The Economic Survey 2024 provides a comprehensive overview of India’s economic performance over the past year, offering insights into key trends, challenges, and opportunities. It serves as a crucial document for policymakers, economists, and the general public to understand the nation’s economic health. The survey highlights growth rates, inflation trends, employment statistics, and sector-specific performances, while also suggesting measures to boost economic growth and stability. By examining the impacts of global events and domestic policies, the Economic Survey 2024 aims to pave the way for informed decision-making and strategic planning to ensure a resilient and thriving economy.

Tags: GS – 3, Economy- Growth & Development- Monetary Policy— Planning– Capital Market– Fiscal Policy— Banking Sector & NBFCs– Inclusive Growth

Contents

- 0.1 Context:

- 0.2 State of the Economy – Steady as She Goes

- 0.3 Monetary Management and Financial Intermediation- Stability is the Watchword

- 0.4 Prices and Inflation- Under Control

- 0.5 External Sector – Stability Amid Plenty

- 0.6 Medium-Term Outlook – A Growth Strategy for New India

- 0.7 Climate Change and Energy Transition: Dealing with Trade-Offs

- 0.8 Social Sector – Benefits that Empower

- 0.9 Employment and Skill Development: Towards Quality

- 0.10 Agriculture and Food Management – Plenty of Upside Left If We Get It Right

- 0.11 Industry – Small and Medium Matters

- 0.12 Services – Fuelling Growth Opportunities

- 0.13 Infrastructure – Lifting Potential Growth

- 0.14 Climate Change and India:

- 1 Conclusion

- 2 FAQs

- 3 To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

Context:

- The Economic Survey 2024, released on July 22, 2024, provides a detailed review of India’s economic performance, projecting a 6.5-7% GDP growth for FY25, and highlights key sectors like agriculture, industry, and services.

- This year, the Economic Survey 2023–24 and the Union Budget 2024 have been delayed due to the general election, as presented by the Chief Economic Adviser, V. Anantha Nageswaran.

State of the Economy – Steady as She Goes

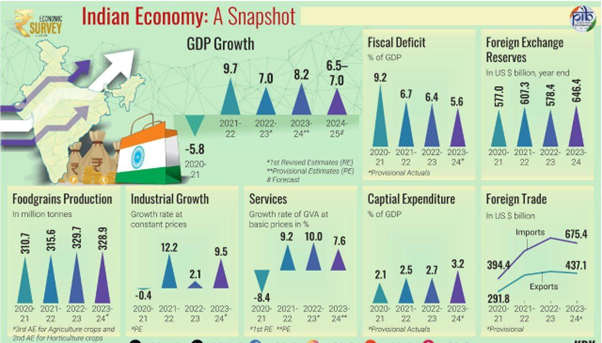

- The Economic Survey conservatively projects a real GDP growth of 6.5–7 per cent, with risks evenly balanced, cognizant of the fact that the market expectations are on the higher side.

- India’s real GDP grew by 8.2 per cent in FY24, exceeding the 8 per cent mark in three out of four quarters of FY24.

- On the supply side, Gross value added (GVA) grew by 7.2 per cent in FY24 (at 2011-12 prices) and net taxes at constant prices grew by 19.1 per cent in FY24.

- With deft management of administrative and monetary policies, retail inflation reduced from 6.7 per cent in FY23 to 5.4 per cent in FY24.

- Current Account Deficit (CAD) stood at 0.7 per cent of the GDP during FY24, an improvement from the deficit of 2.0 percent of GDP in FY23.

- The Indian economy has recovered and expanded in an orderly fashion post pandemic. The real GDP in FY24 was 20 percent higher than its level in FY20, a feat that only a very few major economies achieved.

- 55% of tax collected accrued from direct taxes and remaining 45% from indirect taxes.

- Government has been able to ensure free food grains to 81.4 Crore people. Total expenditure allotted to capital spending has progressively enhanced.

Monetary Management and Financial Intermediation- Stability is the Watchword

- The Monetary Policy committee (MPC) maintained the status quo on the policy repo rate at 6.5 per cent in FY24. Inflation was made to gradually align with its target while supporting growth.

