Wednesday, 1st June 2022

SC Ruling on GST Council Decisions

In News

The Supreme Court has recently ruled that recommendations of the Goods and Services Tax (GST) Council only have persuasive value and cannot be binding on the Centre and states.

About the Case (Union of India and Anr versus M/s Mohit Minerals Through Director):

- Mohit Minerals had filed a writ petition in 2018 before the Gujarat High Court challenging notifications by the Centre levying IGST on importers for ocean freight.

- The respondent company contended that the customs duty is levied on the component of ocean freight and the levy of IGST on the freight element in the course of transportation would amount to double taxation.

- Ocean freight is a method of transport by which goods and cargo is transported by ships through shipping lines.

- GST is paid by the supplier, but if the shipping line is located in a non-taxable territory, then GST is payable by the importer, the recipient of service.

- The Union of India argued before the High Court that although tax is being paid twice on the value of ocean freight, it is not unconstitutional as the tax is on two different aspects of the transaction, namely, the supply of service and import of goods.

The Decision of the Courts

- The Gujarat High Court struck down such a levy of IGST as unconstitutional and ultra vires the IGST Act.

- After this, the SC held that separate IGST on Indian importers for ocean freight is against the concept of "composite supply", and thus violates Section 8 CGST Act.

Analysis by the SC

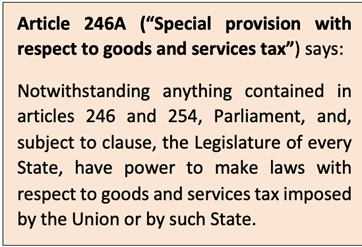

- The SC said that under Article 246A of the Constitution of India, both the Union and the States are conferred equal power to legislate on GST and the recommendations of the GST Council are the product of a collaborative dialogue involving the Union and States.

-

- Thus, to regard recommendations of GST Council as binding would disrupt fiscal federalism.

- Under federalism in India, although the Constitution confers the Union with a higher share of power in certain situations to prevent chaos and provide security, states can still resist the mandates of the Union by using different forms of political contestation.

- On the voting structure of the Council, the SC observed two significant attributions

- First, the GST Council has an unequal voting structure, where the States collectively have a two-third voting share and the Union has a one-third voting share; and

- Second, since India has a multi-party system, it is possible that the party in power at the Centre may or may not be in power in various States.

- Therefore, the bench added that the GST Council is not only an avenue for the exercise of cooperative federalism but also for "political contestation".

Sources:

- Explained: The SC ruling that GST Council decisions are not binding on Centre or states

- Separate IGST On Indian Importers For Ocean Freight Against Concept Of "Composite Supply", Violates Section 8 CGST Act : Supreme Court

- GST Council Has Unequal Voting Structure, Can Be An Avenue For Political Contestation : Supreme Court

- Contestation Between Centre & States Furthers Democracy : Supreme Court On "Uncooperative Federalism"

- India: SC Strikes Down IGST On Ocean Freight

- Uncooperative Federalism - Columbia Law School

Liquid Nano urea

In News

IFFCO has recently begun commercial production of nano urea liquid.

What is liquid nano urea?

- About: It is India’s first liquid nano urea. It is urea in the form of a nanoparticle which contains 4 per cent total nitrogen (w/v) evenly dispersed in water.

- Components: Liquid nano urea has size of a nano nitrogen particle varying from 20-50 nm. (A nanometre is equal to a billionth of a metre.)

- Shelf life: It has a shelf life of a year, and farmers need not be worried about “caking” when it comes in contact with moisture.

How is it better than conventional urea?

- More efficient: While conventional urea has an efficiency of about 25 per cent, the efficiency of liquid nano urea can be as high as 85-90 per cent.

- Better application: Conventional urea fails to have the desired impact on crops as it is often applied incorrectly, and the nitrogen in it is vaporised or lost as gas, liquid nano urea is sprayed directly on the leaves and gets better absorbed by the plant.

- Targeted supply: Fertilisers in nano form provide a targeted supply of nutrients to crops, as they are absorbed by the stomata, pores found on the epidermis of leaves.

