Today’s daily current affairs briefing for UPSC aspirants explores the latest developments relevant to the upcoming civil services examination. Our focus today includes a critical analysis of recent policy changes, international affairs, and national developments, all of which play a pivotal role in shaping India’s socio-political and economic landscape. Stay informed and stay ahead in your UPSC preparations with our daily current affairs updates, as we provide you with concise, well-researched insights to help you connect the dots between contemporary events and the broader canvas of the civil services syllabus.

Contents

- 1 An Outlining of Urban Transformation Strategies

- 2 UPSC Civil Services Examination Previous Year’s Question (PYQs)

- 3 Removal of indexation benefit on sale of property

- 4 UPSC Civil Services Examination Previous Year’s Questions (PYQs)

- 5 IndiaAI Mission

- 6 UPSC Civil Services Examination Previous Year Question (PYQ)

- 7 Climate Change Adaptation vs Mitigation Debate

- 8 India creates legroom to sign UK, EU FTAs with Customs Act amendments

- 9 Amravati as a Buddhist Site

- 10 UPSC Civil Services Examination, Previous Year Question (PYQ)

- 11 Olympic Order

- 12 Llama 3.1

- 13 INS Triput

- 14 Magnetotactic bacteria

- 15 UPSC Civil Services Examination, Previous Year Question (PYQ)

- 16 Frequently Asked Questions (FAQs)

- 16.1 Q: What are daily current affairs?

- 16.2 Q: Why is it important to stay updated with daily current affairs?

- 16.3 Q: Where can I access daily current affairs information?

- 16.4 Q: How can I effectively incorporate daily current affairs into my routine?

- 16.5 Q: What are some tips for critical analysis of daily current affairs?

- 17 To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

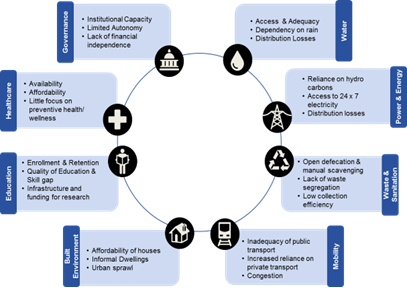

An Outlining of Urban Transformation Strategies

Tags: GS – 3, Economy- Infrastructure– Urbanisation– Poverty and Developmental Issues

Why in the news?

- Urbanisation in India has been a defining trend of the 21st century, with cities becoming the epicentres of economic and social development.

- Home to approximately 500 million people, which accounts for about 36% of India’s population, urban areas are witnessing a steady population growth rate of 2% to 2.5% annually.

- Recognising rapid urbanisation and cities as growth hubs, the new government’s maiden Budget introduces initiatives for planned urban development.

Strategies Outlined in the Budget to Address City Development:

- Proposal to Expand the PMAY Scheme in Urban Areas

- Achievements Since 2015:

- The Pradhan Mantri Awas Yojana (Urban) has provided around 8.5 million housing units for the Economically Weaker Sections (EWS).

- Middle-Income Groups (MIG) with an investment of approximately ₹8 lakh crore.

- Achievements Since 2015:

- Future Plans:

- The Budget proposes to support the construction of an additional 10 million housing units in urban areas with an investment of ₹10 lakh crore, including ₹2.2 lakh crore in central assistance over the next five years.

- For the current year, ₹30,171 crore has been allocated, part of which will subsidise interest to facilitate affordable loans.

- Housing Plans for Migrant Workers in Cities:

- New Initiative:

- Introduction of new rental housing with dormitory-type accommodations for industrial workers.

- Planned to be developed in a public-private partnership (PPP) mode, with upfront financial support under the Viability Gap Funding (VGF) scheme.

- Covering 20% from the central government and potentially similar support from state governments.

- New Initiative:

- Development and Upgradation of Core Infrastructure Requirements:

- Fund Allocation:

- The Atal Mission for Rejuvenation and Urban Transformation (AMRUT) has allocated ₹8,000 crore for urban infrastructure, including water supply, sanitation, roads, and sewerage systems.

- The finance minister has announced the availability of the VGF window for projects undertaken as commercial ventures in PPP mode.

- Significant investment of ₹11.11 lakh crore for capital expenditure in infrastructure, including highways and other sectors, from which cities can benefit.

- Provision of ₹1.50 lakh crore as an interest-free loan for infrastructure development, which states could use for urban projects.

- Fund Allocation:

- Smart Cities and Digital Transformation

- Budgetary Support:

- Smart Cities Mission received ₹8,000 crore in 2023-24, which has been reduced to ₹2,400 crore for 2024-25 to meet residual commitments.

- Budgetary Support:

- New Initiative:

- National Urban Digital Mission (NUDM) introduced with a provision of ₹1,150 crore, focusing on the digitization of property and tax records and their management with GIS mapping.

- Planned City Development

- Fund Allocation:

- ₹25,653 crore as the normal ‘Finance Commission Grant’ for municipalities.

