Today’s daily current affairs briefing for UPSC aspirants explores the latest developments relevant to the upcoming civil services examination. Our focus today includes a critical analysis of recent policy changes, international affairs, and national developments, all of which play a pivotal role in shaping India’s socio-political and economic landscape. Stay informed and stay ahead in your UPSC preparations with our daily current affairs updates, as we provide you with concise, well-researched insights to help you connect the dots between contemporary events and the broader canvas of the civil services syllabus.

Contents

- 1 The Food Security Act Has Revamped the PDS

- 1.1 Why in the news?

- 1.2 Concerns Surrounding Inefficiencies in the PDS:

- 1.3 National Food Security Act (NFSA) of 2013:

- 1.4 Estimating and Understanding PDS Leakages:

- 1.5 PDS Coverage, Impact of NFSA, Reforms, and Technological Innovations:

- 1.6 The Future of PDS and Policy Recommendations:

- 1.7 Conclusion

- 2 UPSC Civil Services Examination PYQ

- 3 PM Narendra Modi’s visit to Singapore

- 4 UPSC Civil Services Examination Previous Year Question (PYQ)

- 5 Law Commission’s Role, Members & Recommendations

- 6 Vertical Fiscal Imbalance

- 7 Judicial Appointments Can’t Be Individual Decision

- 8 UPSC Civil Services Examination, Previous Year Question (PYQ)

- 9 Forum on China-Africa Cooperation (FOCAC)

- 10 UPSC Civil Services Examination PYQ

- 11 Public Accounts Committee (PAC)

- 12 Interpol

- 13 Rift Valley Fever

- 14 Frequently Asked Questions (FAQs)

- 14.1 Q: What are daily current affairs?

- 14.2 Q: Why is it important to stay updated with daily current affairs?

- 14.3 Q: Where can I access daily current affairs information?

- 14.4 Q: How can I effectively incorporate daily current affairs into my routine?

- 14.5 Q: What are some tips for critical analysis of daily current affairs?

- 15 To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

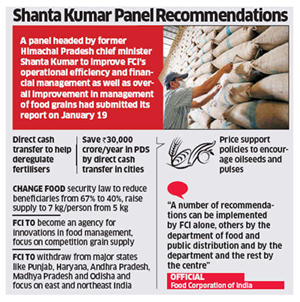

The Food Security Act Has Revamped the PDS

Tags: GS-3, Economy- Growth & Development- Food Security Act-PDS

Why in the news?

- The National Food Security Act (NFSA) of 2013 aimed to improve food security in India by expanding the Public Distribution System (PDS).

- Despite this, inefficiencies and leakages have persisted, highlighting the need to assess the evolution, reforms, and challenges of the PDS, especially with data from the Household Consumption Expenditure Survey (HCES) 2022-23.

Concerns Surrounding Inefficiencies in the PDS:

- Leakage Estimates and Comparison

- National Sample Survey (NSS): Estimates show higher leakages (54% in 2004-05, declining to 42% in 2011-12).

- Indian Human Development Survey (IHDS): Indicates lower leakages (49% in 2004-05, declining to 32% in 2011-12), suggesting more accurate PDS usage.

- Reliability: IHDS is considered more reliable than NSS for PDS purchases due to its focused methodology.

- Expanded PDS by States

- State Programs: Some states extend PDS grain to non-NFSA beneficiaries, impacting leakage estimates, which are currently 22%.

- State: However, states like Bihar, Chhattisgarh, and Odisha saw reductions in leakages after reforms, prompting the NFSA to mandate similar reforms nationwide.

- Mismatch in Timing

- Data Discrepancies: NSS and FCI data use different reference years (agricultural vs. financial year), causing synchronisation issues and discrepancies in leakage estimates.

- Measurement Errors

- Recall Period: NSS data uses a 30-day recall period for consumption, potentially leading to under-reporting and measurement errors, which can inflate leakage estimates.

National Food Security Act (NFSA) of 2013:

- Subsidised Food Grains: NFSA provides subsidised food grains to about two-thirds of India’s population, covering:

- Antodaya Anna Yojana (AAY) households.

- Priority Households (PHH): Benefiting 75% of rural and 50% of urban populations.

- Grievance Redressal Mechanisms: State governments must establish:

- Call centres and helplines.

- Nodal officers and a District Grievance Redressal Officer (DGRO) in each district.

- Constitutional Basis: While the Indian Constitution doesn’t explicitly mention the right to food, the fundamental right to life under Article 21 includes living with human dignity, potentially encompassing the right to food.

