An economic survey serves as a comprehensive analysis and assessment of a country’s economic performance over a specified period. It delves into various aspects of the economy, including GDP growth, inflation rates, employment trends, fiscal policies, and sectoral contributions. The data and insights derived from such surveys are invaluable for policymakers, businesses, and investors in making informed decisions. Edukemy, as an educational platform, likely plays a crucial role in disseminating this economic knowledge to a wider audience, fostering a deeper understanding of economic principles and their practical implications. By incorporating insights from the Economic Survey 2022-23, Edukemy may contribute to empowering individuals with the knowledge necessary to navigate and thrive in an ever-changing economic landscape.

Contents

- 1 What is the Economic Survey?

- 2 Economic Survey 2022-23

- 3 State of the Economy in 2022-23

- 4 What are the highlights or key points mentioned in the budget?

- 5 India’s Medium-term Growth Outlook

- 6 Important Terms

- 7 What are the highlights or key points mentioned in the budget?

- 8 Fiscal Developments

- 9 Revenue Growth and Performance

- 10 Sustainable Debt-to-GDP ratio

- 11 Important Terms

- 12 What are the highlights or key points mentioned in the budget?

- 13 Monetary Management and Financial Intermediation

- 14 Important Terms

- 15 What are the highlights or key points mentioned in the budget?

- 16 Prices and Inflation

- 17 Regulatory Measures

- 18 Important Terms

- 19 What are the highlights or key points mentioned in the budget?

- 20 Social Infrastructure and Employment in India during 2022-23

- 21 Social Infrastructure

- 22 Employment

- 23 What are the highlights or key points mentioned in the budget?

- 24 Economic Performance in Climate Change and Environment

- 25 Important Terms

- 26 What are the highlights or key points mentioned in the budget?

- 27 Economic Performance in Agriculture and Food Management

- 28 Government Interventions for the Allied Sector

- 29 What are the highlights or key points mentioned in the budget?

- 30 Economic Performance in the Industrial Sector

- 31 Important Terms

- 32 What are the highlights or key points mentioned in the budget?

- 33 Economic Performance in the Services Sector

- 34 Performance

- 35 Important Terms

- 36 What are the highlights or key points mentioned in the budget?

- 37 Economic Performance in the External Sector

- 38 Performance

- 39 Important Terms

- 40 What are the highlights or key points mentioned in the budget?

- 41 Economic Performance in the Digital Public Infrastructure

- 42 Important Terms

- 43 What are the highlights or key points mentioned in the budget?

- 44 Frequently Asked Questions (FAQs)

- 44.1 1. What is the Economic Survey 2022-23, and why is it important?

- 44.2 2. What key sectors or areas does the Economic Survey 2022-23 focus on?

- 44.3 3. How does the Economic Survey impact government policy and decision-making?

- 44.4 4. Is the Economic Survey 2022-23 accessible to the general public, and how can one obtain a copy?

- 44.5 5. How does Edukemy contribute to understanding and interpreting the Economic Survey 2022-23?

- 44.6 For Admissions, talk to our Mentor – 9811333901, 9811333782

What is the Economic Survey?

- Annually, the Ministry of Finance releases the Economic Survey of India, which is typically presented in Parliament the day before the Union Budget.

- The Economics Division of the Department of Economic Affairs (DEA) prepares the document with guidance from the Chief Economic Advisor.

- The Economic Survey assesses the Indian economy’s developments over the previous year and provides an economic outlook for the current fiscal year.

- Additionally, the report presents the current state of the Indian economy, including relevant data such as gross domestic product (GDP), inflation, employment, and trade.

- The first Indian Economic Survey was introduced during the year 1950-51.

- Before 1964, it was presented simultaneously with the Union Budget, but it has been separated from the budget since 1964.

Focus of Economic Survey 2021-22

- Policy-making in situations of high uncertainty requires both an understanding of art and science.

- Its objective is to promote an alternative approach to policy-making, moving away from the conventional Waterfall Approach and towards an Agile Approach.

- The Waterfall Approach typically involves an initial analysis of the problem, detailed planning, and precise implementation.

- The Agile Approach, on the other hand, involves feedback loops, real-time monitoring of outcomes, flexible responses, and safety-net buffers.

Focus of Economic Survey 2022-23

- The Indian Economy’s resilience, growth drivers, and delayed returns on transformative reforms.

- The report emphasizes that although the government’s transformative reforms have had delayed growth returns due to temporary economic shocks, they have had a positive impact.

- Nevertheless, in the current decade, the existence of robust medium-term growth drivers gives cause for optimism and hope.

- Following the resolution of global shocks such as the pandemic and the surge in commodity prices in 2022, the Indian economy is well-positioned to experience faster growth in the coming decade.

Economic Survey 2022-23

- Following the President’s speech, the Union Finance Minister presented the Economic Survey for FY 2022-23.

- The 2022-23 Economic Survey indicated that India has fully recuperated from the pandemic and is poised to expand between 6% to 6.8% during the upcoming fiscal year, 2023-24.

State of the Economy in 2022-23

Performance

- India conducted the world’s second-largest vaccination campaign, administering more than 2 billion doses.

- The enhanced financial stability of public sector banks has facilitated an expansion in credit supply, resulting in swift credit growth for the micro, small, and medium enterprises (MSME) sector.

Challenges

- The Indian economy continues to confront persistent challenges, such as the devaluation of the rupee and the potential for additional US Fed interest rate increases.

