The Green Credit Programme (GCP) is an initiative aimed at promoting environmentally sustainable practices within the financial sector. It encourages banks and financial institutions to incorporate environmental considerations into their lending decisions and to prioritize funding for projects that have positive environmental impacts or contribute to sustainable development.

Tags: GS Paper – 3- Renewable Energy- Government Policies & Interventions- Conservation

For Prelims: Green Credit program, LiFE campaign, Carbon credits, Kyoto Protocol, Sovereign Green Bond, Green Energy Corridor

For Mains: Covered Activities under Green Credit Programme, Concerns Regarding Green Credit Programme

Contents

Context:

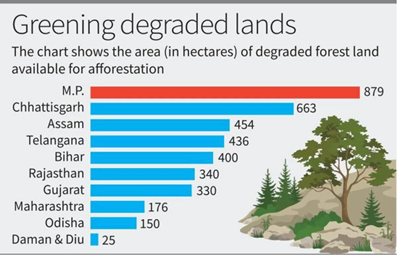

- Ten States have identified parcels of degraded forest land available to earn green credits.

- Chhattisgarh and Madhya Pradesh alone account for up to 40% of these lands.

Green Credit Programme and Rules 2023:

- Legal Basis: These rules are notified under the Environment Protection Act 1986.

- Objective: To incentivize environmentally positive actions through market-based mechanisms and generate green credits, which shall be tradable on a domestic market platform.

- Administration: Administered by the Indian Council of Forestry Research and Education (ICFRE), a society registered as an autonomous body under the Ministry of Environment, Forest and Climate Change. ICFRE will be responsible for issuing green credits, maintaining a green register, establishing a trading platform, and other related activities.

- Calculation of Green Credit: Green credit shall be calculated at the rate of one green credit per tree growing through tree plantation on such land parcel, subject to a minimum density of 1100 trees per hectare.

- Implementation: Initially, voluntary tree plantation is envisaged for degraded land, wasteland, watershed area, etc. Registered and approved entities can pay to finance afforestation projects. State forest departments will carry out the actual afforestation.

- Independence from Carbon Credits: The generation of Green Credit under the Green Credit Rules, 2023, is independent of the carbon credit under the Carbon Credit Trading Scheme, 2023.

- Evaluation and Utilisation: After two years of planting, trees will be evaluated by the ICFRE for eligibility as green credit. Companies that have diverted forest land for non-forest purposes can use these green credits to offset some of their obligations under India’s compensatory afforestation laws

About Green credits:

- Similar to internationally used carbon credits for offsetting emissions.

- Allows individuals or companies to plant trees or conduct afforestation on degraded land.

- Companies utilise these credits to counterbalance deforestation or non-forest land use.

- The Indian Council of Forestry Research and Education is responsible for issuing green credits.

- Eligible activities include tree plantation, water management, sustainable agriculture, and air pollution reduction.

- Incentivizes tree plantation, with one green credit granted for each tree planted.

- State governments (state forest departments) are tasked with identifying degraded land parcels, including open forests and wastelands, for tree plantation.

- Identified parcels must be free from encumbrances and have a minimum size of five hectares.

Concerns Regarding the Green Credit Programme:

- Verification & Validation Complexity: The process of verifying and validating environmentally positive actions can be complex and time-consuming. Concerns exist regarding the administrative burden on both participants and regulatory bodies involved in the verification process.

- Risk of Greenwashing: There is a risk that some participants may engage in greenwashing, falsely claiming environmentally friendly activities to earn Green Credits without genuinely contributing to environmental conservation.

- Compatibility with Carbon Credits: Although the program aims to be independent of carbon credits, concerns arise about potential overlaps and the complexity of evaluation between the two types of environmental credits.

- Accounting for Regional Differences: The program may struggle to account for regional variations in environmental impact, making it challenging to establish uniform credit values for diverse geographical areas.

Government Initiatives to Promote the Green Economy:

- Sovereign Green Bond

- Green Energy Corridor

- National Green Hydrogen Mission

Conclusion:

Hence, enhancing the Green Credit Mechanism necessitates a comprehensive strategy encompassing standardisation, transparency, regional adaptation, and regulatory vigilance, all while fostering enduring sustainability and public engagement. This holistic approach aligns with the United Nations Sustainable Development Goals, particularly SDG 12 (Responsible Consumption and Production), SDG 13 (Climate Action), and SDG 15 (Life on Land).

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q1. The concept of carbon credit originated from which one of the following? (2009)

(a) Earth Summit, Rio de Janeiro

(b) Kyoto Protocol

(c) Montreal Protocol

(d) G-8 Summit, Heiligendamm

Ans: (b)

Q2. Regarding “carbon credits”, which one of the following statements is not correct? (2011)

(a) The carbon credit system was ratified in conjunction with the Kyoto Protocol

(b) Carbon credits are awarded to countries or groups that have reduced greenhouse gases below their emission quota

(c) The goal of the carbon credit system is to limit the increase of carbon dioxide emission

(d) Carbon credits are traded at a price fixed from time to time by the United Nations Environment Programme.

Ans: (d)

Mains

Q1. Should the pursuit of carbon credits and clean development mechanisms set up under UNFCCC be maintained even though there has been a massive slide in the value of a carbon credit? Discuss with respect to India’s energy needs for economic growth. (2014)

Q2. Discuss global warming and mention its effects on the global climate. Explain the control measures to bring down the level of greenhouse gases which cause global warming, in the light of the Kyoto Protocol, 1997. (2022)

FAQs

1. What is the Green Credit Programme?

- The Green Credit Programme is a government initiative aimed at promoting sustainable development by encouraging financial institutions to prioritize funding for environmentally friendly projects and businesses.

2. How does the Green Credit Programme work?

- Under the Green Credit Programme, financial institutions are incentivized or mandated to allocate a certain portion of their lending portfolios to green projects and initiatives. These projects could include renewable energy, energy efficiency, waste management, and other environmentally sustainable activities.

3. What are the benefits of participating in the Green Credit Programme?

- Participating in the Green Credit Programme offers numerous benefits. For financial institutions, it enhances their reputation as socially responsible entities, attracts environmentally conscious clients, and can lead to potential cost savings through reduced environmental risks. For borrowers, it provides access to funding at potentially lower interest rates for green projects, fostering sustainable development.

4. How does the Green Credit Programme impact the environment?

- By directing funds towards environmentally sustainable projects, the Green Credit Programme contributes to mitigating climate change, reducing pollution, conserving natural resources, and promoting biodiversity. Ultimately, it helps in transitioning towards a greener and more sustainable economy.

5. Are there any regulatory requirements associated with the Green Credit Programme?

- Depending on the jurisdiction, participation in the Green Credit Programme may be voluntary or mandatory for financial institutions. Regulatory bodies often establish guidelines, targets, or reporting requirements to ensure compliance and monitor the effectiveness of the programme in promoting sustainable finance. These regulations help maintain transparency and accountability in the implementation of green lending practices.

In case you still have your doubts, contact us on 9811333901.

For UPSC Prelims Resources, Click here

For Daily Updates and Study Material:

Join our Telegram Channel – Edukemy for IAS

- 1. Learn through Videos – here

- 2. Be Exam Ready by Practicing Daily MCQs – here

- 3. Daily Newsletter – Get all your Current Affairs Covered – here

- 4. Mains Answer Writing Practice – here