Today’s daily current affairs briefing for UPSC aspirants explores the latest developments relevant to the upcoming civil services examination. Our focus today includes a critical analysis of recent policy changes, international affairs, and national developments, all of which play a pivotal role in shaping India’s socio-political and economic landscape. Stay informed and stay ahead in your UPSC preparations with our daily current affairs updates, as we provide you with concise, well-researched insights to help you connect the dots between contemporary events and the broader canvas of the civil services syllabus.

Contents

- 1 How to Ensure Dignity for the Terminally-ill

- 2 National Glacial Lake Outburst Floods Risk Mitigation Programme

- 3 UPSC Civil Services Examination, Previous Year Question (PYQ)

- 4 Govt bans 156 fixed dose combination drugs

- 5 CBDT forms committee for Income Tax Act 1961

- 6 UPSC Civil Services Examination, Previous Year Questions (PYQs)

- 7 India-Poland Relations

- 8 Gongronema sasidharanii

- 9 Macrophages

- 10 Solar Magnetic Fields

- 11 Drug Delivery with Nanotechnology

- 12 Frequently Asked Questions (FAQs)

- 12.1 Q: What are daily current affairs?

- 12.2 Q: Why is it important to stay updated with daily current affairs?

- 12.3 Q: Where can I access daily current affairs information?

- 12.4 Q: How can I effectively incorporate daily current affairs into my routine?

- 12.5 Q: What are some tips for critical analysis of daily current affairs?

- 13 To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

How to Ensure Dignity for the Terminally-ill

Tags: GS-2, Governance- SC Judgements

Why in the news?

- Recently, the Supreme Court of India denied a petition from an elderly couple seeking “passive euthanasia” for their comatose son, who has been bedridden for 11 years following a fall.

- This ruling has reignited discussions on the legal and ethical dimensions of euthanasia in India.

What is the Background of the Case?

- About Case:

- The Supreme Court ruled against the petition of Harish Rana’s parents, stating that the case did not qualify as passive euthanasia since the patient was not on any life support systems but was receiving nutrition through a Ryles tube.

- The court indicated that allowing him to die would not constitute passive euthanasia but rather active euthanasia, which remains illegal in India.

What is Passive Euthanasia?

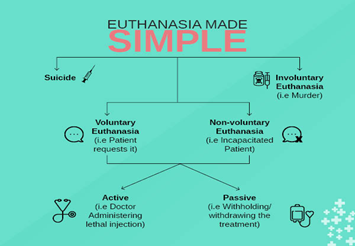

- About: Euthanasia involves ending a patient’s life to alleviate suffering.

- Types of Euthanasia:

- Active Euthanasia: Active euthanasia occurs when medical professionals or another person deliberately takes actions to cause the patient’s death, such as administering a lethal injection.

- Passive Euthanasia: Passive euthanasia involves withholding or withdrawing medical treatment, such as life support, with the intention of allowing the person to die.

- Euthanasia in India:

- The Supreme Court of India, in the landmark judgement of Common Cause vs Union of India (2018), recognized a person’s right to die with dignity, permitting passive euthanasia and the execution of a living will to refuse medical treatment.

- The court laid down guidelines for ‘living wills’ made by terminally ill patients who foresee the possibility of entering a permanent vegetative state.

- Previously, in 2011, the SC recognized passive euthanasia in the Aruna Shanbaug case for the first time, stating that “Dignity in the process of dying is as much a part of the right to life under Article 21.

- Different Countries with Euthanasia:

- Netherlands, Luxembourg, Belgium: These countries allow both types of euthanasia and assisted suicide for individuals facing “unbearable suffering” with no prospect of improvement.

- Switzerland: Assisted suicide has been legal since 1942, focusing on personal choice and control over the dying process, provided individuals are of sound mind and their decision is not motivated by selfish reasons.

- Australia: Both types of euthanasia are legal, applicable to adults with full decision-making capacity who have a terminal illness with a prognosis of death within six or twelve months.

- Netherlands: The Netherlands has a comprehensive legal framework for euthanasia regulated by the “Termination of Life on Request and Assisted Suicide (Review Procedures) Act” of 2001.

What were the Recent Changes in Guidelines made by the Supreme Court on Passive Euthanasia?

- About:

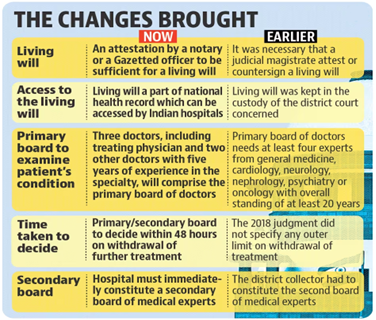

- In 2023, the Supreme Court modified the 2018 Euthanasia Guidelines to simplify the process for granting passive euthanasia to terminally ill patients.

