The China+1 Strategy is a business approach where companies diversify their manufacturing and supply chain operations by setting up production in another country in addition to China. This strategy has become popular due to various reasons, including rising labor costs in China, trade tensions, and the need to reduce dependency on a single country. By adopting the China+1 Strategy, businesses aim to ensure stability, reduce risks, and take advantage of favorable conditions in other countries, ultimately enhancing their global competitiveness and resilience.

Tags: GS – 3, Economy- Growth & Development- China’s Economic Slowdown and Opportunities for India

Contents

- 0.1 Why in the news?

- 0.2 What is the China+1 Strategy?

- 0.3 What are the Opportunities for India to Attract the Foreign Investment?

- 0.4 Sectors Benefiting from the China+1 Strategy in India:

- 0.5 India’s Performance in the China+1 Landscape:

- 0.6 What are the factors hindering India’s Competitiveness:

- 0.7 Way Forward:

- 1 Conclusion

- 2 UPSC Civil Services Examination Previous Year Question (PYQ)

- 3 FAQs

- 4 To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

Why in the news?

- India has the opportunity to capitalise on the China Plus One strategy and attract global manufacturing investments.

- While China’s exports remain strong, India’s large domestic market, low-cost talent, and potential for growth make it an appealing alternative.

What is the China+1 Strategy?

- About:

- The China+1 strategy approach aims to mitigate risks associated with over-reliance on a single country, particularly in light of geopolitical tensions and supply chain disruptions.

- China’s Dominance in Global Supply Chains:

- China has been the epicentre of global supply chains for decades, earning the title of “World’s Factory” due to favourable factors of production and a strong business ecosystem.

- Shift to China in the 1990s:

- In the 1990s, large manufacturing entities from the US and Europe moved production to China, attracted by low manufacturing costs and access to a vast domestic market.

- Disruptions During the Pandemic:

- China’s zero-Covid policy led to industrial lockdowns, resulting in inconsistent supply chain performance and container shortages.

- Evolution of the China+1 Strategy:

- Factors such as China’s zero-Covid policy, supply chain disruptions, high freight rates, and longer lead times have prompted global companies to adopt a “China-Plus-One” strategy.

- This strategy involves exploring in other developing Asian countries, such as India, Vietnam, Thailand, Bangladesh, and Malaysia, to diversify supply chain dependencies.

What are the Opportunities for India to Attract the Foreign Investment?

- Demographic Dividend and Consumption Power:

- Youthful Demographic: India boasts a youthful demographic with 28.4% of the population under 30 in 2023, compared to China’s 20.4%

- Economic Potential: This demographic advantage positions India as a potential multi-trillion dollar economy, making it an attractive market for global companies.

- Cost Competitiveness and Infrastructure Advantage:

- Lower Labor and Capital Costs: India’s production sector is highly competitive, with average manufacturing wages 47% lower than China’s, as highlighted by a 2023 Deloitte study.

- Infrastructure Investment: The government’s heavy investment in infrastructure through the NIP aims to reduce manufacturing costs and improve logistics by 20%, further enhancing India’s attractiveness.

- Business Environment and Policy Initiatives:

- Policy Reforms: Recent interventions like the Production Linked Incentive (PLI) scheme, tax reforms, and relaxed FDI norms have created a conducive business environment.

- Make in India Initiative: Coupled with efforts to promote ease of doing business, the Make in India initiative is attracting foreign investments.

- Digital Skilling and Technological Edge:

- High Internet Penetration: As of January 2024, India has 870 million internet users, representing 61% of its population.

- Access to Global Tech Giants: Access to global tech giants like Google and Facebook, which are unavailable in China, gives Indian youth a digital advantage.

- Strategic Economic Partnerships:

- Sub-Regional Partnerships: India’s focus on sub-regional partnerships and controlling China’s influence through initiatives like the CEPA trade agreement with the UAE demonstrates its strategic approach.

- Trade Diversification: This diversification is expected to increase bilateral trade by 200% within 5 years, ensuring access to new markets while protecting domestic interests.

- Dynamic Diplomacy and Global Influence:

- Active Participation in Global Groupings: India’s participation in groupings like QUAD and I2U2, along with bilateral agreements with key countries, strengthens its economic ties.