- Credit disbursal by Scheduled Commercial Banks (SCBs) stood at ₹164.3 lakh crore, growing by 20.2 per cent at the end of March 2024.

- Growth in broad money (M3), excluding the impact of merger of HDFC with HDFC Bank, was 11.2 per cent (YoY) as on 22 March 2024, compared to 9 per cent a year ago.

- Double-digit and broad-based growth in bank credit, gross and net non-performing assets at multi-year lows, and improvement in bank asset quality highlight the government’s commitment to a healthy and stable banking sector.

- Agriculture and allied activities witnessed double digits growth in credit during FY24.

- Industrial credit growth was 8.5 per cent compared to 5.2 per cent a year ago.

- IBC has been recognised as an effective solution for the twin balance sheet problem, in the last 8 years, 31,394 corporate debtors involving a value of Rs 13.9 Lakh Crore have been disposed off as of March 2024.

- Primary capital markets facilitated capital formation of ₹10.9 lakh crore during FY24 (approximately 29 per cent of the gross fixed capital formation of private and public corporates during FY23).

- The Indian microfinance sector emerges as the second largest in the world after China.

Prices and Inflation- Under Control

- Central Government’s timely policy interventions and the Reserve Bank of India’s price stability measures helped maintain retail inflation at 5.4 per cent – the lowest level since the pandemic.

- The Central Government announced price cuts for LPG, petrol, and diesel. As a result, retail fuel inflation stays low in FY24.

- In August 2023, the price of domestic LPG cylinders was reduced by ₹200 per cylinder across all markets in India. Since then, LPG inflation has been in the deflationary zone.

- Further, Centre lowered the prices of petrol and diesel by ₹2 per litre. Consequently, retail inflation in petrol and diesel used in vehicles also moved to the deflationary zone.

- Core services inflation eased to a nine-year low in FY24; at the same time, core goods inflation also declined to a four-year low.

- Food inflation stood at 6.6 per cent in FY23 and increased to 7.5 per cent in FY24.

- Government took appropriate administrative actions, including dynamic stock management, open market operations, subsidised provision of essential food items and trade policy measures, which helped to mitigate food inflation.

- 29 States and Union Territories recorded inflation below 6 per cent in FY24.

- Going forward, the RBI projects inflation to fall to 4.5 per cent in FY25 and 4.1 per cent in FY26, assuming normal monsoon and no external or policy shocks.

- IMF forecasts inflation of 4.6 per cent in 2024 and 4.2 per cent in 2025 for India.

External Sector – Stability Amid Plenty

- India’s rank in the World Bank’s Logistics Performance Index improved by six places, from 44th in 2018 to 38th in 2023, out of 139 countries.

- The moderation in merchandise imports and rising services exports have improved India’s current account deficit which narrowed 0.7 per cent in FY24.

- India is gaining market share in global exports of goods and services. Its share in global goods exports was 1.8 per cent in FY24, against an average of 1.7 per cent during FY16-FY20.

- India’s services exports grew by 4.9 per cent to USD 341.1 billion in FY24, with growth largely driven by IT/software services and ‘other’ business services.

- India is the top remittance recipient country globally, with remittances reaching a milestone of USD 120 billion in 2023.

- India’s external debt has been sustainable over the years, with the external debt to GDP ratio standing at 18.7 per cent at the end of March 2024.

Medium-Term Outlook – A Growth Strategy for New India

- Key areas of policy focus in the short to medium term – job and skill creation, tapping the full potential of the agriculture sector, addressing MSME bottlenecks, managing India’s green transition, deftly dealing with the Chinese conundrum, deepening the corporate bond market, tackling inequality and improving our young population’s quality of health.

- Amrit Kaal’s growth strategy is based on six key areas – boosting private investment, expansion of MSMEs, agriculture as growth engine, financing green transition, bridging education-employment gap, and building capacity of States.

- For the Indian economy to grow at 7 per cent plus, a tripartite compact between the Union Government, State Governments and the private sector is required.