Modifications in SC Guidelines:

- Attestation of Living Will:

- The requirement for a judicial magistrate’s attestation on a living will was removed.

- Now, attestation by a notary or a gazetted officer is sufficient, making it easier for individuals to express their end-of-life choices.

- Integration with National Health Digital Record:

- Living wills, previously held by district courts, are now required to be part of the National Health Digital Record.

- This integration ensures easier access for hospitals and doctors nationwide, facilitating timely decision-making.

- Appeal Process for Denial of Euthanasia:

- If a hospital’s medical board denies permission to withdraw life support, the patient’s family can appeal to the relevant High Court.

- which will form a new medical board to reassess the case, ensuring a thorough and just review.

What are the Ethical Considerations of Euthanasia?

- Autonomy and Informed Consent:

- Euthanasia involves respecting individual autonomy, allowing people to decide about their lives, especially to end suffering if they are mentally competent.

- It also requires informed consent, ensuring the person fully understands their condition, the euthanasia process, and its consequences to avoid coercion or manipulation.

- Quality of Life vs. Sanctity of Life:

- The debate on euthanasia often revolves around quality of life, which argues that ending suffering and preserving dignity in severe illness can be ethical, versus sanctity of life.

- Which holds that life is intrinsically valuable and should not be ended prematurely, reflecting religious or philosophical beliefs.

- Legal and Social Implications:

- The legal framework for euthanasia varies by jurisdiction, reflecting different cultural attitudes and ethical debates on end-of-life issues. The social impact involves questions about the roles of medical professionals, societal responsibilities, and the need for equitable access to palliative care and psychological support to address the underlying reasons for seeking euthanasia.

Way Forward:

- Need for Legal Clarity:

- The Harish Rana case underscores the necessity for clear legal distinctions between euthanasia and the withdrawal of life-sustaining interventions that may be deemed futile.

- It is imperative to involve medical and ethical experts in judicial decisions to ensure they are based on robust medical understanding and ethical principles.

- Until a definitive legal framework is established, there must be efforts to educate the public about their rights and options through mechanisms such as Advance Care Planning and Advance Medical Directives.

- Ethical Reform:

- Upholding a dignified quality of life and death is a fundamental right that should not be compromised by ethical uncertainties.

- The court should thoroughly examine the ethical aspects of its rulings and consider reforms to address these concerns.

- The Supreme Court’s judgement reveals the need for a more nuanced approach to euthanasia and life support, ensuring that patient dignity and autonomy are respected while adhering to medical and ethical standards.

Conclusion:

The denial to remove the Ryles tube, despite the patient’s terminal condition and lack of recovery prospects, emphasises the need for clearer legal guidelines and ethical reforms. As India navigates these issues, it is crucial to involve medical and ethical experts in decision-making and to ensure that the rights to a dignified life and death are upheld for all individuals.

Source: IE

National Glacial Lake Outburst Floods Risk Mitigation Programme

Tags: GS – 3, DM- Water Resources- GLOF- Environmental Pollution & Degradation

Why in the news?

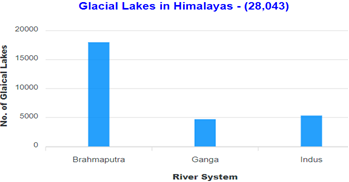

- The National Disaster Management Authority (NDMA) has initiated expeditions to glaciers at altitudes of 4,500 meters and above to assess their vulnerability to Glacial Lake Outburst Floods (GLOF).

- NDMA has identified 189 high-risk lakes out of approximately 7,500 glacial lakes in the Indian Himalayas that require targeted mitigation measures.

National Glacial Lake Outburst Floods Risk Mitigation Programme (NGRMP):

- About:

- The National Glacial Lake Outburst Floods Risk Mitigation Programme (NGRMP) is an initiative by the Government of India aimed at addressing the risks posed by GLOFs.

- A total of 16 teams were deployed for expeditions, out of which 15 have completed their missions, with seven additional expeditions currently underway.

- Of the completed expeditions, 6 were conducted in Sikkim, 6 in Ladakh, 1 in Himachal Pradesh, and 2 in Jammu and Kashmir.

- These teams assess the structural stability and potential breach points of glacial lakes, gather hydrological and geological data, measure water quality and flow rates, identify risk zones, and raise awareness among downstream communities.

- Objective:

- The program aims to assess hazards, install automated monitoring and early warning systems, and implement lake-lowering measures to mitigate GLOF risks.

- Lake-lowering measures involve techniques to reduce the water volume in a glacial lake to mitigate the risk of a GLOF.

