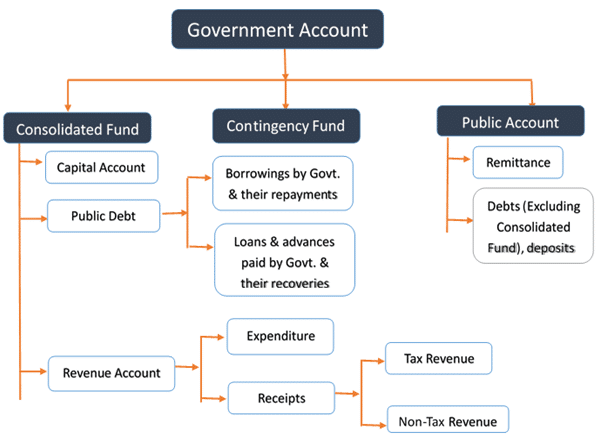

Three types of central government funds are available: the Consolidated Fund of India, the Contingency Fund of India, and the Public Accounts of India. These three types are mentioned in the Indian Constitution. The topic ‘Types of Funds In India’ is covered in the GSII-Indian Polity syllabus for the IAS Examination. In this article, we will provide you with important information about the three types of funds.

Contents

- 1 What are the different funds of India?

- 2 What is government funding?

- 3 What is the Consolidated Fund of India (CFI)?

- 4 Types of Expenditures

- 5 Expenses incurred by the Indian Consolidated Fund

- 6 FAQs

- 6.1 1. What is the National Small Savings Fund (NSSF) in India?

- 6.2 2. Can you explain the significance of the Consolidated Fund of India?

- 6.3 3. What is the Contingency Fund of India, and how is it utilized by the government?

- 6.4 4. How does the Public Account of India function, and what are its primary objectives?

- 6.5 5. What role does the Contingency Fund of State Governments play in India?

- 7 In case you still have your doubts, contact us on 9811333901.

What are the different funds of India?

These are the three main areas where funds from the Indian government are kept.

- The Consolidated Fund of India

- The Contingency Fund of India

- The Public Accounts of India

Consolidated Fund of India

- This account is the most important.

- This fund is populated by:

- Direct and indirect taxes. Loans were taken out by the Indian government

- Anybody/any agency that took it can return the loans/interests to the government

- This fund covers all government expenditures.

- To withdraw funds from this fund, the government must get parliamentary approval.

- Article 266 (1) of India’s Constitution provides for the establishment of this fund.

- Each state can have its own consolidated fund of the state with similar provisions.

- These funds are audited by the Auditor General of India and reported to the relevant legislatures.

Contingency Fund of India

- This fund is provided for in Article 267(1) of the Constitution of India.

- It has a corpus of Rs. 500 crores. It is invested money (money that is kept for a particular purpose).

- This fund is held by the Secretary of the Finance Ministry on behalf of the President of India.

- This fund can be used to cover unexpected or unanticipated expenses.

- Article 267 (2) allows each state to establish its own contingency plan.

Public Accounts of India

- This is Article 266(2) of the Constitution.

- This account/fund is charged with all other public money received by the Indian Government, except those that are covered under the Consolidated Fund of India.

- It is composed of:

- various ministries and departments’ bank savings accounts

- The defense fund and the national small savings fund

- From the National Investment Fund (money made from disinvestment),

- (NCCF) (for disaster relief)

- Provident fund, postal insurance, etc.

- Similar funds

- To withdraw advances from this account, the government doesn’t need to be authorized.

- Each state may have its own accounts.

- The CAG is responsible for auditing all expenditures from India’s public account.

What is government funding?

The government has set accounts that are used for specific spending categories, just like a business. Fund accounting allows for the recording of limited resources by individuals, governing agencies, or donors.

Because it is all about spending and recording, government agencies use it when reporting their accounting. Fund accounting does not focus on profitability. It focuses instead on responsibility for spending.

