The Supreme Court has recently affirmed that states have the authority to levy taxes on mineral rights. This ruling clarifies that individual states can impose taxes on the extraction and use of minerals found within their borders. The decision is significant because it underscores the states’ power to generate revenue from their natural resources, ensuring they can benefit economically from the minerals located within their territories. This ruling supports the idea that states have a vital role in managing and profiting from their natural assets, which can be used to fund various public services and development projects.

Tags: GS – 2, Government Policies & Interventions, GS – 3, Growth & Development – Industrial Growth– Industrial Policy

Contents

- 0.1 Context:

- 0.2 What did the Supreme Court Decide?

- 0.3 What is the Difference Between Royalty and Tax?

- 0.4 Mines and Minerals (Development and Regulation) Act, 1957:

- 0.5 Scenario of the Mining Sector in India:

- 0.6 Mining Industry:

- 1 UPSC Civil Services Examination, Previous Year Questions (PYQs)

- 2 FAQs

- 2.1 Q: What did the Supreme Court decide about states’ taxation power on mineral rights?

- 2.2 Q: Why is this decision important?

- 2.3 Q: How does this decision affect the mining industry?

- 2.4 Q: What impact does this have on state economies?

- 2.5 Q: Does this ruling change anything for the federal government?

- 3 To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

Context:

- The Supreme Court of India has recently addressed a crucial issue regarding the taxation of mineral rights, overturning its 1989 verdict and reaffirming the power of states in this context.

- This decision, delivered by a nine-judge Bench, clarifies the extent of authority both Parliament and states hold over mineral royalties.

What did the Supreme Court Decide?

- Background of the Case:

- In 1989, a seven-judge Bench ruled that the Centre has primary authority over mining regulation under the Mines and Minerals (Development and Regulation) Act, 1957, and Entry 54 of the Union List.

- States were permitted only to collect royalties and not impose additional taxes. The court classified royalties as taxes, making any cess on them beyond state authority.

- A 2004 five-judge Bench later suggested a typographical error in the 1989 ruling, indicating that royalties were not a tax. This led to the current nine-judge review.

- Overturning 1989 Verdict:

- The Supreme Court’s nine-judge Bench ruled that the 1989 verdict, which classified royalties on minerals as a tax under the MMDRA, 1957 was incorrect.

- State vs. Central Authority:

- The Court emphasised that the power to impose taxes on mineral rights resides solely with the states, while Parliament may only impose limitations to prevent hindrances to mineral development.

- The ruling clarifies that Parliament does not possess the power to tax mineral rights under Entry 50 of the List II of the Constitution, which governs state powers and is limited to imposing restrictions, not taxes.

- Parliament can set constraints on how states levy taxes on mineral rights, but it cannot impose taxes directly. This is to ensure that mineral development is not obstructed.

- Dissenting Opinion:

- There was a warning that allowing states to tax mineral rights could lead to attempts to tax lands and buildings under Entry 49 of List II, potentially disrupting the federal system and uniformity in mineral pricing and development.

- Consequently, states will start levying taxes on minerals again, leading to legal uncertainty and adverse economic consequences, including on metal development in India.

- Parliament will need to intervene to ensure uniformity in mineral pricing and development interests, and to prevent states from imposing taxes on mineral rights.

What is the Difference Between Royalty and Tax?

- Royalty:

- Origin: It originates from an agreement between parties. It is a compensation paid for the rights and privileges enjoyed by the grantee.

- Relationship: The royalty payment has a direct relationship with the benefit or privilege conferred upon the grantee.

- Specificity: It is specific to the agreement and is often linked to the exploitation of resources or usage of a privilege granted by the grantor.

- Precedents: The Court referenced several cases, including Hingir-Rampur Coal Co. Ltd. vs. State of Orissa (1961), State of West Bengal vs. Kesoram Industries Ltd. (2004), and others, to establish that royalties are contractual obligations with direct benefits.

- Tax:

- Imposition: It is imposed under a statutory power without reference to any special benefit conferred on the payer. It is enforced by law and does not require the taxpayer’s consent.

