Today’s daily current affairs briefing for UPSC aspirants explores the latest developments relevant to the upcoming civil services examination. Our focus today includes a critical analysis of recent policy changes, international affairs, and national developments, all of which play a pivotal role in shaping India’s socio-political and economic landscape. Stay informed and stay ahead in your UPSC preparations with our daily current affairs updates, as we provide you with concise, well-researched insights to help you connect the dots between contemporary events and the broader canvas of the civil services syllabus.

Contents

- 1 Corporate Tax Cuts Increase Wages

- 2 UPSC Civil Services Examination PYQ

- 3 Harnessing biotechnology for economic development

- 4 Zero FIRs filed in local languages must have translated copy

- 5 Aparajita Bill

- 6 World Bank Revises India’s GDP Growth Estimate

- 7 UPSC Civil Services Examination, Previous Year Questions (PYQs)

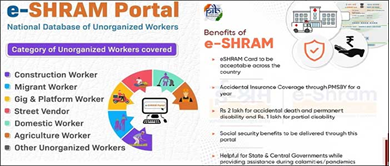

- 8 e-Shram Portal

- 9 AgriSURE Fund

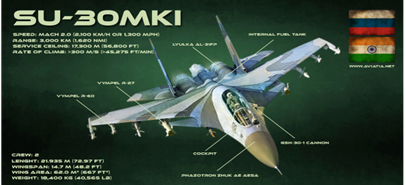

- 10 Su-30MKI Fighter Jet

- 11 Review Petition

- 12 Frequently Asked Questions (FAQs)

- 12.1 Q: What are daily current affairs?

- 12.2 Q: Why is it important to stay updated with daily current affairs?

- 12.3 Q: Where can I access daily current affairs information?

- 12.4 Q: How can I effectively incorporate daily current affairs into my routine?

- 12.5 Q: What are some tips for critical analysis of daily current affairs?

- 13 To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

Corporate Tax Cuts Increase Wages

Tags: GS-3, Economy- Taxation system- GDP- Mobilization of Resources- Corporate Tax

Why in the news?

- In the years prior to the pandemic, two of the largest economies in the world — the U.S. and India — cut corporate tax rates in an attempt to stimulate growth.

About Corporate Tax:

- Definition: Corporate tax is a direct tax levied on the profits of companies or corporations.

- Rate and Calculation: Corporate tax rates vary by country and are applied to taxable income, which is determined after deducting operating expenses, depreciation, and other allowable deductions from gross revenue.

- Significance: Corporate taxes are a crucial source of government revenue, impacting company investment decisions, business operations, and growth strategies.

- Economic Tool: Lower corporate tax rates are used to attract investment and stimulate economic growth, though their effects on wages, employment, and long-term revenue generation can differ.

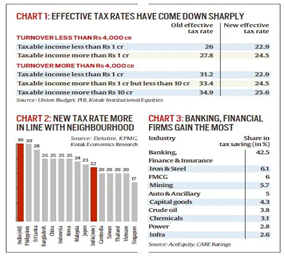

The U.S. Experience with Corporate Tax Cuts:

- Legislation: The Tax Cuts and Jobs Act, enacted in 2018 under President Donald Trump, reduced the top corporate tax rate from 35% to 21%.

- Proponents’ View: Supporters claimed that this reduction would boost investment, economic growth, employment, and wages, with new investments driving technological advancements and productivity gains.

- Impact Study: The study “Lessons from the Biggest Business Tax Cut in U.S. History,” published in the Journal of Economic Perspectives, found that the tax cuts led to a modest increase in investment (8% to 14%), with a limited overall economic impact and a substantial 41% decrease in tax revenue.

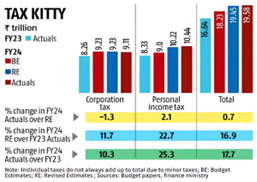

Corporate Tax Cuts in India:

- Tax Rate Reduction: In 2019, India reduced corporate tax rates to 22% for existing companies and 15% for new companies.

