Bank privatization in India refers to the process of transferring ownership of public sector banks to private hands. This move is aimed at improving efficiency, competitiveness, and overall performance in the banking sector. Supporters believe that private ownership can lead to better management and innovation, which could benefit customers with improved services. However, it also raises concerns about job security for bank employees and the potential impact on rural banking services. As the government explores this path, the debate continues over whether privatization will strengthen India’s banking system or create new challenges.

Tags: GS Paper – 3, Economy- Banking Sector & NBFCs– Mobilisation of Resources

Contents

- 0.1 Context:

- 0.2 About the Privatisation of Banks in India

- 0.3 Background:

- 0.4 Reasons for Privatisation:

- 0.5 Policy Considerations:

- 0.6 Arguments Favouring Bank Privatisation:

- 0.7 Arguments Against Bank Privatisation:

- 0.8 Way Forward:

- 1 UPSC Civil Services Examination, Previous Year Question

- 2 FAQs

- 3 To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

Context:

- At a recent FICCI forum, the Chairman of the 16th Finance Commission emphasised that privatising banks is a crucial reform to address the persistent issue of non-performing assets (NPAs) in India.

About the Privatisation of Banks in India

- Definition: Privatisation involves transferring ownership, control, or property of a business or entity from the government to the private sector.

- Current Consideration: The Indian government is exploring the privatisation of public sector banks (PSBs) as part of wider economic reforms aimed at boosting efficiency, enhancing governance, and attracting private investment.

- Debate: Proponents argue that it can lead to improved efficiency and governance, while critics highlight that state-owned banks offer stability and contribute to economic growth and financial inclusion.

- State-Owned Banks: These banks provide stability and support economic growth and financial inclusion. Their role extends beyond profit-making, ensuring broader economic stability.

- Private Banks: These institutions focus on profit, which can sometimes result in riskier behaviour and short-term decision-making.

Background:

- Nationalisation History:

- In 1969, the Indian government nationalised 14 major private banks to align the banking sector with the socialist policies of the time.

- The State Bank of India (SBI) was nationalised earlier in 1955, followed by the insurance sector in 1956.

- Previous Government Stances:

- Over the past two decades, various governments have fluctuated between supporting and opposing the privatisation of Public Sector Undertaking (PSU) banks.

- In 2015, although privatisation was proposed, the then Reserve Bank of India (RBI) Governor opposed it.

- Current Approach:

- Recent moves include privatisation plans and the establishment of an Asset Reconstruction Company (Bad Bank) owned by banks.

- These steps aim to find market-driven solutions to financial sector issues.

- Legislative Action:

- The 2021-22 Budget announced the privatisation of two public sector banks, but the government has yet to amend the banking laws required to sell its majority stake.

Reasons for Privatisation:

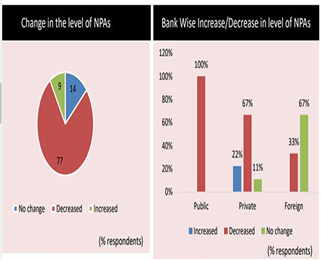

- Degrading Financial Position of Public Sector Banks: Despite capital injections and governance reforms, PSBs continue to have high levels of stressed assets, lower profitability, and less favourable market capitalization and dividend records compared to private banks.

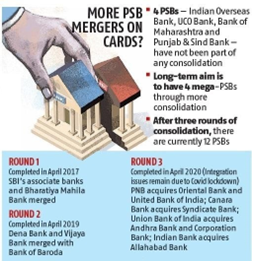

- Long-Term Project: The initial plan involves privatising four PSBs, with a gradual approach based on the success of the first two. This aims to reduce the government’s equity support and consolidate the number of state-owned banks from 28 to 12.

- Strengthening Banks: The government seeks to bolster strong banks while reducing their numbers through privatisation, which would alleviate its support burden.

- Committee Recommendations: Various committees have recommended reducing government stakes in public banks:

- The Narasimham Committee proposed reducing the stake to 33%.

- The P J Nayak Committee suggested lowering it below 50%.

- An RBI Working Group recently advocated for business houses to enter the banking sector.

- Creation of Big Banks: Privatisation aims to create larger banks by merging PSBs with big private banks, thereby enhancing their scale, risk appetite, and lending capacity. This multifaceted approach seeks to develop a more sustainable and robust banking system.

Policy Considerations:

- Narasimham Committee-I (1991):

- Reformed banking structure with a 4-tier system.

- Proposed a quasi-autonomous body under the RBI for supervision.

- Advocated deregulation of interest rates, full disclosure of accounts, and creation of an Asset Reconstruction Fund.

- Narasimham Committee-II (1998):

- Suggested merging major public sector banks to boost international trade.

- Introduced “Narrow Banking” for banks with high NPAs.

- Recommended reforms in the RBI’s regulatory role.

Recent Push for Privatisation

- Profitability and Consolidation:

- Consolidation has led to fewer but larger and profitable PSBs.

- Policymakers aim to privatise a more efficient banking system.

- Equitable Growth:

- Nationalised banks supported regional growth, rural development, and key economic revolutions (green, blue, dairy).

Recent Developments

- Privatisation Plans (2021):

- Budget for FY 2021-22 announced privatisation of two PSBs to enhance efficiency and autonomy. Specific banks for privatisation are pending.

- RBI’s Acceptance of Recommendations (2021):

- RBI accepted 21 out of 33 recommendations from an internal working group.