- Purpose: Taxes are imposed for public purposes without any specific benefit to the payer. They are part of the common burden borne by all citizens.

- Quid Pro Quo: Unlike royalties, taxes do not involve a quid pro quo arrangement. The payment is mandatory and not linked to any specific privilege or benefit.

- Precedents: The Court referred to several cases, including the State of Himachal Pradesh vs. Gujarat Ambuja Cement Ltd. (2005) and Jindal Stainless Ltd. vs. the State of Haryana (2017), to highlight the characteristics of taxes.

Mines and Minerals (Development and Regulation) Act, 1957:

- About:

- The Mines and Minerals (Development and Regulation) Act, 1957 is a pivotal legislation in India governing the mining sector.

- This Act has undergone multiple amendments to address emerging needs and challenges in the mineral sector, ensuring its alignment with national economic and security interests.

- Objectives

- Development of Mining Industry: To promote the growth of the mining industry in India.

- Mineral Conservation: To ensure the conservation of minerals for future use.

- Transparency and Efficiency: To bring transparency and efficiency to mineral exploitation processes.

2015 Amendment:

- Auction Method: Mandated auctioning of mineral concessions to enhance transparency in allocation.

- District Mineral Foundation (DMF): Established DMF to benefit areas and people affected by mining.

- National Mineral Exploration Trust (NMET): Created NMET to boost mineral exploration activities.

- Penalties for Illegal Mining: Implemented stringent penalties to curb illegal mining activities.

2016 and 2020 Amendments:

- Sector-specific Issues: Addressed specific issues in the sector to ensure its smooth functioning.

2021 Amendment

- Captive and Merchant Mines:

- Captive Mines: Operated by companies to produce minerals exclusively for their own use. The minerals extracted may sell up to 50% of their annual production in the open market after meeting the needs of the end-use plant for which the mineral block was originally allocated.

- Merchant Mines: Operated to produce minerals for sale in the open market. The extracted minerals are sold to various buyers, including industries without their own mines.

- Auction-Only Concessions: Ensured that all private-sector mineral concessions were granted through auctions.

2023 Amendment

- Strengthening Exploration and Extraction: Aims to strengthen the exploration and extraction of critical minerals essential for India’s economic development and national security.

- Removal of Minerals from Atomic List: Removed 6 minerals from the list of 12 atomic minerals limited to exploration by State agencies.

- Government Empowerment: Empowered the government to exclusively auction mineral concessions for critical minerals.

- Exploration Licences: Introduced exploration licences to attract foreign direct investment and engage junior mining companies in exploring deep-seated and critical minerals.

- Reducing Import Dependence: Focuses on reducing dependence on imports and encouraging private sector involvement to expedite the exploration and mining of critical minerals.

- Recognising Importance of Critical Minerals: Acknowledged the significance of minerals like lithium, graphite, cobalt, titanium, and rare earth elements for future technologies and India’s commitment to energy transition and net-zero emissions by 2070.

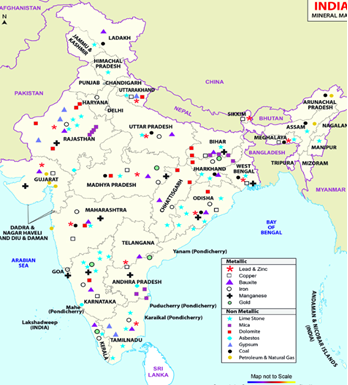

Scenario of the Mining Sector in India:

- Steel Sector:

- Global Ranking: India has emerged as the 2nd largest producer of steel globally.

- Production Statistics (FY 2023-24):

- Crude Steel Production: 144.04 million tonnes.

- Finished Steel Production: 138.83 million tonnes.

- Finished Steel Consumption: 136.65 million tonnes.

- Growth Rates:

- Finished steel production increased by over 12.68% compared to the previous year.

- Finished steel consumption grew by 13.9%.

- Coal Sector:

- Coal Reserves: India holds a total coal reserve of 344.02 billion tonnes, making it the second-largest producer of coal in the world.

- Production Statistics (June 2024):

- Monthly Production: 84.63 million tonnes.

- Growth Rate: 14.49% increase compared to June 2023.

