Today’s daily current affairs briefing for UPSC aspirants explores the latest developments relevant to the upcoming civil services examination. Our focus today includes a critical analysis of recent policy changes, international affairs, and national developments, all of which play a pivotal role in shaping India’s socio-political and economic landscape. Stay informed and stay ahead in your UPSC preparations with our daily current affairs updates, as we provide you with concise, well-researched insights to help you connect the dots between contemporary events and the broader canvas of the civil services syllabus.

Contents

- 1 India overtakes China as most attractive emerging market for investing

- 2 UPSC Civil Services, Previous Year Question (PYQ)

- 3 Banking Sector Struggling with Slower Growth

- 4 UPSC Civil Services Examination, Previous Year Questions (PYQs)

- 5 India-GCC Foreign Ministers’ Meeting

- 6 UPSC Civil Services Examination, Previous Year Question (PYQ)

- 7 Uncommon Cyclones in the Arabian Sea

- 8 UPSC Civil Services Examination PYQ

- 9 Responsible use of Artificial Intelligence in war

- 10 Financialisation

- 11 National Company Law Appellate Tribunal (NCLAT)

- 12 Technical Textiles

- 13 BPaLM Regimen

- 14 Frequently Asked Questions (FAQs)

- 14.1 Q: What are daily current affairs?

- 14.2 Q: Why is it important to stay updated with daily current affairs?

- 14.3 Q: Where can I access daily current affairs information?

- 14.4 Q: How can I effectively incorporate daily current affairs into my routine?

- 14.5 Q: What are some tips for critical analysis of daily current affairs?

- 15 To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

India overtakes China as most attractive emerging market for investing

Tags: GS – 3, Economy- Inclusive Growth– Liberalisation– Growth & Development

Why in the news?

- India has overtaken China for the first time in the MSCI Emerging Markets (EM) Investable Market Index (IMI), becoming the largest country by weight.

- The MSCI Emerging Markets IMI includes large, mid, and small-cap representation across 24 emerging markets, covering approximately 99% of the market capitalization in each country.

Why India Remains a Favorite Emerging Market Growth Story for Investors:

- Economic Transformation:

- Over the last decade, India has transitioned from being part of the “fragile five” economies to becoming the world’s fifth-largest economy. This success is due to structural reforms, development initiatives, and anti-corruption measures.

- India’s stock market has surged by 46% over the last three years, surpassing global equities and other emerging markets.

- Key Growth Drivers:

- Labor Force: India has an expanding pool of medium-skilled workers, particularly in the manufacturing sector, which can replace retiring workers from China and developed economies.

- Capital Investment: With $1.7 trillion expected to be invested in infrastructure by 2030, India is well-positioned for growth, especially as global manufacturers look to diversify supply chains.

- Fiscal Prudence: India’s government focuses on infrastructure while maintaining fiscal discipline, making the country an attractive investment destination.

- Political Stability: Consistent governance enhances investor confidence, a crucial factor in India’s continued growth.

- Benefiting from China’s Decline: India has benefited from global investors reducing exposure to China due to rising geopolitical tensions and economic concerns.

What Makes India Attractive to Investors?

- Business and Political Stability:

- India is perceived as a stable investment destination due to improvements in both business and political stability.

- Ease of Doing Business:

- Recent reforms, such as lowering corporate tax rates and liberalising foreign direct investment norms, have enhanced the ease of doing business in India.

- Production-Linked Incentive Schemes:

- The introduction of production-linked incentive schemes aims to attract foreign investment across various sectors by offering financial incentives based on production targets.

- Fast-Growing Demographics:

- India boasts a large, young consumer market, a skilled labour force, and significant potential for innovation and entrepreneurship, making it an appealing destination for investors.

- Proactive Regulation:

- India has addressed investor challenges related to taxation, currency volatility, and legal disputes, showcasing a proactive regulatory approach.

- Friendly Investment Environment:

- Known for its openness and engagement with sovereign investors, India offers diverse opportunities for collaboration and investment.

Challenges and Risks of Investing in India:

- Inflation:

- Rising inflation poses a risk by leading to tighter monetary policies, higher interest rates, lower asset prices, and currency depreciation.

- Productivity and Reforms:

- To sustain growth, India needs productivity improvements, especially in education, skills training, and urbanisation.

- Over 40% of workers are still employed in primary industries, which limits economic diversification.

