on Currency and Finance?

- 0.3 Key Highlights from the Report on Currency and Finance 2023-24:

- 0.4 Internationalisation of Digital Public Infrastructure (DPI):

- 1 India’s Digital Revolution:

- 2 UPSC Civil Services Examination Previous Year Questions (PYQs)

- 3 FAQs

- 4 To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

Why in the News?

- According to the “Report on Currency and Finance (RCF) for the year 2023-24,” released by the Reserve Bank of India (RBI), India’s digital economy is projected to comprise 20% of the country’s GDP by 2026, up from its current contribution of 10%.

- This projection highlights the transformative potential of digitalization in finance and its significant impact on India’s economic landscape.

What is the Report on Currency and Finance?

- About:

- The “Report on Currency and Finance” is an annual publication by the Reserve Bank of India (RBI).

- It provides a comprehensive analysis of various aspects of the Indian economy and financial system.

- Theme:

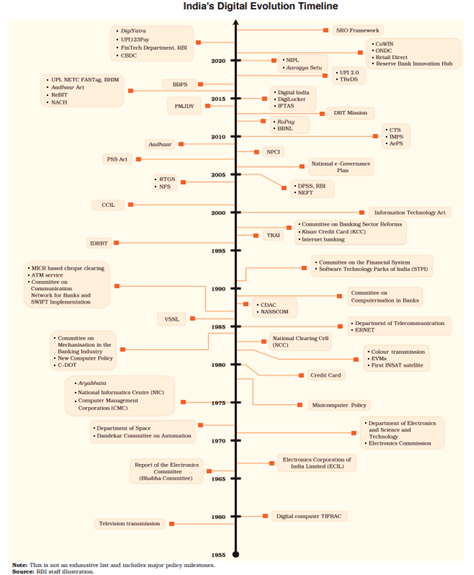

- The theme for the report is “India’s Digital Revolution.”

- It examines the transformative effects of digitalization across different sectors in India, with a particular focus on the financial sector.

- Dimensions:

- The report outlines how digital technologies are transforming economic growth, financial inclusion, public infrastructure, and regulatory frameworks.

- It also addresses the opportunities and challenges associated with these changes.

Key Highlights from the Report on Currency and Finance 2023-24:

Expansion of Financial Services:

- Technological advancements have significantly enhanced the depth and scope of digital financial services.

- The report identifies high potential for further financial inclusion in India through the application of digital technologies.

- Progress in financial inclusion is reflected in the Reserve Bank’s Financial Inclusion Index and a reduction in account access disparities between income groups.

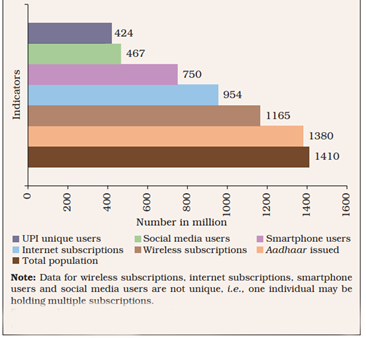

- In rural areas, 46% of the population are wireless phone subscribers, and 54% are active internet users.

- More than half of FinTech users and over a third of digital payment users are from semi-urban and rural areas, indicating potential for increased digital penetration and bridging the rural-urban divide.

- Over two lakh gram panchayats have been connected through BharatNet in the past decade, facilitating e-health, e-education, and e-governance services in rural regions.

Mobile Penetration:

- Internet penetration in India stood at 55% in 2023, with the internet user base growing by 199 million in the last three years.

- India has the lowest global cost per gigabyte (GB) of data at an average of Rs. 13.32 per GB.

- The country also ranks among the highest in global mobile data consumption, with an average per-user per-month usage of 24.1 GB in 2023.

- India has approximately 750 million smartphone users, a number expected to reach around one billion by 2026.

- India is anticipated to become the second-largest smartphone manufacturer globally within the next five years.

Digital Economy:

- Current Contribution: The digital economy currently constitutes 10% of India’s GDP.

- Future Projection: By 2026, this contribution is projected to double, reaching 20% of GDP. This growth is attributed to rapid advancements in digital infrastructure and financial technology.

- Impact: Digitization is enhancing banking infrastructure and public finance systems, leading to more efficient direct benefit transfers and tax collections.

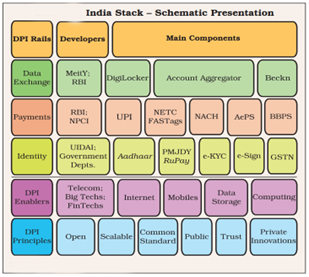

India Stack:

Components:

- Aadhaar: The largest biometric-based identification system globally, with coverage for 1.38 billion ID holders.

- Unified Payments Interface (UPI): A real-time, low-cost transaction platform that has experienced a tenfold increase in transactions over the past four years, significantly contributing to financial inclusion.

- DigiLocker: A cloud-based storage system that offers secure access to documents and streamlines service delivery.

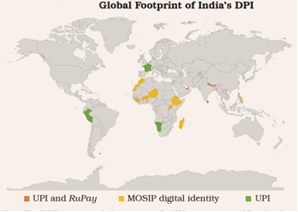

Internationalisation of Digital Public Infrastructure (DPI):

- Digital Identity Solutions:

- India is collaborating with other nations to develop digital identity solutions through the Modular Open-Source Identity Platform (MOSIP) programme.

- Interlinkage of Payment Systems:

- The Unified Payments Interface (UPI) is being integrated with fast payment systems in other countries, including Singapore’s PayNow, the United Arab Emirates’ (UAE) Instant Pay Platform (IPP), and Nepal’s National Payments Interface (NPI), to facilitate cost-effective and rapid remittances.

