Today’s daily current affairs briefing for UPSC aspirants explores the latest developments relevant to the upcoming civil services examination. Our focus today includes a critical analysis of recent policy changes, international affairs, and national developments, all of which play a pivotal role in shaping India’s socio-political and economic landscape. Stay informed and stay ahead in your UPSC preparations with our daily current affairs updates, as we provide you with concise, well-researched insights to help you connect the dots between contemporary events and the broader canvas of the civil services syllabus.

Contents

- 1 Intergenerational Equity as Tax Devolution Criterion

- 1.1 Why in the news?

- 1.2 Principles of Intergenerational Fiscal Equity:

- 1.3 Mechanisms to Achieve Intergenerational Fiscal Equity:

- 1.4 Case Study: High-Income vs. Low-Income States

- 1.5 Issues with Intragenerational Equity:

- 1.6 Suggestions to Strengthen Intergenerational Fiscal Equity:

- 1.7 Conclusion

- 2 UPSC Civil Services examination PYQ

- 3 Call for ruthless action against drugs syndicate

- 4 UPSC Civil Services Examination, Previous Year Questions (PYQs)

- 5 Assam’s Foreigners Tribunal Function

- 6 UPSC Civil Services Examination, Previous Year Question (PYQ)

- 7 Green Revolution in Maize

- 8 UPSC Civil Services Examination, Previous Year Questions (PYQ)

- 9 Wheelchair Tax – GST on disability aids is unfair

- 10 UN Water Convention

- 11 Khelo India Rising Talent Identification (KIRTI) Program

- 12 Phlogacanthus Sudhansusekharii

- 13 Enemy Property Act, 1968

- 14 Frequently Asked Questions (FAQs)

- 14.1 Q: What are daily current affairs?

- 14.2 Q: Why is it important to stay updated with daily current affairs?

- 14.3 Q: Where can I access daily current affairs information?

- 14.4 Q: How can I effectively incorporate daily current affairs into my routine?

- 14.5 Q: What are some tips for critical analysis of daily current affairs?

- 15 To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

Intergenerational Equity as Tax Devolution Criterion

Tags: GS – 2, Centre-State Relations– Indian Constitution– Cooperative Federalism – Constitutional Bodies

Why in the news?

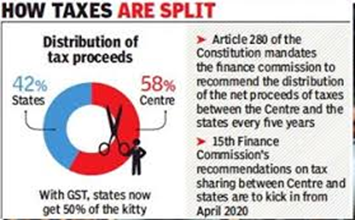

- The allocation of Union tax revenue to States is a perennial topic among policymakers and economists, with central focus on the factors influencing the horizontal distribution of States’ shares in Union tax revenue.

- Currently, the emphasis on intragenerational equity, aimed at redistributing tax revenue among States, often results in intergenerational inequity within States.

- Therefore, it is imperative to integrate intergenerational equity into India’s horizontal distribution formula for tax devolution.

Principles of Intergenerational Fiscal Equity:

- Equal Opportunities and Outcomes

- Each generation should have access to comparable opportunities and should not be disadvantaged by the fiscal policies of previous generations.

- This includes access to high-quality public services such as education, healthcare, and infrastructure.

- Sustainable Public Finance

- Governments should manage finances to ensure long-term sustainability.

- Avoid excessive borrowing that future taxpayers will have to repay, thereby preventing the accumulation of unsustainable public debt.

Mechanisms to Achieve Intergenerational Fiscal Equity:

- Taxation

- Tax revenues should be adequate to cover current public expenditures.

- This ensures that the present generation finances the services it receives, maintaining a balance between revenues and expenditures.

- Borrowing

- Borrowing should be utilised judiciously, primarily for funding large capital projects that benefit multiple generations.

- Excessive borrowing for recurrent expenditures shifts the financial burden to future generations, resulting in higher taxes or reduced public services in the future.

- Savings and Investments

- Establish sovereign wealth funds or other savings mechanisms to accumulate resources during periods of economic surplus.

- These funds can finance public expenditures during economic downturns or invest in long-term projects that benefit future generations.

Case Study: High-Income vs. Low-Income States

- High-Income States

- States: Tamil Nadu, Kerala, Karnataka, Maharashtra, Gujarat, Haryana.

- Economy: Strong, generating substantial tax revenues.

- Revenue Financing: Up to 59.3% independently.

- Union Transfers: Receive relatively low transfers, necessitating expenditure cuts or borrowing, leading to higher fiscal deficits.

- Low-Income States

- States: Bihar, Uttar Pradesh, Madhya Pradesh, Rajasthan, Odisha, Jharkhand.

- Economy: Struggle to generate sufficient own tax revenues.

- Revenue Financing: Only 35.9% independently.

- Union Transfers: Heavily reliant, financing about 57.7% of expenditures, enabling higher levels of public spending relative to their revenues.

Fiscal Indicators and Equity:

- Population and Area

- Reflect the demand for public services.

- States with larger populations and areas typically require more resources, justifying higher financial transfers.

- Per Capita Income

- Used to assess the fiscal capacity of States.

- Lower per capita income States receive more transfers to help them match the service levels of higher-income States.