- The ongoing escalation of global commodity prices may also contribute to an expansion of the current account deficit (CAD).

Outlook 2023-24

- Private consumption and capital formation are driving India’s economic growth in FY23, creating employment opportunities.

- The Emergency Credit Linked Guarantee Scheme (ECGS) has helped to alleviate debt-related issues, contributing to the recovery of MSMEs.

- While global growth is projected to slow in 2023, India’s growth is predicted to be robust in FY24, fueled by a robust credit disbursal and capital investment cycle.

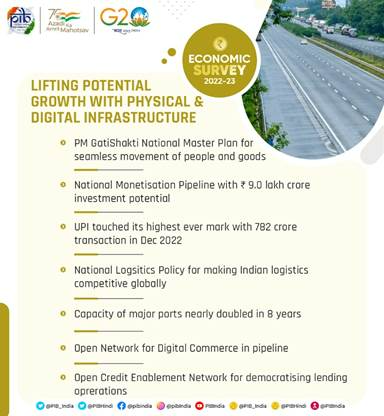

- The expansion of public digital platforms and initiatives like PM GatiShakti, the National Logistics Policy, and Production-Linked Incentive schemes will stimulate economic growth and enhance manufacturing productivity.

What are the highlights or key points mentioned in the budget?

- The capital investment outlay will be increased to Rs. 10 lakh crore, equivalent to 3.3% of GDP.

- The budget creates a new Infrastructure Finance Secretariat, fostering opportunities for private investment in infrastructure.

- The budget incorporates a collateral-free credit guarantee of Rs. 2 lakh crore for MSMEs, lowering the cost of credit by around 1%.

- The budget prioritizes inclusive development accomplishments through various schemes, including PM-KISAN, PMSBY, PMJJY, PM Jan Dhan bank accounts, Ujjawala, and SBM.

India’s Medium-term Growth Outlook

The present decade bears resemblance to the period of 1998-2002, when significant reforms were implemented that resulted in a delayed growth response due to temporary shocks, but ultimately yielded growth benefits through structural improvements.

2014-2022 Period

- During 2014-2022, India underwent significant economic reforms focused on enhancing the ease of living and doing business.

- These reforms centered around the creation of public goods, trust-based governance, partnership with the private sector, and increased agricultural productivity.

- Unfortunately, despite these efforts, key macroeconomic indicators were adversely affected during this period due to balance sheet strain and global economic shocks.

2023-2030 Outlook

The growth prospects for the Indian economy are more favorable than in the years preceding the pandemic, and the country is well-positioned to achieve its potential growth in the medium term.

Important Terms

- Public Goods: Goods that are accessible to all individuals (“non-excludable”) and can be used repeatedly without reducing their benefits to others (“non-rivalrous”) are referred to as public goods.

- Forward and Backward Linkages: Forward linkage pertains to the potential for developing, manufacturing, or creating other goods using a specific product or industry. Backward linkage, on the other hand, involves identifying the other goods or raw materials that have contributed to the production of a particular product.

- Financial Inclusion: The term “financial inclusion” refers to the provision of affordable and useful financial products and services to individuals and businesses that meet their requirements, all delivered responsibly and sustainably.

What are the highlights or key points mentioned in the budget?

- The Government’s Sabka Saath Sabka Vikas philosophy has fostered inclusive development, with a particular emphasis on uplifting the underprivileged (Vanchiton ko Variyata).

- The government has announced the creation of a Digital Public Infrastructure for Agriculture, as well as the establishment of a new Infrastructure Finance Secretariat to promote private investment in infrastructure.

- The government has identified 100 vital transport infrastructure projects aimed at improving logistics and enhancing last and first-mile connectivity for ports, coal, steel, fertilizer, and food grain sectors.

- Several measures have been identified to promote good governance, including the Jan Vishwas Bill aimed at fostering trust-based governance, as well as the National Data Governance Policy.

- In terms of tax policy measures, there are efforts to rationalize taxes, provide tax benefits to startups, and better target tax concessions.

Fiscal Developments

In the fiscal year 2023, the finances of the Union Government displayed resilience, primarily due to factors such as higher direct tax collections and an increase in Goods and Services Tax (GST) revenues.

Revenue Growth and Performance

- Between April and November 2022, the Gross Tax Revenue demonstrated a YoY growth of 15.5%, primarily attributable to the strong performance of direct taxes and GST.

- GST has emerged as a critical revenue source for both the central and state governments, evident from the YoY growth of 24.8% recorded from April to December 2022.

- The Centre’s Capex has been gradually rising from 1.7% of GDP during FY09-FY20 to 2.5% of GDP in FY22.

- The Centre incentivized state governments by providing them with interest-free loans and increasing their borrowing limits to prioritize expenditure on Capex.

- The increased investment in Capex, particularly in infrastructure-heavy sectors such as roads, highways, railways, housing, and urban affairs, has significant positive implications for medium-term growth.

Sustainable Debt-to-GDP ratio

The government’s approach of prioritizing Capex-driven growth would help maintain a positive differential between growth and interest rates, ultimately leading to a sustainable debt-to-GDP ratio in the medium term.

Important Terms

- The Fiscal Glide Path refers to the government’s strategy for meeting its fiscal targets and ensuring adherence to the fiscal consolidation roadmap to achieve desired fiscal deficit targets.

- Fiscal Deficit is the amount by which the government’s total expenditure exceeds its revenue, excluding borrowings.