- Geopolitical Risk:

- Increasing geopolitical tensions can lead to trade wars, sanctions, conflicts, or cyberattacks, disrupting trade flows, supply chains, and market sentiment.

- Events like the Russia-Ukraine war and instability in the Middle East disrupt trade and create uncertainty for India’s growth.

- Supply Chain Disruptions:

- The Covid-19 pandemic exposed vulnerabilities in global supply chains, affecting the availability and cost of raw materials and impacting economic activity and inflation.

- Climate Change:

- Climate change presents both physical risks (to infrastructure, agriculture, health, and biodiversity) and transition risks (related to energy sources, regulations, and policies), affecting investments.

Way Forward:

- Strengthen Diplomatic Relations:

- Engage in bilateral and multilateral partnerships to enhance trade, investment, and technology transfer, further boosting India’s attractiveness as an investment destination.

- Continue Reforms:

- Implement further reforms to improve the ease of doing business, reduce bureaucratic hurdles, simplify procedures, and enhance transparency.

- Embrace Sustainable Practices:

- Invest in renewable energy, clean technologies, and climate resilience measures to mitigate environmental risks and attract socially responsible investors.

- Invest in Skill Development:

- Focus on skill development programs and education to cultivate a highly skilled workforce, fostering innovation and enhancing competitive advantage.

- Proactive Regulation:

- Continue addressing investor challenges with effective tax reforms, currency volatility management, and efficient dispute resolution mechanisms.

UPSC Civil Services, Previous Year Question (PYQ)

Prelims

Q1. Consider the following actions which the Government can take: (2011)

- Devaluing the domestic currency.

- Reduction in the export subsidy.

- Adopting suitable policies which attract greater FDI and more funds from FIIs.

Which of the above actions/actions can help in reducing the current account deficit?

- 1 and 2

- 2 and 3

- 3 only

- 1 and 3

Ans: (d)

Source: ET

Banking Sector Struggling with Slower Growth

Tags: GS – 3, Economy- Banking Sector & NBFCs– Growth & Development— Monetary Policy

Why in the news?

- Reserve Bank of India (RBI) showed that while deposits grew at 11.7 per cent in the quarter ending in June 2024, bank credit rose at 15 per cent.

The Weak Deposit Growth in the Banking Sector:

- Higher Credit-Deposit Gap:

- In the quarter ending June 2024, bank deposits grew by 11.7%, while credit growth stood at 15%.

- This widening gap between credit and deposits has raised concerns for both the government and the Reserve Bank of India (RBI).

- Lenders have been urged to focus more on deposit mobilisation, exploring innovative financial products to bridge the gap.

- Major Reasons for Slower Deposit Growth:

- Shift of Household Savings: A significant portion of household savings has moved from banks to capital markets.

- Surge in Retail Participation: Following the Covid-19 pandemic, retail activity in the capital markets has seen substantial growth, both through direct trading and mutual fund investments.

- Demat Accounts Growth: According to the Economic Survey 2023-24, demat accounts with depositories (NSDL and CDSL) increased from 11.45 crore in FY23 to 15.14 crore in FY24.

- Facilitators of Household Savings Outflow to Capital Markets:

- Higher Returns: Capital markets offer better returns compared to traditional bank deposits, attracting more retail investors.

- Digital Infrastructure & Smartphone Penetration: The ease of accessing markets through robust digital platforms and increased smartphone use has facilitated investment, drawing savings away from banks.

- Mutual Fund Growth: Retail participation has surged, especially through mutual funds, insurance funds, and pension funds.

- For example, the mutual fund industry’s assets under management (AuM) grew by 6.23%, reaching Rs 64.97 lakh crore as of July 2024.

- Currently, there are about 9.33 crore systematic investment plan (SIP) accounts in mutual funds, allowing regular investments into schemes, thus driving further capital market participation.

Obstacles Facing the Indian Banking Sector:

- Infrastructure and Capital Investments Risk:

- Lending for upcoming infrastructure and capital projects, particularly those connected to State government entities, carries default risks due to stressed State finances.

- Banks should establish internal exposure limits based on comprehensive fiscal and financial assessments of individual States to mitigate risk.

- Stock Market and Retail Exposure Risk:

- The stock market’s rapid growth, while creating an illusion of wealth, presents risks for retail exposures. Indicators like rising demat accounts and high PE ratios across sectors signify potential overvaluation.