- Tax Effort and Fiscal Discipline

- Efficiency indicators such as tax effort and fiscal discipline influence the distribution formula.

- States demonstrating higher tax collection efficiency and prudent fiscal management are rewarded with additional transfers, incentivizing better fiscal practices.

Issues with Intragenerational Equity:

- Disparity in Revenue Financing

- Low-income States: Bihar, Uttar Pradesh, Madhya Pradesh, Rajasthan, Odisha, and Jharkhand finance a smaller portion of their revenue expenditure with their own tax revenue and receive larger amounts of Union financial transfers.

- High-income States: Tamil Nadu, Kerala, Karnataka, Maharashtra, Gujarat, and Haryana finance a substantial portion of their revenue expenditure with their own tax revenue but receive fewer Union financial transfers.

- Tax Revenue Contribution

- High-income States: Own tax revenue (including GST, VAT, Excise, Stamp Duty, and Motor Vehicle Tax) finances up to 59.3% of their revenue expenditure.

- Low-income States: Own tax revenue finances only 35.9% of their revenue expenditure.

- Revenue Expenditure to GSDP Ratio

- High-income States: The Revenue Expenditure to GSDP ratio is 10.9%.

- Low-income States: The Revenue Expenditure to GSDP ratio is 18.3%.

- Union Financial Transfers

- Low-income States: Nearly 57.7% of revenue expenditure is financed by Union financial transfers.

- High-income States: Only 27.6% of revenue expenditure is financed by Union financial transfers.

- Fiscal Deficits

- High-income States: Had to incur a deficit of 13.1% of revenue expenditure.

- Low-income States: Ended up with a deficit of only 6.4% of revenue expenditure.

Suggestions to Strengthen Intergenerational Fiscal Equity:

- Reforming the Distribution Formula

- Incorporate More Fiscal Variables: The Finance Commission should include additional fiscal variables in the tax devolution criteria.

- Incentivize Fiscal Improvement: This inclusion would motivate States to enhance their tax efforts and expenditure efficiency, fostering sustainable fiscal practices.

- Enhancing Fiscal Discipline:

- Emphasise Responsible Borrowing: There should be a greater focus on fiscal discipline and responsible borrowing practices.

- Adherence to FRBM Limits: States should be encouraged to adhere to their Fiscal Responsibility and Budget Management (FRBM) limits and implement policies promoting long-term fiscal health.

- Promoting Balanced Development:

- Reduce Economic Disparities: Policies aimed at narrowing economic disparities between States can lead to more equitable fiscal outcomes.

- Invest in Infrastructure and Services: Investments in infrastructure, education, and healthcare in low-income States can improve their economic prospects and decrease their dependence on Union transfers.

Conclusion

Intergenerational fiscal equity is crucial for ensuring the fair distribution of economic opportunities and outcomes across generations. IBy reforming the distribution formula and encouraging responsible fiscal practices, policymakers can ensure that current fiscal decisions do not place undue burdens on future generations, promoting a more sustainable and equitable fiscal environment.

UPSC Civil Services examination PYQ

Prelims:

Q:1 With reference to the Finance Commission of India, which of the following statements is correct? (2011)

- It encourages the inflow of foreign capital for infrastructure development

- It facilitates the proper distribution of finances among the Public Sector Undertakings

- It ensures transparency in financial administration

- None of the statements

Answer: D

Q:2 Consider the following: (2023)

- Demographic performance

- Forest and ecology

- Governance reforms

- Stable government

- Tax and fiscal efforts

For the horizontal tax devolution, the Fifteenth Finance Commission used how many of the above as criteria other than population area and income distance?

- Only two

- Only three

- Only four

- All five

Ans: (b)

Mains:

Q:1 How have the recommendations of the 14th Finance Commission of India enabled the States to improve their fiscal position? (2021)

Q:2 How is the Finance Commission of India constituted? What do you know about the terms of reference of the recently constituted Finance Commission? Discuss. (2018)

Q:3 Q. Discuss the recommendations of the 13th Finance Commission which have been a departure from the previous commissions for strengthening the local government finances. (2013)

Source: TH

Call for ruthless action against drugs syndicate

Tags: GS-2, Polity & Governance- Govt. Policies & Interventions– Health – NCORD

Why in the news?

- While chairing the 7th apex level meeting of the Narco-Coordination Centre (NCORD), Union Home Minister Amit Shah called for ruthless action against drug smuggling syndicates.

- The Minister launched a toll-free helpline called MANAS (Madak Padarth Nishedh Asuchna Kendra) with the number 1933.

- Along with this, a web portal and a mobile app were introduced to allow citizens to connect with the Narcotics Control Bureau (NCB) 24/7.

- People can use these platforms to share anonymous information about drug dealing and trafficking or to seek advice on issues like drug abuse, quitting drugs, and rehabilitation.

Narcotics Control Bureau (NCB):

- About: NCB is the apex drug law enforcement and intelligence agency of India, established in 1986 under the Narcotic Drugs and Psychotropic Substances Act (NDPS Act), 1985.

- Responsibilities: The NCB is responsible for combating drug trafficking and the abuse of illegal substances.

