State finances play a pivotal role in the economic landscape, serving as the bedrock for government operations, public services, and development initiatives. At the heart of managing state finances lie the annual budgets, comprehensive documents that outline revenue sources, expenditure allocations, and fiscal priorities. Through budgets, governments articulate their financial strategies, balancing the needs of various sectors, addressing societal challenges, and fostering economic growth. Understanding state finances through budgets offers insights into the economic health of a region, the effectiveness of governance, and the trajectory of public policy. It is within these meticulously crafted documents that the intricate dance between income and expenditure unfolds, shaping the socioeconomic fabric of states and influencing the lives of their inhabitants.

Tags:GS- 3 Mobilisation of Resources- Government Policies & Interventions- Infrastructure, GS Paper – 2- Education – Health

For Prelims: Reserve Bank of India’s (RBI), Annual Study on State Finances, Covid-19 Pandemic, Fiscal Deficits, GDP, GST(Goods and Services Tax), Finance Commissions, Human Capital, Centrally Sponsored Schemes

For Mains: Fiscal Challenges Faced by Indian States, Significance of States Reducing their Revenue Deficits.

Contents

- 1 Context:

- 1.1 What is the Fiscal Position of Indian State Governments?

- 1.2 Individual share of states in the taxes devolved by the centre (out of 100):

- 1.3 What are the Different Concerns in Management of the State Finances?

- 1.4 What are the Different Suggestions to be Incorporated for Improving State Finances?

- 1.5 Recommendations of 12th Finance Commission:

- 1.6 Recommendations of the 15th Finance Commission :

- 1.7 Conclusion:

- 2 UPSC Civil Services Examination, Previous Year Questions (PYQs)

- 3 FAQs

- 4 In case you still have your doubts, contact us on 9811333901.

Context:

- The state budgets highlight discrepancies in actual grants from the Centre compared to states’ revised/budget estimates, particularly concerning Centrally Sponsored Schemes.

- The 2024-25 budgets or votes on account (VoA) for 26 states (excluding Arunachal Pradesh and Sikkim) are publicly available.

- Analysis shows states anticipate a 9.2% growth in combined revenue receipts this year, contingent upon factors including the accuracy of base revenues indicated in the revised estimates for 2023-24.

Grants for 2021-26 (five years)

| Grants | Amount |

| Revenue deficit grants | 2,94,514 |

| Local governments grants | 4,36,361 |

| Urban Local Bodies | 1,21,055 |

| Rural Local Bodies | 2,36,805 |

| Health Grants | 70,051 |

| Other Grants* | 8,450 |

| Disaster management grants | 1,22,601 |

| Sector-specific grants | 1,29,987 |

| Health | 31,755 |

| School Education | 4,800 |

| Higher Education | 6,143 |

| Implementation of agricultural reforms | 45,000 |

| Maintenance of PMGSY roads | 27,539 |

| Judiciary | 10,425 |

| Statistics | 1,175 |

| Aspirational districts and blocks | 3,150 |

| State-specific grants | 49,599 |

| Total | 10,33,062 |

What is the Fiscal Position of Indian State Governments?

- Over-Reliance on Own Revenues:

- Approximately half of states’ total revenues come from their own tax revenues (SOTR). Any significant deviation between actual and projected growth of own taxes can impact overall revenue expansion for states.

- In the FY2025 Budget estimates, the combined SOTR of the 26 states is expected to grow by 13.8%, following a higher 15.4% growth estimated in the previous year’s revised estimates.

- Below-Par Growth in Own Taxes:

- However, provisional data from several states for April-February 2023-24 indicates that key components of own taxes like sales tax, state GST, and excise duty grew below levels projected in revised estimates.

- Devolution from Centre to States:

- Transfers from the Centre, including taxes and grants, account for 40-45% of states’ revenues.

- Tax devolution from the Centre is projected to increase by 10.4% in 2024, aligned with growth projected in the interim Union budget.

- States have benefited from higher-than-budgeted tax devolution for three consecutive years during FY 2022-24.

- Improved Tax Buoyancy:

- Sales tax/VAT was the primary source of own tax revenue until 2016-17, but State Goods and Services Tax (SGST) has become the main source since 2017-18.