- Shift in Approach: NFSA represents a shift from a welfare model to a rights-based model for food security in India.

Estimating and Understanding PDS Leakages:

- Methodology:

- Estimates are based on comparing household reports of PDS grain with government warehouse data.

- For 2022-23, ration cardholders were entitled to 5 kg per capita per month or 35 kg per household for Priority and Antyodaya families, with additional allocations under Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY).

- Sources of Inaccuracy:

- Time Lag: Mismatches between data collection periods can affect leakage estimates. For example, a one-month lag can change estimates from 18.2% to 17.6%.

- Expanded PDS: Some states have introduced expanded PDS programs beyond NFSA coverage, impacting estimates.

- Diverse Causes: Leakages may result from transport losses, reporting discrepancies, or operational inefficiencies rather than intentional diversion.

PDS Coverage, Impact of NFSA, Reforms, and Technological Innovations:

- PDS Coverage:

- The NFSA expanded PDS coverage, increasing household participation from less than 50% to 70% by 2022-23.

- However, coverage is still below the 75% rural and 50% urban targets. HCES data shows 57%-61% of households with NFSA ration cards.

- Reforms and Innovations:

- States like Chhattisgarh and Odisha adopted reforms such as reducing prices, ensuring doorstep delivery, and digitising records.

- These were later implemented nationally through NFSA.

The Future of PDS and Policy Recommendations:

- The PDS is crucial for food security, especially highlighted during the COVID-19 pandemic.

- However, ongoing policy experiments and technological issues like Aadhaar-based authentication need addressing. Key areas for improvement include:

- Addressing root causes of exclusion and inefficiencies.

- Updating the Census to include over 100 million people currently without PDS benefits.

- Incorporating more nutritious food items such as pulses and edible oils.

Conclusion

The NFSA 2013 has led to improvements in the PDS by reducing leakages and expanding coverage. Nonetheless, challenges persist in reaching full coverage and improving efficiency. Continued focus on state-level reforms, Census updates, and nutritional inclusions is essential for further strengthening the PDS.

UPSC Civil Services Examination PYQ

Mains

Q:1 What are the salient features of the National Food Security Act, 2013? How has the Food Security Bill helped in eliminating hunger and malnutrition in India? (2021)

Q:2 How far do you agree with the view that the focus on the lack of availability of food as the main cause of hunger takes the attention away from ineffective human development policies in India? (2018)

Q:3 Food Security Bill is expected to eliminate hunger and malnutrition in India. Critically discuss various apprehensions in its effective implementation along with the concerns it has generated in WTO. (2013)

Source: TH

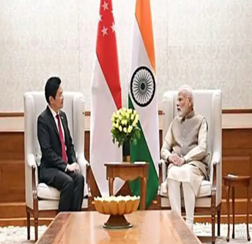

PM Narendra Modi’s visit to Singapore

Tags: GS-2, IR- Bilateral Groupings & Agreements- India and Singapore

Why in the news?

- Recently, Prime Minister Modi visited Singapore during the second leg of a two-nation trip to South-East Asia, having travelled to Brunei Darussalam in the first leg.

India-Singapore Relations:

- Background:

- Colonial Ties: Singapore, established as a trading station by Sir Stamford Raffles in 1819, was governed from Kolkata until 1867, creating deep colonial connections reflected in shared institutions, practices, and the Indian community presence.

- Early Recognition: India was one of the first nations to recognize Singapore’s independence in 1965.

- Strategic Partnership: The India-Singapore relationship was elevated to a Strategic Partnership in 2015 during Prime Minister Narendra Modi’s visit to Singapore.

- India-Singapore Ministerial Roundtable (ISMR)

- Inaugural Meeting: The first ISMR was held in September 2022 in New Delhi.

- Second Meeting: The 2nd ISMR took place in Singapore in August 2024, reviewing progress in key areas such as digitalization, skills development, sustainability, healthcare, and medicine.

- New Pillars: Two additional pillars of cooperation were added— Advanced Manufacturing and Connectivity.

- Trade and Economic Cooperation

- Leading Partner: Singapore is India’s largest trade partner in ASEAN and the leading source of Foreign Direct Investment (FDI).

- Bilateral Trade: Post Comprehensive Economic Cooperation Agreement (CECA), bilateral trade grew from USD 6.7 billion (2004-05) to USD 35.6 billion (2023-24).

- India’s imports stood at USD 21.2 billion, while exports to Singapore were USD 14.4 billion.