- NDMA is focusing on ground-truthing the 189 identified “high-risk” glacial lakes to validate remote sensing data and ensure accurate risk assessment.

- Methodology to Prevent GLOF:

- The program plans to execute three activities simultaneously:

- Installation of automated weather and water level monitoring stations, along with early warning systems.

- Conducting digital elevation modelling and bathymetry.

- Assessing the best methods to reduce the risk, including lake-lowering techniques.

Need for the Study:

- ICIMOD Findings:

- According to the ICIMOD, the Hindu Kush Himalayas are experiencing rapid and irreversible changes due to climate change, increasing the risk of floods and landslides.

- Climate Change: Climate change is altering the frequency, duration, and intensity of precipitation and extreme heat in India, leading to an increased number of flash floods.

- Previous Incidents of GLOFs:

- Nepal Incident: Recently, flash floods struck Thame, a village in the Khumbu region of Nepal, due to an outburst flood from Thyanbo glacial lake.

- Sikkim Flash Flood: A catastrophic GLOF occurred in South Lhonak Lake, Sikkim, in October 2023.

- Uttarakhand Flash Floods: A glacier breach-induced flood in February 2021 in the Rishi Ganga valley resulted in over 200 deaths and significant damage to hydropower plants and Raini village.

Recent Developments in NGRMP:

- Arunachal Pradesh Initiatives:

- The Arunachal Pradesh State Disaster Management Authority (APSDMA) is conducting surveys of high-risk glacial lakes in the Tawang

- Dibang Valley districts as part of the broader NGRMP initiative to map all glacial lakes in the country.

- High-Risk Glacial Lakes Identified in Arunachal Pradesh:

- A total of 27 high-risk glacial lakes have been identified across five districts in Arunachal Pradesh.

- The lakes are located in Tawang (6 lakes), Kurung Kumey (1), Shi Yomi (1), Dibang Valley (16), and Anjaw (3).

- The current expedition teams are focusing on three high-risk lakes in each of the Tawang and Dibang Valley districts.

- Study Objectives:

- The study aims to assess the accessibility, location, size, elevation, nearby habitations, and land use of the lakes at risk of GLOF.

- The findings will support the Centre for Development of Advanced Computing (C-DAC) and the Indian Meteorological Department in installing Automatic Early Warning Systems and Automatic Weather Stations.

Significance of the Study:

- Strategic Location: The strategic importance of Tawang and Dibang Valley districts, both of which share borders with China, makes this study crucial.

- Fragile Himalayan Ecosystem: The interference by China with Himalayan geology and river systems could lead to landslides on both sides of the border, posing a risk to the fragile Himalayan ecosystem.

- Threat of Floods: In 2018, the Arunachal and Assam governments issued flood alerts after China reported a landslide blockage at the Yarlung Zangbo River.

- Heavy Infrastructure: China’s construction of a mega dam on the Yarlung Tsangpo river near the international border raises concerns about potential adverse impacts downstream from Arunachal Pradesh to Assam.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q:1 Siachen Glacier is situated to the (2020)

- East of Aksai Chin

- East of Leh

- North of Gilgit

- North of Nubra Valley

Ans: (d)

Q:2 Consider the following pairs (2019)

Glacier – River

- Bandarpunch : Yamuna

- Bara Shigri : Chenab

- Milam: Mandakini

- Siachen: Nubra

- Zemu : Manas

Which of the pairs given above are correctly matched?

- 1, 2 and 4

- 1, 3 and 4

- 2 and 5

- 3 and 5

Ans: (a)

Q:3 Consider the following statements: (2010)

- On the planet Earth, the fresh water available for use amounts to about less than 1% of the total water found.

- Of the total fresh water found on the planet Earth 95% is bound up in polar ice caps and glaciers.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Ans: (a)

Mains

Q:1 With reference to National Disaster Management Authority (NDMA) guidelines, discuss the measures to be adopted to mitigate the impact of the recent incidents of cloudburst in many places of Uttarakhand. (2016)

Govt bans 156 fixed dose combination drugs

Tags: GS-1, Society & Social Issues- Health

Why in the news?

- Recently, the Union Health Ministry has prohibited 156 fixed dose combination (FDC) medicines, citing a lack of “therapeutic justification” and potential risks to patients.

- While FDC drugs, which combine multiple active ingredients, can be beneficial for conditions such as tuberculosis and diabetes, they may also include unnecessary or harmful components.

Fixed Dose Combination (FDC) Drugs:

- About

- Fixed dose combination (FDC) drugs, or combination products, are formulations that include two or more active drugs in a single dosage form.

- These are also known as cocktail drugs.

