India’s Digital Public Infrastructure is transforming how services are delivered across the country. With advancements in technology, India is leveraging its digital infrastructure to improve efficiency and accessibility in various sectors. This shift is particularly impactful in India’s service sector, where digital tools and platforms are streamlining processes and enhancing service delivery. From e-governance to digital payment systems, these innovations are making services more accessible and user-friendly, helping both businesses and individuals navigate the modern economy with greater ease. As India’s digital public infrastructure continues to evolve, it’s set to further boost the growth and efficiency of the service sector, driving overall economic progress.

Tags: GS – 2, Government Policies & Interventions– E-Governance, GS – 3, Economy- Inclusive Growth- Achievements of India in Digital Infrastructure

For Prelims: Digital public infrastructure, Digital India, UPI, Aadhaar Ecosystem, Open Network for Digital Commerce, Digital India BHASHINI, Digital Rupee, India Stack, DigiLocker, Digital Personal Data Protection Act, 2023.

For Mains: Major Challenges Related to India’s Digital Public Infrastructure, Measures to Enhance the Resilience of India’s Digital Public Infrastructure.

Contents

- 0.1 Context:

- 0.2 What is Digital Public Infrastructure?

- 0.3 Key Developments in India’s Digital Public Infrastructure

- 0.4 Major Challenges Related to India’s Digital Public Infrastructure

- 0.5 Steps to Enhance the Resilience of India’s Digital Public Infrastructure

- 1 Conclusion:

- 2 UPSC Civil Services Examination, Previous Year Question

- 2.1 Prelims

- 2.2 Mains

- 2.3 Q: What is India’s digital public infrastructure?

- 2.4 Q: How does digital public infrastructure impact India’s service sector?

- 2.5 Q: What are some examples of India’s digital public infrastructure?

- 2.6 Q: What challenges does India face with its digital public infrastructure?

- 2.7 Q: How can improving digital public infrastructure benefit India’s service sector?

- 3 To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

Context:

- India has strategically positioned Digital Public Infrastructure as a fundamental aspect of its G20 presidency, advocating for its global adoption as a model for inclusive development.

- Despite significant progress, a global software glitch on 19th July 2024 revealed vulnerabilities in interconnected systems across critical sectors, highlighting the necessity for a more robust approach to digital infrastructure.

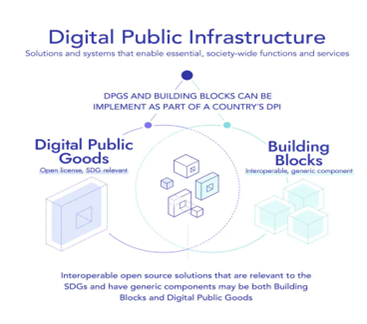

What is Digital Public Infrastructure?

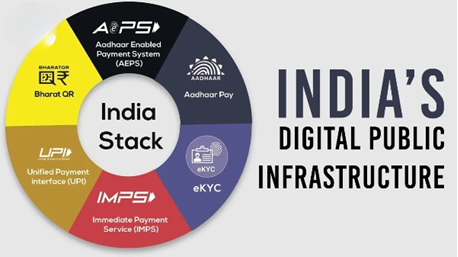

- Digital Public Infrastructure (DPI) refers to the foundational digital systems and services provided by the government or public sector to support and enhance a digital economy and society. It includes:

- Digital Identity Systems: Platforms for verifying and managing individuals’ identities online, exemplified by Aadhaar in India.

- Digital Payment Systems: Infrastructure supporting secure financial transactions, including digital wallets, payment gateways, and banking platforms.

- Public Digital Services: Online services provided by the government, such as e-governance portals, public health information, and digital education platforms.

- Data Infrastructure: Systems for storing, managing, and sharing data securely, ensuring data sovereignty and privacy.

- Cybersecurity Frameworks: Measures and protocols designed to protect digital assets and personal information from cyber threats.

- Broadband and Connectivity: Infrastructure ensuring widespread and equitable access to high-speed internet across regions.

Key Developments in India’s Digital Public Infrastructure

- Unified Payments Interface (UPI)

- Overview: UPI has transformed digital payments in India with remarkable growth since its inception.

- Statistics: UPI transactions increased from 92 crore in FY 2017-18 to 8,375 crore in FY 2022-23.

- International Expansion: Countries such as UAE, Singapore, and France have adopted or are considering UPI.

- Recent Developments: Integration of UPI with credit cards and the launch of UPI Lite for offline transactions have further enhanced financial inclusion and established India as a global leader in digital payments.

- Aadhaar Ecosystem

- Overview: Aadhaar, India’s biometric identification system, underpins numerous government and private sector services.

- Statistics: Over 1.3 billion enrollments make it the world’s largest biometric ID system.

- Integration: Integration with DigiLocker facilitates secure document storage and sharing, significantly reducing fraud in welfare distribution and streamlining KYC processes across sectors.

- Open Network for Digital Commerce (ONDC)

- Overview: ONDC aims to democratise e-commerce by creating an open network to bring 30 million sellers and 10 million merchants online.

