Wednesday, 2nd February 2022

Budget 2022-23

In News

The Finance Minister presented the Budget 2022-23 in the Parliament on 1st February, 2022.

Introduction

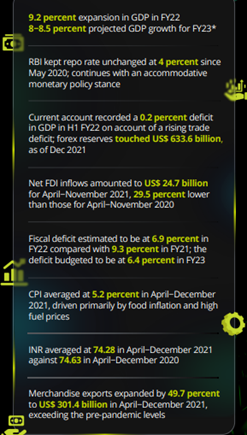

- India’s economic growth in the current year is estimated to be 9.2 per cent, highest among all large economies.

- While celebrating Azadi ka Amrit Mahotsav, India has entered into Amrit Kaal, the 25-year-long leadup to India@100, the government aims to attain the vision of:

- Complementing the macro-economic level growth focus with a micro-economic level all inclusive welfare focus.

- Promoting digital economy & fintech, technology enabled development, energy transition, and climate action, and

- Relying on virtuous cycle starting from private investment with public capital investment helping to crowd-in private investment

- Entering Amrit Kaal, the budget provides impetus for growth along four priorities:

- PM GatiShakti

- Inclusive Development

- Productivity Enhancement & Investment, Sunrise opportunities, Energy Transition, and Climate Action.

- Financing of investments

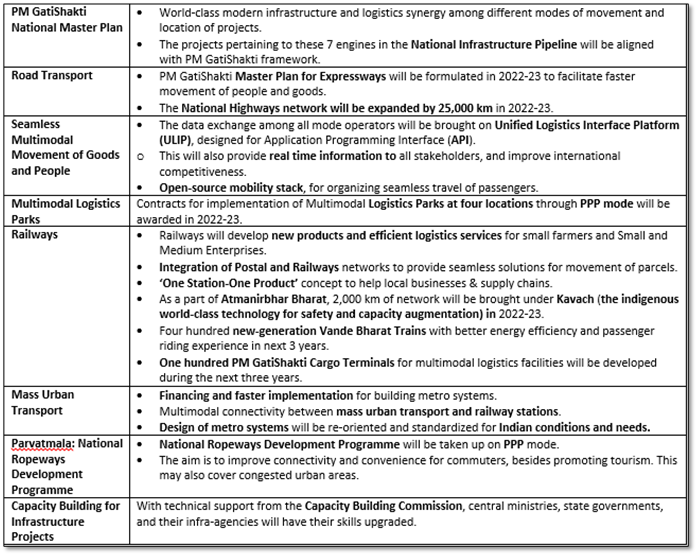

- PM GatiShakti

- PM GatiShakti is a transformative approach for economic growth and sustainable development.

- The approach is driven by seven engines, namely, Roads, Railways, Airports, Ports, Mass Transport, Waterways, and Logistics Infrastructure.

- The approach is powered by Clean Energy and Sabka Prayas – the efforts of the Central Government, the state governments, and the private sector together.

- Inclusive Development

Inclusive Health

- Ayushman Bharat Digital Mission: The National Digital Health Ecosystem, an open platform, consisting of the digital registries of health providers and health facilities, unique health identity, consent framework, and universal access to health facilities, will be rolled out.

- National Tele Mental Health Programme: To better the access to quality mental health counselling and care services, a ‘National Tele Mental Health Programme’ will be launched.

- This will include a network of 23 tele-mental health centres of excellence, with NIMHANS being the nodal centre and International Institute of Information Technology-Bangalore (IIITB) providing technology support

- Mission Shakti, Mission Vatsalya, Saksham Anganwadi & Poshan 2.0: Mission Shakti, Mission Vatsalya, Saksham Anganwadi and Poshan 2.0 were launched recently to provide integrated benefits to women and children.

- Saksham Anganwadis are a new generation anganwadis that have better infrastructure and audio-visual aids, powered by clean energy and providing improved environment for early child development.

Inclusive Infrastructure

- Har Ghar, Nal Se Jal: Current coverage of Har Ghar, Nal Se Jal is 8.7 crores. Allocation of 60,000 crore has been made with an aim to cover 3.8 crore households in 2022-23.

- Housing for All: In 2022-23 80 lakh houses will be completed for the identified eligible beneficiaries of PM Awas Yojana, both rural and urban. The Central Government will work with the state governments for reduction of time required for all land and construction related approval.

Under-developed Areas

- Prime Minister’s Development Initiative for North East Region (PMDevINE): It will be implemented through the North-Eastern Council. It will fund infrastructure, in the spirit of PM GatiShakti, and social development projects based on felt needs of the North-East.

- Aspirational Blocks Programme: 95 per cent of 112 Aspirational districts have made significant progress in key sectors such as health, nutrition, financial inclusion and basic infrastructure. In 2022-23, the programme will focus on such blocks in those Districts, which continue to lag.

- Vibrant Villages Programme: Border villages on the northern border will be covered under the new Vibrant Villages Programme.