- States’ tax buoyancy has improved, particularly with SGST collections showing buoyancy above one since 2021-22 due to economic revival and enhanced compliance from better tax administration, especially in larger states.

- State Governments’ Taxation Reforms:

- States have initiated taxation reforms to enhance their own tax capabilities. These reforms include resetting stamp duty rates, adjusting the fair value of land parcels, and implementing e-stamping or digital stamping for various non-registrable documents.

- Some states have also revised excise duties on liquor, raised licence fees, imposed social security cess on liquor consumption, and facilitated digital payment methods at liquor outlets to boost revenue collection.

- In motor vehicle taxation, common reforms include revising life taxes on vehicles, introducing green taxes or green cess, and enforcing strict measures to penalise vehicle tax defaulters with substantial fines.

| State | 14th FC 2015-20 | 15th FC 2020-21 | 15th FC 2021-26 |

| Andhra Pradesh | 4.305 | 4.111 | 4.047 |

| Arunachal Pradesh | 1.370 | 1.760 | 1.757 |

| Assam | 3.311 | 3.131 | 3.128 |

| Bihar | 9.665 | 10.061 | 10.058 |

| Chhattisgarh | 3.080 | 3.418 | 3.407 |

| Goa | 0.378 | 0.386 | 0.386 |

| Gujarat | 3.084 | 3.398 | 3.478 |

| Haryana | 1.084 | 1.082 | 1.093 |

| Himachal Pradesh | 0.713 | 0.799 | 0.830 |

| Jammu & Kashmir | 1.854 | – | – |

| Jharkhand | 3.139 | 3.313 | 3.307 |

| Karnataka | 4.713 | 3.646 | 3.647 |

| Kerala | 2.500 | 1.943 | 1.925 |

| Madhya Pradesh | 7.548 | 7.886 | 7.850 |

| Maharashtra | 5.521 | 6.135 | 6.317 |

| Manipur | 0.617 | 0.718 | 0.716 |

| Meghalaya | 0.642 | 0.765 | 0.767 |

| Mizoram | 0.460 | 0.506 | 0.500 |

| Nagaland | 0.498 | 0.573 | 0.569 |

| Odisha | 4.642 | 4.629 | 4.528 |

| Punjab | 1.577 | 1.788 | 1.807 |

| Rajasthan | 5.495 | 5.979 | 6.026 |

| Sikkim | 0.367 | 0.388 | 0.388 |

| Tamil Nadu | 4.023 | 4.189 | 4.079 |

| Telangana | 2.437 | 2.133 | 2.102 |

| Tripura | 0.642 | 0.709 | 0.708 |

| Uttar Pradesh | 17.959 | 17.931 | 17.939 |

| Uttarakhand | 1.052 | 1.104 | 1.118 |

| West Bengal | 7.324 | 7.519 | 7.523 |

| Total | 100 | 100 | 100 |

What are the Different Concerns in Management of the State Finances?

- Fluctuations in Grants from Centre to States:

- There’s been notable inconsistency between the actual grants received by states from the Centre and the estimates provided by the states themselves, particularly regarding Centrally Sponsored Schemes (CSS).

- The actual funding from the Centre relies on states fulfilling their share under the CSS and complying with other central guidelines, such as submitting utilisation certificates.

- Disparity in Grant Distribution Among States:

- Between April and February 2023-24, grants for a significant subset of sampled states decreased substantially by 22%, primarily due to factors like reduced revenue deficit grants and the phasing out of GST compensation.

- Despite this, the 26 states have projected an 18% increase in grants in their revised estimates, followed by a 7% decrease in combined grants in 2024.

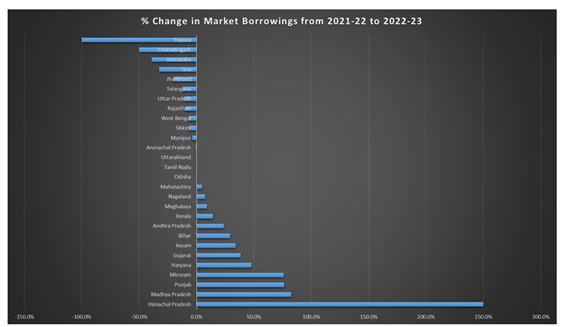

- High Debt Issuance:

- The actual debt issuance during March 2024 amounted to a surprisingly large Rs 1.9 trillion, 51% higher than the indicated amount of Rs 1.3 trillion.