- To mitigate this, integrated supervision and rigorous stress tests on retail portfolios are recommended.

- Interconnected Lending and Governance Challenges:

- The risk of a contagion effect from defaults, exacerbated by interconnected lending and weak governance, presents a significant challenge.

- Focused risk monitoring is crucial, as regulation cannot substitute for strong governance practices.

- SME Challenges in a Re-Globalizing World:

- With re-globalization and geopolitical shifts, small and medium-sized enterprises (SMEs) face challenges, particularly in the context of Free Trade Agreements (FTAs) and regional ambitions.

- Banks must prepare for potential risks to SMEs, especially related to disrupted cash flows.

- Changing Liabilities Landscape:

- With digitization and changing consumption patterns, the nature of liabilities is shifting, impacting retail deposits. Banks with higher credit-deposit ratios may face challenges in liquidity coverage.

- Structural shifts in Indian savings demand a cautious approach from bankers, with a focus on maintaining liquidity amidst these changes.

Fortifying the Indian Banking Sector:

- Building Big Banks:

- The Narasimham Committee (1991) advocated for India to have three or four major commercial banks, alongside several mid-sized banks to support domestic and international growth.

- The government has already taken steps by consolidating PSBs and establishing entities like the Development Finance Institution (DFI) and Bad Bank.

- Requirement for Differentiated Banks:

- There is a growing need for distinct banking entities, addressing the diverse needs of retail, agriculture, and MSMEs.

- The creation of DFIs and niche banks with access to low-cost public deposits would enable better asset-liability management and improve financial inclusion.

- Blockchain Banking:

- Blockchain technology offers an opportunity for enhanced risk management and digital financial inclusion, advancing India’s banking sector by streamlining prudential supervision and supporting the growth of neo-banks.

- Addressing Moral Hazard:

- While public sector bank failures have been rare due to implicit sovereign guarantees, the privatisation of PSBs introduces new challenges.

- Upcoming reforms should focus on increasing individual deposit insurance and efficient resolution mechanisms to reduce moral hazard and systemic risks.

- ESG Integration:

- Banks, particularly those listed on stock exchanges, should integrate Environmental, Social, and Governance (ESG) practices to deliver long-term stakeholder value and meet evolving global standards.

- Enhancing Banking Institutions:

- Strengthening regulatory measures to create diversified loan portfolios, specialised sectoral regulators, and increased powers for addressing deliberate defaults will enhance the resilience of the banking sector.

- Facilitating Corporate Bond Market Growth:

- To reduce reliance on bank-centric lending, there is a need to promote the growth of the corporate bond market, aligning banking systems with a dynamic real economy.

- Enhancing Risk Management Models:

- Developing internal risk models, similar to the Bank Exposure Risk Index, tailored to specific States and infrastructure projects, will help assess and mitigate exposure to potential defaults.

- Addressing Changes in Liabilities:

- Banks need to adapt to changing liabilities resulting from digitisation and shifting consumption trends, particularly in Tier 1 and 2 cities, to maintain a stable deposit base.

Conclusion:

While India’s banking sector is experiencing success, it must proactively address emerging challenges through innovation, regulatory improvements, and adaptive strategies to sustain growth and ensure stability amidst economic uncertainties.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q1. With reference to the Banks Board Bureau (BBB), which of the following statements are correct? (2022)

- The Governor of RBI is the Chairman of BBB.

- BBB recommends for the selection of heads for Public Sector Banks.

- BBB helps the Public Sector Banks in developing strategies and capital raising plans.

Select the correct answer using the code given below:

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Ans: B

Q:2 Consider the following statements:(2021)

- The Governor of the Reserve Bank of India (RBI) is appointed by the Central Government.

- Certain provisions in the Constitution of India give the Central Government the right to issue directions to the RBI in public interest.

- The Governor of the RBI draws his power from the RBI Act.

Which of the above statements are correct?

- 1 and 2 only

- 2 and 3 only

- 1 and 3 only

- 1, 2 and 3

Ans: C

Q:3. Consider the following events: (2018)

- The first democratically elected communist party government formed in a State in India.

- India’s then largest bank, ‘Imperial Bank of India’, was renamed ‘State Bank of India’.

- Air India was nationalised and became the national carrier.