- Revenue Impact: This reduction resulted in a significant revenue loss of approximately ₹1 lakh crore in the 2020-21 fiscal year.

- Labour Market Impact:

- The COVID-19 pandemic disrupted the labour market, leading to increased unemployment.

- Although unemployment rates have improved and labour force participation, particularly among women, has risen, the corporate sector’s contribution to recovery has been limited.

- Earnings Trends:

- Data from the Periodic Labour Force Survey (PLFS) shows a decline in regular wage employees from 22.8% in 2017-18 to 20.9% in 2022-23.

- From 2017 to 2022, the compound annual growth rate (CAGR) of nominal monthly earnings was 4.53% in rural areas and 5.75% in urban areas, which is only marginally above inflation.

- Real wages in rural areas have declined, and urban wages have stagnated.

- Corporate Tax Collection: Post-pandemic growth in corporate tax collections has not translated into improved employment or wages, with tech companies laying off workers.

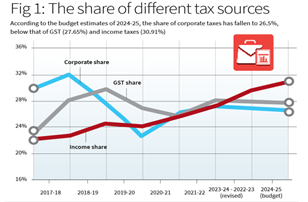

Shift in Tax Burden to Individuals:

- Revenue Composition: The share of corporate taxes in India’s gross tax revenues decreased from nearly 32% in 2017-18.

- Budget Estimates for 2024-25:

- Corporate Taxes: 26.5% of gross tax revenues

- GST: 27.65%

- Income Tax: 30.91%

- Policy Adjustments: This shift in tax burden has led to the government’s decision to remove indexation benefits and tax long-term capital gains to compensate for the reduced share of corporate taxes.

What Lies Ahead?

- Investment Impact: Corporate tax cuts do not guarantee increased investment, especially amidst uncertain future profits.

- Economic Recovery: In economies recovering from the pandemic and facing supply chain disruptions, these tax cuts have had marginal effects on private investment.

- Income Distribution: Tax cuts on profits primarily benefit private capital rather than wage earners, as they boost profits without necessarily driving future investment.

- Policy Recommendations: Economists suggest that maintaining higher taxes on existing profits while providing incentives for future investment may be more effective.

- Complexities: The mixed results of these tax cuts highlight the complexities of policymaking in a global economic environment.

UPSC Civil Services Examination PYQ

Mains

Q:1 Enumerate the indirect taxes which have been subsumed in the Goods and Services Tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017. (UPSC-2019)

Source: TH

Harnessing biotechnology for economic development

Tgas: GS-3, Science & Technology- Biotechnology

Why in the news?

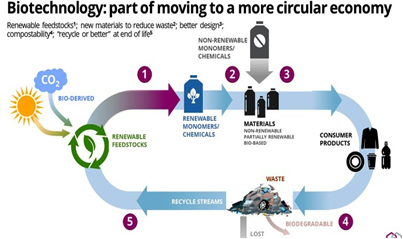

- The Centre’s BioE3 (Biotechnology for Economy, Environment, and Employment) policy seeks to transform industrial and manufacturing processes by incorporating sustainable, biologically inspired methods.

- While aimed at boosting the biotech sector, experts view it as a significant step toward the industrialization of biology, with potential major economic impacts.

About the Biotechnology:

- About:

- Biotechnology involves using living organisms, biological systems, or their components to develop products and technologies.

- It combines biology and technology to offer solutions in medicine, agriculture, environmental management, and industrial processes.

Applications:

- Medical Biotechnology: New drugs, vaccines, gene therapies, diagnostic tools.

- Agricultural Biotechnology: Genetically modified crops for better resistance and nutrition.

- Environmental Biotechnology: Bioremediation to clean pollutants using microorganisms.

- Industrial Biotechnology: Producing biofuels, biodegradable plastics through biological methods.

Status of Biotechnology in India:

- Percentage Share of Biotechnology Segments:

- BioPharmaceuticals: 62% ($57.5 Bn)

- BioAgriculture: 13% ($11.5 Bn)

- BioIndustry: 15% ($14.1 Bn)

- BioIT & BioServices: 10% ($9.3 Bn)

- Economic Contribution: The biotechnology sector is seen as a key driver for India’s $5 trillion economy target.