- Several factors, such as a preference to hold larger cash going into the period of the Model Code of Conduct (MCC), may have driven some states to expand their borrowings.

- It is also possible that some states have chosen to use up a larger part of their borrowing limit for 2023-24 before the year ended. Gross borrowing is projected to increase to Rs 10.5-11 trillion in the current year.

- Low Capital Spending by States:

- Capital spending is anticipated to start on a slow note in the first few weeks of the 2024 with parliamentary elections underway and the lull to sustain until the final Union Budget is presented.

- Overall, capital spending by states this year is likely to end up being heavily back-ended, which may influence the timing of the states’ market borrowings over the course of the year.

- High Degree of Technical Inefficiency:

- In India, collection of different State taxes, viz, Stamp duty and registration fees, sales tax/ VAT, excise duty on alcoholic beverages and motor vehicles tax suffer from a high degree of technical inefficiency.

- This is mostly related to the rate structure – stamp duty rates range between 5-8% across States as against the international average of less than 5%. High tax rates lead to high transaction costs, tax evasion and destabilisation of urban land markets.

- Lack of Uniformity in Motor Vehicle Tax Structure:

- The current rate structure of GST consisting of four tax slabs – 5%, 12%, 18%, and 28%, also adds to complexity.

- The motor vehicle tax structure in India lacks uniformity due to different bases for computation and different rates across, leading to varying incidence of taxes per vehicle in different States.

- Inter-state variations result from the application of ‘lifetime’ and annual tax rates to vehicle categories; use of specific and ad valorem rates; and multiplicity of rates.

- Divergence Between State and Central Governments:

- In India, the Union government has the power to levy major taxes such as income tax, corporation tax and excise duties while States can levy taxes such as stamp duty, registration fees, VAT/sales tax on petroleum products and excise duty on liquor.

- Vertical fiscal imbalance in India is higher than in countries like Brazil and Canada with Indian States collecting 37% of general government taxes while spending 64% of total expenditure.

- Concerns Related to Cess and Surcharge:

- While cess and surcharge are fundamentally distinct concepts, under Article 270 of the Indian Constitution, the revenue collected from both cess and surcharge are at the exclusive disposal of the Union government, i.e., these taxes are not required to be shared with the State governments.

- The revenue collected by the Union government from cesses increased from 6.4% of its gross tax revenue in 2011-12 to 17.7% in 2021-22.

What are the Different Suggestions to be Incorporated for Improving State Finances?

- Balancing Tax and Non-Tax Revenues:

- It’s essential to sustainably increase the Own Tax and Non-Tax Revenue Ratios of the GSDP without overburdening the populace or stifling their entrepreneurial spirit.

- Mobilising financial resources should align with the state’s priorities, ensuring that planned expenditures translate into tangible outcomes.

- Promoting Private Investments in Less Developed States:

- Current data on private investments post-economic reforms reveal a concentration in more developed states with superior infrastructure and governance. Similarly, bilateral and multilateral aid tends to favour these developed states.

- This underscores the need for greater attention to less developed states like Chhattisgarh, which possess abundant resources and growth potential but lack adequate financial support for achieving significant growth.

Recommendations of 12th Finance Commission:

- Taxation Reforms: Focus on developing a non-distortionary and revenue-elastic taxation system with stable and limited tax rates.

- Non-Tax Revenues: Aim to introduce user charges for short-term cost recoveries and strive for full cost recovery in the long run.

- Expenditure Restructuring: Address inefficiencies through size and sectoral allocation adjustments, improving scheme design and service delivery.

- Subsidy Rationalisation: Reduce overall subsidy volume, enhance transparency, and improve targeting.

- Fiscal Transfer System: Give more weight to equalising transfers and extend them to local bodies.

- Empowerment of Local Bodies: Strengthen their role in delivering local public goods effectively.

- Institutional Frameworks: Introduce mechanisms like ceilings on debt and deficits, along with state-level fiscal responsibility legislation, for effective monitoring.