- Cumulative Growth: Coal production increased by 11.65% over the previous year.

- Manganese Ore Sector:

- Production Achievement: Manganese Ore (India) Limited achieved its highest production of 17.56 lakh tonnes in FY 2023-24.

- Growth Rate: 35% growth over the previous year.

- Mineral Production:

- Cumulative Growth: India’s mineral production saw a cumulative growth of 8.2% for the period April-February 2023-24.

- FDI Policy:

- 100% Foreign Direct Investment (FDI) is allowed through automatic routes in the steel and mining sectors, including coal and lignite.

- Mineral Production Index

- Index Value (Base 2011-12): The mineral production index for 2021-22 is 113.3.

- Growth Rate: 12.17% growth compared to 2020-21.

- Total Value of Mineral Production (2021-22): Approximately Rs. 220000 crores.

- Contribution by Metallic Minerals: Approximately Rs. 120000 crores.

Mining Industry:

- Operational Mines: The Indian mining industry comprises many small operational mines.

- Reporting Mines (2021-22): 1319 mines.

- Geographical Distribution:

- Madhya Pradesh: 263 mines.

- Gujarat: 147 mines.

- Karnataka: 132 mines.

- Odisha: 128 mines.

- Chhattisgarh: 114 mines.

- Andhra Pradesh: 108 mines.

- Rajasthan: 90 mines.

- Tamil Nadu: 88 mines.

- Maharashtra: 73 mines.

- Jharkhand: 45 mines.

- Telangana: 39 mines.

- Concentration: These 11 states accounted for 93% of the total number of mines in the country in 2021-22.

Source: IE

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims:

Q:1 With reference to the management of minor minerals in India, consider the following statements: (2019)

- Sand is a ‘minor mineral’ according to the prevailing law in the country

- State Governments have the power to grant mining leases of minor minerals, but the powers regarding the formation of rules related to the grant of minor minerals lie with the Central Government.

- State Governments have the power to frame rules to prevent illegal mining of minor minerals.

Which of the statements given above is/are correct?

- 1 and 3 only

- 2 and 3 only

- 3 only

- 1, 2 and 3

Ans: (a)

Q:2 What is/are the purpose/purposes of ‘District Mineral Foundations’ in India? (2016)

- Promoting mineral exploration activities in mineral-rich districts

- Protecting the interests of the persons affected by mining operations

- Authorising State Governments to issue licences for mineral exploration

Select the correct answer using the code given below:

- 1 and 2 only

- 2 only

- 1 and 3 only

- 1, 2 and 3

Ans: (b)

Mains:

Q:1 Despite India being one of the countries of Gondwanaland, its mining industry contributes much less to its Gross Domestic Product (GDP) in percentage. Discuss. (2021)

FAQs

Q: What did the Supreme Court decide about states’ taxation power on mineral rights?

- Answer: The Supreme Court decided that states have the power to tax mineral rights. This means that states can impose taxes on the extraction and sale of minerals found within their borders.

Q: Why is this decision important?

- Answer: This decision is important because it clarifies that states have the authority to generate revenue from their natural resources. It supports state rights and helps states manage and benefit from their mineral wealth.

Q: How does this decision affect the mining industry?

- Answer: The decision means that mining companies will need to pay taxes to the states where they operate. This could increase their costs, but it also ensures that states receive a fair share of the profits from their natural resources.

Q: What impact does this have on state economies?

- Answer: By taxing mineral rights, states can boost their revenue, which can be used to fund public services like education, healthcare, and infrastructure. This can lead to overall economic development and improved quality of life for residents.

Q: Does this ruling change anything for the federal government?

- Answer: The ruling doesn’t change the federal government’s role, but it reinforces the states’ authority over their resources. The federal government still has its own taxation powers, but this decision emphasizes that states can independently manage and benefit from their mineral rights.

To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

- Join our Main Telegram Channel and access PYQs, Current Affairs and UPSC Guidance for free – Edukemy for IAS

- Learn Economy for free- Economy for UPSC

- Mains Answer Writing Practice-Mains Answer Writing

- For UPSC Prelims Resources, Click here