Climate Change and Energy Transition: Dealing with Trade-Offs

- A report by the International Finance Corporation recognises India’s efforts to achieve committed climate actions, highlighting that it is the only G20 nation in line with 2-degree centigrade warming.

- As of 31 May 2024, the share of non-fossil sources in the installed electricity generation capacity has reached 45.4 per cent.

- Further, the country has reduced the emission intensity of its GDP from 2005 levels by 33 per cent in 2019.

- India’s GDP between 2005 and 2019 has grown with a Compound Annual Growth Rate (CAGR) of about 7 per cent, whereas the emissions grew at a CAGR of about 4 per cent.

- Total annual energy savings of 51 million tonnes of oil equivalent translates to a total annual cost savings of ₹1,94,320 Crore and emissions reduction of around 306 million tonnes.

- Expanding renewable energy and clean fuels will increase demand for land and water.

- Government issued sovereign green bonds amounting to ₹16,000 Crore in January-February 2023 followed by ₹20,000 Crore in October-December 2023.

Social Sector – Benefits that Empower

- Between FY18 and FY24, nominal GDP has grown at a CAGR of around 9.5 per cent while the welfare expenditure has grown at a CAGR of 12.8 per cent.

- Gini coefficient, an indicator of inequality, has declined from 0.283 to 0.266 for the rural sector and from 0.363 to 0.314 for the urban sector of the country.

- More than 34.7 crore Ayushman Bharat cards have been generated, and the scheme has covered 7.37 crore hospital admissions.

- The challenge of ensuring mental health is intrinsically and economically valuable. 22 mental disorders are covered under the Ayushman Bharat – PMJAY health insurance.

- ‘Poshan Bhi Padhai Bhi’ programme for early childhood education aims to develop the world’s largest, universal, high-quality preschool network at Anganwadi Centres.

- Vidyanjali initiative played a crucial role in enhancing educational experiences of over 1.44 cr. students facilitating community engagement and through volunteer contributions.

- The rise in enrolment in higher education has been driven by underprivileged sections such as SC, ST and OBC, with a faster growth in female enrolment across sections, witnessing 31.6 per cent increase since FY15.

- India is making rapid progress in R&D, with nearly one lakh patents granted in FY24, compared to less than 25,000 patent grants in FY20.

- Government provisioned ₹ 3.10 lakh crore in FY25; this shows a 218.8 per cent increase over FY14 (BE).

- Under PM-AWAS-Gramin, 2.63 crore houses were constructed for the poor in the last nine years (as of 10 July 2024).

- 15.14 lakh km of road construction has been completed under Gram Sadak Yojana since 2014-15 (as of 10 July 2024).

Employment and Skill Development: Towards Quality

- Indian labour market indicators have improved in the last six years, with the unemployment rate declining to 3.2 percent in 2022-23.

- The quarterly urban unemployment rate for people aged 15 years and above declined to 6.7 percent in the quarter ending March 2024 from 6.8 per cent in the corresponding quarter of the previous year.

- According to PLFS, more than 45 per cent of the workforce is employed in agriculture, 11.4 percent in manufacturing, 28.9 percent in services, and 13.0 percent in construction.

- According to PLFS, youth (age 15-29 years) unemployment rate has declined from 17.8 per cent in 2017-18 to 10 per cent in 2022-23.

- Nearly two-thirds of the new subscribers in the EPFO payroll have been from the 18-28 years band.

- From the gender perspective, the female labour force participation rate (FLFPR) has been rising for six years.

- As per ASI 2021-22, employment in the organised manufacturing sector recovered to above the pre pandemic level, with the employment per factory continuing its pre-pandemic rise.

- During FY15-FY22, the wages per worker in rural areas grew at 6.9 per cent CAGR vis-à-vis a corresponding 6.1 per cent CAGR in urban areas.

- Number of factories employing more than 100 workers saw 11.8 per cent growth over FY18 to FY22.

- Employment has been rising in bigger factories (employing more than 100 workers) than in smaller ones, suggesting a scaling up of manufacturing units.