- Investment Flows:

- In FY 2023-24, Singapore was the largest source of FDI into India, with inflows of USD 11.77 billion.

- Cumulative FDI from Singapore to India amounts to USD 159.9 billion, constituting 24% of total FDI inflows.

- Fintech Cooperation

- RuPay and UPI-PayNow: Agreements have been made for the acceptance of RuPay cards in Singapore, while the UPI-PayNow Linkage marks the first cross-border P2P payment facility for India.

- Science and Technology Cooperation

- Satellite Launches: India has launched 17 satellites for Singapore in the last decade.

- ASEAN-India Conclave: Singapore co-hosted the inaugural ASEAN-India Women Scientists Conclave in April 2024.

- e-Workshop: An e-workshop on digital health and medical technologies was held in July 2024.

- Multilateral Cooperation

- International Solar Alliance (ISA): Singapore joined ISA in June 2023 and the Global Biofuel Alliance in September 2023.

- ASEAN Coordinator: Singapore served as ASEAN Country Coordinator for India from 2021-24, during which India-ASEAN relations were upgraded to a Comprehensive Strategic Partnership.

- Indian Community in Singapore

- Ethnic Composition: Indians constitute 9.1% of Singapore’s resident population (around 3.5 lakh).

- Official Language: Tamil is one of Singapore’s four official languages, with Hindi, Gujarati, Urdu, Bengali, and Punjabi also offered in schools.

Key Highlights of the Visit:

- Comprehensive Strategic Partnership: India and Singapore elevated their ties to a comprehensive strategic partnership.

- MoUs Signed: Four MoUs were signed, covering:

- Digital Technologies,

- Semiconductor Ecosystem,

- Health and Medicine,

- Educational Cooperation and Skills Development.

- Trade and Investment Boost: Both sides called for enhanced trade and investment flows, with Singapore investing USD 160 billion in India’s economy.

- Cultural Connectivity: The leaders discussed celebrations for the 60th anniversary of bilateral relations in 2025. PM Modi announced the opening of India’s first Thiruvalluvar Cultural Centre in Singapore.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q:1 Consider the following pairs: (2009)

Organization Location of Headquarters

- Asian Development : Tokyo Bank

- Asia-Pacific : Singapore Economic Cooperation

- Association of SouthEast Asian Nations: Bangkok

Which of the above pairs is/are correctly matched?

- 1 and 2 only

- 2 only

- 2 and 3 only

- 3 only

Ans: (b)

Q:2 What is the correct sequence of occurrences of the following cities in South-East Asia as one proceeds from south to north? (2014)

- Bangkok

- Hanoi

- Jakarta

- Singapore

Select the correct answer using the code given below:

- 4 – 2 – 1 – 3

- 3 – 2 – 4 – 1

- 3 – 4 – 1 – 2

- 4 – 3 – 2 – 1

Ans: (c)

Source: IE

Law Commission’s Role, Members & Recommendations

Tags: GS-2, Polity & Governance- Executive- Law Commission

Why in the news?

- The Union government has notified the constitution of the 23rd Law Commission of India with effect from September 1.

- While the chairperson and members are yet to be named, the decision will be taken by the Appointments Committee of Cabinet, chaired by the Prime Minister.

Law Commission of India:

- About:

- The Law Commission of India is a non-statutory body formed by the Government of India periodically.

- The first Law Commission of independent India was set up in 1955 for a term of three years.

- The initial Law Commission was established under British rule in 1834 by the Charter Act of 1833, chaired by Lord Macaulay.

- Objectives:

- The Commission acts as an advisory body to the Ministry of Law and Justice.

- It conducts legal research and reviews existing Indian laws to recommend reforms or enact new legislation, either on the government’s referral or suo motu.

- Composition:

- The Law Commission is headed by a full-time chairperson and includes four full-time members, including a member-secretary.

- The Law and Legislative Secretaries in the Ministry of Law serve as ex-officio members.

- Additionally, the Commission can have up to five part-time members.

- The Commission is chaired by a retired Supreme Court judge or a Chief Justice of a High Court.

- Functions & Role of the Law Commission:

- Reviewing Existing Laws: The commission identifies obsolete or irrelevant laws that need to be repealed or amended.

- Proposing New Laws: Based on emerging legal challenges or gaps in the legal system, the commission proposes new legislation.

- Simplifying Legal Processes: One of its key roles is to simplify the law to make it more accessible and understandable to the public.

- Studying Judicial Reforms: It examines issues like judicial efficiency, reducing delays, and improving justice delivery systems.