- Objective: The initiative challenges existing e-commerce monopolies and provides a level playing field for small and medium enterprises.

- Current Status: The project is in the pilot phase across several cities.

- Account Aggregator Framework

- Overview: The framework is revolutionising financial data sharing by enabling secure, consent-based information sharing across institutions.

- Statistics: Over 1.1 billion accounts are AA-enabled across various banks as of 2023.

- Impact: Particularly benefits MSMEs with faster loan processing times and improved credit access.

- Digital Health Initiatives

- Overview: The Ayushman Bharat Digital Mission is a key component of India’s digital health ecosystem.

- Statistics: As of December 2023, 50 crore individuals have an Ayushman Bharat Health Account (ABHA).

- Platform Utilisation: The CoWIN platform has been repurposed for universal immunisation programs, and telemedicine consultations have surged, with platforms like eSanjeevani conducting over 100 million consultations.

- Digital India BHASHINI

- Overview: BHASHINI (BHASHa INterface for India) is an AI-powered language translation platform aimed at overcoming language barriers in digital communication.

- Integration: It is being incorporated into various government websites and applications to enhance accessibility.

- Central Bank Digital Currency (CBDC)

- Overview: The Reserve Bank of India launched the Digital Rupee pilot in December 2022, marking India’s entry into the CBDC domain.

- Statistics: By mid-2023, over 2.2 crore transactions had been processed.

- Objective: Aims to reduce currency management costs and facilitate real-time, cost-effective cross-border transactions.

- Government e-Marketplace (GeM)

- Overview: The GeM portal has experienced substantial growth, with procurement exceeding Rs 1.24 lakh crore in the first quarter of 2024-25.

- Savings: Achieved a 10% reduction in public procurement costs.

- Adoption: GeM’s success has led to its adoption by public sector enterprises, and its model is being studied by other countries for potential replication.

Major Challenges Related to India’s Digital Public Infrastructure

- The Digital Divide Dilemma

- Overview: The digital divide is a significant issue, with stark disparities in access to technology and digital literacy across different demographics.

- Current Status: As of 2022, India’s internet penetration is about 52%, leaving approximately half the population offline (Internet in India Report 2022).

- Urban-Rural Disparity: While urban areas experience high digital adoption with growing UPI transactions, rural regions continue to rely on cash.

- Gender Disparity: The National Family Health Survey 2019-21 reveals that only 33% of Indian women use the internet compared to 57% of men.

- Digital Literacy Lag

- Overview: Enhancing digital literacy is crucial for effective technology adoption.

- Current Initiatives: Programs like Pradhan Mantri Gramin Digital Saksharta Abhiyan aim to improve digital skills but a significant portion of the population remains digitally illiterate.

- Impact: Limited digital literacy affects the effective use of digital services, including UPI and e-governance platforms.

- Vulnerability to External Shocks

- Overview: External shocks can disrupt digital infrastructure significantly.

- Recent Incident: The global IT system outage on 19th July 2024, caused by a faulty software update from CrowdStrike, exposed vulnerabilities and disrupted critical services.

- Need for Resilience: The lack of robust fail-safe mechanisms underscores the need for a more resilient digital infrastructure.

- Cybersecurity Risks

- Overview: Increased digitization has heightened cybersecurity threats.

- Current Threats: Indian businesses face over 3,000 cyberattacks per week. The ransomware attack on AIIMS Delhi in 2023 highlighted vulnerabilities in critical infrastructure.

- Vernacular Issues

- Overview: Language barriers hinder digital adoption in a multilingual country.

- Current Solutions: Initiatives like BHASHINI aim to address language barriers, but many government apps and websites are still primarily in English or Hindi, limiting accessibility.

- Digital Sovereignty Struggle

- Overview: Data localization policies aim to ensure digital sovereignty but pose challenges.

- Current Policies:

- The Reserve Bank of India’s mandate for local data storage creates compliance complexities for international payment providers.

- The Digital Personal Data Protection Act, 2023, allows data transfer only to countries notified by the government, potentially impacting data protection standards.

- Personal Data Privacy Paradox

- Overview: Expanding digital services raises concerns about data privacy and security.

- Current Issues: Implementation of the Digital Personal Data Protection Act, 2023 is pending, and incidents like Aadhaar data breaches from 2018 have heightened public concern.

Steps to Enhance the Resilience of India’s Digital Public Infrastructure

- Enhanced Cybersecurity Measures

- Increased Budget: Allocate more funds to cybersecurity.

- Audits and Response: Mandate cybersecurity audits for critical infrastructure and implement a national cyber incident response plan with regular drills.

- Interoperability Standards

- Development: Create national interoperability standards for seamless integration of digital services.

- Open API Policy: Develop an open API policy to encourage innovation and secure third-party integrations.

- Regulatory Sandbox: Establish a sandbox for testing financial services interoperability and adopt the IndEA (India Enterprise Architecture) framework.