- ₹500 crore for the incubation of new cities.

- Fund Allocation:

- Transit-Oriented Development:

- Development of mass rapid transit systems to allow dense development around transit hubs without overwhelming road traffic.

- Enhanced focus on economic and transit planning and orderly development of peri-urban areas using town planning schemes.

- Allocation of ₹1,300 crore to encourage electric bus systems in cities, addressing high upfront costs and promoting eco-friendly transportation.

- Solid Waste Management

- Proposed Initiatives:

- Introducing bankable projects for SWM in collaboration with state governments and financial institutions, leveraging the VGF.

- Inspired by cities like Indore, Madhya Pradesh, which have demonstrated financially viable SWM models.

- Proposed Initiatives:

- Street Vending and Economic Opportunities

- Development Initiatives:

- Developing 100 weekly ‘haats’ or street food hubs in select cities.

- Encouraging states to facilitate the preparation of street-vending plans and development of ‘haats’ according to local needs.

- Development Initiatives:

Purpose of Newly Launched National Urban Digital Mission (NUDM)

- Digitisation of Property and Tax Records

- Ensuring transparency, accuracy, and efficiency in maintaining property records and tax management systems.

- Easier access to information and transactions for property owners while aiding municipal bodies in maintaining up-to-date records and improving revenue collection.

- Geographic Information System (GIS) Mapping

- Providing a precise understanding of spatial data for urban planning and management.

- Supporting better decision-making processes by offering detailed visual representations of urban areas.

- Financial Management

- Streamlining budgeting, expenditure tracking, and revenue generation for urban local bodies using digital tools.

- Enhancing the financial health of municipalities to ensure efficient utilisation of funds for urban development projects.

Challenges and Future Prospects:

- Funding and Resource Allocation

- Adequate funding and resource allocation are critical to the success of these initiatives.

- Ensuring consistent financial support from both central and state governments is essential for sustained progress.

- Capacity Building

- Building the capacity of urban local bodies to implement and manage digital solutions is vital.

- This includes training municipal staff, enhancing technical expertise, and fostering a culture of innovation.

- Interoperability and Integration

- Ensuring various digital systems and platforms are interoperable and integrated seamlessly is crucial for effective urban management.

- This requires standardisation of technologies and collaborative efforts among different stakeholders.

- Data Privacy and Security

- Safeguarding privacy and ensuring data security as cities collect and process vast amounts of data.

- Implementing robust cybersecurity measures to protect sensitive information and maintain public trust.

Conclusion:

The Budget presents a comprehensive approach to urban development, combining financial provisions and procedural strategies to promote planned urbanisation. However, the successful implementation of these initiatives depends on the vision and determination of cities, represented by municipalities, and guided by state governments. Crucially, the participation of citizens remains the cornerstone for the success of any city’s development strategy.

UPSC Civil Services Examination Previous Year’s Question (PYQs)

Prelims:

Q:1 With reference to the Indian economy after the 1991 economic liberalisation, consider the following statements: (2020)

- Worker productivity (Rs. per worker at 2004-05 prices) increased in urban areas while it decreased in rural areas.

- The percentage share of rural areas in the workforce steadily increased.

- In rural areas, the growth in the non-farm economy increased.

- The growth rate in rural employment decreased.

Which of the statements given above is/are correct?

- 1 and 2 only

- 3 and 4 only

- 3 only

- 1, 2 and 4 only

Ans: (b)

Mains:

Q:1 The frequency of urban floods due to high intensity rainfall is increasing over the years. Discussing the reasons for urban floods, highlight the mechanisms for preparedness to reduce the risk during such events. (2016)

Q:2 Do government’s schemes for up-lifting vulnerable and backward communities by protecting required social resources for them, lead to their exclusion in establishing businesses in urban economies? (2014)

Source: TH

Removal of indexation benefit on sale of property

Tags: GS-3, Economy- Growth & Development- Inclusive Growth– Infrastructure

Why in the news?

- The Budget 2024 announced the removal of the indexation benefits available on property sales.

- Consequently, many people who sell their property will now not be able to inflate their purchase price and reduce their capital gains.

Capital Gain Tax:

- About:

- A capital gains tax is a tax imposed on the sale of an asset. It is calculated as the difference between the sale price of the property and its purchase price.

- Any gain or loss incurred from the sale of a house property may be subject to tax under the ‘Capital Gains’ head.

- Similarly, capital gains or losses may arise from the sale of different types of capital assets such as stocks, mutual funds, bonds, and other investments.

- Types:

- Depending on the period an asset is held by the owner, there are two types of capital gains: Short-term Capital Gains and Long-term Capital Gains.

- Budget 2024 and Capital Gain Tax:

- For classifying assets into long-term and short-term, there will only be two holding periods: 12 months and 24 months.

- The holding period has been removed.

- All listed securities with a holding period exceeding 12 months are considered Long-Term. The holding period for all other assets is 24 months.