- According to the Food and Drug Administration (FDA) in the USA, a combination product is defined as “a product composed of any combination of a drug and a device, a biological product and a device, a drug and a biological product, or a drug, device, and biological product.”

- It is generally accepted that most drugs should be used as single compounds.

- Acceptability

- Fixed dose combinations are acceptable only if:

- The dosage of each ingredient meets the needs of a specific population group.

- The combination demonstrates a proven benefit over single compounds used separately in terms of therapeutic effect, safety, or patient compliance.

- Fixed dose combinations are acceptable only if:

- Advantages of FDC Drugs

- FDC formulations offer unique benefits such as complementary mechanisms of action, synergistic effects, improved tolerability, extended product life-cycle management, and cost savings.

- The use of FDCs can be a rational approach to achieving optimal therapeutic outcomes while reducing the pill burden on patients.

- Challenges/Demerits of FDC Drugs

- There is an increased risk of adverse drug effects and drug interactions compared to when the drugs are administered individually.

- Many FDCs introduced in India are irrational and expose patients to unnecessary risks of adverse reactions.

- Irrational FDCs can impose additional financial burdens on consumers.

- Medical practitioners endorsing such combinations may face controversy and litigation as these combinations are not typically covered in standard reference texts or reputable medical journals.

- Despite these issues, pharmaceutical manufacturers continue to benefit from high sales and actively promote these combinations.

156 Fixed Dose Combination Drugs Banned

- About the News:

- The government has banned 156 FDC medicines, including antibiotics for fevers and colds, painkillers, and multivitamins, due to potential health risks.

- The Union Health Ministry issued a gazette notification under Section 26 A of the Drugs and Cosmetics Act of 1940, prohibiting their manufacture, sale, and distribution.

- This decision follows recommendations from an expert committee and the Drugs Technical Advisory Board (DTAB), which found no therapeutic justification for the ingredients in these FDCs.

- Key Highlights:

- The banned combinations include common formulations such as anti-allergic medicines with nasal decongestants, antibiotics with acne treatments, and migraine medicines with anti-nausea drugs.

- The ban specifically includes the mefenamic acid-tranexamic acid combination and sildenafil with blood vessel relaxants.

- This action represents the most significant crackdown on FDCs since 2016, when 344 drugs were banned, with 328 combinations upheld in 2018.

- The inclusion of some pre-1988 drugs, previously exempt from bans, has generated industry surprise and concern over the immediate removal of these long-used products from the market.

Source: IE

CBDT forms committee for Income Tax Act 1961

Tags: GS – 3, Economy- Planning —Government Budgeting– Fiscal Policy- Government Policies & Interventions

Why in the news?

- The Income Tax Department is undergoing a major revamp of the Income Tax Act, 1961, led by a newly formed internal committee.

- This initiative, announced by the Central Board of Direct Taxes (CBDT) chairman, is part of a broader government effort aimed at modernising and simplifying India’s direct tax laws.

Why is the Income Tax Act Being Reviewed?

- Historical Complexity:

- The Income Tax Act, 1961, has faced criticism for its complexity and outdated provisions.

- Previous attempts to simplify the Act, such as the 1958 Law Commission’s review of the Income Tax Act of 1922, demonstrated that a complete overhaul of the tax structure is necessary for true simplification.

- Need for Modernization:

- The current review seeks to update the law to better reflect modern economic realities and global best practices, making it more transparent and easier to understand.

- Improvement of Compliance:

- Simplifying the tax law is expected to improve taxpayer compliance by reducing ambiguities and streamlining the filing process.

- Dispute Resolution:

- The Vivad Se Vishwas scheme has been introduced to resolve long-standing disputes.

- The review will also consider shortening the reassessment period and raising monetary thresholds to reduce conflicts between taxpayers and the tax department.

What are the Key Aspects of the Income Tax Act, 1961?

- About:

- The Income Tax Act of 1961 is the key statute governing income taxation in India.

- It provides a detailed framework for how income tax is levied, administered, and collected from individuals and corporations.

- The Act consists of 298 sections and 23 chapters, covering all aspects of taxation in India.

- Income tax is a direct tax that individuals must bear themselves, without the option to transfer it to others.

- Objectives:

- Economic Stability: The Act aims to maintain economic stability by regulating private spending and ensuring a progressive taxation system.

- Progressive Taxation: It seeks to ensure fairness and equity by taxing individuals based on their income levels.

- Revenue Collection: The Act facilitates efficient revenue collection and management by clearly defining the rules for taxing income from various sources.

- Key Provisions:

- Tax Slabs: Establishes income brackets and the corresponding tax rates for individuals and businesses.