- Nodal Ministry: Ministry of Home Affairs, Government of India.

Narco-Coordination Centre (NCORD):

- About:

- The NCORD mechanism was formed in 2016 for better coordination between states and the Ministry of Home Affairs.

- It was further strengthened through a four-tier system in 2019.

- Aim:

- NCORD enhances coordination among various central and state agencies involved in combating drug trafficking and abuse.

- It facilitates better communication, cooperation, and intelligence sharing among law enforcement and drug control agencies.

- Structure:

- Apex Level NCORD Committee, headed by Union Home Secretary.

- Executive Level NCORD Committee, headed by Special Secretary, Ministry of Home Affairs.

- State Level NCORD Committees, headed by Chief Secretaries.

- District Level NCORD Committees, headed by District Magistrates.

Fight Against Drug Menace – India’s Regulatory Framework:

- Article 47 of the Indian Constitution:

- The National Policy on Narcotic Drugs and Psychotropic Substances is based on the Directive Principles contained in Article 47 of the Indian Constitution.

- The Article directs the State to endeavour to bring about prohibition of the consumption, except for medicinal purposes, of intoxicating drugs injurious to health.

- Signatory to International Conventions: India is a signatory to:

- The Single Convention on Narcotic Drugs 1961, as amended by the 1972 Protocol.

- The Conventions on Psychotropic Substances, 1971.

- The United Nations Convention against Illicit Traffic in Narcotic Drugs and Psychotropic Substances, 1988.

- Existing Laws: The broad legislative policy is contained in the three Central Acts:

- Drugs and Cosmetics Act, 1940.

- The Narcotic Drugs and Psychotropic Substances Act, 1985.

- The Prevention of Illicit Traffic in Narcotic Drugs and Psychotropic Substances Act, 1988.

Institutions Involved:

- The Narcotics Control Bureau (NCB) was created in 1986 as a nodal agency to fight against this menace.

- The Ministry of Health and Family Welfare (MoHFW) and the Ministry of Social Justice and Empowerment (MSJE) are involved with alcohol and drug demand reduction policies and drug de-addiction programmes.

- To prevent misuse of dual-use drugs, a permanent inter-ministerial committee has been formed with the Ministry of Health and Family Welfare and the Ministry of Chemicals.

Technological Intervention:

- The NCORD portal has been launched as an effective mechanism for information exchange between various institutions/agencies.

- A toll-free helpline called MANAS (Madak Padarth Nishedh Asuchna Kendra) with the number 1933 has been launched.

Other Measures:

- The government aims to achieve a drug-free India by 2047 through a three-point strategy: strengthening institutional structure, coordination among all narco agencies, and extensive public awareness campaigns.

- As part of this strategy, a number of steps have been taken, including:

- Establishment of a dedicated Anti-Narcotics Task Force (ANTF) in each state/UT.

- High priority to drug disposal drives.

- Launch of the NIDAAN Portal for Narco offenders.

- Creation of canine squads for drug detection.

- Strengthening forensic capabilities.

- Establishment of Special NDPS Courts and Fast Track Courts.

- Nasha Mukt Bharat Abhiyan (NMBA) for generating awareness against drug abuse.

Key Highlights of the Speech Made by the Minister:

- Major Challenges Posed by Synthetic Drugs:

- The business of synthetic drugs is increasingly linked with terrorism, and drug money has emerged as a serious threat to national security.

- The drug trade also strengthens other channels of economic transactions meant to weaken the economy.

- Many organisations involved in the drug trade are also engaged in illegal hawala dealings and tax evasion.

- Maritime Routes for Drug Smuggling:

- Maritime routes are being used for smuggling drugs, threatening India’s maritime security.

- Shift from “Need to Know” to “Duty to Share” Approach:

- The Minister emphasised that agencies should shift from a “Need to Know” policy to a “Duty to Share” approach.

- He stressed the need for a strict approach to cutting off drug supply, a strategic approach to reducing demand, and a compassionate approach to minimising harm.

- Although these aspects are different, all must be addressed to achieve success in combating drug issues.

- Drug Seizure Statistics:

- The Minister stated that from 2004 to 2023, 1.52 lakh kg of drugs worth ₹5,933 crore were seized.

- In the 10 years from 2014 to 2024, this quantity increased to 5.43 lakh kg, worth more than ₹22,000 crore.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Mains

Q:1 India’s proximity to the two of the world’s biggest illicit opium-growing states has enhanced her internal security concerns. Explain the linkages between drug trafficking and other illicit activities such as gunrunning, money laundering and human trafficking. What counter-measures should be taken to prevent the same? (2018)

Q:2 In one of the districts of a frontier state, narcotics menace has been rampant. This has resulted in money laundering, mushrooming of poppy farming, arms smuggling and near stalling of education. The system is on the verge of collapse. The situation has been further worsened by unconfirmed reports that local politicians as well assume senior police officers are providing surreptitious patronage to the drug mafia. At that point of time a woman police officer, known for her skills in handling such situations is appointed as Superintendent of Police to bring the situation to normalcy. If you are the same police officer, identify the various dimensions of the crisis. Based on your understanding, suggest measures to deal with the crisis. (2019)

Source: TH

Assam’s Foreigners Tribunal Function

Tags: GS- 2 -Governance- Tribunals- Judgements & Cases- Judiciary- Quasi Judicial Bodies

Why in the news?