- The taxation of Short-Term Capital Gains for listed equity shares, units of an equity-oriented fund, and units of a business trust has been increased to 20% from 15%.

- Other financial and non-financial assets which are held for short term shall continue to attract the tax at slab rates.

- The limit on the exemption of Long-Term Capital Gains on the transfer of equity shares, equity-oriented units, or units of Business Trust has increased from Rs.1 Lakh to Rs.1.25 lakh per year.

- However, the rate at which it is taxed has increased from 10% to 12.5%.

- The tax on long-term capital gains on other financial and non-financial assets is reduced from 20% to 12.5%.

Indexation Benefits:

- About:

- In case of property sale, indexation helps in adjusting its purchase price according to the prevailing inflation rate.

- The adjustment inflates the purchase price of a property considering the inflation over the invested years.

- This ultimately brings down the taxable capital gains on the sale of the property.

- Through indexation, investors can accurately determine their capital gains and ensure they are paying taxes only on the real gains after inflation is adjusted.

- Calculation:

- The government releases cost inflation index (CII) numbers to index capital gains on specified assets.

- CII number takes into account the prevailing inflation for the particular financial year.

- Formula to calculate the adjusted purchase price using the cost inflation index is:

- Indexed cost = Purchase Amount * (CII in year of sale / CII in year of purchase).

- Initially, the I-T department had set 1981 as the base year and later shifted it to 2001, with a base value of 100.

- Each year’s index is computed relative to this base.

- This adjustment ensures that the taxable gain reflects the real increase in the asset’s value, not just the effect of inflation.

Indexation Benefits Removed in Budget 2024:

- The indexation benefit that was previously available on the sale of long-term assets has now been removed.

- Any sale of a long-term asset made after 23rd July 2024 will attract a tax rate of 12.5% only without the indexation benefit.

- However, the indexation benefit can be taken on the sale of property bought or inherited before 2001.

Example Tax Rules:

- Example (Under Previous Tax Rules)

- Purchase Price of Property: ₹50 lakh

- Adjusted Purchase Price (Indexed): ₹64.82 lakh

- Sale Price (2024-25): ₹70 lakh

- Long-Term Capital Gain (LTCG): ₹5.18 lakh

- LTCG Tax Liability: ₹1.036 lakh (20% of Gain)

- Example (Under New Tax Rule – Budget 2024)

- Purchase Price of Property: ₹50 lakh

- Sale Price (2024-25): ₹70 lakh

- Gain: ₹20 lakh

- LTCG Tax Liability: ₹2.5 lakh (12.5% of Gain)

Possible Impact of Removal of Indexation Benefit:

- Slowdown in the Resale Market:

- It may discourage owners of older residential properties and land from selling, as the increased tax liability reduces their potential profit.

- Rise in Cash Transactions:

- There’s a concern that this change could incentivize under-the-table cash deals to avoid the higher tax burden, counteracting efforts to formalise the real estate sector.

- Higher Property Prices:

- Sellers may attempt to offset the increased tax burden by raising property prices, effectively transferring the cost to buyers.

UPSC Civil Services Examination Previous Year’s Questions (PYQs)

Prelims

Q1. Which part of the Constitution of India declares the ideal of a Welfare State? (2020)

- Directive Principles of State Policy

- Fundamental Rights

- Preamble

- Seventh Schedule

Ans: (a)

Q2. Other than the Fundamental Rights, which of the following parts of the Constitution of India reflect/ reflect the principles and provisions of the Universal Declaration of Human Rights (1948)? (2020)

- Preamble

- Directive Principles of State Policy

- Fundamental Duties

Select the correct answer using the code given below:

- 1 and 2 only

- 2 only

- 1 and 3 only

- 1, 2 and 3

Ans: (d)

Mains

Q:1 ‘Constitutional Morality’ is rooted in the Constitution itself and is founded on its essential facets. Explain the doctrine of ‘Constitutional Morality’ with the help of relevant judicial decisions. (2021)

Source: ET

IndiaAI Mission

Tags: GS – 2,E-GovernanceGovernment Policies & Interventions, GS – 3, S&T- Artificial Intelligence – India in Technology

Why in the news?

- Recently, In the Union Budget 2024, the Ministry of Electronics and IT has been allocated Rs 551 crore for the IndiaAI Mission for the fiscal year 2024-25.

About IndiaAI Mission:

- The IndiaAI Mission is an initiative by the Government of India designed to leverage Artificial Intelligence (AI) to drive economic growth, enhance governance, and improve the quality of life for citizens.

- The mission aims to position India as a global leader in AI innovation and adoption.

Key Pillars of the Mission:

- IndiaAI Compute Capacity:

- Establish a scalable AI computing ecosystem with over 10,000 GPUs through public-private partnerships (PPP).

- Develop an AI marketplace offering AI as a service and pre-trained models, serving as a central hub for essential AI resources.

- IndiaAI Innovation Centre:

- Focus on the development and deployment of indigenous large multimodal models (LMMs) and domain-specific foundational models.