- Global Ranking: India ranks among the Top 12 biotechnology destinations worldwide and is the 3rd largest in the Asia Pacific, holding a 3% share in the global biotechnology industry.

- Global Innovation and Economic Status: In 2022, India became the fifth-largest economy globally and was ranked 40th in the Global Innovation Index (GII) Report 2023. It is a leading innovation economy in Central and Southern Asia.

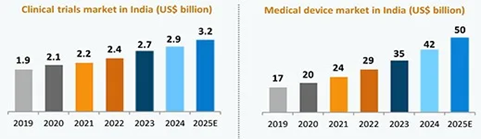

- Market Value: The Indian biotechnology industry was valued at $93.1 billion in 2022, with projections to reach $300 billion by 2030.

Potential of Biotechnology in India:

- Bioresources: India has abundant bioresources, particularly due to its rich biodiversity and unique bioresources in the Himalayas, positioning it advantageously in the global biotechnology arena.

- Youth and Skilled Workforce: With a population of 1.4 billion, and 47% under the age of 25, India boasts a large, skilled workforce crucial for biotechnology growth.

- Sectoral Contributions: The biotechnology sector in India has significantly contributed to areas like health, medicine, agriculture, industry, and bioinformatics.

BioE3 Policy Benefits:

- Introduction to BioE3: India’s BioE3 policy prepares the country for a biotechnology-driven economy. It focuses on long-term gains through research, talent development, and biomanufacturing growth.

- Economic Impact: Biomanufacturing, using biological organisms in production, is projected to reach $2-4 trillion over the next decade, boosting economic integration of biotechnology.

- Strategic Alignment: BioE3 aligns with India’s AI, Quantum, and Green Hydrogen Missions, promoting global leadership in technology and addressing climate change and energy security.

- Biomanufacturing Hubs: The policy envisions hubs focusing on:

- Bio-Based Chemicals & Enzymes

- Smart Proteins & Functional Foods

- Precision Biotherapeutics

- Climate-Resilient Agriculture

- Carbon Capture & Utilisation

- Marine & Space Research: Producing oxygen, food in space habitats, and novel marine compounds for pharmaceuticals.

Government Initiatives in Biotechnology:

- Startup India & Make in India Programs: These initiatives aim to establish India as a world-class hub for biotechnology and bio-manufacturing, fostering innovation and entrepreneurship in the sector.

- National Biopharma Mission: Supporting 101 projects across over 150 organisations and 30 MSMEs, this mission accelerates biopharma development and innovation.

- India-Finland Collaboration (2022): India and Finland expanded cooperation in biotechnology, digital education, mobile technologies, and ICT under a bilateral agreement.

- Biotechnology Industry Research Assistance Council (BIRAC): Established by the Department of Biotechnology (DBT), BIRAC empowers biotechnology enterprises to undertake strategic research and innovation.

- Biotechnology Parks and Incubators: Set up by DBT across India, these facilities provide infrastructure support for translating research into commercial products and services.

- Favourable Government Policies: Draft R&D Policy 2021, PLI Schemes, and Clinical Trial Rules have enhanced India’s global reputation as the “pharmacy of the world.”

- FDI Policy: 100% FDI is allowed under the automatic route for greenfield pharma and under the government route for brownfield pharma, with up to 74% allowed automatically.

Way Forward:

- The BioE3 Policy will complement existing government initiatives like the ‘Net Zero’ carbon economy and ‘Lifestyle for Environment’ (LiFE).

- It will propel India toward green growth by promoting a circular bioeconomy and aligning with the vision of Viksit Bharat, ensuring a sustainable and innovative future responsive to global challenges.

Source: IE

Zero FIRs filed in local languages must have translated copy

Tags: GS-2, Polity & Governance- transparency & Accountability – Judiciary

Why in the news?