- Non-debt receipts encompass both revenue receipts (tax and non-tax) and non-debt capital receipts. Any shortfall in non-debt receipts is met by government borrowing, which contributes to the fiscal deficit.

- Tax Buoyancy refers to the responsiveness of tax revenue to changes in national income and discretionary changes in tax policies over time. It measures the overall impact of these changes on tax revenue.

- Non-tax revenue refers to the revenue generated by the government that is not derived from taxes. This revenue includes interest receipts on loans to States and Union Territories, dividends and profits earned from Public Sector Enterprises and the Reserve Bank of India, and external grants and receipts for services provided by the Union Government.

- Counter-cyclical fiscal policy refers to government actions that run counter to prevailing economic or business trends.

What are the highlights or key points mentioned in the budget?

- The effective capital expenditure, set at 4.5% of GDP, is included in the FY24 budget which has increased four times since FY16, reaching Rs. 10 lakh crore.

- The government will extend the 50-year interest-free loan to state governments for another year, with a significantly higher allocation of Rs. 1.3 lakh crore.

- States will be permitted a fiscal deficit of 3.5% of GSDP, with 0.5% linked to power sector reforms.

- The Union government is pursuing fiscal consolidation, targeting a fiscal deficit below 4.5% by 2025-26.

Monetary Management and Financial Intermediation

- Starting in April 2022, the Reserve Bank of India (RBI) began its cycle of monetary tightening, resulting in a 225 basis point increase in the repo rate.

- This has reduced surplus liquidity and improved the financial institutions’ balance sheets, thereby facilitating lending.

- It is anticipated that credit demand will continue to rise, supported by an increase in private capital expenditures, leading to a virtuous cycle of investment.

Performance and Growth

- The Gross Non-Performing Assets (GNPA) ratio of Scheduled Commercial Banks (SCBs) has declined to a seven-year low of 5.0%, while the Capital-to-Risk Weighted Assets Ratio (CRAR) remains robust at 16.0%.

- In FY22, the Insolvency and Bankruptcy (IBC) channel yielded the highest recovery rate compared to other channels, indicating a positive trend for SCBs.

Important Terms

- The Monetary Policy Committee is a committee of six members responsible for determining the policy repo rate required to achieve the inflation target in the economy. It is required to meet at least four times a year, and a quorum of four members is necessary for its meetings.

- The money multiplier is the ratio of Broad money (M3) to Reserve Money (MO), which explains how an increase in the monetary base leads to a multiplied increase in the money supply.

- Government Securities (G-Secs) are tradable instruments issued by the Central or State Governments.

- Treasury Bills (T-bills) are short-term G-Secs issued by the Government of India and are presently issued in three tenors: 91-day, 182-day, and 364-day.

- State Development Loans (SDLs) are Dated Government securities issued by State Governments.

- The India Volatility Index (India VIX) is a volatility index that is based on the prices of NIFTY Index Options. It calculates a volatility figure (%) that indicates the expected market volatility over the next 30 calendar days. India VIX uses a computation methodology with appropriate amendments to adapt to the NIFTY options order book.

- Insurance penetration: This term refers to the ratio of total insurance premiums to Gross Domestic Product (GDP) within a year.

- Insurance density: This term refers to the ratio of insurance premium to population, or insurance premium per capita. It is measured in US Dollars and reflects the level of development of the insurance sector in a country.

What are the highlights or key points mentioned in the budget?

- PM Matsya Sampada Yojana will launch a new sub-scheme focused on agriculture credit, with a targeted investment of 6,000 crore.

- Additional collateral-free guaranteed credit of 2 lakh crore will be enabled for MSMEs through Credit Guarantee, with a reduction of about 1% in the cost of credit.

- A National Financial Information Registry will be established as a central repository of financial and ancillary information to facilitate the efficient flow of credit, promote financial inclusion, and foster financial stability.

- To simplify, ease, and reduce the cost of compliance, financial sector regulators will be requested to conduct a comprehensive review of existing regulations related to financial sector regulations.

- GIFT IFSC will facilitate the establishment of Data Embassies for countries seeking digital continuity solutions.

- SEBI will be empowered to develop, regulate, maintain, and enforce norms and standards for education in the National Institute of Securities Markets, to enhance capacity building in the securities market.

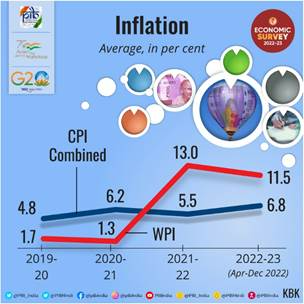

Prices and Inflation

- Consumer price inflation in India went through three phases in 2022. In the first phase, which lasted from January to April, inflation reached its peak of 7.8% due to the war between Russia and Ukraine and crop shortages resulting from heat waves in some parts of the country.

- However, timely measures taken by the government and the Reserve Bank of India helped to curb inflation, resulting in a decrease to 5.7% by December.

Bottlenecks

The difference between the wholesale price index and the consumer price index persisted, and despite efforts, core inflation remained stubbornly resistant to change.

Regulatory Measures

- To control the rise in prices, the government implemented various measures such as reducing export duty on petrol and diesel, eliminating import duty on major inputs, imposing an export ban on wheat products and export duty on rice, and decreasing the basic duty on crude and refined palm oil.

- The government’s prompt policy intervention in the housing sector, combined with low-interest rates for home loans, stimulated demand in the affordable housing segment and drew in more buyers during FY23.