- Goa became a part of independent India.

Which of the following is the correct chronological sequence of the above events?

- 4 – 1 – 2 – 3

- 3 – 2 – 1 – 4

- 4 – 2 – 1 – 3

- 3 – 1 – 2 – 4

Ans: B

Mains

Q:1 Pradhan Mantri Jan Dhan Yojana (PMJDY) is necessary for bringing unbanked to the institutional finance fold. Do you agree with this for the financial inclusion of the poorer section of the Indian society? Give arguments to justify your opinion. (2016)

Source: IE

India-GCC Foreign Ministers’ Meeting

Tags: GS-2, IR- Bilateral relation Grouping- Indian Diaspora- India-GCC

Why in the news?

- Recently, External Affairs Minister S Jaishankar arrived in Saudi Arabia’s capital, Riyadh, to attend the First India-Gulf Cooperation Council (GCC) Foreign Ministers’ Meeting.

What is the Gulf Cooperation Council (GCC)?

- About:

- The Gulf Cooperation Council (GCC) is a political and economic alliance comprising six Middle Eastern countries—Saudi Arabia, Kuwait, the United Arab Emirates, Qatar, Bahrain, and Oman. It was formed in Riyadh, Saudi Arabia, in May 1981.

- Objective:

- The GCC’s primary goal is to promote unity among its member states, based on shared political, cultural, and economic interests rooted in Arab and Islamic cultures. The Presidency of the GCC rotates annually among the member states.

Organisational Structure:

- Supreme Council:

- The Supreme Council is the highest authority in the GCC, composed of the heads of the Member States.

- The presidency rotates among the member countries in alphabetical order.

- Ministerial Council:

- This body consists of the Foreign Ministers or other representatives from each member state.

- The Ministerial Council meets every three months to implement the decisions of the Supreme Council and propose new policies.

- Secretariat General:

- The Secretariat General acts as the administrative arm of the GCC, responsible for monitoring the implementation of policies and arranging meetings within the organisation.

India and GCC Relations:

- Introduction:

- The Gulf region is India’s immediate neighbour, separated only by the Arabian Sea.

- The Gulf Cooperation Council (GCC) has become a significant trading and potential investment partner for India.

- Both regions share mutual interests in geostrategic stability and security, as GCC nations are located near critical sea lanes across the Persian Gulf.

- Political Dialogue:

- The first India-GCC Political Dialogue took place alongside the United Nations General Assembly in 2003.

- In September 2022, India and GCC signed a Memorandum of Understanding (MoU) on Consultation Mechanisms, establishing a framework for an annual dialogue between the External Affairs Minister (EAM) and the GCC Troika (GCC Secretary General, Foreign Ministers of the current and next GCC presidencies, and other senior officials).

- Economic and Commercial Relations:

- The relationship is evolving beyond energy into sectors like tourism, construction, and finance, creating vast opportunities for trade and investments.

- Bilateral trade between India and the GCC reached USD 161.59 billion during FY 2023-24, with India exporting USD 56.3 billion and importing USD 105.3 billion from the region.

- Oil imports have grown steadily, with a sharp rise during FY22 due to high oil prices following the Russia-Ukraine conflict and the post-COVID recovery in demand.

- India-GCC Free Trade Agreement (FTA): Negotiations are ongoing, boosted by the successful India-UAE FTA.

- Energy Cooperation:

- GCC countries hold nearly 50% of the world’s oil reserves and supply 35% of India’s oil imports and 70% of its gas imports.

- India is in the process of executing the second phase of its Strategic Petroleum Reserve (SPR), and several GCC nations have shown interest in this initiative.

- Indian Diaspora and Remittances:

- Approximately 8.9 million Indians live in GCC countries, making up 66% of India’s non-resident population.

- Although remittances from GCC countries dropped from over 50% in 2016-17 to 30% in 2020-21, they still form a significant share of India’s total inward remittances, as per the RBI Remittances Survey 2021.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q:1 Which of the following is not a member of ‘Gulf Cooperation Council’? (2016)

(a) Iran

(c) Oman

(b) Saudi Arabia

(d) Kuwait

Ans: (a)

Source: IE

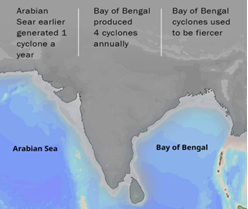

Uncommon Cyclones in the Arabian Sea

Tags: GS-1, Geography- Geographical Phenomena – Cyclones

Why in the news?