- On July 5, the Assam government directed the Border wing of the State’s police to not forward cases of non-Muslims who entered India illegally before 2014 to the Foreigners Tribunals (FTs).

- This directive aligns with the Citizenship (Amendment) Act of 2019, which provides a citizenship application window for non-Muslims — Hindus, Sikhs, Christians, Parsis, Jains, and Buddhists — who allegedly fled persecution in Afghanistan, Bangladesh, and Pakistan.

About Foreign Tribunal:

Objective:

- Foreign Tribunals (FTs) are quasi-judicial bodies established under the Foreigners (Tribunals) Order of 1964, which was issued under Section 3 of the Foreigners’ Act of 1946.

- These tribunals allow local authorities in a state to refer individuals suspected of being foreigners for further examination.

Exclusivity:

- Currently, FTs are exclusive to Assam, while other states handle cases of “illegal immigrants” under the Foreigners’ Act.

Composition:

- Each FT is led by a member who is a judge, advocate, or civil servant with judicial experience.

- In 2021, the Ministry of Home Affairs informed Parliament that Assam has 300 FTs.

- However, the State’s Home and Political Department website indicates that only 100 FTs are currently operational.

Powers of Foreign Tribunal:

- Under the 1964 order, FTs possess similar powers to civil courts.

- They can summon people, enforce attendance, examine individuals under oath, and request documents.

- When a person is suspected of being a foreigner, the tribunal must serve a notice in English or the state’s official language within 10 days of receiving the case.

- The individual then has 10 days to respond and another 10 days to present evidence supporting their claim of citizenship.

- The FT must resolve the case within 60 days.

- If the person cannot prove their citizenship, the tribunal can send them to a detention centre, now called a transit camp, for eventual deportation.

Role of Assam Police Border Organisation:

Formation and Evolution:

- The Assam Police Border Organisation was initially formed in 1962 as part of the State police’s Special Branch under the Prevention of Infiltration of Pakistani (PIP) scheme.

- It became an independent wing in 1974 and is now led by the Special Director General of Police (Border).

- Following Bangladesh’s liberation war, the PIP scheme was renamed the Prevention of Infiltration of Foreigners (PIF) scheme.

Personnel:

- The Central government has sanctioned 3,153 of the 4,037 personnel posts in this wing under the PIF scheme, with the remaining 884 posts sanctioned by the Assam government.

Responsibilities:

- Detecting and deporting illegal foreigners.

- Patrolling the India-Bangladesh border alongside the Border Security Force.

- Maintaining a secondary line of defence to prevent illegal entry.

- Monitoring people living in riverine and sandbar areas.

- Referring individuals with questionable citizenship to FTs to determine their nationality based on documentation.

- The Election Commission of India can also refer cases of ‘D’ (doubtful) voters to an FT.

- People excluded from the National Register of Citizens (NRC) draft, released in August 2019, can appeal to FTs to prove their citizenship.

- Approximately 19.06 lakh out of 3.3 crore applicants were excluded from the NRC, and the process is currently on hold.

About the Recent Controversy:

- Supreme Court Ruling:

- On July 11, 2024, the Supreme Court overturned a Foreign Tribunal decision that had declared Rahim Ali, a now-deceased farmer, a foreigner 12 years ago.

- The court termed this decision a “grave miscarriage of justice” and emphasised that the Foreigners’ Act does not authorise authorities to randomly select people and demand they prove their citizenship.

- Industry-like Scenario:

- In September 2018, an FT member in Morigaon, central Assam, remarked that cases involving foreigners had become like an industry, with many people trying to profit from the situation.

- The member also pointed out that notices were often placed on trees or electric poles, leaving the accused unaware of the cases against them.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q:1 Consider the following statements: (2009)

- Central Administrative Tribunal (CAT) was set up during the Prime Ministership of Lal Bahadur Shastri.

- The Members for CAT are drawn from both judicial and administrative streams.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Ans: (b)

Mains:

Q:1 “The Central Administrative Tribunal which was established for redressal of grievances and complaints by or against central government employees, nowadays is exercising its powers as an independent judicial authority.” Explain. (2019)

Green Revolution in Maize

Tags: GS-3, Economy- Cropping Patterns– Agricultural Resources- Food Security- Green Revolution

Why in the news?

- Recently, India’s maize industry has undergone a remarkable transformation, evolving from a basic feed crop to a crucial component in the fuel and industrial sectors.

- This shift is indicative of a broader green revolution, echoing the historic advances made in wheat and rice but with a modern twist driven largely by private-sector innovations.

What is the Current State of Maize Production in India?

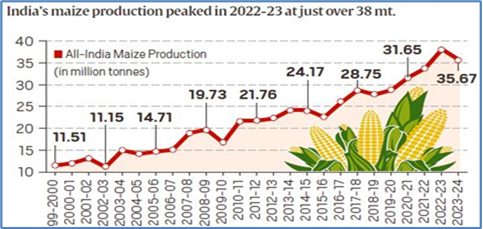

Tripling Production:

- Since 1999-2000, India’s maize production has more than tripled, increasing from 11.5 million tonnes to over 35 million tonnes annually.