- Address the specific needs of India’s diverse industries and sectors with these models.

- IndiaAI Datasets Platform:

- Streamline access to high-quality non-personal datasets for AI innovation.

- Provide a unified data platform to facilitate access for Indian startups and researchers, aiding in the development of robust AI models.

- IndiaAI Application Development Initiative:

- Promote AI applications in critical sectors by addressing problem statements from Central Ministries, State Departments, and other institutions.

- Focus on creating impactful AI solutions for large-scale socio-economic transformation.

- IndiaAI Future Skills:

- Reduce barriers to AI education by expanding AI courses at various academic levels and establishing Data and AI Labs in Tier 2 and 3 cities.

- Ensure a steady pipeline of skilled AI professionals across the nation.

- IndiaAI Startup Financing:

- Support deep-tech AI startups with streamlined access to funding.

- Provide risk capital and financial support to nurture a vibrant ecosystem of AI startups that drive technological advancements and economic growth.

- Safe & Trusted AI:

- Promote responsible AI development through implementing Responsible AI projects, developing indigenous tools and frameworks, and establishing guidelines for ethical, transparent, and trustworthy AI technologies.

Global IndiaAI Summit 2024:

- In July 2024, the Union government hosted the Global IndiaAI Summit in New Delhi.

- The summit aimed to foster collaboration and knowledge exchange, emphasising India’s commitment to the ethical and inclusive growth of AI technologies.

- It provided a platform for leading international AI experts from various sectors to share insights on key AI issues and challenges.

IndiaAI Mission and Budget 2024:

- The IT Ministry will issue a tender to procure 300 to 500 GPUs to enhance domestic computing capacity for AI system development.

- This follows an initial budgetary allocation of Rs 551 crore for the IndiaAI Mission in the Union Budget 2024-25.

- Approved by the Union Cabinet in March with a total budget of Rs 10,372 crore, the mission aims to establish over 10,000 GPUs and develop AI models with more than 100 billion parameters, focusing on sectors like healthcare, agriculture, and governance.

- Of the Rs 10,370 crore plan, Rs 4,564 crore is allocated for building computing infrastructure, and approximately Rs 2,000 crore is designated for supporting deep-tech startups at various growth stages.

- Implementation will follow a PPP model with 50% viability gap funding. If compute prices fall, private entities must increase compute capacity within the same budget to meet higher demand.

- The Ministry’s initial approach includes AI computing, skilling, and dataset applications.

- Recognizing the challenges faced by small businesses in accessing computing capacity, the government plans to support GPU procurement for Indian startups.

- India’s approach is akin to the European Union’s strategy, which has introduced rules to facilitate hardware access for AI development.

- The IndiaAI Mission will also establish the IndiaAI Datasets Platform to host high-quality AI-ready datasets, essential for developing large language models.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q:1 With the present state of development, Artificial Intelligence can effectively do which of the following? (2020)

- Bring down electricity consumption in industrial units

- Create meaningful short stories and songs

- Disease diagnosis

- Text-to-Speech Conversion

- Wireless transmission of electrical energy

Select the correct answer using the code given below:

(a) 1, 2, 3 and 5 only

(b) 1, 3 and 4 only

(c) 2, 4 and 5 only

(d) 1, 2, 3, 4 and 5

Ans: (b)

Mains

Q:1 What are the main socio-economic implications arising out of the development of IT industries in major cities of India? (2022)

Q:2 “The emergence of the Fourth Industrial Revolution (Digital Revolution) has initiated e-Governance as an integral part of government”. Discuss. (2020)

Source: IE

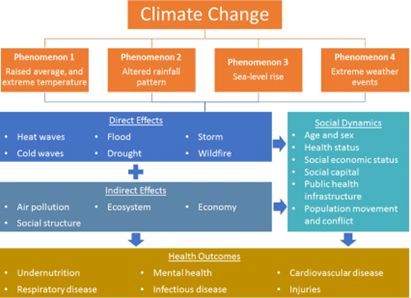

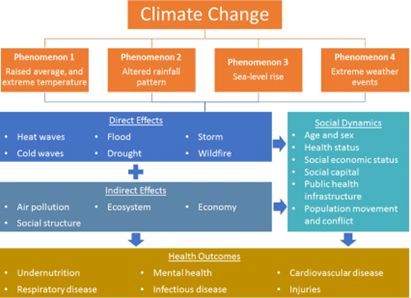

Climate Change Adaptation vs Mitigation Debate

Tags: GS-1, Climatic Change– Allocation of funds and Mitigation measures Mission Adaptation

Why in the News?

- The Economic Survey has highlighted flaws and inequities in the global climate action regime, suggesting alternative pathways that incorporate lifestyle and behavioural changes.

- It emphasises that adaptation should receive as much importance as mitigation.

What’s the Difference Between Climate Change Mitigation and Adaptation?