- The north Indian Ocean supplies a large part of the moisture required to generate the 200 lakh crore or so buckets of water during the summer monsoon.

- That implies a lot of evaporation from the Arabian Sea and the Bay of Bengal, which requires these seas to be warm enough to allow evaporation.

- Warm tropical oceans also tend to be hotbeds of cyclones. And yet, the north Indian Ocean is the least active region of the world’s oceans vis-à-vis the number of cyclones.

Cyclones:

- About

- Cyclones are massive, swirling air systems rotating around a centre of low pressure. They are powerful natural phenomena characterised by intense winds and heavy rainfall.

- These systems form in low-pressure areas where winds spiral upward.

Conditions for Tropical Cyclone Formation

- Temperature:

- Cyclones require warm sea surface temperatures above 27°C to provide the heat needed for their development.

- Supply of Warm Air:

- A large and continuous supply of warm, moist air is essential. This air releases substantial latent heat, which fuels the cyclone’s growth.

- Coriolis Force:

- A strong Coriolis force is necessary to prevent the low-pressure centre from filling in. The Coriolis effect, which is weak near the equator, restricts cyclone formation between 0° and 5° latitude.

- Unstable Conditions:

- An unstable atmosphere creates local disturbances.

- These disturbances, coupled with the absence of strong vertical wind shear, facilitate the development and intensification of cyclones.

- The vertical transport of latent heat is crucial for cyclone development, and strong wind shear can disrupt this process.

Why Are Cyclones Rare in the Arabian Sea?

- Sea Surface Temperatures (SSTs):

- Cyclones require sea surface temperatures (SSTs) above 26.5°C for formation. However, during the monsoon season, the Arabian Sea’s surface temperature often remains below this threshold, limiting cyclogenesis.

- Monsoon Influence:

- The southwest monsoon winds from June to September generate strong vertical wind shear, which disrupts the formation of cyclones. High wind shear prevents storms from intensifying and often leads to their dissipation.

- Dry Air from the Arabian Peninsula:

- The flow of dry, hot air from the Arabian Peninsula suppresses cloud formation and moisture in the atmosphere, reducing the likelihood of cyclone formation in the Arabian Sea.

- Geographical Barriers:

- Landmasses to the west, such as Oman and the Arabian Peninsula, can influence cyclone paths and cause them to weaken before causing significant damage.

Historical Cyclones in the Arabian Sea;

- Cyclone of 1964:

- One of the earliest recorded cyclones in the Arabian Sea during the monsoon season, this storm caused significant damage to the Gujarat coast in India.

- Cyclone 1976:

- This rare cyclone originated over the Bay of Bengal, crossed India, entered the Arabian Sea, and intensified before weakening near Oman.

- Cyclone Gonu (2007):

- One of the strongest cyclones in the Arabian Sea’s history, Cyclone Gonu reached Category 5 strength and caused widespread damage in Oman and Iran.

- Cyclone Kyarr (2019):

- A Category 4 cyclone that, despite not making landfall in India, caused flooding in coastal areas of Gujarat and Maharashtra.

Recent Developments: Climate Change and Cyclone Frequency:

- Increasing Sea Temperatures:

- Climate models indicate a warming trend in the Arabian Sea, increasing the energy needed for cyclone formation and intensification.

- Changing Wind Patterns:

- Weakening monsoon winds, driven by climate change, allow cyclones to form and persist longer, leading to storms occurring in months that were previously cyclone-free.

- Rising Intensity:

- Modern cyclones in the Arabian Sea, such as Cyclones Kyarr (2019) and Tauktae (2021), have been more intense than past cyclones, leading to greater destruction in coastal areas.

Impacts of Cyclones on the Arabian Sea:

- Flooding:

- Coastal areas are vulnerable to flooding from heavy rains and storm surges caused by cyclones, particularly in cities like Mumbai and Karachi, which can disrupt infrastructure and displace populations.

- Agriculture:

- Cyclones can destroy crops and disrupt agricultural activities in coastal areas, causing economic losses and food shortages.

- Fisheries:

- Fishing communities are highly vulnerable, as cyclones can lead to loss of life and destruction of boats and fishing equipment.