- Easy on pocket: The liquid nano urea comes in a half-litre bottle priced at Rs 240, and carries no burden of subsidy By contrast, a farmer pays around Rs 300 for a 50-kg bag of heavily subsidised urea.

- Reduced subsidy bill: According to IFFCO, a bottle of the nano urea can effectively replace at least one bag of urea. This will reduce financial burden of government since the international market price of a bag of urea is between Rs 3,500 and Rs 4,000.

- Checking pollution: Apart from reducing the country’s subsidy bill, it will help reducing the unbalanced and indiscriminate use of conventional urea, increase crop productivity, and reduce soil, water, and air pollution.

Sources:

GDP-GVA Divergence

In News

Recently, the two measures of India’s economy— ‘gross value added’ and ‘gross domestic product’—have grown at widely different paces.

About the News

- While change in GDP significantly lagged the change in GVA in FY21, it was the opposite in FY22.

- In FY21, GDP growth lagged GVA growth by 180 basis points, the first such phenomenon under the current series, as the Centre brought onto the books several years of dues owed to the Food Corporation of India.

- Food subsidy costs ballooned in one go during the lockdown and tax collections were severely hit. This created a massive gap between the GDP and GVA.

- In FY22, however, tax collections grew at a rapid pace (28%) due to quick recovery in economic activity, while subsidies, despite remaining elevated, fell by over a third due to the base effect. This resulted in GDP growing 8.7%, while GVA rose just 8.1%.

What is the difference between GVA & GDP?

- In 2015, in the wake of a comprehensive review of its approach to GDP measurement, India to bring the compilation of national accounts into conformity with the United Nations System of National Accounts (SNA) of 2008, India introduced GVA measurement.

- As per the SNA, gross value added, is defined as the value of output minus the value of intermediate consumption and is a measure of the contribution to GDP made by an individual producer, industry or sector.

- While India had been measuring GVA earlier, it had done so using GDP at ‘factor cost’.

- GVA may prove to be a better metric under exceptional circumstances as in the case of the last two years. GVA provides a better measure if one needs to gauge output of specific sectors.

- Gross domestic product (GDP) is a measure of the country’s national income by adding up the expenditures in the economy. GDP is the official measure of economic growth in the country.

- The main difference is that GDP includes net taxes and removes subsidies, which is why the two metrics can differ in years of sharp taxation or subsidy changes.

- While GDP is the internationally-accepted measure of overall economic growth in the country, GVA provides sector-wise details of economic activity from the production side.

History of such divergence

- Overall, GDP tends to print higher than GVA as tax collections often remain bigger than subsidy pay outs.

- Between FY13 and FY17, the GDP growth always exceeded GVA growth rate, but never by more than 30 basis points. This gap grew to 60-70 bps in FY18 and FY19, thanks to strong tax collections post demonetisation, while subsidies fell on a year-on-year basis.

- In FY20, however, GDP growth came in lower than GVA for the first time, though only by 10 bps, as tax collections grew 3%, and subsidies rose by 18%.

Source:

East India Company

On June 1, 1874, the East India Company was formally dissolved by Act of Parliament. The British East India Company was a private corporation formed in December 1600 to establish a British presence in the lucrative Indian spice trade, which until then had been monopolized by Spain and Portugal.

The company eventually became an immensely powerful agent of British imperialism in South Asia and the de facto colonial ruler of large parts of India. Partly because of endemic corruption, the company was gradually deprived of its commercial monopoly and political control, and its Indian possessions were nationalized by the British crown in 1858. It was formally dissolved in 1874 by the East India Stock Dividend Redemption Act (1873).

Sources:

High Potential Individual (HPI) visa

- Context: The UK government has recently announced special work provisions via the new High Potential Individual (HPI) visa route.

- High Potential Individual (HPI) visa route, will allow graduates from the world's top 50 non-UK universities, including Indian students to stay and work in the country for minimum 2 years.

- For a PhD or other doctoral qualification, the work visa will be for at least three years and the Visa grant comes without the need for a specific job offer in hand.

- Also, the Visa has options to bring in dependents or close family members.