RBI’s Forecast

- The Reserve Bank of India (RBI) has projected an increase in domestic prices of cereals, spices, and milk shortly, primarily attributed to supply shortages and rising feed costs.

- Additionally, the changing global climate is heightening the risk of a surge in food prices.

Important Terms

- The Consumer Price Index (CPI) is a measure of retail inflation in a nation, calculated using index numbers that track changes in prices at the household level. It is also commonly referred to as the “market basket.”

- The Wholesale Price Inflation (WPI) is calculated using index numbers that track the changes in the prices of goods before they are sold at the retail level.

- Market Value: It refers to the estimated value at which a property would be sold on the open market under normal conditions.

- Assessed Value: Assessed value is the value assigned to a property by a government tax assessor to determine property taxes. It is typically based on factors such as the property’s size, location, and condition, as well as recent sales of comparable properties in the area.

What are the highlights or key points mentioned in the budget?

- Program for Pharmaceutical Innovation: The government will initiate a program to encourage research and innovation in the pharmaceutical sector by establishing centers of excellence.

- Chemicals and Petrochemicals: To facilitate the Ethanol Blending Program, the government will exempt custom duty on denatured ethyl alcohol and reduce custom duty on acid grade fluorspar and crude glycerine to 2.5%. This move aims to reduce India’s reliance on crude oil, potentially leading to lower prices and a positive impact on the country’s foreign exchange reserves.

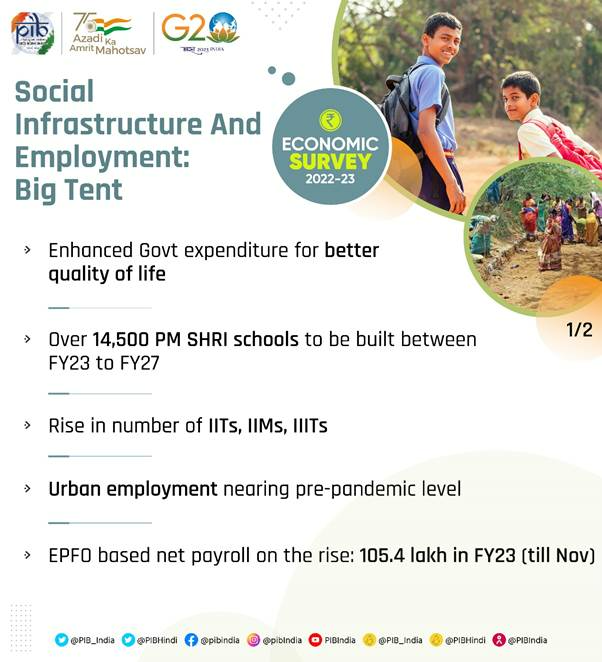

Social Infrastructure and Employment in India during 2022-23

- To develop human capital, the government has increased its spending on the social sector, with a focus on strengthening education and health.

- The government’s social sector spending has increased significantly, from Rs. 9.1 lakh crore in FY16 to Rs. 21.3 lakh crore in FY23.

Social Infrastructure

Education

- Enriching the nation’s growth and development prospects is one of the expected outcomes of the National Education Policy 2020.

- The government’s efforts in improving enrollment ratios and achieving gender parity in schools have shown positive results.

Healthcare

- The government increased its budgeted spending on the health sector to 2.1% of GDP in FY23, a significant increase from the 1.6% allocated in FY21.

- The Ayushman Bharat Scheme has benefited almost 22 crore people as of January 4, 2023, and more than 1.54 lakh health and wellness centers have been established across the country, reflecting the government’s efforts to improve access to healthcare services.

Poverty Alleviation

- The UN Multidimensional Poverty Index shows that more than 41 crore people have been lifted out of poverty between 2005-06 and 2019-21, indicating progress towards achieving the Sustainable Development Goal of halving poverty by 2030.

Aadhaar and Co-Win

- The Co-WIN platform, developed with the help of Aadhar, has facilitated the administration of over 2 billion vaccine doses.

Aspirational Districts Programme

- The Aspirational Districts Programme has been recognized as a model of good governance, particularly in remote areas.

Employment

- Labour Force Participation: Unemployment rates in India have declined from 5.8% in 2018-19 to 4.2% in 2020-21, indicating a recovery in labor markets post the Covid-19 pandemic.

- 1(a). The Rural Female Labour Force Participation Rate has shown a positive trend, rising from 19.7% in 2018-19 to 27.7% in 2020-21.

- eShram Portal: The eShram portal was created to establish a national database of unorganized workers, and as of December 31, 2022, more than 28.5 crore workers had registered on the platform.

- JAM Trinity and DBT: The JAM Trinity, along with Direct Benefit Transfer (DBT), has helped marginalized communities become part of the formal financial system, empowering them.

What are the highlights or key points mentioned in the budget?

- Healthcare for All

- Launch of the Sickle Cell Anemia Elimination Mission aimed at eradicating sickle cell anemia by 2047.

- Introduction of multidisciplinary courses to ensure the availability of skilled manpower for future medical technologies, high-end manufacturing, and research.

- Access to Education and Skills Development

- District Institutes of Education and Training will be developed into vibrant centers of excellence for teacher training.

- Creation of a National Digital Library for Children and Adolescents.

- Leave No One Behind

- Pradhan Mantri PVTG Development Mission with an allocation of 15,000 crore to implement the Mission in the next three years under the Development Action Plan for the Scheduled Tribes.