- Average per-hectare yields have also risen from 1.8 to 3.3 tonnes.

- As per APEDA, India is the fifth largest maize producer, accounting for 2.59% of global production in 2020.

- Maize is the third most important cereal crop in India after rice and wheat, accounting for around 10% of total food grain production in the country.

Major States:

- Karnataka, Madhya Pradesh, Bihar, Tamil Nadu, Telangana, Maharashtra, and Andhra Pradesh are the primary maize-growing states.

Year-Round Cultivation:

- Maize is grown throughout the year, predominantly as a Kharif crop, with 85% of the maize cultivation area during this season.

Export Volume:

- India exported 3,453,680.58 MT of maize worth Rs. 8,987.13 crores in 2022-23.

- Major export destinations include Bangladesh, Vietnam, Nepal, Malaysia, and Sri Lanka.

Major Uses:

- Approximately 60% of maize is used as feed for poultry and livestock, while only about 20% is directly consumed by humans.

- Maize is a primary energy source in livestock feed, with 55-65% of broiler feed and 15-20% of cattle feed comprising maize.

- Maize grains, containing 68-72% starch, are used in industries such as textiles, paper, and pharmaceuticals.

- Recent developments have shifted focus to using maize for ethanol production, particularly as a substitute for rice in ethanol blending due to food security concerns.

- During the crushing season, distilleries run on sugarcane molasses and juice/syrup, while in the off-season they use grains, with a recent shift towards maize.

Green Revolution:

Leadership and Achievements

- Norman Borlaug: Spearheaded the Green Revolution in the 1960s, developing High Yielding Varieties (HYVs) of wheat. His contributions earned him the Nobel Peace Prize in 1970 for his role in alleviating global hunger.

Role in India

- M.S. Swaminathan: Played a pivotal role in advancing the Green Revolution in India, significantly boosting the production of wheat and rice through high-yielding varieties.

- Transformation: Between 1967-68 and 1977-78, the Green Revolution transformed India from a food-deficient nation to a leading agricultural power, enhancing food security and reducing reliance on imports.

How does Maize’s Green Revolution Compare to Wheat and Rice?

Self-Pollinating vs. Cross-Pollinating:

- Unlike self-pollinating wheat and rice, maize’s cross-pollinating nature makes hybrid breeding commercially viable.

- The Green Revolution in wheat and rice was driven by farmers cultivating high-yielding varieties, being self-pollinating plants that are not amenable to hybridization.

- The Green Revolution in maize has been, and continues to be, a private sector-led one. Private-sector hybrids dominate over 80% of maize cultivation, with high yields limited to the first generation.

- Farmers cannot harvest the same yields if they save the grains from these yields and reuse them as seeds (self-termination nature of seeds).

Innovations in Maize Cultivation:

- The Indian Agricultural Research Institute (IARI) has bred India’s first “waxy” maize hybrid (AQWH-4) with high amylopectin starch content, making it better suited for ethanol production.

- Normal maize starch has 30% amylose and 70% amylopectin, while IARI’s waxy maize hybrid has 93.9% amylopectin.

- Amylose starch makes the grain hard, while amylopectin makes it soft, affecting starch recovery and fermentation rates.

- Softness aids in better grain grinding for flour production. Granules with higher amylopectin are more easily broken down into glucose units, which are then fermented into ethanol using yeast.

- Normal maize grains have 68-72% starch, but only 58-62% is recoverable. The new Pusa Waxy Maize Hybrid-1 has 71-72% starch with 68-70% recovery.

- This hybrid offers an average yield of 7.3 tonnes per hectare and has the potential to reach 8.8 tonnes.

Private Sector’s Role:

- The International Maize and Wheat Improvement Center (CIMMYT) has established a maize doubled haploid (DH) facility in Kunigal (Karnataka), producing high-yielding, genetically pure inbred lines.

- This facility speeds up the development of maize hybrids and enhances breeding efficiency.

- In the conventional process, inbred lines are formed by continuous self-pollination for 6-8 generations. DH technology enables the production of completely uniform lines after just two cropping cycles.

- In 2022, the Kunigal facility produced and shared 29,622 maize DH lines. The lines are high-yielding, tolerant to drought, heat, and water-logging, nutrient-use efficient, and resistant to pests and diseases such as fall armyworm and maize lethal necrosis.

- Companies like Mahyco, Shriram Bioseed, Advanta Seeds, and others play a significant role in developing and promoting high-yield maize hybrids.

Initiatives to Promote Maize in India:

National Food Security Mission (NFSM)

- Objective: To increase the production of rice, wheat, pulses, coarse cereals, and commercial crops by extending the area under cultivation and enhancing productivity.

- Maize Focus: Under the NFSM, special emphasis is given to promoting maize cultivation through improved seed distribution, mechanisation, pest management, and efficient irrigation practices.

India Maize Summit

- Background: Organised in 2022, the summit brought together various stakeholders, including farmers, industry experts, policymakers, and researchers.