- Recently, The Union Ministry of Home Affairs (MHA) has directed Union Territories (UTs) to ensure that ‘zero FIRs’ recorded in local languages are accompanied by a translated copy of the same when forwarded to states with different languages.

About FIRs:

- The term “First Information Report” (FIR) is not explicitly defined in the Indian Penal Code (IPC), Code of Criminal Procedure (CrPC), or any other law.

- However, in police regulations, information recorded under Section 154 of CrPC is referred to as an FIR.

- Section 154 mandates that any information regarding the commission of a cognizable offence, if provided orally to a police officer in charge, must be reduced to writing.

- A copy of the recorded information must be given to the informant free of cost.

- Key elements of an FIR include:

- It must pertain to a cognizable offence.

- It should be reported orally or in writing to the police station head.

- It must be documented, signed by the informant, and its contents entered in a daily diary.

Zero FIRs

- A Zero FIR can be lodged at any police station by the victim, regardless of where they reside or where the crime took place.

- Upon receiving a Zero FIR, the police station forwards it to the appropriate jurisdiction for further investigation.

- The FIR does not receive a regular number, and a fresh FIR is registered by the concerned police station.

- The concept of Zero FIR was introduced following the Justice Verma Committee recommendations after the 2012 Nirbhaya gang rape case.

- The aim is to prevent delays and ensure that victims do not face hurdles in getting their complaints registered.

- The provision ensures faster action after filing the FIR, aiding in timely redressal of grievances.

FIRs under New Criminal Laws:

- The three new criminal laws—Bharatiya Nyaya Sanhita 2023, Bharatiya Nagarik Suraksha Sanhita 2023, and Bharatiya Sakshya Adhiniyam 2023—came into effect from July 1, 2024.

- These laws replaced the IPC, CrPC, and the Indian Evidence Act, respectively.

- Under the new laws, FIRs can now be reported via electronic means, eliminating the need for physical visits to police stations.

- This facilitates quicker reporting and enables faster action by law enforcement.

- The Bharatiya Nagarik Suraksha Sanhita (BNSS) mandates the registration of a ‘Zero FIR.’

- Section 176(3) of BNSS requires mandatory collection of forensic evidence and video recording of crime scenes in cases punishable by seven years or more.

- States lacking forensic facilities can use those of other states.

- Victims receive a free copy of the FIR, ensuring their active participation in the legal process.

Source: IE

Aparajita Bill

Tags: GS-2, Polity Governance- constitution – Transparency & Accountability – Amendment & Bills

Why in the news?

- The Aparajita Woman and Child (West Bengal Criminal Laws Amendment) Bill 2024 has been unanimously approved by the West Bengal Assembly.

- This Bill mandates the death penalty for rape cases where the victim either dies or is left in a permanent vegetative state.

- The approval of this Bill follows significant public protests in West Bengal in response to the rape and murder of a young doctor at R.G. Kar Medical College and Hospital in Kolkata.

Current Indian Laws to Curb Sexual Assaults on Women:

- Criminal Law (Amendment) Act 2013

- Amended the Indian Penal Code (IPC) to permit the death penalty in cases of rape resulting in death or a persistent vegetative state, and for repeat offenders.

- Criminal Laws (Amendment) Act 2018

- Introduced the death penalty for rape and gang rape involving girls under the age of 12.

- Bhartiya Nyaya Sanhita 2023

- Maintains previous penal provisions and adds the death penalty for gang rape of women under 18 years of age.

Salient Provisions of the Aparajita Bill:

- Amendments to Existing Laws

- The Bill revises the Bharatiya Nyaya Sanhita 2023 (BNS), the Bharatiya Nyaya Suraksha Sanhita 2023 (BNSS), and the Protection of Children Against Sexual Offences Act 2012 (POCSO).

- Provisions of BNS Revised

- Adds “or with death” to the maximum punishment descriptions for aggravated rape cases (e.g., rape by a public servant).

- Mandates the death penalty for rape where the victim dies or is left in a permanent vegetative state.

- Prescribes the death penalty for gang rape of a woman over 18 years of age.