- Recruitment of 38,800 teachers and support staff for the 740 Eklavya Model Residential Schools serving 3.5 lakh tribal students over the next three years.

- Provision of central assistance of 5,300 crore for the Upper Bhadra Project to provide water for drought-prone regions.

- Urban Development

- Property tax governance reforms and ring-fencing user charges on urban infrastructure will be implemented to make cities ready for municipal bonds.

- An Urban Infrastructure Development Fund will be established using the priority sector lending shortfall to create urban infrastructure in Tier 2 and Tier 3 cities.

- The transition from manhole to machine-hole mode will be achieved by implementing 100% mechanical desludging of septic tanks and sewers to improve urban sanitation.

- Empowering the Youth

- The Pradhan Mantri Kaushal Vikas Yojana 4.0 will be launched to skill the youth for international opportunities, and 30 Skill India International Centres will be set up across different states.

- A Unified Skill India Digital Platform will be created to facilitate demand-based formal skilling, link with employers including MSMEs, and provide access to entrepreneurship schemes.

Economic Performance in Climate Change and Environment

In the ‘Climate Change and Environment chapter of the Economic Survey 2022-23, India’s nationally determined contributions (NDCs) were outlined, which include transitioning to renewable energy resources, committing to achieving “Net Zero” emissions by 2070 and taking steps towards energy independence.

Performance and Goals

- India has committed to reducing the emissions intensity of its GDP by 45% by 2030, from 2005 levels, as part of its nationally determined contributions (NDCs) to address climate change.

- Another target is to achieve 50% of the cumulative installed capacity of electric power from non-fossil fuel-based sources by 2030.

- India has already achieved its target of 40% installed electric capacity from non-fossil fuels ahead of 2030 and is expected to exceed 500 GW of installed capacity from non-fossil fuels by 2030, leading to a decline of the average emission rate by around 29% by 2029-30 compared to 2014-15.

- This target is expected to contribute to a decline in the average emission rate by about 29% by 2029-30 compared to 2014-15.

- At the UNFCCC COP26 climate summit in Glasgow, India launched a mass movement called LiFE – Lifestyle for Environment.

- In November 2022, India issued its first Sovereign Green Bonds (SGrBs) Framework, with the Reserve Bank of India auctioning two tranches of ₹4,000 crore SGrBs.

- The Economic Survey also highlighted India’s plans to achieve energy independence by 2047 by relying on green hydrogen through the National Green Hydrogen Mission.

- India has become a favored destination for renewable energy investments, with the past 7 years seeing investments worth USD 78.1 billion.

- As of October 2022, the installed solar power capacity, a key metric under the National Solar Mission, stood at 61.6 GW.

Important Terms

- The amount of carbon removed from the atmosphere and stored in biomass, deadwood, soil, and litter in the forest is known as carbon stock.

- Arunachal Pradesh has the highest carbon stock in forests among Indian states at 1023.84 million tonnes, followed by Madhya Pradesh at 609.25 million tonnes.

- Jammu & Kashmir has the highest per-hectare forest carbon stock at 173.41 tonnes, followed by Himachal Pradesh at 167.0 tonnes, Sikkim at 166.2 tonnes, and Andaman & Nicobar Islands at 162.9 tonnes.

- An electrolyzer is a device that uses a chemical process called electrolysis to separate the hydrogen and oxygen molecules in water, producing hydrogen gas without emitting carbon dioxide into the atmosphere.

- This sustainable production of hydrogen can serve as the foundation for a decarbonized economy.

- Environmental, Social, and Governance (ESG) goals are a set of standards that companies follow to ensure better governance, ethical practices, environmental sustainability, and social responsibility.

What are the highlights or key points mentioned in the budget?

- Viability Gap Funding will support the development of Battery Energy Storage Systems with a capacity of 4,000 MWH.

- An inter-state transmission system will be established to evacuate and integrate 13 GW of renewable energy from Ladakh into the grid.

- The Amrit Dharohar initiative aims to promote the unique conservation style of local communities for wetlands.

- The Green Credit Programme will be notified under the Environment (Protection) Act to induce behavioral change and incentivize environmentally sustainable and responsive actions by companies, individuals, and local bodies.

- The PM-PRANAM initiative aims to incentivize States and Union Territories to promote alternative fertilizers and balanced use of chemical fertilizers to restore, raise awareness, nourish, and ameliorate Mother Earth.

- Bhartiya Prakritik Kheti Bio-Input Resource Centres will set up 10,000 bio-input resource centers, creating a national-level distributed micro-fertilizer and pesticide manufacturing network, to facilitate 1 crore farmers to adopt natural farming over the next 3 years.

- The MISHTI initiative will establish mangrove plantations along the coastline and on saltpan lands to promote shoreline habitats and tangible incomes.

- Basic Custom Duty (BCD) on denatured ethyl alcohol will be exempted to support the Ethanol Blending Programme. BCD on acid-grade fluorspar and crude glycerine will be reduced to 2.5%.

- Excise duty on GST-paid compressed biogas will be exempted to avoid cascading of taxes, as proposed in the budget.

Economic Performance in Agriculture and Food Management

Over the past six years, India’s agricultural sector has experienced a robust average annual growth rate of 4.6%. As a result, agriculture has made a significant contribution to the country’s overall growth, development, and food security.

- Performance

- India has become a net exporter of agricultural products in recent years, with exports reaching a record high of USD 50.2 billion in 2021-22.