- Infrastructure Damage:

- Cyclones cause extensive damage to buildings, power lines, roads, and communication networks, necessitating prolonged recovery efforts.

Preparing for Cyclones in the Arabian Sea:

- Improved Forecasting:

- Investment in meteorological technologies can help improve cyclone path and intensity predictions, giving coastal communities more time to prepare.

- Infrastructure Resilience:

- Strengthening coastal infrastructure through better drainage systems, cyclone shelters, and stronger buildings can reduce cyclone-related damage.

- Public Awareness Campaigns:

- Regular public education on cyclone risks, evacuation plans, and emergency procedures is essential for protecting coastal populations.

- Disaster Management Systems:

- Governments must maintain effective disaster management systems to respond quickly to cyclones, provide relief, and ensure efficient recovery for affected communities.

Conclusion:

Though cyclones in the Arabian Sea are rare, the increasing frequency and intensity driven by climate change necessitate proactive strategies to mitigate their impacts. Coastal nations must prioritise preparedness through improved forecasting, strengthened infrastructure, and public awareness to minimise the damage caused by these powerful storms.

UPSC Civil Services Examination PYQ

Mains

Q:1 Discuss the meaning of colour-coded weather warnings for cyclone prone areas given by India Meteorological Department. (2022)

Source: TH

Responsible use of Artificial Intelligence in war

Tags: GS-3, Science & Technology- Defence technology- AI

Why in the news?

- The expansion of AI in military applications is prompting global efforts to regulate its use. Conflicts such as those in Ukraine and Gaza are testing AI’s role in combat.

- India’s engagement in shaping international norms for AI in warfare remains limited, highlighting the need for proactive participation as frameworks for AI arms control develop.

Responsible Use of Artificial Intelligence in the Military Domain (REAIM)

- About the Summit

- Objective: The REAIM summit aims to establish global norms for AI in military applications.

- Location and Co-Hosts: The second summit starts on September 9 in Seoul, co-hosted by Kenya, the Netherlands, Singapore, and the United Kingdom.

- Objectives of the Korea Summit

- Understand Implications: Assess the impact of military AI on global peace and security.

- Implement Norms: Develop new standards for AI use in military contexts.

- Global Governance: Propose ideas for long-term international governance of military AI.

- Outcome of the First Summit

- Focus: The first summit in February 2023 in The Hague addressed issues like autonomous weapons and the need for human oversight in the use of force.

- Current Discussions: Ongoing UN discussions on lethal autonomous weapon systems (LAWS) since 2019.

The AI Debate in Warfare:

- Increased Use of AI

- Applications: AI is increasingly used in intelligence, surveillance, reconnaissance (ISR), and other military tasks.

- Benefits: Enhances data processing, situational awareness, decision-making speed, targeting precision, and reduces civilian casualties.

- Concerns Over AI in Warfare

- Risks: Critics warn of potential dangers and ethical issues related to AI decision-making support systems (AI-DSS) in warfare.

- Promoting Responsible Use

- Global Efforts: The REAIM process focuses on responsible AI use rather than reversing AI advancements.

- US Initiatives: Draft political declaration on responsible AI use issued at the Hague summit, formalised in November 2023. NATO’s guidelines released in July 2023. Bilateral talks with China on AI’s impact on nuclear deterrence.

Stand of India, China, US, and UN on AI in Weapons

- US Resolution at the UNGA

- Resolution: The US introduced a resolution on responsible AI use, co-sponsored by 123 countries, adopted by consensus.

- Focus: REAIM fosters detailed discussions and aims to build an international coalition for new global norms.

- India’s Stand

- Current Position: India is cautiously observing developments, having not endorsed the Hague summit’s “call to action.” There is a risk of being left behind if India does not actively engage in shaping global norms.

- China’s Stand

- Proactivity: China is actively involved in discussions on military AI, having released a White Paper in 2021 and supported the Hague summit’s call to action.

Conclusion

As AI’s role in warfare grows, it is crucial for countries like India to participate in shaping international norms and regulations. Engaging in global discussions will help ensure that national interests are considered and contribute to the development of responsible AI standards in military applications.

Source: IE

Financialisation

Tags: GS-3, Economy- Growth & Development

Why in the news?

- On September 7, 2024, the Chief Economic Adviser (CEA) warned that financialisation could distort India’s macroeconomic outcomes and India’s stock market capitalisation is about 140% of the GDP.