- Climate Change Mitigation:

- Involves avoiding and reducing emissions of heat-trapping greenhouse gases to prevent extreme global warming.

- Climate Change Adaptation:

- Involves altering human behaviour, systems, and ways of life to protect societies, economies, and the environment from the impacts of climate change.

- Interrelationship:

- Reduced emissions make it easier to adapt to unavoidable changes.

- Mitigation actions will take decades to affect rising temperatures, so adapting now is crucial.

The Economic Survey 2023-24 on Climate Change

- Ineffective and Inequitable International Framework:

- None of the targets set by the international framework have been met.

- Developing nations are under undue pressure to attain the 1.5 or 2°C temperature targets, diverting focus and resources from immediate needs.

- A warmer world might be more equitable and resilient than one strictly adhering to the 1.5°C target.

- The survey suggests potential shifts in India’s energy transition trajectory.

- Importance of Adaptation:

- As the 1.5°C target will likely be breached soon, rapid development and adaptation are necessary for increasing resilience.

- Improving incomes and overall well-being is considered the best insurance against climate change impacts.

- Mitigation by Rich and Adaptation by Developing Countries:

- Higher temperatures will intensify climate impacts, necessitating that rich countries focus on mitigation while developing countries focus on adaptation.

- Hypocrisy of the Developed World:

- Developed countries, despite historical responsibility, lag in carbon reduction and have not met emission reduction targets or commitments to provide finance and technology to developing countries.

- The international climate architecture is seen as preserving the existing world order rather than saving the planet.

- The equitable Kyoto Protocol was replaced by the Paris Agreement, favouring developed countries.

What are the Alternative Approaches Focussing on Climate Change Adaptation?

- Building Climate Resilient Infrastructure:

- Example: Central Vista project improving over the current buildings in the Central Secretariat complex.

- Climate Proofing:

- Reducing GHG emissions from investments and increasing resilience to climate change impacts.

- Example: The Smart City Mission contains elements of climate proofing.

- Lifestyle and Behavioural Changes:

- Example: India’s Mission Life calls for conscious consumption for the well-being of the planet.

Source: IE

India creates legroom to sign UK, EU FTAs with Customs Act amendments

Tags: GS – 3, IR- Bilateral relations- Agreement with involvement india – Inclusive Growth

Why in the news?

- The Union Budget 2024 has introduced amendments to the Customs Act, easing compliance with value-addition norms that are typically in place to prevent the misuse of concessions agreed upon in trade agreements.

Rules of Origin:

About:

- Rules of origin are the criteria used to define where a product was made. They determine the economic nationality of a product in international trade.

Criteria for Determining Origin:

- Wholly Obtained or Produced: Goods that are completely produced or obtained in a country, such as agricultural products, minerals, and fish.

- Substantial Transformation: Products that have undergone substantial transformation in a country, typically defined by a change in tariff classification, a specific percentage of value added, or specific manufacturing processes.

Benefits of Rules of Origin:

- Prevention of Trade Deflection: Prevents trade deflection, where goods are routed through countries with the lowest tariffs to take advantage of preferential trade agreements.

- Encouragement of Local Manufacturing: By setting specific criteria for substantial transformation, these rules encourage countries to develop local industries and add value within their borders.

- Trade Preferences and Economic Integration: Allows countries to grant trade preferences to their partners in FTAs, facilitating economic integration and boosting intra-regional trade.

- Fair Trade Practices: Ensures that only eligible products benefit from trade preferences, maintaining fair competition.

- Customs and Trade Statistics: Accurate determination of origin helps in maintaining proper customs records and compiling trade statistics, which are vital for economic analysis and policy-making.

- Protection of Domestic Industries: By defining which products qualify for preferential treatment, rules of origin can protect domestic industries from unfair competition from imported goods that do not meet the origin criteria.

Changes Proposed w.r.t. Rules of Origin in Budget 2024:

- Amendment in Section 28DA of the Customs Act, 1962:

- The Indian government has amended Section 28DA of the Customs Act, 1962, replacing the requirement for a “certificate” of origin with a broader “proof” of origin, which can be a certificate or a self-declaration in accordance with a trade agreement.

- This change aligns with global customs practices and may be implemented if agreed upon in future trade agreements.

- Impact:

- Tax experts note that this amendment allows for greater flexibility in determining the origin of goods.

- Concerns are raised about potential breaches in self-certification and the need for high integrity in the exporting countries to prevent loss of customs revenue for India.

- While developed countries have robust tracking systems and use self-certification in FTAs, India remains cautious due to past experiences with goods being diverted from countries like China via Indonesia and Vietnam.

- The amendment could impact future free trade agreements (FTAs), such as the one with the European Free Trade Association (EFTA), which includes provisions for self-certification.

Several Breaches in Rules of Origin:

- Breaches in Rule of Origin:

- The amendments to the Customs Act allow Indian trade negotiators to choose which foreign exporters can self-certify the origin of goods. However, India has faced several breaches in rules of origin.