Recommendations of the 15th Finance Commission :

- Setting a threshold for annual allocation to Centrally Sponsored Schemes (CSS) to phase out those with low utility or insignificant outlay. Third-party evaluation of all CSS should be completed within a stipulated time frame, with funding patterns fixed transparently and kept stable.

- States should also have more options for short-term borrowings beyond ways and means advances and overdraft facilities from the Reserve Bank of India, potentially forming independent debt management cells.

- Rationalising Revenue Deficits: States should refrain from borrowing to meet revenue expenditure, adhering to the principle that capital receipts should not fund revenue expenditure. However, fiscal deficits may increase to accommodate rising investment requirements.

- Leveraging Royalty Rates on Minerals: While the power to revise royalty rates on minerals lies with the Central Government, states with mineral-rich resources should advocate for periodic revisions of royalty rates, levied on an ad valorem basis, to enhance state revenue streams.

Conclusion:

Hence, To enhance state government finances, a multifaceted strategy is essential, involving increased revenue mobilisation, prudent fiscal management, and efficient resource utilisation. Improved coordination between central and state authorities, alongside regular policy assessments, is vital. Through these measures, states can fortify their financial standing and effectively address citizen needs.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims:

Q:1 Consider the following statements: (2018)

- The Fiscal Responsibility and Budget Management (FRBM) Review Committee Report has recommended a debt to GDP ratio of 60% for the general (combined) government by 2023, comprising 40% for the Central Government and 20% for the State Governments.

- The Central Government has domestic liabilities of 21% of GDP as compared to that of 49% of GDP of the State Governments.

- As per the Constitution of India, it is mandatory for a State to take the Central Government’s consent for raising any loan if the former owes any outstanding liabilities to the latter.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: C

Mains:

Q.1 Public expenditure management is a challenge to the Government of India in the context of budget-making during the post-liberalization period. Clarify it. (2019)

Q.2 Normally countries shift from agriculture to industry and then later to services, but India shifted directly from agriculture to services. What are the reasons for the huge growth of services vis-a-vis the industry in the country? Can India become a developed country without a strong industrial base? (2014)

Source: (IE)

FAQs

Q: What is a state budget?

A state budget is a financial plan outlining the government’s anticipated revenue and proposed expenditures for a specific period, usually one fiscal year. It serves as a blueprint for allocating resources to various sectors like education, healthcare, infrastructure, and public safety.

Q: How is a state budget created?

The process of creating a state budget typically involves several stages. It starts with agencies and departments submitting funding requests to the governor’s office. The governor then proposes a budget based on revenue projections and policy priorities. The legislature reviews and may amend the proposed budget before passing it into law. Finally, the governor signs the budget bill, officially enacting it into law.

Q: What are the main sources of revenue for state budgets?

State budgets derive revenue from various sources, including taxes (such as income, sales, property, and corporate taxes), federal grants, fees and licenses, lottery proceeds, and investment income. The proportion of revenue from each source varies depending on the state’s economy, tax policies, and federal funding allocations.

Q: How are state budgets allocated?

State budgets allocate funds to different programs, agencies, and initiatives based on legislative priorities and public needs. Common allocations include education (K-12 and higher education), healthcare (Medicaid and public health programs), transportation, public safety (law enforcement and emergency services), social services, infrastructure development, and debt servicing.

Q: What is the significance of a balanced budget for states?

A balanced budget is when a state’s projected revenues match or exceed its expenditures for a given fiscal year. It is essential for fiscal stability and responsible financial management. A balanced budget ensures that states do not accumulate excessive debt, maintain their creditworthiness, and can fund essential services without relying heavily on borrowing or deficit spending. However, achieving and maintaining a balanced budget can be challenging, especially during economic downturns or when facing unexpected expenses.

In case you still have your doubts, contact us on 9811333901.

For UPSC Prelims Resources, Click here

For Daily Updates and Study Material:

Join our Telegram Channel – Edukemy for IAS

- 1. Learn through Videos – here

- 2. Be Exam Ready by Practicing Daily MCQs – here

- 3. Daily Newsletter – Get all your Current Affairs Covered – here

- 4. Mains Answer Writing Practice – here