- Replaces “imprisonment for life” with “rigorous imprisonment for life” for repeat offenders.

- Increases penalties for revealing a rape victim’s identity and for publishing related court proceedings.

- Replaces lighter punishments for acid attacks with “rigorous imprisonment for life” only.

- Provisions of POCSO Act Revised

- Introduces the death penalty for penetrative sexual assault, where previously life imprisonment was the maximum penalty.

- Provisions of BNSS Revised

- Reduces the time frame for completing investigations from two months to 21 days (extendable by 15 days) and for trials from two months to 30 days.

Task Forces and Special Courts

- Establishes specialised institutions, including Special Police Teams dedicated to investigating crimes against women.

- Creates a district-level Aparajita Task Force for handling rape cases.

- Sets up Special Courts in every district to expedite the inquiry and trial of rape cases and appoints Special Public Prosecutors.

Other Similar State Laws to Curb Sexual Assaults on Women

- Andhra Pradesh (Disha Bill 2019)

- Introduced the death penalty for rape, including cases involving minors under 16 years, gang rape, and repeat offenders.

- Maharashtra (Shakti Bill 2020)

- Enforced the death penalty for rape cases and introduced shortened timelines for investigation and trial.

- Madhya Pradesh (2017) and Arunachal Pradesh (2018)

- Established the death penalty for the rape or gang rape of women up to 12 years old.

- Status

- Both the Disha Bill and the Shakti Bill are pending presidential assent.

Difficulties in Introducing State Laws to Curb Sexual Assaults on Women

- The Aparajita Bill must be approved by the Governor of West Bengal and then the President of India to become effective.

- President’s Assent:

- Essential due to the Supreme Court ruling in Mithu vs. State of Punjab (1983).

- Which determined that mandatory death sentences violate fundamental rights under Articles 14 (equality before law) and 21 (right to life), potentially leading to unfair and unreasonable legal procedures.

Source: TH

World Bank Revises India’s GDP Growth Estimate

Tags: GS-3, Economy- Growth & Development- Inclusive growth

Why in the news?

- Recently, The World Bank (WB) revised its forecast for India’s GDP growth to 7% for FY25 from 6.6% previously, citing increases in household real estate investments and investments in infrastructure.

Highlights of the World Bank’s Forecast on the Indian Economy:

- GDP Growth:

- India remained the fastest-growing major economy with an 8.2% growth rate last fiscal.

- It is projected to grow at 7% in the current fiscal and 6.7% in FY26.

- Industrial Growth:

- Growth is expected to slow to 7.3% in FY26 from 7.6% in FY25.

- The industrial sector recovered to 9.5% growth in FY24 after disruptions caused by the Covid-19 pandemic.

- Gross Fixed Capital Formation (GFCF):

- GFCF growth is expected to slow to 7.8% in FY25 from 9.0% in FY24.

- The GFCF growth rate was 6.6% in FY23.

- Service Sector Growth:

- Growth is predicted to slip to 7.4% in FY25 and 7.1% in FY26 due to weakening IT investment globally.

- Service sector growth stood at 7.6% in FY24.

- Agricultural Growth:

- Expected to jump sharply to 4.1% in FY25 compared to 1.4% in FY24.

- Export-Import Growth:

- Exports are forecasted to grow by 7.2% in FY25.

- Imports are expected to grow by 4.1% in FY25 compared to 10.9% in FY24.

Opportunities and Challenges for the Indian Economy:

- Export Sector:

- India can expand exports in electronics, green technology, textiles, and footwear alongside IT and pharmaceuticals.

- However, India has been losing ground in labour-intensive sectors like apparel and footwear, with its share in global apparel exports dropping from 4% in 2018 to 3% in 2022.

- Competitor countries like Bangladesh and Vietnam have increased their global export share in key sectors.

- Trade Barriers:

- While India benefits from the reconfiguration of global value chains post-pandemic, tariff and non-tariff barriers have risen.

- The National Logistics Policy (NLP) and digital initiatives are helping reduce trade costs, but protectionism could hinder future trade-focused investments.