- Significant Recommendations by the Law Commission:

- In its 262nd Report, the Commission recommended the abolition of the death penalty, except for crimes related to terrorism or waging war against the state.

- Its 1999 report on electoral reforms proposed holding simultaneous elections for the Lok Sabha and State Assemblies to enhance governance and political stability.

- The Criminal Procedure (Identification) Act, 2022, replacing the Identification of Prisoners Act, 1920, was recommended by the Law Commission.

- The 21st Law Commission, in 2018, advised that implementing the Uniform Civil Code (UCC) is “neither necessary nor desirable at this stage”.

- Currently, the 22nd Law Commission has been tasked with examining issues related to the Uniform Civil Code.

Constitution of the 23rd Law Commission:

- About:

- The Union Government notified the formation of the 23rd Law Commission of India through a notification on September 2.

- The panel will include a full-time chairperson, four full-time members (including a member-secretary), five part-time members, and ex-officio members (the Secretaries of Legal Affairs and Legislative Departments).

- The commission’s tenure is set until August 31, 2027.

- Composition:

- The Chairperson and full-time members may be sitting judges of the Supreme Court or High Courts, or other experts selected by the government.

- The final decision on appointments will be made by the Appointments Committee of the Cabinet, chaired by the Prime Minister.

- Serving judges, if appointed, will serve until their retirement or the expiry of the Commission’s term.

- In the case of experts, a Chairperson will receive a monthly salary of Rs. 2.50 lakh, and members will receive Rs. 2.25 lakh.

- Terms of Reference

- The terms of reference for the 23rd Law Commission remain similar to previous commissions, with key mandates:

- Repeal of obsolete laws: Identifying laws that are no longer relevant.

- Review of existing laws: Propose amendments to laws not aligned with contemporary economic needs.

- Directive Principles: Examine existing laws under the Directive Principles of State Policy and propose ways to implement constitutional objectives.

- The terms of reference for the 23rd Law Commission remain similar to previous commissions, with key mandates:

- Role of the 22nd Law Commission

- The 22nd Law Commission submitted 11 reports, including a notable one on Section 124A (Sedition) of the Indian Penal Code in April 2023.

- It recommended retaining the provision due to concerns over internal security threats but proposed amendments for greater clarity.

- Another report in March suggested a new law for trade secrets protection.

- The Commission also worked on reports regarding simultaneous elections and the Uniform Civil Code, though these were not submitted before the end of the commission’s term.

Source:IE

Vertical Fiscal Imbalance

Tags: GS-3, Economy- Fiscal policy- Vertical Fiscal Imbalance (VFI) in India

Why in the news?

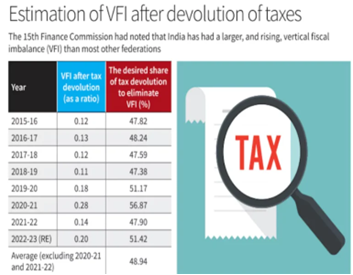

- The financial relationship between the Union and States in India is asymmetrical, with States responsible for 61% of revenue expenditure but collecting only 38% of revenue receipts, as noted by the 15th Finance Commission.

- This creates a Vertical Fiscal Imbalance (VFI), where States heavily rely on Union transfers, as their expenditure responsibilities exceed their revenue capacity.

Central Transfers to States

- About

- The Finance Commissions recommend the share of States in the net tax revenue of the Union government.

- As per Article 280, the President must constitute a Finance Commission (FC) every five years or earlier.

- Article 280(3)(a) mandates the FC to make recommendations on dividing the net proceeds of taxes between the Union and States.

- The difference between gross and net tax revenue includes collection costs, revenue assigned to Union Territories, and cess/surcharges.

- Composition of Transfers

- Taxes devolved to States are untied funds, allowing States to spend as per their discretion.

- Over 80% of total central transfers to States are tax devolution.

- The Centre also provides grants for specified purposes, which have ranged from 12% to 19% of total transfers.

- Tax Devolution to States

- The 14th Finance Commission (FC) raised tax devolution from 32% to 42%.

- The 15th FC recommended 41% devolution for the 2021-26 period, with a 1% adjustment for the newly formed Union Territories of J&K and Ladakh.

- The Commission emphasised tax devolution as the primary means of transfer, ensuring unconditional transfers and greater spending flexibility for States.

- Formula for Distribution Among States

- Population/Demography: Reflects the expenditure needs of a state.

- Demographic Performance: Rewards States for controlling population growth, considering factors like fertility rate, infant mortality, and sex ratio.