Government funds are a grouping that is used to account for tax-supported activities by the federal government. The other type is the proprietary fund which accounts for government-like business activities. There are many types of government funds, and each one maintains its own balance sheet. A balance sheet is maintained by a branch to show that it has spent the money correctly.

What is the Consolidated Fund of India (CFI)?

The government introduced the Appropriations Bill (No. The government introduced the Appropriations (No. 5) Bill to give it the power to withdraw funds from the Consolidated Fund of India. It was approved by the Lok Sabha despite opposition.

The Constitution prohibits the government from taking money out of the Consolidated Fund of India. The government however cited the pandemic crisis as the reason for taking this step.

Article 266 of the Constitution defines this fund. This article states that “all revenues received by India’s Government, all loans made by it by issuing treasury bills or loans or means advances and all money received from that Government for repayment of loans shall be consolidated into one fund, to be called the Consolidated Fund of India.”

In simple terms, it is the sum of all revenue received, interest earned, and money borrowed by the government into its Consolidated Fund of India. It’s a record of all the income the government receives via income tax, customs, and central excise, as well as the expenses it incurs (except for exceptional items).

In every budget, the government presents a statement of expected receipts and expenditures to the Parliament for the following financial year. This is known as the ‘Annual financial statement’ and is the main Budget document.

The Annual Financial Statement lists the receipts and payments to the government in three sections.

One of these is the Consolidated Fund of India. The Public Account and Contingency Fund are the other two.

Consolidated Fund of India also includes income from direct taxes, such as corporate tax or income tax. It also includes indirect taxes, such as GST, customs, and excise duty. The fund also receives dividends and profits from Public Sector Undertakings. It also receives debt repayments, loan recoveries, and disinvestment receipts.

With the exception of a few transactions that are made through the Contingency Fund or the Public Account, all government expenditure is incurred from this Consolidated Fund. Without authorization from Parliament, no amount can be taken from the Fund.

The Fund has two divisions: Revenue Account and Capital Account.

Revenue Account

The Revenue Account is used to track the revenue from taxation, other receipts, and expenditure.

Capital Account

Capital Accounts are expenditures that are incurred to increase concrete assets’ durable or reduce recurring liabilities. It also includes several types of Capital Receipts.

Receipts refer to receipts of a capital nature that cannot be used as a setoff to Capital Expenditure.

This section deals with expenditures that are incurred in order to increase concrete assets or reduce recurring liabilities. Receipts of a capital nature that are intended to be used as an offset to Capital expenditure are also included.

The section’s Public Debt’ (and Loans and Advances) includes loans that were raised and their repayments, such as external debt or internal debt.

The Consolidated Fund also charges certain items, such as salaries and allowances for top government officials. These include the President, Chairman, and Deputy Chairman of Rajya Sabha as well as the Speaker and Deputy Speaker of Lok Sabha. They also include salaries, allowances, and pensions for Judges of the Supreme Court, the Comptroller-General of India, and the Central Vigilance Commission.

Controller General of Accounts (CGA)

The CGA is the Government of India’s Principal Accounting Adviser. The office is located in the Department of Expenditure, Ministry of Finance, GOI.

- CGA is accountable for creating and maintaining an efficient and technically robust management accounting system.

- It also prepares and submits accounts to the Central Government.

- It is also responsible for internal audits and controls for the exchequer.

Types of Expenditures

Charged Expenditures

- Non-votable charges are known as expenses that are charged.

- There is no vote for this sum, which is drawn out of the Consolidated Fund of India. Parliamentary approval is not required.

- These funds are paid regardless of whether or not the budget is approved.

- This expense includes emoluments, allowances, and expenses on behalf of Presidents and their offices, as well as salaries and allowances for the Chairman, Deputy Chairman, and Deputy Chairman Rajya Sabha, the Speaker, Supreme Court judges, CAG, and the Deputy Speaker of the Lok Sabha.

- Another example of a charged expenditure is the debt charge of the government.

- They cannot be voted on because they are to be guaranteed by the government.

- Although voting doesn’t occur, discussions about these issues can be held in both houses.