- The yearly net payroll additions to the EPFO more than doubled from 61.1 lakh in FY19 to 131.5 lakh in FY24.

- The EPFO membership numbers grew by an impressive 8.4 per cent CAGR between FY15 and FY24.

- Manufacturing sector is less exposed to AI as industrial robots are neither as nimble nor as cost-effective as human labour.

- The gig workforce is expected to expand to 2.35 crore by 2029–30.

- The Indian economy needs to generate an average of nearly 78.5 lakh jobs annually until 2030 in the non-farm sector to cater to the rising workforce.

- Compared to 50.7 crore persons in 2022, the country would need to care for 64.7 crore persons in 2050.

- Direct public investment equivalent to 2 percent of GDP has the potential to generate 11 million jobs, nearly 70 percent of which will go to women.

Agriculture and Food Management – Plenty of Upside Left If We Get It Right

- Agriculture and allied sectors registered an average annual growth rate of 4.18 per cent at constant prices over the last five years.

- The allied sectors of Indian agriculture are steadily emerging as robust growth centres and promising sources for improving farm incomes.

- As of 31 January 2024, the total credit disbursed to agriculture amounted to ₹ 22.84 lakh Crore.

- As of January 31, 2024, banks issued 7.5 crores Kisan Credit Card (KCC) with a limit of ₹9.4 lakh crores.

- An area of 90.0 lakh hectares has been covered under micro irrigation in the country under the Per drop more crop (PDMC) from 2015-16 to 2023-24.

- It is estimated that for every rupee invested in agricultural research (including education), there is a payoff of ₹ 13.85.

Industry – Small and Medium Matters

- Economic growth of 8.2 per cent in FY24 was supported by an industrial growth rate of 9.5 per cent.

- Despite disruptions on many fronts, the manufacturing sector achieved an average annual growth rate of 5.2 per cent in the last decade with the major growth drivers being chemicals, wood products and furniture, transport equipment, pharmaceuticals, machinery, and equipment.

- Accelerated Coal production over the past five years has helped in reducing import dependence.

- India’s pharmaceutical market stands as the world’s third largest by volume with the valuation of USD 50 billion.

- India is the world’s second-largest clothing manufacturer and one of the top five exporting nations.

- India’s electronics manufacturing sector accounts for an estimated 3.7 per cent of the global market share in FY22.

- PLI schemes attracted over ₹1.28 Lakh Crore of investment until May 2024, which has led to production/sales of ₹10.8 Lakh Crore and employment generation (direct & indirect) of over ₹8.5 Lakh.

- Industry must take the lead in incentivising R&D and innovation and improving the skill levels of the workforce by forging active collaboration with academia.

Services – Fuelling Growth Opportunities

- Services sector contribution to the overall Gross Value Added (GVA) has now reached the level prior to pandemic i.e. about 55%.

- The services sector has the highest number of active companies (65 per cent). A total number of 16,91,495 active companies exist in India as of 31 March 2024.

- Globally, India’s services exports constituted 4.4 per cent of the world’s commercial services exports in 2022.

- Computer services and business services exports accounted for about 73 per cent of India’s services exports and witnessed a 9.6 per cent growth YoY in FY24.

- India’s share in digitally delivered services exports globally increased to 6.0 per cent in 2023 from 4.4 per cent in 2019.

- The aviation sector in India has grown substantially, with a 15 per cent YoY increase in total air passengers handled at Indian airports in FY24.

- Air cargo handled at Indian airports increased by 7 per cent YoY to 33.7 lakh tonnes in FY24.

- FY24 ended with an outstanding services sector credit of ₹45.9 lakh crore in March 2024, with a YoY growth of 22.9 per cent.

- Passenger traffic originating in Indian Railways increased by about 5.2 per cent in FY24 compared to the previous year.

- Revenue-earning freight in FY24 (excluding Konkan Railway Corporation Limited) witnessed an increase of 5.3 per cent in FY24 over the previous year.

- Tourism industry witnessed over 92 lakh foreign tourist arrivals in 2023, implying a YoY increase of 43.5 per cent.