- The HPI visa cannot be extended and the candidate will have to apply for another visa if he/she wants to stay and work further in the UK.

- No Indian university has earned a rank in UK’s lists issued by the UK government. Therefore Indian students who graduated from an Indian university will not be eligible for this visa.

- The United States of America (USA) has the most number of eligible universities in all lists.

Source:

- How UK's new HPI visa route will benefit Indian graduates; All you need to now

- Indian universities missing from UK’s High Potential Individual visa; Chinese universities feature

Image source:

India International Centre for Buddhist Culture & Heritage

- Context: The Indian & Nepalese Prime Ministers have recently taken part in the Shilanyas programme for the India International Centre for Buddhist Culture and Heritage in the Lumbini Monastic Zone.

- The India International Centre for Buddhist Culture and Heritage has been constructed, with the view to promoting Buddhist philosophy and teachings of Gautama Buddha.

- This centre will be the first ‘Net Zero Emission’ building in Nepal, compliant in terms of energy, water and waste handling.

- The work of this centre has been undertaken by the International Buddhist Confederation (IBC), India under the auspices of the Lumbini Development Trust with the financial support of the Ministry of Culture, Government of India.

- When completed, the Centre will be a world-class facility welcoming pilgrims and tourists from all over the world to enjoy the essence of spiritual aspects of Buddhism.

Source:

- India International Centre for Buddhist Culture & Heritage: Strengthening Buddhist heritage & legacy

Image source:

Respiratory syncytial virus - Edukemy Current Affairs

- Context: According to a recent study, the Lower respiratory infection attributable to respiratory syncytial virus (RSV) was responsible for more than 1,00,000 deaths in children under five worldwide in 2019.

- Respiratory syncytial virus, or RSV, is a common respiratory virus that usually causes mild, cold-like symptoms, such as runny nose, dry cough, sore throat, sneezing and headache.

- It is the most common cause of bronchiolitis (inflammation of the small airways in the lung) and pneumonia (infection of the lungs) in children younger than 1 year of age.

- RSV spreads through contact with respiratory droplets (coughing, sneezing, or kissing) from an infected person or touching surfaces contaminated with the virus and then touching your eyes, nose, or mouth.

- Most people recover in a week or two, but RSV can be serious, especially for infants and older adults.

- An antiviral drug called palivizumab is available to prevent severe RSV illness in high-risk infants.

- Overall, 97% of RSV deaths in children under five is said to have occurred in low- and middle-income countries.

Source:

- Respiratory Syncytial Virus (RSV)

- Respiratory Syncytial Virus Infection (RSV)

- Respiratory syncytial virus (RSV)

- New research: Respiratory syncytial virus and the toll it takes on young children

Image source:

Sela monkey

- Context:A new species of Monkey from Arunachal Pradesh, has been named after a strategic mountain pass- the Sela Pass.

- Sela macaque(Macaca selai), is the new-to-science primate that has been identified and analysed by the Zoological Survey of India (ZSI).

- This species has been identified to begeographically separated from the Arunachal macaque (Macaca munzala) of Tawang district by Sela.

- TheSela Pass is believed to have acted as a barrier by restricting the migrationof individuals of these two species for approximately two million years.

- Differentiating traitsare the pale face and brown coat for Sela Macaque, while the Arunachal macaque has a dark face and dark brown coat; the former also has longer tail compared to the latter.

- However, the two species, havesimilar physical characteristics such as heavy-build shape and long dorsal body hair.

- TheSela Pass is a high-altitude mountain pass located on the border between the Tawang and West Kameng districts in Arunachal Pradesh.

- With an elevation of 13,714 ft above mean sea level, the Pass connectsTawang Town to Tezpur and Guwahati.

- It carries theNational Highway 13, connecting Tawang with the rest of India.

Source:

Image source:

Key takeaways from GDP data: Hindustan Times

Essence: As expected, the growth rate of the economy in the last quarter of 2021-22 remained lowest in the last four quarters because of the Omicron-driven third wave and high inflation.