- The agricultural sector has experienced robust growth due to several measures implemented by the government, including the augmentation of crop and livestock productivity, the fixation of MSP for all mandated crops at 1.5 times the all-India weighted average cost of production, the promotion of crop diversification, and the mechanization and boosting of horticulture and organic farming.

- Private investment in agriculture increased to 9.3% in 2020-21, while institutional credit to the agricultural sector continued to grow, reaching Rs. 18.6 lakh crore in 2021-22.

- India’s foodgrain production has seen a sustained increase, reaching 315.7 million tonnes in 2021-22. As per the First Advance Estimates for 2022-23 (Kharif only), the total foodgrains production in the country is estimated to be 149.9 million tonnes, which is higher than the average Kharif foodgrain production of the previous five years (2016-17 to 2020-21). Furthermore, the Government of India has recently decided to provide free foodgrains to beneficiaries under the NFSA 2013 for one year, starting from 1 January 2023.

- The National Agriculture Market (e-NAM) Scheme has established an online, competitive, and transparent bidding system to ensure that farmers receive remunerative prices for their produce. This scheme covers 1.74 crore farmers and 2.39 lakh traders.

- The Paramparagat Krishi Vikas Yojana (PKVY) is promoting organic farming through Farmer Producer Organisations (FPO).

- India is at the forefront of promoting millets, following the UNGA’s declaration of 2023 as the International Year of Millets (IYM) during its 75th session in 2021.

Government Interventions for the Allied Sector

- In 2020, the government launched the Animal Husbandry Infrastructure Development Fund (AHIDF) worth Rs. 15,000 crore to promote development in animal husbandry.

- The National Livestock Mission (NLM) focuses on developing entrepreneurship and improving breeds of poultry, sheep, goat, and piggery, as well as feed and fodder development.

- The National Animal Disease Control Programme (NADCP) aims to control Foot & Mouth Disease and Brucellosis by implementing complete vaccination.

- The Pradhan Mantri Matsya Sampada Yojana (PMMSY) aims to promote sustainable and responsible development of the fisheries sector.

What are the highlights or key points mentioned in the budget?

- Digital Public Infrastructure for Agriculture

- Will be built as an open source, open standard, and inter-operable public good

- Aims to promote farmer-centric solutions related to inputs, marketing, etc.

- Agriculture Accelerator Fund

- To encourage agri-startups in rural areas

- Enhancing the productivity of cotton crop

- Aims to adopt a cluster-based and value chain approach through Public Private Partnerships (PPP)

- Atmanirbhar Horticulture Clean Plant Program

- Aim to boost the availability of disease-free, quality planting material for high-value horticultural crops at an outlay of *2,200 crore

- Global Hub for Millets (referred to as ‘Shree Anna’)

- Indian Institute of Millet Research, Hyderabad will be supported as the Centre of Excellence

- Agriculture Credit

- Rs.20 Lakh crore credit for Animal Husbandry, Dairy and Fishing sector

- A new sub-scheme of PM Matsya Sampada Yojana will be launched with a targeted investment of 6,000 crore

- Cooperation

- The government is promoting a cooperative-based economic development model, especially for small and marginal farmers, and other marginalized sections

- The government has initiated the computerization of 63,000 Primary Agricultural Credit Societies (PACS) and enabled them to become multipurpose PACS

- Also aim is to facilitate setting up cooperative societies in uncovered panchayats and villages in the next 5 years

- Reduction in Basic Customs Duty (BCD) on key inputs for domestic manufacture of shrimp feed to boost export.

Economic Performance in the Industrial Sector

According to the Economic Survey 2022-23, the Industrial Sector witnessed a growth of 3.7% in Gross Value Added (GVA) during the first half of FY 22-23. This growth rate is higher than the average growth rate of 2.8% achieved in the first half of the last decade.

- Performance

- Strong growth in Private Final Consumption Expenditure, export stimulus, increased investment demand due to enhanced public capital expenditure, and strengthened bank and corporate balance sheets have boosted industrial growth.

- The industry has responded robustly to the increase in demand.

- Both the Purchasing Managers Index (PMI) and Index of Industrial Production (IIP) have been on an upward growth trajectory since July 2021.

- Strong growth in Private Final Consumption Expenditure, export stimulus, increased investment demand due to enhanced public capital expenditure, and strengthened bank and corporate balance sheets have boosted industrial growth.

- Both MSMEs and large industries have experienced double-digit growth in credit, with MSMEs growing by 30% since January 2022.

- India’s electronics exports have nearly tripled, rising from US $4.4 billion in FY19 to US $11.6 billion in FY22, with India becoming the world’s second-largest mobile phone manufacturer.

- Foreign Direct Investment (FDI) in the Pharma Industry has quadrupled, increasing from US $180 million in FY19 to US $699 million in FY22.

- Production Linked Incentive (PLI) schemes have been introduced across 14 categories with an estimated capex of Rs. 4 lakh crore over the next five years to integrate India into global supply chains.

- As of January 2023, the Companies Act 2013 has been amended, reducing over 39,000 compliances and decriminalizing more than 3,500 provisions.

- ‘Make in India 2.0’ is now focused on 27 sectors, including 15 manufacturing and 12 service sectors, to further enhance India’s integration into the global value chain.

Important Terms

- Employment Elasticity: Employment elasticity measures the percentage change in employment associated with a 1% increase in GDP, indicating the labor-intensive growth of an economy.