- Income Distance: The gap between a State’s per capita income and the national average; lower-income States may receive a larger share.

- Area: States with larger areas face higher administrative costs, justifying a higher share.

- Forest & Ecology: States with significant forest cover may be compensated for reduced economic activities in those areas.

- Tax and Fiscal Efforts

- Grant-in-Aid: Besides tax devolution, the Centre provides grants-in-aid based on 15th FC recommendations.

- Types of Grants

- Revenue Deficit Grants: To support States with deficits.

- Sector-Specific Grants: For sectors like health, education, etc., with some being performance-linked.

- State-Specific Grants: For social needs, governance, infrastructure, water, and sanitation.

- Grants to Local Bodies: Grants for Disaster Risk Management are also part of central transfers to support States in managing disasters.

Vertical Fiscal Imbalance (VFI) in India:

- Constitutional Division of Financial Duties

- The Union government collects significant taxes like Personal Income Tax and Corporation Tax, while state and local governments are responsible for efficiently delivering public services.

- Rising VFI in India

- India’s VFI has widened over time, as highlighted by the 15th Finance Commission, with crises like COVID-19 deepening the revenue-expenditure gap for states.

- The Role of the Finance Commission

- The Finance Commission addresses VFI by recommending how to distribute taxes between the Union and States.

- It also provides grants under Article 275 to states needing financial assistance and many of these transfers are tied to specific purposes.

- Unconditional Transfers

- Only the devolution of taxes from net proceeds is unconditional, making it crucial for states to address their fiscal needs without burdens.

- Raising Tax Devolution to Address VFI

- Many states demand raising the share of tax devolution to 50% to eliminate VFI.

- Analysts argue for increasing the share to 49% to give states more untied resources, fostering better fiscal federalism and spending efficiency.

Source: TH

Judicial Appointments Can’t Be Individual Decision

Tags: GS-2, Polity & Governance- Judiciary- Supreme Court – Transparency & Accountability– Judgement

Why in the news?

- The Supreme Court ruled that a Chief Justice of a High Court cannot individually reconsider recommendations for a judge’s elevation; this must be done collectively by the High Court Collegium.

- The ruling granted relief to two District Judges, Chirag Bhanu Singh and Arvind Malhotra, whose candidatures for elevation to the Himachal Pradesh High Court were directed for fresh consideration by the Collegium.

Procedure for Appointing High Court Judges:

- Constitutional Provision

- Article 217 of the Indian Constitution specifies the process for appointing High Court judges. The President appoints judges by warrant after consulting the Chief Justice of India (CJI), the Governor, and, for non-Chief Justice roles, the Chief Justice of the High Court.

- Eligibility: A High Court judge must be an Indian citizen and meet one of the following criteria:

- Ten years in a judicial office in India, or

- Ten years as an advocate in a High Court or multiple High Courts consecutively. Judges serve until the age of 62.

- Procedure

- Recommendation: The Chief Justice of the High Court initiates the process and consults two senior-most puisne judges before recommending names.

- Collegium Review: A Collegium consisting of the CJI and two senior-most judges reviews these recommendations.

- Approval: Recommendations are sent to the Chief Minister, who advises the Governor to forward the proposal to the Union Law Minister.

- Controversy over Consultation

- Initial constitutional provisions designated the CJI as a consultant. This evolved through Supreme Court rulings:

- First Judges Case (1982): Consultation was interpreted as not requiring concurrence.

- Second Judges Case (1993): Consultation was redefined to mean concurrence; the CJI’s advice became binding.

- Third Judges Case (1998): The CJI’s opinion was prioritised, requiring consultation with four senior judges, and all Collegium members’ opinions had to be in writing.

- Initial constitutional provisions designated the CJI as a consultant. This evolved through Supreme Court rulings:

- Background of Current Case

- Initial Recommendations: In December 2022, the Himachal Pradesh High Court Collegium recommended Chirag Bhanu Singh and Arvind Malhotra for elevation. This was deferred by the Supreme Court Collegium in July 2023 and remitted for reconsideration in January 2024.

- Intervention: The Law Minister requested fresh recommendations for Singh and Malhotra. However, the High Court CJ recommended others, disregarding Singh and Malhotra.

- Supreme Court Case: Singh and Malhotra challenged the decision, arguing it undermined their seniority and records.

- Supreme Court Judgment Highlights

- Collective Process: Judicial appointments must reflect collective Collegium wisdom, not individual prerogative.

- Judicial Scrutiny: Limited scrutiny is allowed to ensure effective and collective consultation but does not cover suitability or the content of consultation.