- A report by the Global Trade Research Initiative (GTRI) highlighted a suspicious 60-fold increase in silver imports from the UAE, a country that doesn’t produce silver, indicating a possible breach of the rules of origin in the India-UAE FTA.

- Strict Rules of Origin Verification Norms to Address Issues Related to Breaches:

- In response to these breaches, India implemented strict rules of origin verification norms, known as CAROTAR, in 2020.

- The CAROTAR provides the minimum basic information that the importer needs to know before importing goods.

- These rules help the importer to ascertain the country of origin, assist Customs Authorities in the smooth clearance of import of goods under FTAs, and claim concessional duty.

- This move led to concerns from several Southeast Asian countries during the India-ASEAN FTA review.

- What Needs to be Done:

- Despite these strict measures, India’s trade deficit with ASEAN countries increased to $43.57 billion in FY23, up more than 40% from $25.75 billion in FY22.

- Trade experts have noted that circumventing rules of origin is a recurring issue and that enforcing these rules requires robust customs administration.

- They also highlighted the challenge of balancing ease of doing business with trade regulation.

Source: IE

Amravati as a Buddhist Site

Tags: GS Paper – 1, Art & Culture- Indian Architecture– Amravati School of Art

Why in the news?

- The Finance Minister recently announced ₹15,000 crore in financial support for Andhra Pradesh to develop its capital city, Amravati, and boost other state development activities.

- This renewed focus on Amravati highlights its historical and spiritual significance, which remains relatively unrecognised.

Key Facts About Amaravati and Andhra Buddhism:

- Historical Evolution:

- In the late 1700s, Raja Vessareddy Nayudu discovered ancient limestone ruins in Dhanyakataka village, leading to its renaming as Amravati.

- Systematic destruction of these ruins continued until 1816, when Colonel Colin Mackenzie’s survey rediscovered the grand Amravati Stupa.

- In 2015, the Andhra Pradesh Chief Minister announced Amaravati as the new capital, inspired by the historic Buddhist site, aiming to modernise it.

- Amravati and Andhra Buddhism:

- Buddhism, founded by Siddhartha Gautama (the Buddha) in the 5th century BCE in Magadh (now Bihar), spread to Andhra Pradesh through trade routes.

- Significant evidence of Buddhism in Andhra Pradesh dates back to the 3rd century BCE with Emperor Ashoka’s inscriptions.

- Andhra monks participated in the first Buddhist council in 483 BCE.

- Buddhism thrived in Andhra for about six centuries and influenced its early urbanisation process.

- Difference Between Northern Buddhism and Andhra Buddhism:

- Merchant Patronage: In Andhra, merchants and craftsmen supported Buddhism, contrasting with the royal patronage in North India.

- Political Influence: Andhra’s rulers issued inscriptions supporting Buddhism, showing a bottom-up spread.

- Local Integration: Buddhism in Andhra incorporated local practices like megalithic burials and deity worship.

- Significance of Amravati in Buddhism:

- Amravati is known as the birthplace of Mahayana Buddhism, emphasising the Bodhisattva path.

- Acharya Nagarjuna, a key Buddhist philosopher, developed the Madhyamika philosophy here.

- Mahayana Buddhism spread from Amravati to South Asia, China, Japan, Korea, and Southeast Asia.

- Factors Leading to the Decline of Buddhism in Andhra Pradesh:

- Rise of Shaivism: The rise of Shaivism, supported by local rulers, overshadowed Buddhism.

- Decline of Urbanisation: Economic degradation reduced support for Buddhism by the fourth century CE.

- Arrival of Islam: Islamic rulers’ support for Islamic institutions led to the decline of Buddhist patronage.

Key Features of the Amaravati School of Art:

- About:

- The Amaravati School of Art, emerging from the ancient Buddhist site of Amravati in Andhra Pradesh during the post-Mauryan period.

- It is one of ancient India’s three major art styles, alongside the Mathura and Gandhara schools.

- Historical Context and Influences:

- The central monument of the Amravati School, which served as a major hub for Buddhist art and architecture.

- However, the site suffered from degradation due to government neglect and the use of its materials for construction in the early 19th century.

- Excavations by officials like Walter Elliot and the subsequent shipment of sculptures to various global locations further contributed to the site’s decline.

Key Characteristics of Amravati School of Art:

- Major Centres: Amaravati and Nagarjunakonda.

- Patronage: Supported primarily by Satavahana rulers.

- Tribhanga Posture: Characteristic use of the three-bend posture in sculptures.

- Materials and Craftsmanship: Sculptures are renowned for their aesthetic quality and intricate detailing, crafted mainly from palnad marble, a limestone conducive to fine carving.

- Artistic Themes: Includes narrative panels depicting the Buddha’s life, Jataka tales, and various Buddhist rituals.

- Iconic Depiction: Buddha often shown with a robe on the left shoulder and hand in the abhaya gesture (fearlessness), a style replicated across South and Southeast Asia.

