The Prevention of Money Laundering Act (PMLA), 2002, is a legislation in India aimed at combating money laundering by providing measures for detection and prevention. It establishes stringent regulations for financial institutions and authorities to trace and confiscate illicit funds.

Tags: GS –2 Government Policies & Interventions- Statutory Bodies, GS Paper – 3 Capital MarketMoney Laundering

For Prelims: Supreme Court, Money Laundering, Prevention of Money Laundering Act, 2002, Enforcement Directorate, United Nations Convention Against Illicit Traffic in Narcotic Drugs and Psychotropic Substances 1988, Enforcement Case Information Report, Foreign Exchange Management Act, 1999.

For Mains: Legal and Regulatory framework in India to combat Money Laundering, Prevention of Money-Laundering Act (PMLA) and its objectives, Impact of Money Laundering on the economy.

Contents

Context:

- It highlights a critical concern that the PMLA includes offences unrelated to its primary objective of combating drug money laundering.

What is Money Laundering?

- The Financial Action Task Force (FATF), established in 1989, aims to coordinate global efforts against money laundering. As a member, India is obligated to contribute to these efforts.

- The enactment of the Prevention of Money Laundering Act (PMLA) was a response to a United Nations General Assembly political declaration in 1998, urging member states to establish national anti-money laundering laws.

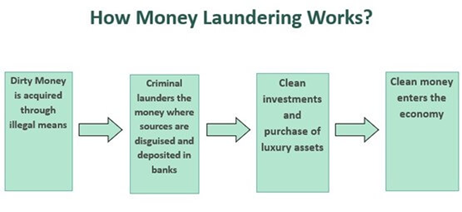

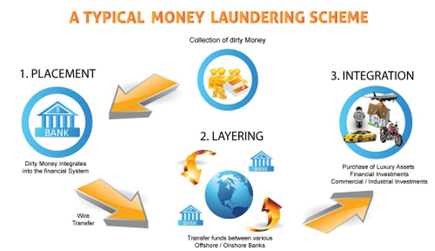

- Money laundering is a complex process used by individuals and organisations to conceal the origins of illegally obtained money. It involves making illicit funds appear legitimate through a series of transactions.

Stages of Money Laundering:

- Placement: Initial stage involving the introduction of illicit funds into the financial system, such as through bank deposits or currency exchanges.

- Layering: Complex financial transactions to separate illicit funds from their source, often through transfers between accounts or across borders.

- Integration: Laundered funds are reintroduced into the economy as legitimate, typically through investments in businesses or real estate.

Methods of Money Laundering:

- Structuring (Smurfing): Breaking large sums of cash into smaller amounts for discreet bank deposits.

- Trade-Based Laundering: Using trade transactions to move value internationally and conceal the source of illicit funds.

- Shell Companies: Creating businesses with no legitimate activity to funnel illicit funds through seemingly legal transactions.

- Real Estate: Purchasing property with illicit funds and then selling it to convert the value into legitimate assets.

What is PMLA, 2002?

- The Prevention of Money Laundering Act, 2002 (PMLA) is an Act enacted by the Parliament of India to prevent money laundering and enable the confiscation of assets derived from such activities.

- It aims to combat money laundering associated with illegal activities like drug trafficking, smuggling, and terrorism financing.

Key Provisions of PMLA:

- Offences and Penalties: PMLA defines money laundering offences and imposes penalties for such activities, including rigorous imprisonment and fines for offenders.

- Attachment and Confiscation of Property: The Act allows for the attachment and confiscation of property involved in money laundering and establishes an Adjudicating Authority to oversee these proceedings.

- Reporting Requirements: PMLA mandates certain entities, such as banks and financial institutions, to maintain transaction records and report suspicious transactions to the Financial Intelligence Unit (FIU).

- Designated Authority and Appellate Tribunal: The Act establishes a Designated Authority to aid in investigating and prosecuting money laundering offences and sets up an Appellate Tribunal to hear appeals against Adjudicating Authority orders.

Objectives of PMLA:

- Prevention: To prevent money laundering by implementing stringent measures and monitoring financial transactions.