- Recommendations included raising promoters’ stake cap from 15% to 26% over 15 years and implementing a fit and proper control mechanism.

Arguments Favouring Bank Privatisation:

- Efficiency and Profitability:

- Private banks, driven by profit motives, are often seen as more efficient with streamlined operations and better financial performance.

- Public banks, however, excel in financial inclusion by reaching underserved regions and marginalised groups.

- Government’s Monopoly:

- Government ownership in PSBs accounts for nearly 70% of banking assets, leading to reduced competition and inefficiency.

- Previous Experience:

- Strategic disinvestment has historically led to efficiency gains and higher returns for shareholders.

- Potential for leveraging microfinance institutions (MFIs) and new private banks (NPBs) for social programs like DBT and PMJDY.

- Reduced Burden on Public Exchequer:

- Privatization could alleviate the need for government recapitalization to meet Basel III requirements, thus reducing fiscal strain.

Arguments Against Bank Privatisation:

- Monopoly Concerns:

- Privatization might lead to concentration, cartelization, and reduced competition, impacting the affordability and accessibility of banking services.

- PSBs play a vital role in serving vulnerable sections, rural areas, and priority sectors.

- Financial Exclusion:

- Private banks might focus on profitable urban areas, neglecting rural and underserved regions, whereas PSBs provide crucial services to remote and marginalized communities.

- Security Concerns:

- Privatization could remove the sovereign guarantee behind PSB deposits, potentially reducing trust and security in household savings.

- Underreporting of NPAs:

- Both private and public banks have historically underreported NPAs. Critics argue that privatization may worsen this issue by incentivizing private banks to downplay NPAs.

- Monopoly and cartelisation Risks:

- Concentration of banking power in a few private entities may lead to monopolistic practices, reducing competition and potentially increasing fees.

- Case Study: Bank Failures in the US:

- The US, with a predominantly private banking sector, has seen significant bank failures, suggesting that privatization does not guarantee stability or success.

Way Forward:

- Selective Approach:

- The government plans to focus on smaller PSBs for privatisation, excluding major banks like SBI, PNB, and Bank of Baroda.

- This approach aims to improve efficiency while preserving the social mandate of larger institutions.

- Regulatory Vigilance:

- Regardless of ownership, maintaining robust regulatory oversight is essential. The RBI must ensure stability, transparency, and prudent lending practices to safeguard the banking system.

- Public-Private Partnership:

- A hybrid model could be considered, where PSBs retain their social objectives but collaborate with private players to enhance efficiency and performance.

- Balancing Reform and Stability:

- While addressing NPAs is important, preserving a stable banking system is equally crucial.

- Reforms can be implemented without full privatisation, ensuring that state-owned banks continue to serve public interests effectively.

- Overall Balance:

- The privatisation of banks requires a careful balance between enhancing efficiency, ensuring accountability, and protecting public interests.

- Achieving this balance is critical to advancing India’s banking sector reforms.

UPSC Civil Services Examination, Previous Year Question

Prelims

Q:1 In the context of governance, consider the following: (2010)

- Encouraging Foreign Direct Investment inflows

- Privatisation of higher educational Institutions

- Down-sizing of bureaucracy

- Selling/offloading the shares of Public Sector Undertakings

Which of the above can be used as measures to control the fiscal deficit in India?

- 1, 2 and 3

- 2, 3 and 4

- 1, 2 and 4

- 3 and 4 only

Ans: (d)

Q:2 With reference to the governance of public sector banking in India, consider the following statements: (2018)

- Capital infusion into public sector banks by the Government of India has steadily increased in the last decade.

- To put the public sector banks in order, the merger of associate banks with the parent State Bank of India has been affected.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Ans: (b)

Mains

Q:1 Pradhan Mantri Jan Dhan Yojana (PMJDY) is necessary for bringing the unbanked to the institutional finance fold.Do you agree with this for financial inclusion of the poorer section of the Indian society? Give arguments to justify your opinion (2016)

Source: TH

FAQs

Q: What does bank privatization mean?

- Answer: Bank privatization means transferring the ownership of public sector banks (banks owned by the government) to private individuals or companies. This shift aims to improve efficiency, profitability, and customer service by allowing private entities to manage the banks.

Q: Why is the Indian government considering bank privatization?

- Answer: The Indian government is considering bank privatization to reduce its financial burden, improve the performance of banks, and encourage more competition in the banking sector. Privatized banks are expected to operate more efficiently and with better customer focus.

Q: How will bank privatization affect customers?

- Answer: For customers, bank privatization could mean better services, more innovative products, and quicker decision-making. However, some people worry that it might also lead to higher fees or less focus on rural banking services, which public banks traditionally support.

Q: What are the potential risks of bank privatization?

- Answer: The risks include potential job losses for bank employees, reduced focus on social banking (like loans for farmers and small businesses), and the possibility of banks prioritizing profits over customer welfare. There’s also concern about the stability of privatized banks in economic downturns.

Q: What benefits can come from privatizing banks in India?

- Answer: Benefits of bank privatization may include improved efficiency, better management, and increased capital investment. Private banks may be more responsive to market needs, leading to enhanced innovation, more competitive banking services, and overall economic growth.

To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

- Join our Main Telegram Channel and access PYQs, Current Affairs and UPSC Guidance for free – Edukemy for IAS

- Learn Economy for free- Economy for UPSC

- Learn CSAT – CSAT for UPSC

- Mains Answer Writing Practice-Mains Answer Writing

- For UPSC Prelims Resources, Click here