- Current Account Deficit (CAD):

- The CAD reduced to 0.7% in FY24 from 2% in FY23.

- Foreign exchange reserves reached $670.1 billion in August 2023.

- The CAD is expected to widen steadily to 1.1% in FY25, 1.2% in FY26, and 1.6% in FY27.

- Jobs in India:

- Despite strong economic growth, urban youth unemployment remains high at 17%.

- Jobs linked to international trade have declined in the last decade.

- Deeper integration into global value chains can create more jobs and opportunities for productivity growth.

Measures can India Adopt to Accelerate Economic Growth:

- Expanding Manufacturing Sector: Boost manufacturing to create jobs for agricultural workers through targeted training, incentives, and promoting food processing industries.

- Gig Economy Skilling: Partner with platforms like Uber to offer micro-skilling for gig jobs. Create a national freelance marketplace to connect skilled workers with businesses.

- Export Processing Zones (EPZs) 2.0: Develop sustainable EPZs with tax breaks for green tech and high-value manufacturing. Equip SMEs for e-commerce exports with incentives and training.

- Smart Taxation and Revamped PPP: Use technology for smart taxation and expand the tax base. Reform PPPs with risk-sharing to attract private capital for infrastructure projects.

- Industry-Academia Collaboration: Align curriculum with industry needs through stronger partnerships. Offer micro-credentials to enable continuous upskilling.

- Formalization Incentives: Provide tax breaks and credit access to informal businesses that formalise, enhancing financial inclusion with digital tools.

- Green Infrastructure Bonds: Issue green bonds for sustainable projects. Use AI and big data to identify infrastructure gaps and optimise resource allocation.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q:1 In the ‘Index of Eight Core Industries’, which one of the following is given the highest weight? (2015)

(a) Coal production

(b) Electricity generation

(c) Fertiliser production

(d) Steel production

Ans: (b)

Q:2 Increase in absolute and per capita real GNP do not connote a higher level of economic development, if: (2018)

(a) Industrial output fails to keep pace with agricultural output.

(b) Agricultural output fails to keep pace with industrial output.

(c) Poverty and unemployment increase.

(d) Imports grow faster than exports.

Ans: (c)

Q:3 In a given year in India, official poverty lines are higher in some States than in others because: (2019)

(a) Poverty rates vary from State to State

(b) Price levels vary from State to State

(c) Gross State Product varies from State to State

(d) Quality of public distribution varies from State to State

Ans: (b)

Mains

Q.1 “Industrial growth rate has lagged behind in the overall growth of Gross-Domestic-Product (GDP) in the post-reform period” Give reasons. How far are the recent changes in Industrial Policy capable of increasing the industrial growth rate? (2017)

Q.2 Normally countries shift from agriculture to industry and then later to services, but India shifted directly from agriculture to services. What are the reasons for the huge growth of services vis-a-vis the industry in the country? Can India become a developed country without a strong industrial base? (2014)

Source: IE

e-Shram Portal

Tags: GS-3, Economy- Government Policies & Interventions– Employment– Skill Development

Why in the news?

- Recently, The Ministry of Labour & Employment (MoLE) stated that eShram has registered more than 30 crore unorganised workers, showcasing its rapid and widespread adoption among the unorganised workers.

About e-Shram Portal:

- Aim of e-Shram Portal:

- Designed to register 38 crore unorganised workers such as construction labourers, migrant workers, street vendors, and domestic workers, issuing them an e-Shram card with a 12-digit unique number.

- Accident Benefits:

- Registered workers on the e-Shram portal are entitled to Rs 2 lakh for death or permanent disability and Rs 1 lakh for partial disability due to accidents.

- Background:

- The e-Shram portal was developed following the Supreme Court’s directive to the government to register unorganised workers, enabling them to access welfare benefits under various schemes.

- Implementation:

- State and UT governments will handle the registration of unorganised workers across the nation through the e-Shram portal.