- Detection: To detect and investigate instances of money laundering through proper enforcement and regulatory mechanisms.

- Confiscation: To confiscate properties derived from money laundering activities to deter offenders and disrupt illicit financial flows.

- International Cooperation: To facilitate international cooperation in combating money laundering and terrorist financing activities.

Amendments to PMLA, 2002 in 2023:

- Clarification about the Position of Proceeds of Crime: Proceeds of the Crime encompass not only property derived from scheduled offences but also include any property acquired through engagement in criminal activities related to or resembling the scheduled offence.

- Money Laundering Redefined: Previously, Money Laundering was contingent upon another crime, known as the predicate offence or scheduled offence. The amendment aims to redefine Money Laundering as an independent crime, distinct from its reliance on a predicate offence.

Factors Necessitated the Adoption of PMLA, 2002:

- Flourishing Drug Trade at Global Level: In response to the escalating drug trade, the United Nations convened the United Nations Convention against Illicit Traffic in Narcotic Drugs and Psychotropic Substances in 1988. This urged all nations to combat money laundering associated with drug crimes.

- Formation of Financial Action Task Force: Recognizing the severity of money laundering, seven major industrial nations established the Financial Action Task Force (FATF) in 1989 to address the issue.

- UNGA Resolution and Indian Legislation: Following a 1990 United Nations General Assembly resolution, which urged member countries to enact legislation to prevent drug money laundering, the Indian government used FATF recommendations to draft the Prevention of Money Laundering Act in 2002. It was enacted in 2005 to combat cross-border drug trafficking.

- Narasimham Committee Recommendations: The Narasimham Committee on Banking Sector Reforms, formed by the Reserve Bank of India in 1998, emphasised the importance of addressing money laundering within the Indian financial system, prompting legislative action.

- Focus on Drug Money Laundering: Initially centred on combating drug money laundering, the 2002 Act incorporated offences listed in the Indian Penal Code and the Narcotic Drugs and Psychotropic Substances Act 1985.

- Evolution of PMLA: While UN resolutions and FATF recommendations primarily target drug money laundering, the Prevention of Money Laundering Act of India has evolved through amendments, acquiring a broader scope over time.

Note:

- The PMLA was enacted by India’s Parliament under Article 253 which empowers it to make laws for implementing the international conventions.

- This Article indicates that a law Parliament makes to implement any decision of an international body will be confined to the subject matter of that decision.

- Item 13 in the Union list of the Seventh Schedule of the Constitution is specific on this point.

The Different Concerns Regarding PMLA, 2002:

- Proceeds of Crime – Too Broad Definition: Debates have arisen over the expansive interpretation of “proceeds of crime” in the PMLA, with concerns raised about its potential inclusion of lawful financial transactions, potentially leading to misuse.

- Inclusion of a Large Number of Offences: Critics highlight that the PMLA encompasses numerous offences beyond its original scope of combating drug money laundering, diverging from the UN resolution that focused solely on this issue.

- Burden of Proof on Accused: Criticism has been directed towards the burden of proof placed on the accused, which is seen as overly burdensome and potentially hindering fair trials.

- Overreach by Authorities: There are concerns that the legislation grants excessive powers to authorities, raising fears of misuse and overreach. Balancing law enforcement empowerment with safeguarding individual rights presents a complex challenge.

- Stringent Bail Conditions: The PMLA allows for stringent bail conditions, which some argue contradict the fundamental principle of presumption of innocence until proven guilty, as established in Anglo-Saxon jurisprudence.

- Arrest without Written Communication: Violations of constitutional and statutory provisions occur when individuals are arrested without written communication of the grounds, as mandated by Article 22(1) of the Constitution and Section 19(1) of the 2002 PMLA. Enforcement Directorate officers have been noted for such actions.

Suggestions Need to be Implemented in Reforming PMLA, 2002:

- Refinement of “Proceeds of Crime” Definition: Collaborate with legal experts, financial institutions, and stakeholders to craft a precise and comprehensive definition of “Proceeds of Crime” in the PMLA, aligned with international standards. Ensure clarity and specificity in the definition to mitigate ambiguity that could disrupt financial operations.