- Crowding-in Private Investment: Higher government spending leading to an increase in private sector investment is known as crowding-in. This occurs because increased government spending boosts economic growth and creates more profitable investment opportunities for firms.

- Global Headwinds: In economics, headwinds refer to negative factors that could slow down the growth of an economy.

- Gross Fixed Capital Formation (GFCF): GFCF is the aggregate of gross additions to fixed assets, including construction, machinery, and equipment, plus changes in stocks during the counting period.

- High-Frequency Indicators (HFIs): HFIs are daily data that provide insights into various aspects of the economy, such as fertilizer sales, agricultural commodity trade, new business registrations, and e-way bills.

- Purchasing Managers Index (PMI-Manufacturing): PMI-Manufacturing is a survey-based measure that tracks changes in key business variables compared to the previous month. It provides an index of the prevailing direction of economic trends in the manufacturing and service sectors.

What are the highlights or key points mentioned in the budget?

- The effective capital expenditure has been allocated at 4.5% of GDP in the budget.

- The highest ever outlay of 2.40 lakh crore has been earmarked for railways as a capital expenditure.

- The budget has identified 100 critical transport infrastructure projects to improve last and first-mile connectivity for sectors such as ports, coal, steel, fertilizer, and food grains.

- Regional air connectivity will be improved by reviving 50 additional airports, heliports, water aerodromes, and advanced landing grounds.

- To promote green mobility, the budget proposed an exemption of excise duty on compressed biogas with GST paid to avoid cascading of taxes. Customs duty exemption will also be extended to the import of capital goods and machinery required for the manufacture of lithium-ion cells used in electric vehicles.

- To deepen domestic value addition in the manufacture of mobile phones, the budget proposed relief in customs duty on the import of certain parts and inputs such as camera lenses. The basic customs duty on parts of open cells of TV panels will be reduced to 2.5%. The concessional duty on lithium-ion cells for batteries will continue for another year.

- The budget proposed nullifying the 5% basic customs duty on seeds used in the manufacturing of lab-grown diamonds to support the diamond industry.

Economic Performance in the Services Sector

The Services Sector in India is projected to increase by 9.1% in FY23, which is higher than the 8.4% (Year-on-year) growth achieved in FY22.

Performance

- Since July 2022, there has been a strong expansion in the PMI services, indicating growth in the services sector.

- India ranked among the top ten countries in the world in terms of services exports, with a 4% share of global commercial services exports in 2021.

- India’s services sector has demonstrated resilience in the face of the COVID-19 pandemic and geopolitical uncertainties due to the rising demand for digital support, cloud services, and infrastructure modernization.

- The real estate sector in India has sustained growth, with housing sales levels reaching pre-pandemic levels and recording a 50% increase between 2021 and 2022.

- The tourism sector in India has shown signs of recovery with an increase in foreign tourist arrivals in FY23 and a rise in hotel occupancy rates from 30-32% in April 2021 to 68-70% in November 2022.

- India’s financial services are being transformed by digital platforms, and the e-commerce market is projected to grow at an annual rate of 18% through 2025.

Important Terms

- Global Competency Centers (GCCs): These centers offer specialized knowledge and resources to support projects or programs across multiple business areas, serving as repositories of expertise.

- Neobanks: These banks are exclusively digital, without any physical branches except for their office space in the offline world.

What are the highlights or key points mentioned in the budget?

- The government has announced reforms related to the GIFT IFSC to enhance financial services.

- A Center of Excellence for Artificial Intelligence will be established.

- The budget proposes to simplify the KYC procedure by adopting a “risk-based” approach rather than the current “one size fits all” approach.

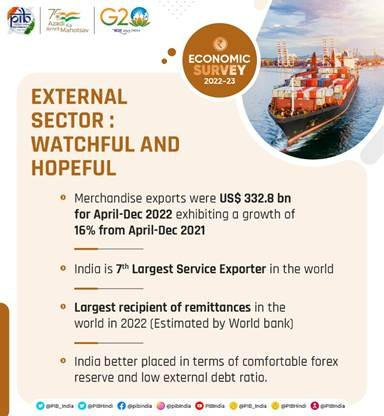

Economic Performance in the External Sector

- Due to the geopolitical events of recent times, India’s external sector has been experiencing significant global challenges.

- Nevertheless, India has been able to expand its markets and increase its exports to Brazil, South Africa, and Saudi Arabia.

Performance

- The second quarter (Q2) of FY23 saw India’s current account balance (CAB) record a deficit of US$ 36.4 billion, which was 4.4% of GDP. This is in contrast to a deficit of US$ 9.7 billion, which was 1.3% of GDP in Q2 of FY22. The higher merchandise trade deficit of US$ 83.5 billion and an increase in net investment income outgo were the main contributors to this.

- India signed CEPA with UAE and ECTA with Australia in 2022 to increase its market size and ensure better penetration.

- In 2022, India received US$ 100 billion in remittances, making it the largest recipient of remittances in the world. Remittances are the second-largest source of external financing after service export.

- India’s Forex Reserves as of December 2022 stood at US$ 563 billion, covering 9.3 months of imports. However, this is a decline from 13 months of imports in FY 21-22. Despite this decline, India remained the 6th largest foreign exchange reserves holder in the world.

Important Terms

- The Nominal Effective Exchange Rate (NEER) is calculated as a weighted average index of the exchange rates between a country’s currency and its trading partners’ currencies, with weights based on their respective shares in the country’s trade basket.