- Status of Unorganized Sector in India:

- The Ministry of Labour and Employment classifies the unorganised labour force into four categories:

- Occupation: Includes small and marginal farmers, landless agricultural labourers, sharecroppers, fishermen, beedi makers, and those in animal husbandry.

- Nature of Employment: Covers attached agricultural labourers, bonded labourers, migrant workers, contract, and casual labourers.

- Specially Distressed Category: Includes toddy tappers, scavengers, head load carriers, animal cart drivers, loaders, and unloaders.

- Service Category: Comprises midwives, domestic workers, fishermen, barbers, vegetable and fruit vendors, and newspaper vendors.

- The Ministry of Labour and Employment classifies the unorganised labour force into four categories:

Initiatives Already Taken to Support Unorganised Sector:

- Pradhan Mantri Shram Yogi Maan-dhan (PM-SYM)

- Labour Code

- Pradhan Mantri Rojgar Protsahan Yojana (PMRPY)

- PM SVANidhi: Micro Credit Scheme for Street Vendors

- Atmanirbhar Bharat Abhiyan

- Deendayal Antyodaya Yojana National Urban Livelihoods Mission

- PM Garib Kalyan Ann Yojana (PMGKAY)

- One Nation One Ration Card

- Atmanirbhar Bharat Rozgar Yojana

- Pradhan Mantri Kisan Samman Nidhi

- World Bank Support to India’s Informal Working Class

Source: BS

AgriSURE Fund

Tags: GS-3, Economy- Agriculture Sector- Agriculture & Farmers Welfare–

Why in the news?

- Recently, the Union Minister for Agriculture and Farmers’ Welfare and Rural Development Shri Shivraj Singh Chouhan launched the AgriSURE Scheme in New Delhi.

About the AgriSURE Fund:

- Launch:

- On September 4, 2024, the Union Minister for Agriculture and Farmers’ Welfare and Rural Development inaugurated the AgriSURE Scheme in New Delhi.

- About:

- AgriSURE (Agriculture Fund for Start-ups & Rural Enterprises) is a pioneering fund aimed at transforming India’s agricultural sector. It focuses on technology-driven, high-risk, high-impact ventures.

- Funding Structure:

- Total Fund: ₹750 crore

- Sources:

- Government of India: ₹250 crore

- NABARD: ₹250 crore

- Banks, insurance companies, and private investors: ₹250 crore

- Type: Blended capital fund, registered as a SEBI Category II Alternative Investment Fund (AIF)

- Focus Areas:

- Promoting innovative technology-driven agricultural initiatives

- Enhancing the farm produce value chain

- Developing rural infrastructure and ecosystem linkages

- Generating employment

- Supporting Farmers Producer Organisations (FPOs)

- Encouraging entrepreneurship through IT solutions and machinery rental services for farmers

- Management:

- NAB VENTURES, a wholly owned subsidiary of NABARD, will manage the fund.

- Challenges of Rural Startups

- Financial Accessibility: Rural startups face difficulties in obtaining financing due to financial institutions’ reluctance to lend and limited banking services in rural areas.

- Resource Procurement: Entrepreneurs struggle with acquiring raw materials and other resources due to connectivity issues and logistical constraints.

- Technological Gaps: Limited technological awareness, insufficient training programs, and a lack of comprehensive services hinder the growth of rural startups.

Source: PIB

Su-30MKI Fighter Jet

Tags: GS-3, Science & Technology- Defence technology

Why in the news?

- Recently, the Cabinet Committee on Security approved the acquisition of 240 aero-engines for the Su-30MKI aircraft of the Indian Air Force (IAF).

What is the Su-30MKI Fighter Jet?

- About:

- The Su-30MKI is a multirole combat fighter aircraft developed collaboratively by Sukhoi Design Bureau and Hindustan Aeronautics Limited (HAL) for the Indian Air Force (IAF).

- Key Features

- Generation: Fourth-generation fighter jet.

- Engines: Powered by two AL-31 FP aero engines, a high-temperature turbojet by-pass engine of modular design.

- Missile Capability: Equipped with air-launched BrahMos supersonic cruise missiles; successfully tested in November 2017.

