The implementation of an electronic cash transfer system for welfare schemes represents a pioneering endeavor aimed at mitigating corruption, reducing wastage, and fostering systemic reforms. This ambitious project seeks to revolutionize the traditional mechanisms of distributing benefits by harnessing the power of digital technology. By transitioning from manual cash disbursements to electronic transfers, governments aspire to enhance transparency, accountability, and efficiency in the administration of welfare programs. This paradigm shift not only streamlines the distribution process but also curtails the scope for malpractices such as embezzlement, bribery, and leakage of funds. Moreover, electronic cash transfers offer beneficiaries greater autonomy and accessibility, empowering them to directly receive their entitlements without intermediaries. Additionally, the implementation of this system fosters the digitization of financial transactions, promoting financial inclusion and formalization of the economy. However, while this initiative holds significant promise, its success hinges upon robust technological infrastructure, effective governance frameworks, and comprehensive capacity-building measures. Furthermore, ensuring the security and privacy of personal data in electronic transactions remains paramount to safeguarding the interests of beneficiaries. In essence, the adoption of an electronic cash transfer system for welfare schemes signifies a pivotal step towards fostering integrity, efficiency, and inclusivity in social welfare administration.

Tag: Government policies and interventions for development in various sectors and issues arising out of their design and implementation.

Contents

Decoding the Question:

- In the Introduction, try to write about DBT and its objectives.

- In Body, discuss how it will minimize corruption, eliminate wastages, and facilitate reforms.

- Try to Conclude with the significance of the electronic cash transfer system.

Answer:

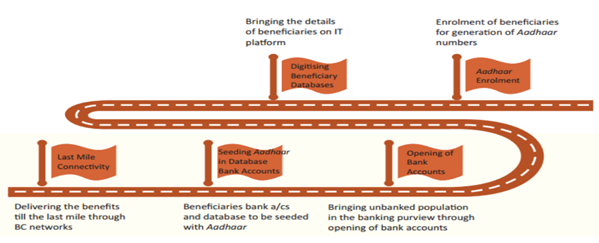

Government launched cash transfer by electronic mode in 51 districts in 2013 for 29 schemes. Subsidies in kerosene, fertilizers and LPG will be transferred as cash to the beneficiaries in their bank accounts. Benefits such as scholarships, pensions, and MGNREGA (Mahatma Gandhi National Rural Employment Guarantee Act) wages will be directly credited to the bank or post office accounts of identified beneficiaries.

Minimize Corruption, Eliminate Leakages, Facilitate Reforms:

- No Direct Contact: Before the introduction of DBT, people used to get in government offices to get their cash benefits in which sometimes public officials demand money to do work. Once DBT introduced direct contact between officials and general people.

- Direct Benefits to Consumers: DBT is based on Aadhar metadata, and it is used for the identification of beneficiaries. Correct identification of beneficiaries leads to the transfer of the amount directly in the beneficiaries’ account.

- No Middlemen: Middlemen in implementation of the various social sector schemes. After the introduction of the DBT, the concept of middle men vanished, and actual beneficiaries are now getting benefits.

- Inclusion and exclusion error: Through the use of Aadhar data, the exclusion and inclusion error can be eliminated. This will help in the elimination of resource wastages because it will help in eliminating ghost beneficiaries.

- Ghost beneficiaries: Once ghost beneficiaries are eliminated, it will not only help in the reduction of corruption and also help in facilitating reforms.

- Restructuring of all the social sectors can be initiated as better targeted delivery to the actual needy population will help government machinery to bring reforms in various schemes, especially welfare schemes.

- Better targeting: Collection of data and analysis based on the data will help in achieving all three objectives of eliminating wastage, facilitating reforms, and minimizing corruption.

The electronic fund transfer can be said as a game-changer in areas of the welfare of the people and taking people out of all forms of poverty. However, there are some considerable challenges such as identification of beneficiary, financial illiteracy, insufficiency of last-mile delivery mechanisms, weak grievance redressal system, etc. but with increasing digitization, de-duplication of the beneficiary database, seeding of bank account details and Aadhaar numbers in the digitized database it can be made more effective.

In case you still have your doubts, contact us on 9811333901.

For UPSC Prelims Resources, Click here

For Daily Updates and Study Material:

Join our Telegram Channel – Edukemy for IAS

- 1. Learn through Videos – here

- 2. Be Exam Ready by Practicing Daily MCQs – here

- 3. Daily Newsletter – Get all your Current Affairs Covered – here

- 4. Mains Answer Writing Practice – here