- Indigenous Style: Unlike Mathura and Gandhara schools, which have Graeco-Roman influences, Amravati art developed independently with a strong emphasis on local traditions.

Global Dispersion of Amravati Art:

- International Collections: Major collections are housed in the British Museum, the Art Institute of Chicago, Musee Guimet in Paris, and the Metropolitan Museum of Art in New York.

- Indian Museums: Notable collections are in the Government Museum in Chennai and the National Museum in New Delhi.

- Return of Artefacts: Australia is the only country to have returned a stolen Amravati-style sculpture.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q:1 Which one of the following statements is correct?(2021)

- Ajanta Caves lie in the gorge of Waghora river.

- Sanchi Stupa lies in the gorge of Chambal river.

- Pandu-lena Cave Shrines lie in the gorge of Narmada river.

- Amaravati Stupa lies in the gorge of Godavari river

Ans: (a)

Q:2 Which of the following kingdoms were associated with the life of the Buddha? (2015)

- Avanti

- Gandhara

- Kosala

- Magadha

Select the correct answer using the code given below:

- 1, 2 and 3

- 2 and 3 only

- 1, 3 and 4

- 3 and 4 only

Ans: (d)

Mains:

Q:1 Highlight the Central Asian and Greco-Bactrian elements in Gandhara art. (2019)

Q:2 Gandhara sculpture owed as much to the Romans as to the Greeks. Explain. (2014)

Olympic Order

Tags: GS-1, Art & Culture- Sports Achievement

Why in the News?

- Recently, Abhinav Bindra was bestowed with the Olympic Award by the International Olympic Committee.

About Olympic Order:

- Highest Award by IOC:

- The Olympic Order is the highest award bestowed by the International Olympic Committee (IOC) for outstanding contributions to the Olympic Movement.

- Establishment:

- Established in 1975, it replaced the Olympic Diploma of Merit and is awarded to individuals who have demonstrated exceptional merit in the cause of sport or rendered significant services to the Olympic Movement.

- Grades:

- The Olympic Order has three grades: gold, silver, and bronze. The gold order is reserved for heads of state and exceptional circumstances.

- Insignia:

- The insignia of the Olympic Order features a collar or chain with the five Olympic rings and the kotinos emblem, an olive wreath. Recipients also receive a lapel badge in the corresponding grade.

Significance:

- Recognition of Contributions:

- The Olympic Order is a symbol of recognition for those who have made significant contributions to the Olympic Movement, promoting the ideals of unity, friendship, and fair play that the Olympics embody.

- Testament to IOC’s Commitment:

- It is a testament to the IOC’s commitment to honouring those who have advanced the cause of sport and the Olympic Movement globally.

Source: IT

Llama 3.1

Tags: GS-3, Science & Technology- Achievement in technology

Why in the News?

- Recently, Meta has unveiled its new open-source AI model, Llama 3.1.

About Llama 3.1

- Meta’s Largest Open Source AI Model:

- Llama 3.1 is Meta’s largest ever open-source AI model, outperforming the likes of OpenAI’s GPT-4o and Anthropic’s Claude 3.5 Sonnet on numerous benchmarks.

- Complexity:

- The new Llama 3.1 models are reportedly far more complex compared to Llama 3 models.

Features:

- Multilingual Capabilities:

- It can converse in eight languages.

- Enhanced Coding and Math Skills:

- It can write higher-quality computer code and solve more complex math problems than previous versions.

- Parameters:

- It comes with 405 billion parameters, or variables that the algorithm takes into account to generate responses to user queries.

- Cost-Effectiveness:

- Running inference on Llama 3.1 405B is cost-effective, being around 50% cheaper than closed models like OpenAI’s GPT-4o.

- Security Systems:

- Llama comes with systems like Llama Guard that can be secure against unintentional harms such as bad health advice or unintended self-replication.

What is an Open Source AI Model?

- Definition:

- An open-source AI model is an artificial intelligence technology that is publicly available for both commercial and non-commercial use under several open-source licences.

- Characteristics:

- These models are characterised by the availability of their components to users under licences that allow them to study how the system works and inspect its components.

- Developer Resources:

- They come with datasets, ready-to-use interfaces, and prebuilt algorithms to help developers embark on their app development journey

Source: IE

INS Triput

Tags: GS Paper – 3, Indigenization of Technology- Various Security Forces & Agencies & Their Mandate

Why in the news?

- Recently, Goa Shipyard Limited (GSL) launched the first indigenously-built Talwar class frigate, ‘Triput’.

About INS Triput:

- First Indigenously Built Talwar-Class Frigate:

- INS Triput is the first indigenously built frigate of the Talwar class.

Project Details:

- India-Russia Deal:

- In October 2016, India and Russia signed a deal to buy four stealth frigates of the Admiral Grigorovich class (also known as Project 1135.6 class).

- Two frigates, ‘Tushil’ and ‘Tamal’, will be directly imported.

- The remaining two frigates will be built in India by GSL through a transfer of technology (ToT).