- Deductions: Permits deductions under sections like 80C (investments), 80D (medical insurance premiums), and 80G (donations), subject to annual limits.

- Assessment: Specifies the procedures for assessing taxable income, filing returns, and conducting audits.

- Tax Deducted at Source (TDS): Requires the deduction of tax at the source for certain payments, simplifying the tax collection process.

- Capital Gains: Governs the taxation of profits from the sale of assets, with specific provisions for short-term and long-term gains.

- Penalties and Appeals: Outlines penalties for non-compliance and the processes for resolving disputes through appeals.

Key Recent Reforms:

- Corporate Tax Rates:

- The effective tax rate for corporate taxpayers dropped from 29.49% in 2017-18 to 23.26% in 2021-22.

- Additionally, the corporate tax rate for foreign companies has been reduced to 35%, and the angel tax has been abolished.

- Personal Income Tax Slabs:

- The reduction in the number of income-tax slabs and lower rates for lower-income groups are expected to benefit many individual taxpayers.

- The simplification of tax slabs has contributed to an increase in the number of taxpayers, rising from 89.8 million in 2019-20 to 93.7 million in 2022-23.

What are the Expected Benefits of the Overhaul of Income Tax Act, 1961?

- Conciseness and Clarity: The revised Act will be streamlined and easier to understand, reducing the administrative burden on both taxpayers and authorities by eliminating outdated clauses.

- Enhanced Taxpayer Experience: Simplified tax laws will reduce ambiguity, making the system more user-friendly, which should increase trust and compliance.

- Capital Gains Tax Reform: Planned reforms include increasing taxes on equity capital gains and securities transactions, aiming to balance the tax burden across different asset classes and income groups.

- Broader Tax Base: Clearer regulations and simplified compliance could lead to higher tax compliance and a broader tax base, boosting revenue despite potential tax rate reductions.

- Improved Business Environment: A more transparent and predictable tax regime will attract more foreign and domestic investment, supporting economic growth.

- Long-Term Economic Benefits: A modernised tax system will enhance economic growth and stability, supporting India’s goal of becoming a developed country by 2047, with streamlined processes improving tax administration efficiency.

What are the Key Facts About the Central Board of Direct Taxes?

- Historical Background:

- The CBDT’s origins date back to the Central Board of Revenue Act, 1924.

- The board was bifurcated in 1964, creating the CBDT for direct taxes and the Central Board of Excise and Customs for indirect taxes, formalised under the Central Boards of Revenue Act, 1963.

- Structure: The CBDT is led by a chairman and includes six members, all holding the rank of ex-officio Special Secretary to the Government of India.

- Selection: The Chairman and Members are selected from the Indian Revenue Service (IRS), ensuring expertise in tax administration.

- Functions: The CBDT formulates policies related to direct taxes, oversees the Income Tax Department, and proposes changes to tax laws and rates in line with government policies.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q:1 Which one of the following effects of creation of black money in India has been the main cause of worry to the Government of India? (2021)

- Diversion of resources to the purchase of real estate and investment in luxury housing.

- Investment in unproductive activities and purchase of precious stones, jewellery, gold, etc.

- Large donations to political parties and growth of regionalism.

- Loss of revenue to the State Exchequer due to tax evasion.

Ans: (d)

Mains:

Q:1 What is the meaning of the term ‘tax expenditure’? Taking the housing sector as an example, discuss how it influences the budgetary policies of the government. (2013)

India-Poland Relations

Tags: GS – 2, IR- Bilateral Groupings & Agreements– Groupings & Agreements Involving India – Effect of Policies & Politics of Countries on India’s Interests

Why in the news?

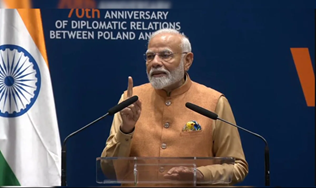

- The Prime Minister of India’s visit to Poland marked the 70th anniversary of India-Poland diplomatic relations.

- During this visit, both nations elevated their bilateral relationship to a “Strategic Partnership,” committing to enhanced cooperation across various sectors.

Key Highlights of Prime Minister’s Visit to Poland:

- Elevation to Strategic Partnership: India and Poland elevated their relationship to a “Strategic Partnership,” reflecting strong ties and mutual commitment to cooperation.

- Five-Year Action Plan (2024-2028):

- Political Dialogue and Security: Regular high-level contacts, annual dialogues, and security consultations. A Joint Working Group for defence cooperation is scheduled for 2024.

- Trade and Investment: Focus on balancing trade, exploring high-tech and green technologies, and enhancing economic security through the Joint Commission for Economic Cooperation (JCEC).