Arguments in Favour of the Collegium System:

- Upholding Judicial Independence

- The Collegium system maintains judicial independence by having judges appoint their peers, preventing executive interference and protecting the rule of law.

- Prioritising Merit and Experience

- Judges are selected based on qualifications, experience, and judicial acumen, allowing a nuanced assessment beyond academic credentials to ensure competent appointments.

- Promoting Diversity and Inclusivity

- The system has improved diversity by appointing judges from varied backgrounds, such as women and marginalised communities, reflecting India’s diverse society.

- For instance, Justice Leila Seth and Justice BV Nagarathna‘s appointments demonstrate this commitment.

- Ensuring Institutional Memory and Continuity

- Senior judges in the Collegium preserve institutional memory and ensure continuity in judicial practices, supporting a stable legal system even amid political changes.

Arguments Against the Collegium System;

- Lack of Transparency

- The Collegium System is criticised for its opaque decision-making process, undermining public trust and raising concerns about fairness, exemplified by the controversial appointment of Soumitra Sen.

- Uncle Judges’ Syndrome

- Closed-door deliberations may foster nepotism and cronyism, with personal connections potentially influencing appointments, as highlighted by the Law Commission of India’s 2008 report.

- Lack of Diversity and Representation

- The system is criticised for inadequate diversity in gender, caste, and regional representation, potentially leading to a judiciary that doesn’t reflect India’s demographic diversity.

- Lack of External Oversight and Input

- Operating without external oversight, the Collegium System lacks input from public and civil society, leading to concerns about a decision-making process isolated from broader societal perspectives.

- The 2016 Parliamentary Standing Committee report recommended a more participatory approach involving both the judiciary and the executive.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q:1 Consider the following statements: (2019)

- The 44th Amendment to the Constitution of India introduced an Article placing the election of the Prime Minister beyond judicial review.

- The Supreme Court of India struck down the 99th Amendment to the Constitution of India as being violative of the independence of judiciary.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Ans: (b)

Mains

Q:1 Critically examine the Supreme Court’s judgement on the ‘National Judicial Appointments Commission Act, 2014’ with reference to the appointment of judges of higher judiciary in India. (2017)

Source: NDTV

Forum on China-Africa Cooperation (FOCAC)

Tags: GS-2, IR- Bilateral Relation- Regional and Global Groupings and agreements involving India- India-Africa relation

Why in the news?

- Recently, China is hosting the ninth Forum on China-Africa Cooperation (FOCAC) Summit, a diplomatic event aimed at strengthening ties with African nations.

Forum on China-Africa Cooperation (FOCAC)

- Establishment: FOCAC was founded in 2000 to formalise strategic partnership between China and African nations.

- Summit Frequency: Held every three years, with hosting alternating between China and an African member.

- Membership: Includes 53 African nations (excluding Eswatini) and the African Union Commission.

- 2024 Summit Theme: “Joining Hands to Advance Modernization and Build a High-Level China-Africa Community with a Shared Future.”

- Focus: The summit will cover state governance, industrialisation, agricultural upgradation, and cooperation on China’s Belt and Road Initiative (BRI).

Current Context of FOCAC 2024:

- Dates: September 4-6, 2024, in Beijing.

- African Challenges: High inflation, currency depreciation, and significant debt burden.

- Geopolitical Issues: Conflicts including the Israel-Hamas and Russia-Ukraine wars, and Houthi attacks on Mediterranean shipping.

- Summit Fatigue: African leaders are experiencing fatigue from recent Africa+1 summits with Türkiye, Russia, South Korea, and the U.S.

- Banjul Format: Suggested for improved management—15 countries plus the African Union Commission.

- FOCAC Effectiveness: Depends on Africa’s ability to set the agenda and own strategic planning.

Priorities for Africa at FOCAC 2024:

- Trade Expansion: Increase exports to China; as of July 2024, China-Africa trade at $167 billion, with African exports at $69 billion—mostly raw materials.

- Agricultural Development: Build a sustainable sector with help from China and India in crops, fertilisers, and tools; focus on local processing.

- Green Energy & Industrialization: Establish refining and processing hubs; challenges include electricity shortages and environmental issues.

- Debt Management: Address debt sustainability; China holds 12% of Africa’s debt. Need for transparency and better negotiation strategies.

- Strategic Engagement: Develop a coherent strategy and harmonise positions before the summit.

China’s Role in African Debt:

- Total Loans: $170 billion (2000-2022).

- Debt Share: Holds 12% of Africa’s public and private debt.