- Sovereign debt, also known as national debt, refers to the debt a country owes to its creditors, which can be domestic or foreign.

What are the highlights or key points mentioned in the budget?

The government has increased the allocation for key schemes that boost exports, including Remission of Duties and Taxes on Export Products (RODTEP), Rebate of State and Central Taxes and Levies (ROSCTL), Interest Equalization Scheme, and Market Access Initiative (MAI).

Economic Performance in the Digital Public Infrastructure

India’s potential GDP growth rate could increase by approximately 60-100 basis points (BPS) due to the Digital Public Infrastructure (DPI).

Shortly, platforms like Open Network for Digital Commerce (ONDC) and Open Credit Enablement Network (OCEN) will create opportunities for e-commerce market access and credit availability for small businesses, contributing to the expected economic growth.

- Performance

- Unified Payment Interface (UPI):

- UPI-based transactions grew in both value (121%) and volume (115%) between 2019-22.

- It paved the way for its international adoption.

- Telephone and Radio – For Digital Empowerment:

- The total telephone subscriber base in India is 117.8 crore (as of Sept,22), with 44.3% of subscribers in rural India.

- More than 98% of the total telephone subscribers are connected wirelessly.

- India’s overall teledensity as of March 2022 is 84.8% (number of telephone connections per 100 people).

- The Economic Survey highlights the launch of 5G services in India as a significant achievement in the telecommunications sector.

- The Indian Telegraph Right of Way (Amendment) Rules, 2022, will simplify the deployment of telegraph infrastructure to expedite the rollout of 5G services.

- Prasar Bharati, the autonomous public service broadcaster in India, broadcasts in 23 languages and 179 dialects from 479 stations, covering 92% of India’s total area and reaching 99.1% of the population.

- Digital Public Goods

- The following schemes have transformed India’s marketplace and enabled citizens to access services across sectors:

- MyScheme

- TrEDS

- GEM

- e-NAM

- UMANG

- The Open Credit Enablement Network aims to democratize lending operations while allowing end-to-end digital loan applications.

- The National AI portal has published 1520 articles, 262 videos, and 120 government initiatives. “Bhashini” is being viewed as a tool for overcoming the language barrier.

- The bouquet of digital public infrastructure products, such as e-RUPI and e-Way Bill, have ensured real value for money to consumers while reducing the compliance burden for producers.

- The following schemes have transformed India’s marketplace and enabled citizens to access services across sectors:

Important Terms

- Hyperloop is an autonomous electric transportation system that enables passengers to travel at ultra-high speeds of 600+ miles per hour.

What are the highlights or key points mentioned in the budget?

- The infrastructure sector has been allocated ₹10 lakh crore in the Budget, which is equivalent to 3.3% of GDP.

- The highest allocation of ₹2.4 lakh crore has been given to Railways since 2013-14.

- The announcement of 100 crucial transport infrastructure projects has been made to improve logistic efficiency.

- A one-year extension of the 50-year interest-free loan to state governments has been given to promote complementary policies and encourage infrastructure investment.

Frequently Asked Questions (FAQs)

1. What is the Economic Survey 2022-23, and why is it important?

Answer: The Economic Survey 2022-23 is an annual document presented by the Government of India before the Union Budget. It provides a comprehensive review of the country’s economic performance over the past year and outlines future policy directions. It is crucial as it serves as a valuable resource for policymakers, economists, and the public, offering insights into economic trends, challenges, and opportunities.

2. What key sectors or areas does the Economic Survey 2022-23 focus on?

Answer: The Economic Survey typically covers a wide range of sectors, including agriculture, industry, services, infrastructure, and social development. In addition to sector-specific analyses, it may also delve into macroeconomic indicators, fiscal policy, monetary policy, and global economic trends. The goal is to present a holistic view of the economic landscape and identify areas for growth and improvement.

3. How does the Economic Survey impact government policy and decision-making?

Answer: The Economic Survey serves as a guide for the government in formulating policies and making strategic decisions. Recommendations and insights provided in the survey influence fiscal and monetary policies, sector-specific reforms, and overall economic planning. Policymakers use the survey’s findings to address challenges, capitalize on opportunities, and enhance the overall economic well-being of the country.

4. Is the Economic Survey 2022-23 accessible to the general public, and how can one obtain a copy?

Answer: Yes, the Economic Survey is a public document, and copies are generally available online on the official website of the Ministry of Finance, Government of India. Additionally, it is often published in print and can be accessed through government publications or authorized distributors. The document is designed to be accessible to a wide audience, including researchers, students, and the general public interested in understanding the economic outlook of the country.

5. How does Edukemy contribute to understanding and interpreting the Economic Survey 2022-23?

Answer: Edukemy plays a pivotal role in simplifying complex economic concepts and analyses present in the Economic Survey. Through various educational resources, such as articles, videos, and courses, Edukemy aims to make the Economic Survey more understandable for students, professionals, and anyone interested in economics. The platform may offer insights, explanations, and expert perspectives to enhance the comprehension of the survey’s content and its implications on the Indian economy.

For UPSC Prelims Resources, Click here

For Daily Updates and Study Material:

Join our Telegram Channel – Edukemy for IAS

- 1. Learn through Videos – here

- 2. Be Exam Ready by Practicing Daily MCQs – here

- 3. Daily Newsletter – Get all your Current Affairs Covered – here

- 4. Mains Answer Writing Practice – here

Visit our YouTube Channel – here