- Inclusive Digital Literacy Programs

- Nationwide Initiative: Launch “Digital Saksharta Abhiyan 2.0” for practical digital skills, with partnerships for outreach.

- Curriculum Integration: Include digital literacy in school curricula from secondary levels.

- Targeted Programs: Develop specific programs for women, the elderly, and marginalised communities.

- Cybersecurity Board

- establishment: Set up a Cyber Security Board with members from both government and private sectors to analyse cyber incidents and recommend improvements.

- Architecture and Response: Implement zero-trust architecture, a standardised incident response playbook, and modernise state networks.

- Agile Regulatory Framework

- Task Force: Form a multi-stakeholder Digital Economy Task Force for adaptive policymaking.

- Regulations: Develop technology-neutral, principle-based regulations that are flexible and future-proof.

- Infrastructure Expansion

- BharatNet Project: Accelerate the project to connect all 600,000 villages with high-speed internet.

- Edge Computing: Promote edge computing to enhance service delivery in remote areas.

- 5G Rollout: Develop a national strategy for efficient 5G deployment and beyond.

- Vernacular Digital Content

- Multi-lingual Support: Mandate multi-lingual support for all government digital services.

- AI Translation Tools: Develop AI-powered real-time translation tools and voice-based interfaces to improve accessibility.

- Green Digital Infrastructure

- Energy Efficiency: Set standards for energy efficiency in data centres and digital infrastructure.

- Renewable Energy: Promote renewable energy use in powering digital infrastructure.

- Green Technology: Incentivize green technology adoption to align digital growth with environmental sustainability goals.

Conclusion:

India’s digital public infrastructure is crucial for inclusive growth, yet faces challenges like digital divide, cybersecurity threats, and language barriers. Addressing these requires enhancing digital literacy, improving cybersecurity, establishing robust regulatory frameworks, and expanding infrastructure. A comprehensive approach will ensure a resilient and equitable digital ecosystem.

UPSC Civil Services Examination, Previous Year Question

Prelims

Q:1 Consider the following statements about G-20: (2023)

- The G-20 group was originally established as a platform for the Finance Ministers and Central Bank Governors to discuss international economic and financial issues.

- Digital public infrastructure is one of India’s G-20 priorities.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Answer: C

Q:2 Consider the following statements: (2018)

- Aadhaar card can be used as a proof of citizenship or domicile.

- Once issued, Aadhaar number cannot be deactivated or omitted by the Issuing Authority.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Ans: (d)

Q:3 In India, under cyber insurance for individuals, which of the following benefits are generally covered, in addition to payment for the loss of funds and other benefits? (2020)

- Cost of restoration of the computer system in case of malware disrupting access to one’s computer

- Cost of a new computer if some miscreant wilfully damages it, if proved so

- Cost of hiring a specialised consultant to minimise the loss in case of cyber extortion

- Cost of defence in the Court of Law if any third party files a suit

Select the correct answer using the code given below:

- 1, 2 and 4 only

- 1, 3 and 4 only

- 2 and 3 only

- 1, 2, 3 and 4

Ans: (b)

Q:4 In India, it is legally mandatory for which of the following to report on cyber security incidents? (2017)

- Service providers

- Data centres

- Body corporate

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (d)

Mains

Q:1 What are the different elements of cyber security ? Keeping in view the challenges in cyber security, examine the extent to which India has successfully developed a comprehensive National Cyber Security Strategy. (2022)

Source: TH

Q: What is India’s digital public infrastructure?

- Answer: India’s digital public infrastructure includes the technologies and systems that support online services and digital communication for the public. This encompasses things like digital payment systems, online government services, and electronic records management.

Q: How does digital public infrastructure impact India’s service sector?

- Answer: Digital public infrastructure boosts India’s service sector by making services more accessible and efficient. For instance, digital payment systems make transactions quicker, online government services reduce bureaucratic delays, and digital records improve the management of various services, from healthcare to education.

Q: What are some examples of India’s digital public infrastructure?

- Answer: Examples include the Unified Payments Interface (UPI) for seamless digital payments, Aadhaar for identity verification, and various online portals for services like tax filing and pension management. These systems simplify processes and make services more user-friendly.

Q: What challenges does India face with its digital public infrastructure?

- Answer: Challenges include ensuring cybersecurity, addressing digital literacy gaps, and reaching remote or underserved areas. Some people may struggle with technology or lack access to digital tools, which can hinder the effectiveness of these systems.

Q: How can improving digital public infrastructure benefit India’s service sector?

- Answer: Improving digital public infrastructure can streamline service delivery, reduce costs, and enhance customer experiences. It can lead to faster processing of requests, more accurate record-keeping, and better access to services for people across the country, ultimately boosting the overall efficiency and growth of the service sector.

To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

- Join our Main Telegram Channel and access PYQs, Current Affairs and UPSC Guidance for free – Edukemy for IAS

- Learn Economy for free- Economy for UPSC

- Mains Answer Writing Practice-Mains Answer Writing

- For UPSC Prelims Resources, Click here