- Expansion of UPI and RuPay:

- India is partnering with central banks and foreign payment service providers to extend the acceptance of UPI and RuPay beyond its borders.

- This includes countries such as Bhutan, Mauritius, Singapore, and the UAE.

- Beckn Protocol Sharing:

- The Beckn protocol is being shared with other nations to enable the provision of public and private services through open, lightweight, and decentralised specifications.

- This protocol supports the creation of open, peer-to-peer decentralised networks for cross-sector economic transactions.

India’s Digital Revolution:

Challenges Posed by Digitalisation:

- Impact on Financial Markets:

- Digitalisation introduces complex financial products that can impact market stability, with digital players and unreliable funding models increasing system vulnerabilities.

- Fear of Monopolisation:

- While UPI applications have increased customer options, a few applications dominate transactions. To address this, NPCI limits market share for individual providers to 30% by December 2024.

- Cybersecurity Challenges:

- The rise in digitalisation has led to a sharp increase in cybersecurity incidents, with CERT-In reporting over 1.32 million incidents in 2023. Data breaches cost an average of USD 2.18 million in India.

- Consumer Protection Issues:

- Digitalisation has led to deceptive practices (“dark patterns”) and raised concerns about data protection and privacy, potentially compromising consumer trust.

- Transformation of Workforce Composition:

- Digital technologies are altering job quality, skill requirements, and labour policies. AI in financial services shifts roles to higher-skilled tasks, automating routine functions and aiding decision-making.

- Sector Changes (2013-2019):

- Support roles in the financial sector declined, while the number of professionals and technicians increased.

- Challenges in Private Sector Banks:

- High turnover rates in private sector banks in 2022-23 pose risks, including loss of institutional knowledge and increased recruitment costs.

Steps Taken to Address Challenges:

- Financial and Digital Inclusion:

- Digital Banking Units (DBUs) have been established.

- Enhanced UPI with offline and conversational payments in local languages.

- Payment Infrastructure Development Fund (PIDF) launched to expand payment infrastructure.

- Digitalisation of agricultural finance is in progress.

- Customer Protection:

- RBI issued Guidelines on Digital Lending to improve loan servicing, disclosures, grievance redressal, credit assessment standards, and data privacy.

- Reserve Bank-Integrated Ombudsman Scheme (RB-IOS) enhances grievance redress mechanisms.

- Public awareness campaigns like ‘RBI Kehta Hai’ and e-BAAT programme educate on digital payment products and fraud prevention.

- Data Protection:

- Data localisation for payments data has been implemented.

- Guidelines prevent digital lending apps from accessing private information without explicit user consent.

- Card-on-file tokenization (CoFT) introduced to enhance digital payment security.

- Cyber Security:

- Two-factor authentication and increased customer control over card usage have been promoted.

- Faster turnaround times for transaction failures and increased supervisory oversight have been implemented.

- Comprehensive guidelines for IT and Cyber Risk management issued by the RBI.

- FinTech Regulation:

- RBI launched the Regulatory Sandbox scheme, Reserve Bank Innovation Hub, and FinTech Hackathons to foster FinTech innovations.

- Digital Technologies in Regulation and Supervision:

- Digital tools like DAKSH system are used to enhance supervisory processes.

- Integrated Compliance Management and Tracking System (ICMTS) and Centralised Information Management System (CIMS) are implemented to improve data management and analytics.

UPSC Civil Services Examination Previous Year Questions (PYQs)

Prelims:

Q:1 Consider the following statements: (2021)

- The Governor of the Reserve Bank of India (RBI) is appointed by the Central Government.

- Certain provisions in the Constitution of India give the Central Government the right to issue directions to the RBI in public interest.

- The Governor of the RBI draws his power from the RBI Act.

Which of the above statements are correct?

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Ans: (c)

Mains:

Q:1 Implementation of Information and Communication Technology (ICT) based Projects/Programmes usually suffers in terms of certain vital factors. Identify these factors and suggest measures for their effective implementation. (2019)

FAQs

Q: What is the Report on Currency and Finance (RCF) 2023-24?

Answer: The Report on Currency and Finance (RCF) 2023-24 is an annual publication by the Reserve Bank of India (RBI) that provides an analysis of the country’s economic and financial health. It covers various aspects like monetary policy, fiscal trends, and economic developments over the past year.

Q: Why is the RCF 2023-24 important?

Answer: The RCF is important because it gives a comprehensive overview of India’s economic situation, helping policymakers, businesses, and the public understand the current economic landscape. It highlights key trends, challenges, and areas for improvement, guiding future economic decisions.

Q: What are some key findings of the RCF 2023-24?

Answer: Some key findings might include insights into GDP growth, inflation rates, fiscal deficit, and the performance of various sectors like agriculture, industry, and services. The report could also discuss the impact of global economic conditions on India and suggest measures to enhance economic stability and growth.

Q: How does the RCF 2023-24 affect the average person?

Answer: The RCF affects the average person by influencing government and RBI policies that impact everyday life. For example, recommendations on controlling inflation can help manage the cost of living, while insights into economic growth can inform job creation and income opportunities.

Q: Where can one access the RCF 2023-24?

Answer: The RCF 2023-24 can be accessed on the official Reserve Bank of India (RBI) website. It is usually available as a downloadable PDF, making it easy for anyone interested to read and understand the report’s findings and implications.

To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

- Join our Main Telegram Channel and access PYQs, Current Affairs and UPSC Guidance for free – Edukemy for IAS

- Learn Economy for free- Economy for UPSC

- Mains Answer Writing Practice-Mains Answer Writing

- For UPSC Prelims Resources, Click here