- Radar: Fitted with Tarang Radar Warning Receiver (RWR), developed by Defence Research and Development Organisation (DRDO).

- Range: Maximum unrefueled flight range of 3,000 km; extends to 8,000 km with two in-flight refuelling.

Manufacturer

Hindustan Aeronautics Limited (HAL)

- Recent Development

- The Cabinet Committee on Security recently approved the procurement of 240 aero-engines for the Su-30MKI aircraft.

Source: TH

Review Petition

Tags: GS-2, Polity & Governance- Judiciary

Why in the news?

- Recently, A group of medical students filed a review petition challenging the Supreme Court’s decision to dismiss their writ petition, which sought to cancel the NEET UG 2024 examination.

About Review Petition:

- Doctrine of Functus Officio:

- When a court issues a judgement, it generally cannot be reopened due to the doctrine of functus officio, which means that once a decision has been made following legal procedures, the case is closed.

- Exception – Review Petition:

- The review petition is an exception to this doctrine, allowing a case to be examined again. “Review” means to re-examine a judgement or order.

- Constitutional Basis:

- Supreme Court: Article 137 of the Constitution grants the Supreme Court the authority to review its judgments or orders to correct “patent errors,” not minor mistakes.

- High Courts: Article 226 permits High Courts to review their judgments, but only for breaches of law or constitutional violations.

- Grounds for Review:

- According to a 2013 Supreme Court ruling, the grounds for a review petition include:

- Discovery of new, important evidence that was not previously available.

- Mistake or error apparent on the face of the record.

- Any other sufficient reason analogous to the first two grounds.

Procedure:

- Eligibility: Any person aggrieved by a ruling, not just the parties to the case, can file a review petition.

- Time Frame: The petition must be filed within 30 days from the date of the judgement or order, as per the 1996 rules framed by the Supreme Court.

- Submission: The petition must outline the grounds for review, including legal arguments and supporting precedents.

- Consideration: Review petitions are generally considered without oral arguments and reviewed “through circulation” by the judges. Oral hearings may be permitted in exceptional cases.

- Circulation: The petition is reviewed by the same bench that issued the original judgement, or any competent court if the original bench is unavailable.

- Outcome: The Supreme Court will assess if the petition meets the criteria for review. If the petition is dismissed, a curative petition may be available for further relief.

Source: IE

Frequently Asked Questions (FAQs)

Q: What are daily current affairs?

A: Daily current affairs refer to the most recent and relevant events, developments, and news stories that are happening around the world on a day-to-day basis. These can encompass a wide range of topics, including politics, economics, science, technology, sports, and more.

Q: Why is it important to stay updated with daily current affairs?

A: Staying updated with daily current affairs is crucial because it helps individuals make informed decisions in their personal and professional lives. It enables people to understand the world around them, stay aware of significant events, and engage in informed discussions about important issues.

Q: Where can I access daily current affairs information?

A: There are various sources for daily current affairs, including newspapers, news websites, television news broadcasts, radio programs, and dedicated apps or newsletters. Social media platforms are also widely used to share and access current affairs information.

Q: How can I effectively incorporate daily current affairs into my routine?

A: To incorporate daily current affairs into your routine, consider setting aside specific times each day to read or watch news updates. You can also subscribe to newsletters or follow news apps to receive curated content. Engaging in discussions with peers or participating in online forums can further enhance your understanding of current events.

Q: What are some tips for critical analysis of daily current affairs?

A: When analyzing daily current affairs, it’s essential to cross-reference information from multiple sources to ensure accuracy. Additionally, consider the source’s credibility and bias, if any. Develop the ability to identify the main points and implications of news stories, and critically evaluate the significance and impact of the events reported.

To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

- Join our Main Telegram Channel and access PYQs, Current Affairs and UPSC Guidance for free – Edukemy for IAS

- Learn Economy for free- Economy for UPSC

- Learn CSAT – CSAT for UPSC

- Mains Answer Writing Practice-Mains Answer Writing

- For UPSC Prelims Resources, Click here