Focus Areas:

- Securing a sustainable maize supply to meet the growing demand in various sectors, including food, feed, and industrial uses.

- Discussing technological advancements, market trends, and innovations in maize cultivation.

- Strategies to enhance farmer prosperity through better pricing, market access, and adoption of high-yield varieties.

Rashtriya Krishi Vikas Yojana (RKVY)

- Objective: To incentivize states to increase public investment in agriculture and allied sectors.

- Maize Promotion: Under RKVY, states are encouraged to implement maize-specific projects focusing on:

- High-yield seed distribution.

- Capacity building and training programs for farmers.

- Adoption of modern agricultural practices and technologies.

- Development of infrastructure for storage, processing, and marketing.

UPSC Civil Services Examination, Previous Year Questions (PYQ)

Prelims

Q:1 Given below are the names of four energy crops. Which one of them can be cultivated for ethanol? (2010)

(a) Jatropha

(b) Maize

(c) Pongamia

(d) Sunflower

Ans: (b)

Wheelchair Tax – GST on disability aids is unfair

Tags: GS paper- 2- Social Issues

Why in the news?

- Since the Goods and Services Tax (GST) law was enacted in 2017, disabled individuals have been required to pay an additional five percent GST on essential mobility aids, such as prosthetic limbs, Braillers, and wheelchairs.

- This was intended to simplify and consolidate India’s tax system but has inadvertently resulted in significant financial burden on disabled individuals.

- It is crucial to examine the impact of the GST regime on disabled individuals and address its discriminatory effects.

Impact of GST on Disabled Individuals and Broader Implications:

- Financial Burden on Essential Mobility Aids:

- Dependency on Aids: Disabled individuals rely heavily on mobility aids like prosthetic limbs, wheelchairs, and Braillers for daily functioning.

- Tax Implication: Under the current GST regime, these essential items are taxed at five percent. This tax adds an extra financial strain on individuals who already face numerous challenges.

- Example: A motorised wheelchair costing Rs 1 lakh incurs an additional Rs 5,000 as GST. If the wheelchair lasts for 500 kilometres, the effective tax burden per kilometre of mobility is Rs 10, highlighting the inequity since able-bodied individuals do not face such taxes for walking.

- Braille Publications: Blind individuals must also bear the GST burden on Braille publications, adding to their costs due to their disability.

- Discriminatory Nature of the Tax:

- Penalising Disability: The GST on disability aids imposes a financial burden on essential tools for achieving normalcy and independence, effectively penalising individuals for their disability.

- Unequal Treatment: Unlike able-bodied individuals, who do not incur additional costs for daily activities, disabled individuals face an inequitable tax burden, exacerbating their challenges.

- Constitutional Discrepancy: This tax is inconsistent with the principles of equality and non-discrimination enshrined in the Indian Constitution.

- Psychological and Social Implications

- Marginalisation: The additional cost on essential mobility and learning tools sends a message of marginalisation and inferiority to disabled individuals.

- Impact on Dignity: This tax undermines their dignity and self-worth, perpetuating negative stereotypes and social stigma associated with disability.

- Exclusion: Rather than fostering inclusion, this discriminatory tax policy reinforces barriers, hindering efforts towards societal integration, education, and economic participation for disabled individuals.

Analysis of GST Based on Constitutional Principles

- Fundamental Right to Equality (Article 14)

- Equality Before Law: Article 14 guarantees equality before the law and equal protection within India. The GST on disability aids creates unreasonable classification, disadvantages disabled individuals due to their condition.

- Reasonableness Test: The tax fails the reasonableness and equality test, imposing undue burdens on a vulnerable section of society.

- Fundamental Right to Non-Discrimination (Article 15)

- Prohibition of Discrimination: Article 15 prohibits discrimination based on various grounds, including physical disabilities. The tax directly contravenes this provision by discriminating against individuals based on their disabilities.

- Rights of Persons with Disabilities Act, 2016: This Act reinforces the prohibition of discrimination against disabled individuals, further supporting the argument against GST on disability aids.

- Indirect Discrimination and Judicial Interpretation

- Principle of Indirect Discrimination: Chief Justice D Y Chandrachud’s 2021 judgement (Lt. Col. Nitisha v. Union of India) highlighted the need to recognize indirect discrimination.

- Application to GST: Even if the GST on disability aids is not overtly discriminatory, its disproportionate impact on disabled individuals constitutes indirect discrimination, reinforcing the need for review and reform.

The Judiciary’s Stance on Similar Issues:

Sakal Papers Case (1961):

- Context:

- The Supreme Court of India struck down government-imposed restrictions on newspaper advertising, aimed at promoting smaller newspapers by limiting the number of advertisements larger ones could carry.

- Judgement:

- The Court ruled that these restrictions violated the fundamental right to freedom of speech and expression under Article 19(1)(a) of the Constitution.

- The regulation indirectly affected newspaper circulation and, consequently, the dissemination of information.

- Principle Established:

- Government actions that indirectly impact fundamental rights must be scrutinised and can be invalidated if deemed unreasonable.