- Transparency Concerns: Half of Chinese loans to sub-Saharan Africa are not disclosed in sovereign debt records.

- Debt Forgiveness: Unlikely to forgive large debts but may write off small, interest-free loans.

- Debt Trap Diplomacy: Practices require closer scrutiny despite disputed narratives.

Lessons for India from Africa’s Engagement with China:

- Continuity: Maintain regular dialogues, akin to FOCAC; hold IAFS-IV soon.

- Industrial Support: Invest in agriculture, pharmaceuticals, and manufacturing; focus on farm mechanisation, food processing, and cold storage.

- Innovative Financing: Use public-private partnerships and blended finance to assist without increasing debt.

- Digital Tools: Enhance connectivity with digital technologies like UPI, expanding beyond Mauritius.

UPSC Civil Services Examination PYQ

Mains

Q:1 Increasing interest of India in Africa has its pros and cons. Critically Examine. (2015)

Source: IE

Public Accounts Committee (PAC)

Tags: GS – 2, Polity & Governance- Parliament– Indian Constitution– Executive

Why in the news?

- Recently, The Public Accounts Committee (PAC) will hold a performance review of “regulatory bodies established by Act of Parliament”, such as the Securities and Exchange Board of India (SEBI).

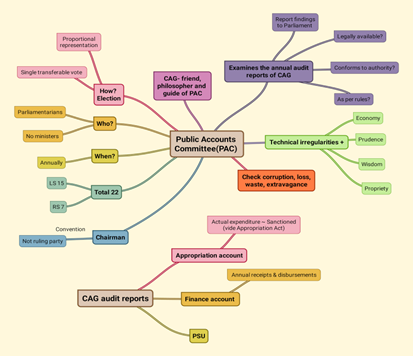

Public Accounts Committee (PAC):

Purpose and Function

- Role:

- The PAC is a parliamentary committee tasked with auditing the revenue and expenditure of the Government of India. Its primary role is to scrutinise the audit report of the Comptroller and Auditor General (C&AG) after it is presented to Parliament.

- Objective:

- To ensure that the funds allocated by Parliament are spent within the approved scope of demands and to assess whether the expenditures adhere to legal and authoritative guidelines.

Genesis and Evolution:

- Inception:

- Established in 1921, the PAC was initially chaired by the Finance Member and managed by the Finance Department (later Ministry of Finance).

- Post-1950:

- Following the adoption of the Indian Constitution on January 26, 1950, the PAC became a Parliamentary Committee under the Speaker’s control. Its secretarial functions were transferred to the Parliament Secretariat (now Lok Sabha Secretariat).

- Membership:

- Composition: The PAC consists of up to 22 members—15 elected by the Lok Sabha and up to 7 by the Rajya Sabha.

- Election and Term: Members are elected annually using a proportional representation method through a single transferable vote. The term of office for members is one year.

- Chairperson: Appointed by the Speaker from the Lok Sabha members of the Committee. Since 1967-68, the Chairperson has been a Member of the Opposition.

- Ministerial Exclusion: Ministers are not eligible to be members of the PAC. If a member is appointed a Minister, they cease to be a PAC member.

Functions and Responsibilities

- Examination: The PAC examines:

- Accounts showing the appropriation of sums granted by Parliament.

- Annual finance accounts of the Government.

- Other accounts laid before the House as deemed appropriate by the Committee.

- Scrutiny:

- Ensures that the disbursed money was legally available and applied to the intended service or purpose.

- Verifies that expenditures conform to governing authorities and that re-appropriations are made according to established rules.

- Extends its review to the effectiveness, faithfulness, and economy of expenditures, including cases of losses, unnecessary expenditures, and financial irregularities.

Source: TH

Interpol

Tags: GS-2, Polity & Governance- Important International Institutions

Why in the news?

- Recently, The Central Bureau of Investigation (CBI) chief announced that Interpol had issued a record 100 Red Notices last year, the highest ever, on India’s request.

What about the Interpol?

- About:

- Full Name: International Criminal Police Organization (INTERPOL)

- Common Name: Interpol

- Headquarters: Lyon, France

- Membership: 195 member countries

- Official Languages: Arabic, English, French, and Spanish

- Status: Independent international organisation, not part of the United Nations system

- Function: Facilitates international police cooperation against cross-border crimes but does not actively investigate crimes.

- Governance

- General Assembly: The supreme decision-making body, with one delegate from each member country.

- General Secretariat: Manages day-to-day operations under the Secretary General, appointed for a five-year term by the General Assembly.