- Leadership Roles: As India assumes leadership roles in G20 and SCO, it can leverage its position to shape global trade trends.

- Large Domestic Market:

- Massive Consumer Base: India’s domestic market of 1.3 billion people with rising incomes offers a compelling alternative to China.

- Economic Growth: India’s GDP per capita has grown at an average of 6.9% between 2018 and 2023, providing a strong foundation for sustained economic growth and increased global trade.

Sectors Benefiting from the China+1 Strategy in India:

- Information Technology/Information Technology Enabled Services (IT/ITeS):

- Key Player in IT Services: According to a 2024 NASSCOM report, India is recognized as a key player in IT services exports.

- Make in India Initiative: The “Make in India” initiative aims to establish India as a manufacturing hub for IT hardware, attracting major global technology firms.

- Pharmaceuticals:

- Large-Scale Industry: Valued at Rs 3.5 lakh crore in 2024, India’s pharmaceutical industry is the world’s third-largest by volume.

- Global Supplier: India supplies nearly 70% of WHO’s vaccine needs and offers manufacturing costs 33% lower than the US, earning the title “pharmacy of the world.”

- Metals and Steel:

- Natural Resources: India’s rich natural resources position it as a major steel exporter.

- PLI Scheme for Specialty Steel: The PLI scheme for specialty steel is expected to attract Rs 40,000 crore in investments by 2029.

- Enhanced Attractiveness: China’s withdrawal of export rebates and imposition of duties on processed steel products enhance India’s attractiveness in the global market.

India’s Performance in the China+1 Landscape:

- Import Growth:

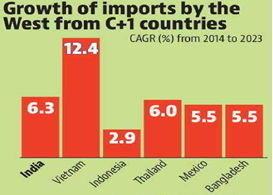

- High Growth Rate: India’s imports from Western countries have shown the second-highest growth among the countries analysed, with a compound annual growth rate (CAGR) of 6.3% from 2014 to 2023.

- Comparison: Vietnam and Thailand have outperformed India, with a CAGR of 12.4% in imports by the US, UK, and EU.

- Business Perception:

- Challenges: Despite having abundant resources and strategic planning, India has struggled to create a positive impression among businesses relocating from China.

- Competitors: Vietnam and Thailand have emerged as more attractive destinations for businesses.

- Tariff Rates:

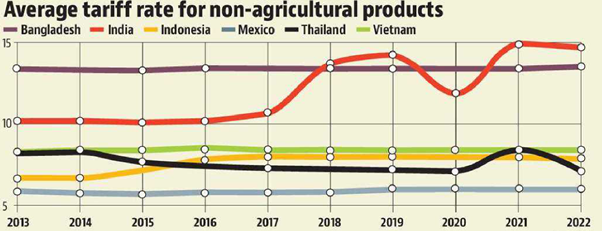

- High Tariffs: India’s higher tariff rates, averaging 14.7% for non-agricultural products, have deterred Western investors.

- Inverted Duty Structure: The inverted duty structure in India, where taxes on imported raw materials are higher than those on final products, reduces the competitiveness of Indian exports.

- Promising Future Prospects:

- Interest from Companies: India has emerged as the most favoured destination for companies planning to relocate production or invest in new facilities in Asia, with 28 companies showing interest compared to 23 for Vietnam.

- Electronics Sector: Notably, a significant portion of these interested firms (8 out of 28) are from the electronics sector, an area where India has previously lagged behind Vietnam.

What are the factors hindering India’s Competitiveness:

- Ease of Doing Business:

- Regulatory Environment: India’s complex regulatory environment, marked by bureaucratic hurdles and inconsistent policy implementation, deters both domestic and foreign investors.

- Manufacturing Competitiveness:

- High Input Costs: India faces significant challenges in manufacturing competitiveness due to high input costs.

- Inadequate Infrastructure: Poor infrastructure increases operational costs and reduces business efficiency.

- Skilled Labour Shortage: There is a shortage of skilled labour, affecting productivity and quality.

- Infrastructure Deficiencies:

- Transportation and Logistics: Poor transportation and logistics infrastructure hinder efficiency and increase costs.

- Energy Infrastructure: Inadequate energy infrastructure results in unreliable power supply, affecting operations.

- Labour Market Rigidities:

- Restrictive Labour Laws: Restrictive labour laws hinder flexibility and job creation, especially in the organised sector.