- Climate and Technology: Cooperation on sustainable technology, clean energy, and space exploration. Poland recognizes India’s ambition to join the International Energy Agency; India encourages Poland to join ISA and CDRI.

- Transport and Connectivity: Enhanced transport infrastructure and increased flight connections.

- Counter-Terrorism Efforts: Commitment to combating terrorism and pushing for the early adoption of the Comprehensive Convention on International Terrorism (CCIT).

- India-EU Relations: Support for concluding India-EU trade negotiations, operationalizing the India-EU Trade and Technology Council, and implementing the India-EU Connectivity Partnership.

- Cultural and People-to-People Ties: Strengthening cultural exchanges, educational partnerships, and tourism.

- Memorial Visits and Historical Tributes:

- Dobry Maharaja Memorial: Tribute to the Jam Saheb of Nawanagar for sheltering Polish children during WWII.

- Kolhapur Memorial: Tribute to the generosity of the Kolhapur princely state for sheltering Polish refugees during WWII.

- Monument to the Battle of Monte Cassino: Wreath laid in honour of shared sacrifices during WWII.

- Tomb of the Unknown Soldier: Tribute to Polish soldiers who died in service.

Significance of the Visit:

- Recalibration of Foreign Policy: Emphasises strengthening ties with European nations beyond traditional partners, with Poland offering opportunities in trade, investment, and technology.

- Healthcare Collaboration: Poland’s demand for healthcare professionals presents an opportunity for Indian doctors, enhancing bilateral cooperation.

- Geopolitical Context: The visit holds strategic importance given Poland’s role in the Ukraine conflict, positioning Poland as a key partner for India in Central Europe.

Key Highlights of India-Poland Relations:

- Political Relations:

- Diplomatic ties established in 1954, with India’s embassy opening in Warsaw in 1957.

- Early alignment against colonialism, imperialism, and racism.

- Close relations during the Communist era (1944-1989) with high-level visits and state trading.

- Post-1989, trade transitioned to hard currency arrangements, reflecting economic growth.

- Poland’s EU accession in 2004 enhanced the bilateral relationship, making Poland a key economic partner for India in Central Europe.

- Agreements:

- Early agreements include cultural cooperation (1957), avoidance of double taxation (1989), science and technology cooperation (1993), combating organised crime and terrorism (2003), and extradition (2003).

- Recent agreements include the Mutual Legal Assistance Treaty in Criminal Matters and Gainful Occupation for Diplomatic Families (2022).

- Economic and Commercial Relations:

- Poland is India’s largest trading and investment partner in Central and Eastern Europe.

- Bilateral trade grew by 192%, from USD 1.95 billion in 2013 to USD 5.72 billion in 2023, with trade balance favouring India.

- Indian Exports to Poland: Textiles, base metals, chemicals, machinery, electrical equipment, and ceramic products.

- Polish Imports to India: Machinery, mineral products, chemicals, and optical instruments.

- Investment: Indian investment in Poland exceeds USD 3 billion (IT, pharmaceuticals, manufacturing), while Polish investment in India is about USD 685 million (clean technologies, electric buses).

- Cultural and Educational Relations:

- Strong tradition of Indology in Poland, with Sanskrit translations since the 19th century.

- Over 300,000 yoga practitioners and numerous yoga centres in Poland; International Day of Yoga is celebrated with enthusiasm.

- Commemorations honour Jam Saheb Digvijaysinhji Ranjitsinhji Jadeja of Nawanagar for saving Polish refugees during WWII.

- Polish locations named after Indian leaders, including a bust of Mahatma Gandhi at the University of Warsaw.

- Indian Community:

- Approximately 25,000 Indians in Poland, including traders, professionals, and students.

Conclusion:

So, both sides will ensure regular monitoring of the implementation of the Action Plan, with the annual political consultation as the primary mechanism for reviewing and updating the activities. The extension of the Action Plan for another five-year period will be adopted by the respective ministers in charge of foreign affairs.

Source: PIB

Gongronema sasidharanii

Tags: GS-3, Ecology & Environment- Biodiversity- Species

Why in the news?

- A newly discovered plant species, Gongronema sasidharanii, was recently identified in Pampadum Shola National Park, Kerala.

Gongronema sasidharanii:

- Discovery: A new plant species discovered in Pampadum Shola National Park, Idukki District, Kerala.

- Appearance: Characterised by smooth stems and small urn-shaped flowers that range from creamy white to purplish-green.

- Geographic Significance: First record of the Gongronema genus in South India; previously found only in Northeast India and a few northern states.

Pampadum Shola National Park:

- Location: Eastern Southern Western Ghats, Idukki District, Kerala.

- Size: Approximately 12 sq km; name translates to ‘the forest where the snake dances.’