- Executive Committee: Comprises 13 members from different regions, overseeing the implementation of General Assembly decisions and supervising the Secretary General.

- National Central Bureau (NCB)

- Role: Central point of contact in each member country for Interpol.

- Administration: Managed by police officials, often within the government ministry responsible for policing.

- India’s NCB: Central Bureau of Investigation (CBI).

- Types of Notices:

- Red Notice: Seeks location and arrest of a person wanted for extradition. Closest to an international arrest warrant.

- Blue Notice: Locates, identifies, or obtains information on a person of interest in a criminal investigation.

- Green Notice: Warns about a person’s criminal activities who may pose a threat to public safety.

- Yellow Notice: Locates missing persons or identifies individuals unable to identify themselves.

- Black Notice: Seeks information on unidentified bodies.

- Orange Notice: Warns of imminent threats to persons or property, such as an event or object.

- Purple Notice: Provides information on criminal methods, procedures, objects, or hiding places.

- Interpol-UNSC Special Notice: Informs members about individuals or entities subject to UN sanctions.

Source: TOI

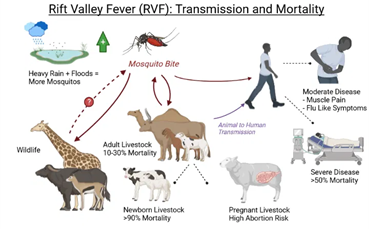

Rift Valley Fever

Tags: GS-3, Science & Technology- Biology- Health- Disease

Why in the news?

- Recently, Valley fever, a fungal disease endemic to the western United States, is seeing a significant rise in cases across California, prompting concerns among health officials and researchers.

Valley Fever (Coccidioidomycosis):

- About:

- Alternative Name: Coccidioidomycosis

- Cause: Infection caused by the fungus Coccidioides.

- Endemic Areas: Southwestern United States, south-central Washington, parts of Mexico, Central and South America.

- Transmission:

- Method: Inhalation of fungal spores from dust or disturbed soil.

- Hosts: Affects both people and animals.

- Spread: Generally not spread person-to-person or animal-to-person, with rare exceptions through organ transplantation or wound contact.

- Symptoms:

- Common Presentation: Often asymptomatic or mild symptoms that resolve on their own.

- Severe Symptoms (in about 1% of symptomatic cases):

- Pneumonia

- Pleural effusion or empyema (fluid or pus in lungs)

- Acute respiratory distress syndrome (ARDS)

- Hydropneumothorax (ruptured pockets of fluid or air in lungs)

- Disseminated coccidioidomycosis (spread to other body parts, including the brain)

- Coccidioidal meningitis (life-threatening brain infection)

- Treatment:

- Mild Cases: Usually resolve without treatment.

- Severe Cases: Managed with antifungal medications.

Source: IT

Frequently Asked Questions (FAQs)

Q: What are daily current affairs?

A: Daily current affairs refer to the most recent and relevant events, developments, and news stories that are happening around the world on a day-to-day basis. These can encompass a wide range of topics, including politics, economics, science, technology, sports, and more.

Q: Why is it important to stay updated with daily current affairs?

A: Staying updated with daily current affairs is crucial because it helps individuals make informed decisions in their personal and professional lives. It enables people to understand the world around them, stay aware of significant events, and engage in informed discussions about important issues.

Q: Where can I access daily current affairs information?

A: There are various sources for daily current affairs, including newspapers, news websites, television news broadcasts, radio programs, and dedicated apps or newsletters. Social media platforms are also widely used to share and access current affairs information.

Q: How can I effectively incorporate daily current affairs into my routine?

A: To incorporate daily current affairs into your routine, consider setting aside specific times each day to read or watch news updates. You can also subscribe to newsletters or follow news apps to receive curated content. Engaging in discussions with peers or participating in online forums can further enhance your understanding of current events.

Q: What are some tips for critical analysis of daily current affairs?

A: When analyzing daily current affairs, it’s essential to cross-reference information from multiple sources to ensure accuracy. Additionally, consider the source’s credibility and bias, if any. Develop the ability to identify the main points and implications of news stories, and critically evaluate the significance and impact of the events reported.

To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

- Join our Main Telegram Channel and access PYQs, Current Affairs and UPSC Guidance for free – Edukemy for IAS

- Learn Economy for free- Economy for UPSC

- Learn CSAT – CSAT for UPSC

- Mains Answer Writing Practice-Mains Answer Writing

- For UPSC Prelims Resources, Click here