A silver line in recently released GDP data is a decent 8.7% year-on-year increase in GDP growth rate in 2021-22 with most sectors of the economy gathering pace. Most sectors of the economy have surpassed its pre-pandemic level of growth.

However, data says that all is not well. Manufacturing contracted by 0.2% in the last quarter and high inflation and corporate profits lowered because of high input prices. Increasing private consumption and private investment is a solution but that needs inflation to be controlled which remains much above the 6% barrier. Government will again have to do the heavy lifting even though its ability is limited because of an already high fiscal deficit.

Why should you read this article?

- To understand the current status of the economy and its silver linings and issues.

Source:

NITI Aayog needs a new plan: Economic Times

Essence: The author argues the need for the revamp of the NITI Aayog. The need of revamp has arisen due to need for India to have a framework to guide it to achieve shared and sustainable prosperity over the next 25 years, but with flexibility to deal with uncertainties. The article talks about the various phases of planning India like Direct Planning and Indicative planning. After these phases, came the NITI Aayog, with which the momentum for producing plans has accelerated, driven in part by a need to plan for Sustainable Development Goals (SDGs).

The article stresses on the need to for NITI Aayog to prepare a long-term perspective vision, in the context of rising inequalities and looming climate change challenges. To achieve its long-term vision, the NITI Aayog should have the power to sign off on capital and recurrent expenditure allocations to central ministries, states and local administrations. NITI Aayog should be given a much clearer and vital role with a leadership team that has the requisite political backing and technical skills.

The current NITI Aayog needs a legitimized authorizing environment, perhaps working through the constitutionally mandated Inter-State Council in the spirit of cooperative federalism.

Why should you read this artice?

- To know the various phases of Planning in India

- To understand the current problems with NITI Aayog

- To know what can be done to revamp the NITI Aayog.

Source:

Anganwadi Development by German Lady

Background

After visiting a dilapidated Anganwadi in Kerala, Maria Kasselmann started Positive Power for Children e.V, an NGO that works to renovate decaying government schools.

About her Initiative

- The state government's Anganwadi centres frequently lacked bathrooms, drinking water, and had leaking roofs, making it difficult for children to attend school.

- Maria Kasselmann, a former primary school teacher from Germany who visited India, was taken aback by the absence of basic amenities.

- Maria started a donation campaign in Germany, in 2008, seeking financial help from the residents. All the funds collected through her initiative helped the school transform into an ideal institute equipped with the facilities.

- So far, her initiative has aided in the transformation of 22 government schools, with an average of 40 students learning in each school.

Quote: “You cannot make people learn. You can only provide the right conditions for learning to happen.”- Vince Gowmon

Source:

Share the article

Get Latest Updates on Offers, Event dates, and free Mentorship sessions.

Get in touch with our Expert Academic Counsellors 👋

Frequently Asked Questions

UPSC Daily Current Affairs focuses on learning current events on a daily basis. An aspirant needs to study regular and updated information about current events, news, and relevant topics that are important for UPSC aspirants. It covers national and international affairs, government policies, socio-economic issues, science and technology advancements, and more.

UPSC Daily Current Affairs provides aspirants with a concise and comprehensive overview of the latest happenings and developments across various fields. It helps aspirants stay updated with current affairs and provides them with valuable insights and analysis, which are essential for answering questions in the UPSC examinations. It enhances their knowledge, analytical skills, and ability to connect current affairs with the UPSC syllabus.

UPSC Daily Current Affairs covers a wide range of topics, including politics, economics, science and technology, environment, social issues, governance, international relations, and more. It offers news summaries, in-depth analyses, editorials, opinion pieces, and relevant study materials. It also provides practice questions and quizzes to help aspirants test their understanding of current affairs.

Edukemy's UPSC Daily Current Affairs can be accessed through:

- UPSC Daily Current Affairs can be accessed through Current Affairs tab at the top of the Main Page of Edukemy.

- Edukemy Mobile app: The Daily Current Affairs can also be access through Edukemy Mobile App.

- Social media: Follow Edukemy’s official social media accounts or pages that provide UPSC Daily Current Affairs updates, including Facebook, Twitter, or Telegram channels.