- Terrain and Climate: Undulating terrain with altitudes between 1600-2400 m; misty, cloudy climate with heavy North-East monsoon rains.

- Vegetation: Includes evergreen forests, moist deciduous forests, shola grasslands, and semi-evergreen forests.

- Flora and Fauna:

- Flora: 22 tree species, 74 herbs and shrubs, 16 climbers.

- Fauna: Tigers, leopards, giant gizzard squirrels, flying squirrels, Nilgiri Tahr, spotted deer, Nilgiri marten, and around 100 butterfly species.

Source: TH

Macrophages

Tags: GS-3, Science & Technology- Biology- Humanology

Why in the news?

- Recently, published in a new paper, a team of scientists describes the complex interplay between diseased liver cells and macrophages.

About the Macrophages:

- About:

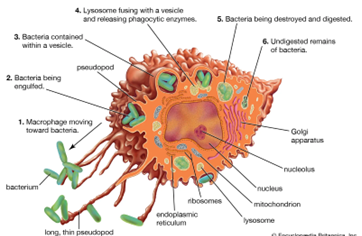

- Macrophages are white blood cells crucial to the immune system.

- Role:

- They engulf and digest microorganisms, clear debris and dead cells, and activate other immune cells.

- Formation and Origin:

- Origin:

- Macrophages derive from monocytes, which come from the bone marrow.

- Monocytes circulate in the blood for 1-3 days before migrating into tissues, where they transform into macrophages or dendritic cells.

- Origin:

- Locations:

- Locations: Found in organs such as the liver, brain, bones, and lungs, and in the blood, especially at infection sites.

Macrophage Functions:

- Phagocytosis:

- Macrophages engulf and digest pathogens, debris, and foreign particles, aiding in pathogen removal and antigen presentation to immune cells.

- Antigen Presentation:

- Acting as antigen-presenting cells (APCs), macrophages capture and display antigens from pathogens, facilitating immune responses by presenting them to T cells.

- Cytokine Production:

- Macrophages produce cytokines that regulate communication between immune cells and control inflammation, either enhancing or suppressing immune responses.

- Tissue Repair and Remodelling:

- Post-infection or injury, macrophages assist in removing damaged tissue and promoting new cell growth, crucial for tissue repair.

- Immune Regulation:

- Macrophages balance pro-inflammatory and anti-inflammatory signals to ensure appropriate immune responses without excessive damage to healthy tissues.

Types of Macrophages

- Tissue-Resident Macrophages:

- Permanently located in specific tissues, such as Kupffer cells in the liver, alveolar macrophages in the lungs, and microglia in the brain, performing tissue-specific functions.

- Monocyte-Derived Macrophages:

- Monocytes from the bloodstream migrate into tissues, differentiate into macrophages, and adapt to their new environment to perform similar roles as tissue-resident macrophages.

- M1 Macrophages:

- Pro-inflammatory macrophages are activated to combat pathogens by producing inflammatory cytokines and reactive oxygen species.

- M2 Macrophages:

- Anti-inflammatory macrophages involved in tissue repair and immune regulation, producing anti-inflammatory cytokines and aiding in wound healing.

- Specialized Names:

- Microglia: Macrophages in the brain.

- Kupffer Cells: Macrophages in the liver sinusoids.

Source: SD

Solar Magnetic Fields

Tags: GS-3, Science & Technology- SMF

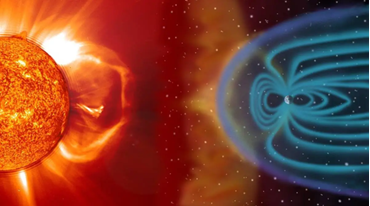

Why in the news?

- Recently, the IIA astronomers have pioneered a method to probe the Sun’s magnetic fields using data from the Kodaikanal Tower Tunnel Telescope.

Recent Research by the Indian Institute of Astrophysics (IIA):

- Methodology:

- Researchers studied an active sunspot region with complex features using Hydrogen-alpha (6562.8 Å) and Calcium II 8662 Å spectral lines.

- The Tunnel Telescope’s 3-mirror Coelostat setup enabled accurate tracking of the Sun, enhancing data precision.

- Findings:

- Observations revealed the stratification of the magnetic field at various solar atmospheric heights.

- The unique telescope setup improved the accuracy of solar magnetic field data.

- Technological Insights:

- Tunnel Telescope Setup: Uses a primary mirror (M1) for solar tracking and secondary (M2) and tertiary mirrors (M3) for light alignment.

- Achromatic Doublet Lens: Focuses the Sun’s image with high precision for detailed analysis.