Indian Express Case (1984):

- Context:

- The Supreme Court addressed a customs duty imposed on newsprint, which the government justified as a revenue measure.

- Judgement:

- The Court recognized that the duty increased newsprint costs, thereby raising newspaper prices and affecting public access to information.

- The duty was struck down for infringing on the right to freedom of speech and expression.

- Principle Reinforced:

- Policies with indirect consequences on fundamental rights must undergo rigorous scrutiny and justification.

Aashirwad Films Case (2007):

- Context: The Supreme Court reviewed a discriminatory tax levied on non-Telugu films in Andhra Pradesh.

- Judgement: The Court declared the tax unconstitutional, finding it “socially divisive” and a violation of the right to equality under Article 14 of the Constitution. The tax unfairly burdened non-Telugu films and their audiences.

- Principle Highlighted: Taxation or regulation creating unreasonable distinctions between different classes of people or entities must be invalidated.

Way Forward: Reform for Dignity and Empowerment

- Issue of Dignity:

- While GST revenue from disability aids is minimal compared to the total, the imposition of this tax on essential aids like wheelchairs and Braillers is a matter of dignity.

- Taxing disabled individuals for basic needs communicates a message of inferiority rather than empowerment.

- Judicial Precedent:

- The 2021 judgement on Article 15 (Lt. Col. Nitisha) emphasises the need to recognize indirect discrimination, reinforcing the argument against the discriminatory GST on disability aids.

Conclusion

The five percent GST on essential disability aids is a manifest injustice, penalising disabled individuals for their condition. This policy not only contravenes constitutional principles of equality and non-discrimination but also undermines the dignity of disabled individuals. Reforming this tax regime is crucial to ensuring that disabled individuals are treated with the dignity and respect they deserve

Source: IE

UN Water Convention

Tags: Ecology & Environment- Conservation-UN Water Convention

Why in the news?

- On July 19, 2024, Ivory Coast became the 10th African nation to join the United Nations Water Convention.

About the UN Water Convention:

- Full Name: Convention on the Protection and Use of Transboundary Watercourses and International Lakes

- Adopted: Helsinki, 1992

- Entered into Force: 1996

- Purpose: Promotes sustainable management of shared water resources, supports the implementation of Sustainable Development Goals (SDGs), prevents conflicts, and fosters peace and regional integration.

History:

- Origins: Initially a regional framework for the pan-European region.

- Global Accession: Since March 2016, all UN Member States can join.

- Notable Accessions:

- 2018: Chad and Senegal, the first African Parties.

- March 2023: Iraq, the first from the Middle East.

- June 2023: Namibia, the first from Southern Africa.

- July 2023: Panama, the first from Latin America.

Requirements for Parties:

- Prevent, Control, and Reduce: Manage transboundary impacts.

- Reasonable and Equitable Use: Ensure sustainable management of transboundary waters.

- Cooperation: Parties must cooperate by forming specific agreements and joint bodies with neighbouring states sharing the same transboundary waters.

Significance:

- Sustainable Development Goals: Helps achieve the 2030 Agenda for Sustainable Development.

- UNECE: The United Nations Economic Commission for Europe supports the Convention.

Ivory Coast’s Context:

- Transboundary River Basins: Shares eight basins (Black Volta, Bia, Tanoe, Comoe, Niger, Sassandra, Cavally, and Nuon) with six neighbouring countries: Ghana, Burkina Faso, Mali, Guinea, Liberia, and Sierra Leone.

Source: DTE

Khelo India Rising Talent Identification (KIRTI) Program

Tags: GS-2, Polity & Governance- Govt. incentive – KIRTI Program

Why in the news?

- On July 19, 2024, the Khelo India Rising Talent Identification (KIRTI) Program received a significant boost under the leadership of the Union Minister for Youth Affairs.

About KIRTI Program:

- Target Group: School children aged 9 to 18 years.

- Objectives:

- Talent Identification: Discover and nurture sports talent from every part of the country.

- Combat Distractions: Utilise sports to address issues related to drug addiction and excessive screen time.

Program Details:

- Initial Launch: The program was launched across 50 centres in India.

- Phase 1: Assessing 50,000 applicants in the first phase across 10 sports, including athletics, boxing, wrestling, hockey, football, and wrestling.

- Target for FY 2024-25: Conduct 20 lakh assessments nationwide through Talent Assessment Centres.

Key Features:

- Athlete-Centric Approach: Transparent selection process using Information Technology.

- Data Analytics: Artificial Intelligence is employed to predict athletic potential.

- Decentralised Approach: Focuses on pocket-based talent identification to support both sports excellence and mass participation

Source: PIB

Phlogacanthus Sudhansusekharii

Tags: GS-3, Ecology & Environment- Biodiversity- Species

Why in the news?

- Recently, the Botanical Survey of India (BSI) discovered a new plant species named Phlogacanthus sudhansusekharii, from Itanagar Wildlife Sanctuary in Arunachal Pradesh.