- Reassessment of Burden of Proof: Explore amendments to establish a reasonable burden of proof that upholds the principles of a fair trial while safeguarding constitutional rights. Consider equitable distribution of the burden of proof between the prosecution and the accused to ensure fairness and justice.

- Safeguards Against Overreach by Officers: Establish clear guidelines and protocols for investigative methods to protect individual rights and privacy, ensuring lawful asset seizures and adherence to due process. Institute an independent oversight mechanism to review and monitor law enforcement actions in money laundering cases, ensuring accountability and transparency.

- Review of Stringent Bail Conditions: Conduct a comprehensive review of stringent bail conditions under Section 45 of the PMLA to assess necessity and impact on accused individuals. Align bail procedures for money laundering cases with those applicable to other financial crimes to eliminate bias and undue hardship.

- Periodic Review and Amendment of PMLA: Facilitate parliamentary discussions and debates on potential amendments, engaging legal experts, lawmakers, and financial institution representatives. Enhance flexibility in adapting to evolving needs and standards through ongoing dialogue and evaluation.

- Enhanced Independence and Transparency of ED: Introduce measures for enhanced transparency in ED operations, including regular reporting and disclosure of cases handled and actions taken. Promote public awareness and education about the purpose, procedures, and implications of the PMLA, fostering cooperation and understanding between law enforcement and citizens.

- Consultative Approach: Facilitate open dialogues and consultations to address concerns and gather perspectives on proposed reforms. Actively participate in international forums to contribute to global efforts against money laundering and stay updated on evolving standards and best practices.

Conclusion:

Thus, the current approach to bail in PMLA cases appears Justice V.R. Krishna Iyer’s landmark assertion in the Gudikanti Narasimhulu case underscored the grave judicial responsibility in denying bail, emphasising its significance under Article 21 and the need for thoughtful consideration of its implications on individuals and society.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q.:1 Discuss how emerging technologies and globalisation contribute to money laundering. Elaborate measures to tackle the problem of money laundering both at national and international levels. (2021)

Source: (TH)

FAQs on Introspecting PMLA, 2002

1. What is PMLA, 2002, and why is it significant?

The Prevention of Money Laundering Act, 2002 (PMLA) is an Indian law enacted to prevent money laundering and to provide for confiscation of property derived from money laundering. It is significant because it aims to curb the illegal activities that fuel organized crime and terrorism by targeting the financial aspect of such operations.

2. Who does the PMLA, 2002, apply to?

PMLA, 2002, applies to a wide range of individuals and entities, including individuals, banking institutions, financial intermediaries, and certain non-profit organizations. Essentially, anyone involved in financial transactions falls under its purview.

3. What constitutes money laundering under PMLA, 2002?

Money laundering involves various acts, such as acquiring, owning, possessing, or transferring any proceeds of crime, directly or indirectly. Additionally, concealing or aiding in the concealment of the location, source, disposition, movement, rights with respect to the proceeds of crime is also considered money laundering under PMLA, 2002.

4. What are the penalties for non-compliance with PMLA, 2002?

Non-compliance with PMLA, 2002, can result in severe penalties, including imprisonment and fines. Depending on the severity of the offense, penalties can range from monetary fines to rigorous imprisonment for varying durations.

5. How does PMLA, 2002, impact businesses and individuals?

PMLA, 2002, imposes stringent obligations on businesses and individuals to maintain records, verify the identity of clients, and report suspicious transactions to the authorities. Compliance requires significant resources and diligence but helps in fostering transparency and integrity in financial transactions, ultimately contributing to a safer and more secure financial system.

In case you still have your doubts, contact us on 9811333901.

For UPSC Prelims Resources, Click here

For Daily Updates and Study Material:

Join our Telegram Channel – Edukemy for IAS

- 1. Learn through Videos – here

- 2. Be Exam Ready by Practicing Daily MCQs – here

- 3. Daily Newsletter – Get all your Current Affairs Covered – here

- 4. Mains Answer Writing Practice – here