About Financialisation:

- Definition: Financialisation refers to the growing size and influence of a country’s financial sector in relation to its overall economy.

- Economic Influence: It is the process through which financial markets, institutions, and elites gain a stronger influence over economic policy and outcomes.

- Shift in Focus: Financialisation reflects the transition from traditional industrial or productive activities, such as manufacturing, to financial activities, including the trading, management, and speculation of financial assets.

- Broader Reach: The term also highlights the increasing diversity of financial transactions, market players, and their interconnectedness with various parts of the economy and society.

- Historical Context: This shift occurred as countries moved away from industrial capitalism.

- Economic Impact: It affects both the macroeconomy and microeconomy by restructuring financial markets, influencing corporate behaviour, and shaping economic policy.

- Sectoral Disparity: Financialisation has led to a disproportionate rise in incomes within the financial sector compared to other sectors of the economy.

Source: TH

National Company Law Appellate Tribunal (NCLAT)

Tags: GS-2, Polity & Governance- Judiciary — Transparency & Accountability

Why in the news?

- On September 7, 2024, the National Company Law Appellate Tribunal (NCLAT) temporarily halted the acquisition of power-generating company Coastal Energen by a consortium led by Adani Power.

About NCLAT:

- Establishment:

- NCLAT is a quasi-judicial body constituted under Section 410 of the Companies Act, 2013.

- It was set up on 1st June 2016 to hear appeals against the orders passed by the National Company Law Tribunal (NCLT).

- Objective:

- Its primary aim is to expedite the resolution of corporate disputes, promote transparency, and enhance efficiency in corporate governance and insolvency processes in India.

- Functions:

- NCLT Appeals: NCLAT hears appeals against the orders of NCLT under Section 61 of the Insolvency and Bankruptcy Code, 2016 (IBC).

- IBBI Orders: It hears appeals against orders passed by the Insolvency and Bankruptcy Board of India (IBBI) under Sections 202 and 211 of the IBC.

- CCI Orders: NCLAT also addresses appeals against orders of the Competition Commission of India (CCI).

- National Financial Reporting Authority: It serves as an appellate body for appeals against the orders of the National Financial Reporting Authority (NFRA).

- Advisory Role: NCLAT has advisory jurisdiction on legal issues referred to it by the President of India.

- Headquarters:

- Located in New Delhi.

- Composition:

- NCLAT is composed of a chairperson along with judicial and technical members, appointed by the Central Government based on expertise in law, finance, management, accountancy, or administration.

- Disposal of Cases:

- Upon receiving an appeal, NCLAT is responsible for passing appropriate orders—confirming, modifying, or setting aside the original order.

- It is required to dispose of appeals within six months from the date of receipt, with further appeals permitted to the Supreme Court.

- Powers:

- NCLAT has the authority to regulate its own procedures and exercise powers similar to those granted to a civil court under the Code of Civil Procedure, 1908.

- These powers include the ability to summon and examine witnesses, mandate the production of documents, receive evidence through affidavits, and issue commissions.

- Any order passed by NCLAT can be enforced in the same way as a decree passed by a civil court.

- Civil courts are restricted from hearing any suit or proceeding on matters that fall under NCLAT’s jurisdiction as per the Companies Act, 2013, or any other applicable law.

- No court or authority can grant an injunction to prevent or delay actions that NCLAT is legally authorised to take under this Act or any other law in force.

Source: BB

Technical Textiles

Tags: GS-3, Economy- Growth & Development- Textiles

Why in the news?

- Annual export of technical textiles will cross $10 billion by 2030, said Giriraj Singh, Union Minister for Textiles.

About Technical Textiles:

- Technical textiles refer to textile materials and products primarily valued for their technical and functional properties rather than for aesthetic purposes.

- Other terms for technical textiles include industrial textiles, functional textiles, performance textiles, engineering textiles, invisible textiles, and hi-tech textiles.

- They are designed with enhanced physical, mechanical, thermal, or chemical properties to serve specific functions in sectors like construction, civil engineering, transport, defence, medical, and healthcare.

- These textiles are either used individually or as components within other products to provide functions like fire resistance or structural reinforcement.

- Technical textiles are manufactured from both natural and synthetic fibres.