About Phlogacanthus Sudhansusekharii:

- Research Institution: Botanical Survey of India (BSI)

- Location: Itanagar Wildlife Sanctuary, Papum Pare district, Arunachal Pradesh

- Species Overview:

- Family: Acanthaceae

- Genus: Phlogacanthus Honoree: Named after Dr. Sudhansu Sekhar Dash, a BSI scientist recognized for his significant contributions to plant and ecological research in the Indian Himalayan region.

- Genus Information:

- Phlogacanthus: Includes 13 species in India, primarily in the northeastern and eastern Himalayan regions.

About the Itanagar Wildlife Sanctuary:

- Location: Naharlagun, near the capital city of Arunachal Pradesh

- Area: 140.30 sq. km

- Boundaries:

- East: Pam River

- South: Pachin

- Northeast: Neorochi

- North: Chingke stream

- Flora:

- Forest Types: Mix of evergreen and semi-evergreen forests

- Features: Hilly terrain with bamboo patches and a variety of orchid species

- Fauna:

- Wildlife: Tigers, leopards, clouded leopards, elephants, barking deer, sambar, hoolock gibbons, macaques

- Bird Species: Hornbills, eagles, pheasants.

Source: DH

Enemy Property Act, 1968

Tags: GS-2, Polity & Governance – Property Act

Why in the news?

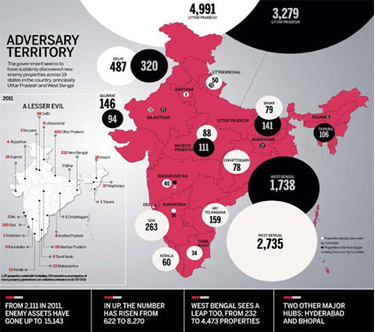

- The Indian government has recently begun auctioning benami properties belonging to individuals who now hold Pakistani or Chinese passports.

- The Act was enacted in response to the Indo-China War of 1962 and the Indo-Pak Wars of 1965 and 1971.

- Uttar Pradesh (5,982) has the highest number of enemy properties, followed by West Bengal (4,354).

- Most of these properties belong to people who migrated to Pakistan, and over 100 to those who migrated to China.

Definition of Enemy Property:

- Enemy Property: Refers to any property owned by or held on behalf of an enemy, enemy subject, or enemy firm.

- Enemy: Defined as any country that has committed an act of aggression or declared war against India.

- Property: Includes immovable assets and negotiable instruments like shares, debentures, and other commercial assets.

Provisions:

- Succession Rights: The Act states that the heirs of those who migrated to Pakistan or China lose their rights to inherit the property left behind by their ancestors.

- Scope: Encompasses property left by those who moved to China post-1962 Sino-Indian war and to Pakistan post-1965 and 1971 Indo-Pak wars.

- Custodian Role: The Custodian of Enemy Property for India (CEPI) took over the management of these properties and may sell or lease them to state governments for public use.

Enemy Property (Amendment and Validation) Act, 2017:

- Expanded Definitions: Enlarges the definition of “enemy subject” and “enemy firm” to include legal heirs and successors, regardless of nationality.

- Permanent Status: Once declared enemy property, the designation remains even if the enemy or their heirs change nationality, die, or the business is wound up.

Supreme Court Ruling:

- Ownership: The Supreme Court ruled that the CEPI does not acquire ownership of enemy properties but holds them in trust for management and administration.

- Union Ownership: The Union of India does not possess ownership rights over enemy properties.

Custodian of Enemy Property for India (CEPI):

- Function: Operates under the Ministry of Home Affairs.

- Authority: A statutory authority with powers equivalent to those of a civil court under the Code of Civil Procedure, 1908.

Source: (TH)

Frequently Asked Questions (FAQs)

Q: What are daily current affairs?

A: Daily current affairs refer to the most recent and relevant events, developments, and news stories that are happening around the world on a day-to-day basis. These can encompass a wide range of topics, including politics, economics, science, technology, sports, and more.

Q: Why is it important to stay updated with daily current affairs?

A: Staying updated with daily current affairs is crucial because it helps individuals make informed decisions in their personal and professional lives. It enables people to understand the world around them, stay aware of significant events, and engage in informed discussions about important issues.

Q: Where can I access daily current affairs information?

A: There are various sources for daily current affairs, including newspapers, news websites, television news broadcasts, radio programs, and dedicated apps or newsletters. Social media platforms are also widely used to share and access current affairs information.

Q: How can I effectively incorporate daily current affairs into my routine?

A: To incorporate daily current affairs into your routine, consider setting aside specific times each day to read or watch news updates. You can also subscribe to newsletters or follow news apps to receive curated content. Engaging in discussions with peers or participating in online forums can further enhance your understanding of current events.

Q: What are some tips for critical analysis of daily current affairs?

A: When analyzing daily current affairs, it’s essential to cross-reference information from multiple sources to ensure accuracy. Additionally, consider the source’s credibility and bias, if any. Develop the ability to identify the main points and implications of news stories, and critically evaluate the significance and impact of the events reported.

To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

- Join our Main Telegram Channel and access PYQs, Current Affairs and UPSC Guidance for free – Edukemy for IAS

- Learn Economy for free- Economy for UPSC

- Mains Answer Writing Practice-Mains Answer Writing

- For UPSC Prelims Resources, Click here