Self-help groups (SHGs) and their patrons, micro-finance outfits, have emerged as pivotal instruments for economic empowerment, particularly in developing economies. These entities facilitate access to financial services and foster community development by pooling resources and providing loans to members, predominantly women, for entrepreneurial endeavors. However, while SHGs and micro-finance institutions hold promise for poverty alleviation and social progress, their legitimacy and accountability demand systematic evaluation and oversight to ensure enduring success. Firstly, the legitimacy of SHGs hinges on their democratic functioning, transparency, and equitable distribution of benefits among members. Scrutiny is necessary to assess whether decision-making processes are inclusive and representative of all stakeholders. Moreover, the accountability of micro-finance outfits necessitates monitoring mechanisms to prevent exploitation and ensure responsible lending practices. Instances of over-indebtedness and coercion underscore the urgency of rigorous evaluation and regulation. Without comprehensive assessment and scrutiny, the potential of SHGs and micro-finance institutions to catalyze sustainable development may be undermined by governance lapses and ethical breaches. Therefore, concerted efforts towards systematic evaluation are indispensable for realizing the full potential of these entities in fostering inclusive growth and poverty reduction.

Tag: Governance.

Contents

Decoding the Question:

- In the Introduction, try to briefly write about the Self-Help Groups (SHGs).

- In Body,

- Mention various successes of SHGs.

- Also, write the need for the financial assessment.

- Can suggest some measures.

- In Conclusion, try to write about the overall significance of SHGs.

Answer:

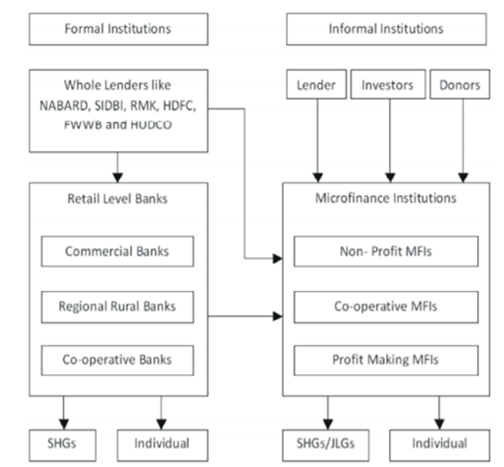

Self-help groups are informal groups of people who come together to address their common problems. It is an association of poor people especially of women from backward classes and work for solving problems through mutual help. SHGs provide cheap micro credit to women and marginalized communities to change their position within the society.

Need for the Financial Assessment of SHGs:

- SHGs has weak Financial Management, there is diversion of funds for other activities like: Marriages, household activities, etc.

- They also borrow multiple loans from different microfinance agencies.

- Sometimes the interest rate charged for loans is very high, which is difficult to repay.

- The dependence of SHGs on government, NGOs or other agencies for funding.

- These groups are concentrated in rural areas, there is negligence of urban poor.

- There is meager income from various enterprises, poor management practices, poor scientific practices and lack of specialized training in taking up income generating activity.

- These groups are also affected by the increasing politicization.

Measures to Address Issues:

- There should be subsidized credit schemes for SHGs for their long-term financial sustainability.

- The income of these groups can be raised by skill upgradation and capacity development.

- There should be awareness programmes for proper financial management and promotion of savings.

- There should be a cap on the interest charged on loans.

SHGs has evolved as a movement for financial inclusion of marginalized communities, poor and women. The government can consider the recommendations of Malegam Committee for providing financial sustainability to SHGs. The Self-Help Group (SHG)-Bank Linkage Programme of NABARD is a right step in the direction of providing easy microcredit to the groups.

In case you still have your doubts, contact us on 9811333901.

For UPSC Prelims Resources, Click here

For Daily Updates and Study Material:

Join our Telegram Channel – Edukemy for IAS

- 1. Learn through Videos – here

- 2. Be Exam Ready by Practicing Daily MCQs – here

- 3. Daily Newsletter – Get all your Current Affairs Covered – here

- 4. Mains Answer Writing Practice – here