- In 2023, residential real estate sales in India were at their highest since 2013, witnessing a 33 per cent YoY growth, with a total sale of 4.1 lakh units in the top eight cities.

- Global Capability Centres (GCCs) in India have grown significantly, from over 1,000 centres in FY15 to more than 1,580 centres by FY23.

- The Indian e-commerce industry is expected to cross USD 350 billion by 2030.

- The overall tele-density (number of telephones per 100 population) in India increased from 75.2 per cent in March 2014 to 85.7 per cent in March 2024. The internet density also increased to 68.2 per cent in March 2024.

- As of 31 March 2024, 6,83,175 kilometres of Optical Fibre Cable (OFC) has been laid, connecting a total of 2,06,709 Gram Panchayats (GPs) by OFC in the BharatNet phase I & II.

Infrastructure – Lifting Potential Growth

- Buoyant public sector investment has had a pivotal role in funding large-scale infrastructure projects in recent years.

- The average pace of NH construction increased by nearly 3 times from 11.7 km per day in FY14 to around 34 km per day by FY24.

- Capital expenditure on Railways has increased by 77 percent in the past 5 years, with significant investments in the construction of new lines, gauge conversion and doubling.

- Indian Railways to introduce Vande metro transit coaches in FY 25.

- In FY24, new terminal buildings at 21 airports have been operationalised which has led to an overall increase in passenger handling capacity by approximately 62 million passengers per annum.

- India’s rank in the International Shipments category in the World Bank Logistics Performance Index has improved to 22nd in 2023 from 44th in 2014.

- The clean energy sector in India saw new investment of ₹8.5 lakh crore (USD 102.4 billion) between 2014 and 2023.

Climate Change and India:

- The Western approach does not seek to address the root of the problem, i.e. overconsumption, but rather chooses to substitute the means to achieve overconsumption.

- A one-size-fits-all approach will not work, and developing countries need to be free to choose their own pathways.

- “Mission LiFE” focuses on human-nature harmony promoting mindful consumption rather than over consumption that lies at the root of the global climate change problem.

Conclusion

The Economic Survey 2023-24 highlights India’s robust economic performance and strategic focus on growth, stability, and sustainability. Government policies aim to maintain this positive trajectory, address challenges, and seize opportunities for continued development. Analysing the survey provides insights into the country’s economic path and necessary policy measures for sustainable growth.

Source: PIB

FAQs

Q: What is the Economic Survey 2024?

- Answer: The Economic Survey 2024 is a comprehensive report released by the Indian government that reviews the country’s economic performance over the past year. It provides detailed analysis, data, and insights into various economic sectors and outlines future prospects and challenges.

Q: Why is the Economic Survey important?

- Answer: The Economic Survey is important because it helps policymakers, businesses, and the public understand the current state of the economy. It informs government planning and budget decisions and provides a basis for economic reforms and policies to promote growth and stability.

Q: What key areas does the Economic Survey 2024 cover?

- Answer: The Economic Survey 2024 covers key areas such as GDP growth, inflation, employment, agricultural and industrial performance, trade, fiscal deficit, and social sectors like health and education. It provides a detailed look at these sectors to assess their performance and recommend improvements.

Q: How does the Economic Survey affect the common person?

- Answer: For the common person, the Economic Survey affects daily life by influencing government policies on taxes, subsidies, and public services. It can impact job opportunities, prices of goods and services, and overall economic stability, which in turn affects household finances and living standards.

Q: What are the major findings of the Economic Survey 2024?

- Answer: The major findings of the Economic Survey 2024 include an analysis of economic growth rates, inflation trends, and employment statistics. It highlights the progress in various sectors, identifies areas needing improvement, and suggests policy measures to address economic challenges and promote sustainable development.

To get free counseling/support on UPSC preparation from expert mentors please call 9773890604

- Join our Main Telegram Channel and access PYQs, Current Affairs and UPSC Guidance for free – Edukemy for IAS

- Learn Economy for free- Economy for UPSC

- Mains Answer Writing Practice-Mains Answer Writing

- For UPSC Prelims Resources, Click here