- INS Triput is the first ship built by GSL under this project. The second frigate, ‘Tamal’, will be delivered by February 2025.

- Existing Fleet:

- The Indian Navy already operates six ships of this class: INS Talwar, INS Trishul, INS Tabar, INS Teg, INS Tarkash, and INS Trikand.

Features of INS Triput

- Dimensions and Speed:

- The ship is 124 meters long and 15.5 meters wide.

- It is propelled by four gas turbines designed to achieve a maximum speed of 28 knots at a displacement of approximately 3200 tons.

- Stealth Capabilities:

- It features a hull design that reduces radar cross-section, enhancing its stealth capabilities.

- Weapons and Sensors:

- The ship is equipped with a combination of state-of-the-art weapons and sensors.

- It includes an Integrated Platform and Bridge Management System and other advanced features.

- Air Defence:

- The ship’s air defence capability revolves around vertical launch long-range Surface to Air missile systems, designed to counter enemy aircraft and anti-ship cruise missiles.

- Indigenous Systems:

- The ship is fitted with indigenous power generation and distribution systems, AC, Steering System, and Stabilisers developed by private industry.

- Armament:

- It is armed with Russian-made Klub-N anti-ship missiles or BrahMos supersonic cruise missiles

Source: PIB

Magnetotactic bacteria

Tags: GS Paper – 1, Physical Geography–Mineral & Energy Resources

Why in the news?

- Recently, researchers have uncovered fossil remains of magnetic particles, known as magneto fossils produced by magnetotactic bacteria, in rock varnish layers in Ladakh, India.

About Magnetotactic Bacteria:

- Nature:

- Magnetotactic bacteria are mostly prokaryotic organisms that arrange themselves along the Earth’s magnetic field.

- These bacteria are present in freshwater and marine habitats.

- Behaviour:

- These organisms follow the magnetic field to reach places with optimal oxygen concentration.

- The bacteria contain novel structured particles rich in iron within small sacs that function as a compass.

- Mineral Formation:

- Magnetotactic bacteria create tiny crystals made of iron-rich minerals like magnetite or greigite.

- These crystals help the bacteria navigate changing oxygen levels in their aquatic environments.

- Evolutionary Significance:

- It is believed that these microbes may represent some of Earth’s earliest inhabitants.

Highlights of the Research:

- Ladakh Rock Varnish:

- Researchers observed similarities between the rock varnish in Ladakh and those observed on Mars by the Perseverance rover.

- Elevated concentrations of oxidized manganese (Mn4+) and carboxylic acid functionalities were identified on the varnish surface, suggesting the presence of organic signatures.

- Biotic Origin:

- The findings indicate that the magnetic minerals in the rock varnish are likely biotic in origin.

Significance:

- Biosignature Detection:

- By detecting biotic signatures in rock varnish, scientists can better focus on identifying biosignatures on Mars and other celestial bodies.

- Implications for Space Missions:

- This information is crucial for future space missions, including those planned by ISRO and other space agencies, aiming to explore Mars and assess its habitability.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q:1 The word ‘Denisovan’ is sometimes mentioned in media in reference to (2019)

- fossils of a kind of dinosaurs

- an early human species

- a cave system found in North-East India

- a geological period in the history of Indian subcontinent

Ans: (b)

Source: PIB

Frequently Asked Questions (FAQs)

Q: What are daily current affairs?

A: Daily current affairs refer to the most recent and relevant events, developments, and news stories that are happening around the world on a day-to-day basis. These can encompass a wide range of topics, including politics, economics, science, technology, sports, and more.

Q: Why is it important to stay updated with daily current affairs?

A: Staying updated with daily current affairs is crucial because it helps individuals make informed decisions in their personal and professional lives. It enables people to understand the world around them, stay aware of significant events, and engage in informed discussions about important issues.

Q: Where can I access daily current affairs information?

A: There are various sources for daily current affairs, including newspapers, news websites, television news broadcasts, radio programs, and dedicated apps or newsletters. Social media platforms are also widely used to share and access current affairs information.

Q: How can I effectively incorporate daily current affairs into my routine?

A: To incorporate daily current affairs into your routine, consider setting aside specific times each day to read or watch news updates. You can also subscribe to newsletters or follow news apps to receive curated content. Engaging in discussions with peers or participating in online forums can further enhance your understanding of current events.

Q: What are some tips for critical analysis of daily current affairs?

A: When analyzing daily current affairs, it’s essential to cross-reference information from multiple sources to ensure accuracy. Additionally, consider the source’s credibility and bias, if any. Develop the ability to identify the main points and implications of news stories, and critically evaluate the significance and impact of the events reported.

To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

- Join our Main Telegram Channel and access PYQs, Current Affairs and UPSC Guidance for free – Edukemy for IAS

- Learn Economy for free- Economy for UPSC

- Mains Answer Writing Practice-Mains Answer Writing

- For UPSC Prelims Resources, Click here