- Tax Structure:

- Complex Tax Regime: The complex tax regime, including multiple indirect taxes, adds to the cost of doing business.

- Land Acquisition Challenges:

- Cumbersome Process: The cumbersome process of land acquisition for industrial projects delays investments and raises costs.

Way Forward:

- Targeted Incentives and Subsidies:

- Attractive Incentives: Offer incentives and subsidies, particularly in electronics, automotive, and pharmaceuticals, including tax benefits, land subsidies, and infrastructure support.

- Improve Ease of Doing Business:

- Streamline Regulatory Processes: Focus on reducing bureaucratic hurdles, simplifying labour laws, and easing land acquisition procedures.

- Enhance Environmental Clearances: Simplify procedures to enhance the overall ease of doing business.

- Develop Specialised Industrial Clusters:

- Dedicated Clusters: Create industrial clusters or manufacturing hubs with world-class infrastructure and support services.

- Shared Facilities: Include plug-and-play facilities, common testing and certification centres, and shared logistics infrastructure.

- Invest in Skill Development:

- Vocational Training: Strengthen vocational training programs in collaboration with industry.

- Promote STEM Education: Focus on promoting STEM education and upskilling the existing workforce.

- Enhance Infrastructure and Logistics:

- Modern Transportation Networks: Invest in roads, railways, ports, and airports.

- Reliable Utilities: Improve the reliability and availability of power supply, water, and other essential utilities.

- Streamline Trade Policies and Agreements:

- Free Trade Agreements: Negotiate FTAs with key trading partners to improve market access.

- Simplify Import-Export Procedures: Reduce tariffs and streamline procedures to enhance global competitiveness.

- Promote Research and Innovation:

- Public-Private Partnerships: Encourage partnerships in R&D to foster innovation.

- Incentives for R&D Centers: Provide incentives for companies to establish R&D centres and collaborate with academic institutions.

Conclusion

The China+1 strategy presents a crucial opportunity for India to address its longstanding manufacturing sector challenges and emerge as a global manufacturing powerhouse. By tackling key bottlenecks and implementing a comprehensive strategy, India can leverage this trend to drive sustainable economic growth and job creation, cementing its position as a preferred manufacturing destination.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q:1 What is the importance of developing Chabahar Port by India? (2017)

- India’s trade with African countries will increase enormously.

- India’s relations with oil-producing Arab countries will be strengthened.

- India will not depend on Pakistan for access to Afghanistan and Central Asia.

- Pakistan will facilitate and protect the installation of a gas pipeline between Iraq and India.

Ans: (c)

Mains

Q:1 A number of outside powers have entrenched themselves in Central Asia, which is a zone of interest to India. Discuss the implications, in this context, of India’s joining the Ashgabat Agreement. (2018)

FAQs

Q: What is the China+1 Strategy?

- Answer: The China+1 Strategy is a business approach where companies that have been manufacturing in China also set up operations in another country. This helps them reduce their dependence on China and diversify their production base.

Q: Why are companies adopting the China+1 Strategy?

- Answer: Companies are adopting this strategy to avoid risks like trade tensions, rising costs, and supply chain disruptions. By having another manufacturing base, they can ensure smoother operations and better manage potential issues.

Q: Which countries are benefiting from the China+1 Strategy?

- Answer: Countries like India, Vietnam, Thailand, and Indonesia are seeing increased investments as companies look for alternatives to China. These countries offer lower labor costs, favorable business environments, and growing markets.

Q: How does the China+1 Strategy affect global trade?

- Answer: This strategy can lead to a more balanced global trade system by distributing manufacturing more evenly across different regions. It can also strengthen economies of the countries chosen as additional manufacturing hubs.

Q: What are the challenges of the China+1 Strategy for companies?

- Answer: Companies may face challenges like setting up new supply chains, dealing with different regulations, and ensuring quality control in the new locations. It requires significant investment and planning to successfully implement the China+1 Strategy.

To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

- Join our Main Telegram Channel and access PYQs, Current Affairs and UPSC Guidance for free – Edukemy for IAS

- Learn Economy for free- Economy for UPSC

- Mains Answer Writing Practice-Mains Answer Writing

- For UPSC Prelims Resources, Click here