The costs incurred by the Consolidated Fund of India are shown in the following table. Candidates should be aware of these since questions derived from them could be asked in the UPSC Prelims.

Expenses incurred by the Indian Consolidated Fund

The following expenses are deducted from the Consolidated Fund of India:

- The President’s emoluments and allowances, as well as other costs related to his job,

- Salaries and allowances of the Rajya Sabha Chairman and Deputy Chairman, as well as the Speaker and Deputy Speaker of the Lok Sabha

- Compensation, allowances, and pensions of Supreme Court judges

- Judges’ pensions from the High Courts

- The Auditor General and Comptroller General of India’s salary allowances, salaries, and pensions

- The chairman’s salary, allowances, and pension, as well as those of the Union Public Service Commission’s members

- Administration expenses for the Supreme Court, the office of the Comptroller and Auditor General of India, and the Union Public Service Commission, including the wages, allowances, and pensions of those employed in these offices

- The debt-related charges that the government of India is liable for include interest as well as sinking fund charges, redemption charges, as well as other expenses related to the issue of loans as well as the redemption and service of debt.

- Any amount required to pay any decree, judgment, or award issued by any court or arbitral tribunal.

- Other expenditures authorized by Parliament are to be charged.

Voted or Votable Expenditures

- This is the budget that exists.

- The budget’s expenses are made up of the demand for grants.

- The requests for grants are made by members of the Lok Sabha along with the annual financial statement. In general, there is a demand for grants that are submitted to the entire ministry and department.

Supplementary Grants

Supplementary grants are awarded when the amount that was approved by Parliament through the appropriation act to fund specific services for the current year’s financial calendar year turns out to be insufficient.

Additional Grants

They are granted when a necessity is felt during the current financial year to fund an additional expense for a new service that was not included in the budget for the year.

Excess Grants

An excess grant is awarded when the amount of money spent on any item in a financial year is greater than the amount allocated for the service within the budget.

FAQs

1. What is the National Small Savings Fund (NSSF) in India?

The National Small Savings Fund (NSSF) is one of the types of funds operated by the government of India. It serves as a reservoir for various small savings schemes like Public Provident Fund (PPF), National Savings Certificate (NSC), and others. Understanding its role and functioning is crucial for individuals looking to invest in government-backed savings instruments.

2. Can you explain the significance of the Consolidated Fund of India?

The Consolidated Fund of India is a key component of the government’s financial structure. What makes it distinct, and how is it different from other funds? This FAQ can shed light on the importance of the Consolidated Fund, its sources of revenue, and the nature of expenditures financed through it.

3. What is the Contingency Fund of India, and how is it utilized by the government?

The Contingency Fund of India is established to meet unforeseen expenditures and emergencies. This FAQ can explore the purpose, sources of funding, and the process involved in utilizing this fund. It would be beneficial for individuals interested in understanding how the government manages unexpected financial requirements.

4. How does the Public Account of India function, and what are its primary objectives?

The Public Account of India is another facet of the government’s financial framework. This FAQ can delve into the nature of transactions handled by the Public Account, its distinctiveness from other funds, and its role in managing specific receipts and expenditures that are outside the Consolidated Fund of India.

5. What role does the Contingency Fund of State Governments play in India?

State governments also have their Contingency Funds, which function similarly to the Contingency Fund of India. This FAQ can outline the purpose of these state-level funds, their sources of revenue, and how they contribute to ensuring financial stability and responsiveness to unforeseen events at the state level. Understanding this can be vital for those interested in state-level finances.

In case you still have your doubts, contact us on 9811333901.

For UPSC Prelims Resources, Click here

For Daily Updates and Study Material:

Join our Telegram Channel – Edukemy for IAS

- 1. Learn through Videos – here

- 2. Be Exam Ready by Practicing Daily MCQs – here

- 3. Daily Newsletter – Get all your Current Affairs Covered – here

- 4. Mains Answer Writing Practice – here

Visit our YouTube Channel – here