- They are categorised into 12 major groups based on their application areas, including Agrotech, Geotech, Buildtech, Mobiltech, Hometech, Clothtech, Indutech, Meditech, Sportstech, Protech, Packtech, and Oekotech.

National Technical Textiles Mission:

- Launched by the Ministry of Textiles, the mission seeks to enhance the penetration of technical textiles in India and promote the sector’s growth.

- Its goal is to position India as a global leader in technical textiles.

- The mission comprises four key components:

- Research, Innovation, and Development

- Promotion and Market Development

- Export Promotion

- Education, Training, and Skill Development

- Target: The mission aims to increase the domestic market size of the technical textile sector to $40-50 billion by 2024, with an average annual growth rate of 15-20%.

Source: TH

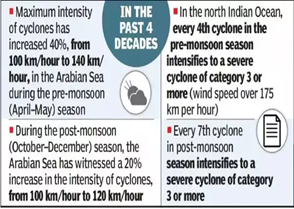

BPaLM Regimen

Tags: GS-3, Science & Technology- Biotechnology

Why in the news?

- Recently, The Union Health Ministry introduced the BPaLM regimen to treat Multidrug-Resistant Tuberculosis under the National TB Elimination Program.

About BPaLM Regimen:

- About:

- The BPaLM regimen is a newly introduced treatment for Multidrug-Resistant Tuberculosis (MDR-TB).

- It was introduced by the Union Ministry of Health and Family Welfare as part of the National TB Elimination Program (NTEP).

- Composition: This regimen includes four drugs—Bedaquiline, Pretomanid, Linezolid, and optionally Moxifloxacin.

- The regimen introduces Pretomanid, a new anti-TB drug approved by the Central Drugs Standard Control Organization (CDSCO) for use in India.

- Efficacy:

- The BPaLM regimen offers a safer and more effective treatment compared to traditional MDR-TB therapies.

- It is all-oral, reducing the pill burden and making it more patient-friendly.

- This regimen can cure drug-resistant TB in just six months, significantly shorter than the previous treatment duration of up to 20 months, and comes with fewer side effects.

- National TB Elimination Program (NTEP):

- The NTEP is a government initiative focused on eliminating tuberculosis in India, aiming for eradication by 2025.

- It is a centrally sponsored scheme under the National Health Mission, with both State and Central Governments sharing resources.

- The program follows the DOTS strategy (Directly Observed Treatment, Short-course Chemotherapy), ensuring patients are diagnosed, treated, and monitored until cured.

- NTEP provides free, high-quality TB diagnosis and treatment across the country.

- The NI-KSHAY Portal (Ni=End, Kshay=TB) is a web-based system used for managing TB patients under NTEP.

Source:TOI

Frequently Asked Questions (FAQs)

Q: What are daily current affairs?

A: Daily current affairs refer to the most recent and relevant events, developments, and news stories that are happening around the world on a day-to-day basis. These can encompass a wide range of topics, including politics, economics, science, technology, sports, and more.

Q: Why is it important to stay updated with daily current affairs?

A: Staying updated with daily current affairs is crucial because it helps individuals make informed decisions in their personal and professional lives. It enables people to understand the world around them, stay aware of significant events, and engage in informed discussions about important issues.

Q: Where can I access daily current affairs information?

A: There are various sources for daily current affairs, including newspapers, news websites, television news broadcasts, radio programs, and dedicated apps or newsletters. Social media platforms are also widely used to share and access current affairs information.

Q: How can I effectively incorporate daily current affairs into my routine?

A: To incorporate daily current affairs into your routine, consider setting aside specific times each day to read or watch news updates. You can also subscribe to newsletters or follow news apps to receive curated content. Engaging in discussions with peers or participating in online forums can further enhance your understanding of current events.

Q: What are some tips for critical analysis of daily current affairs?

A: When analyzing daily current affairs, it’s essential to cross-reference information from multiple sources to ensure accuracy. Additionally, consider the source’s credibility and bias, if any. Develop the ability to identify the main points and implications of news stories, and critically evaluate the significance and impact of the events reported.

To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

- Join our Main Telegram Channel and access PYQs, Current Affairs and UPSC Guidance for free – Edukemy for IAS

- Learn Economy for free- Economy for UPSC

- Learn CSAT – CSAT for UPSC

- Mains Answer Writing Practice-Mains Answer Writing

- For UPSC Prelims Resources, Click here