- Limitations of Traditional Diagnostic Probes:

- Calcium II 8542 Å and Helium I 10830 Å lines have limitations in assessing chromospheric magnetic fields.

- The new method using Hydrogen-alpha and Calcium II 8662 Å lines offers a more comprehensive view of solar magnetic fields.

About Solar Magnetic Fields:

- Magnetic Field Generation:

- The Sun’s magnetic fields are produced by the movement of electrically charged particles like ions and electrons.

- Influence on Solar Features:

- Magnetic fields affect sunspots, prominences, and coronal loops, playing a crucial role in solar phenomena.

- Layers of the Solar Atmosphere:

- The Sun’s atmosphere includes the photosphere, chromosphere, and corona, with magnetic fields connecting these layers and contributing to coronal heating.

- Sunspots:

- Sunspots are areas with concentrated magnetic fields that create cooler, darker regions on the Sun’s surface.

- The sunspot cycle reflects the recycling of magnetic fields.

- Chromospheric and Coronal Magnetic Fields:

- Magnetic field lines loop through the Sun’s atmosphere, forming complex structures visible in the outer layers but measured primarily in the photosphere.

- Measurement Techniques:

- The Sun’s magnetic field is measured by analysing the energy difference in light emitted by electrons transitioning between atomic orbits, with magnetometers used to determine field strength and direction.

Source: TH

Drug Delivery with Nanotechnology

Tags: GS-3, Science & Technology- Nanotechnology

Why in the news?

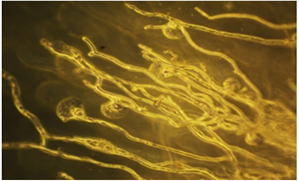

- Recently, A new technique utilising polymeric nanoparticles has been created to effectively deliver antifungal medications, specifically targeting fungal infections such as pulmonary aspergillosis.

About Nanoparticle-Based Drug Delivery System:

- Nikkomycin-Loaded Nanoparticles:

- Nikkomycin, a chitin synthesis inhibitor from Streptomyces bacteria, is incorporated into polymeric nanoparticles to target fungal infections.

- Chitin, present in fungal cell walls but absent in humans, makes an effective target for antifungal treatments. This system disrupts fungal growth specifically.

- Effectiveness Against Aspergillosis:

- The system shows strong efficacy against Aspergillus flavus and Aspergillus fumigatus, the fungi causing pulmonary aspergillosis.

- It inhibits fungal growth without cytotoxicity or hemolytic effects, offering a safer treatment option.

- Potential Applications:

- Beneficial for patients with asthma, cystic fibrosis, HIV, cancer, or those on long-term corticosteroid therapy, who are at higher risk of fungal infections.

About Nanotechnology:

- Nanotechnology:

- Involves manipulating atoms and molecules at the nanoscale (1 to 100 nanometers) to create structures and systems with unique properties.

- Nanoparticles:

- Extremely small particles with a high surface area-to-volume ratio, endowing them with distinct physical and chemical characteristics.

Source: PIB

Frequently Asked Questions (FAQs)

Q: What are daily current affairs?

A: Daily current affairs refer to the most recent and relevant events, developments, and news stories that are happening around the world on a day-to-day basis. These can encompass a wide range of topics, including politics, economics, science, technology, sports, and more.

Q: Why is it important to stay updated with daily current affairs?

A: Staying updated with daily current affairs is crucial because it helps individuals make informed decisions in their personal and professional lives. It enables people to understand the world around them, stay aware of significant events, and engage in informed discussions about important issues.

Q: Where can I access daily current affairs information?

A: There are various sources for daily current affairs, including newspapers, news websites, television news broadcasts, radio programs, and dedicated apps or newsletters. Social media platforms are also widely used to share and access current affairs information.

Q: How can I effectively incorporate daily current affairs into my routine?

A: To incorporate daily current affairs into your routine, consider setting aside specific times each day to read or watch news updates. You can also subscribe to newsletters or follow news apps to receive curated content. Engaging in discussions with peers or participating in online forums can further enhance your understanding of current events.

Q: What are some tips for critical analysis of daily current affairs?

A: When analyzing daily current affairs, it’s essential to cross-reference information from multiple sources to ensure accuracy. Additionally, consider the source’s credibility and bias, if any. Develop the ability to identify the main points and implications of news stories, and critically evaluate the significance and impact of the events reported.

To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

- Join our Main Telegram Channel and access PYQs, Current Affairs and UPSC Guidance for free – Edukemy for IAS

- Learn Economy for free- Economy for UPSC

- Learn CSAT – CSAT for UPSC

- Mains Answer Writing Practice-Mains Answer Writing

- For UPSC Prelims Resources, Click here