Inclusive Banking

- Anytime – Anywhere Post Office Savings: In 2022, 100 per cent of 1.5 lakh post offices will come on the core banking system enabling financial inclusion. Access to accounts through net banking, mobile banking, ATMs, and also provide online transfer of funds between post office accounts and bank accounts will also be enabled.

- Digital Banking: 75 Digital Banking Units (DBUs) in 75 districts of the country by Scheduled Commercial Banks will be set up.

- Digital Payments: The financial support for digital payment ecosystem announced in the previous Budget will continue in 2022-23. This will encourage further adoption of digital payments.

- Productivity Enhancement & Investment, Sunrise Opportunities, Energy Transition, and Climate Action

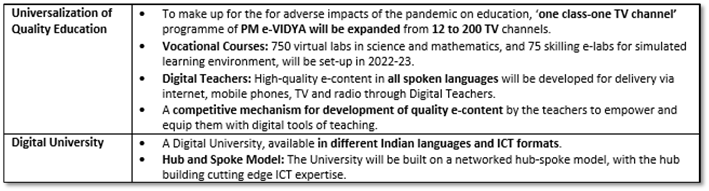

Productivity Enhancement & Investment

Energy Transition and Climate Action

- Financing of Investments

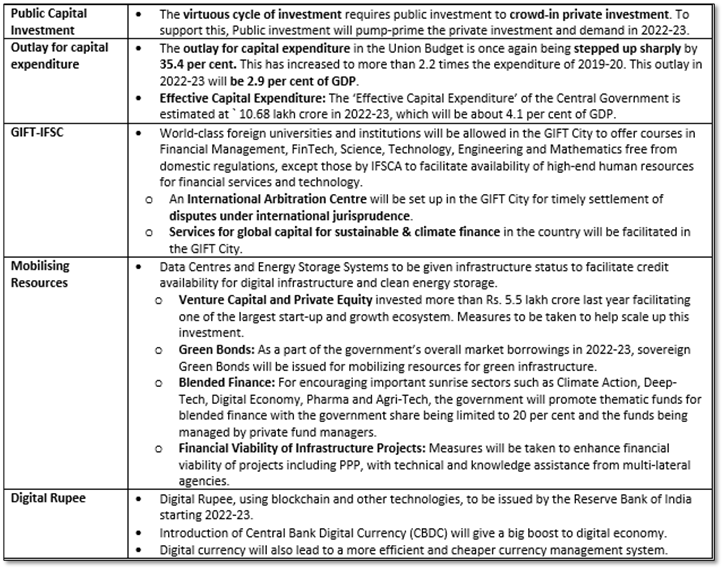

Financial Assistance to States for Capital Investment: For 2022-23, the allocation is 1 lakh crore to assist the states in catalysing overall investments in the economy. These fifty-year interest free loans are over and above the normal borrowings allowed to the states.

- This allocation will be used for PM GatiShakti related and other productive capital investment of the states. It will also include components for:

- Supplemental funding for priority segments of PM Gram Sadak Yojana, including support for the states’ share

- Digitisation of the economy, including digital payments and completion of OFC network, and

- Reforms related to building byelaws, town planning schemes, transit-oriented development, and transferable development rights.

- Fiscal Deficit of States: In 2022-23, in accordance with the recommendations of the 15th Finance Commission, the states will be allowed a fiscal deficit of 4 per cent of GSDP of which 5 per cent will be tied to power sector reforms.

Fiscal Management

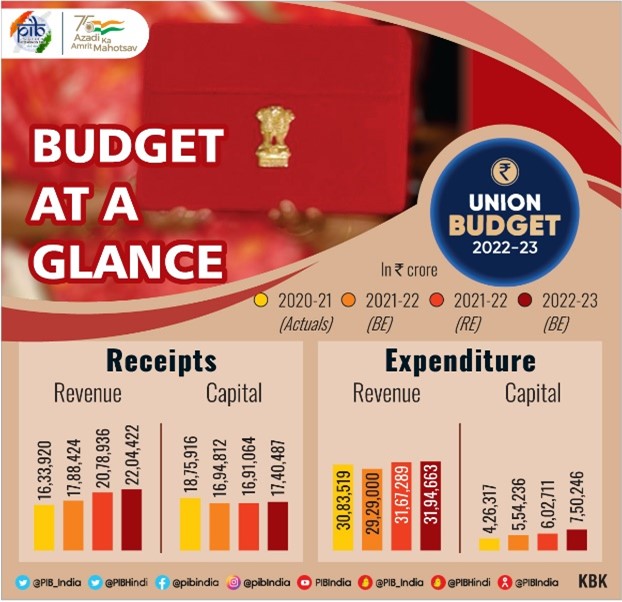

- Budget Estimates 2021-22: 34.83 lakh crore

- Revised Estimates 2021-22: 37.70 lakh crore

- Total expenditure in 2022-23 estimated at Rs. 39.45 lakh crore

- Total receipts other than borrowings in 2022-23 estimated at Rs. 22.84 lakh crore

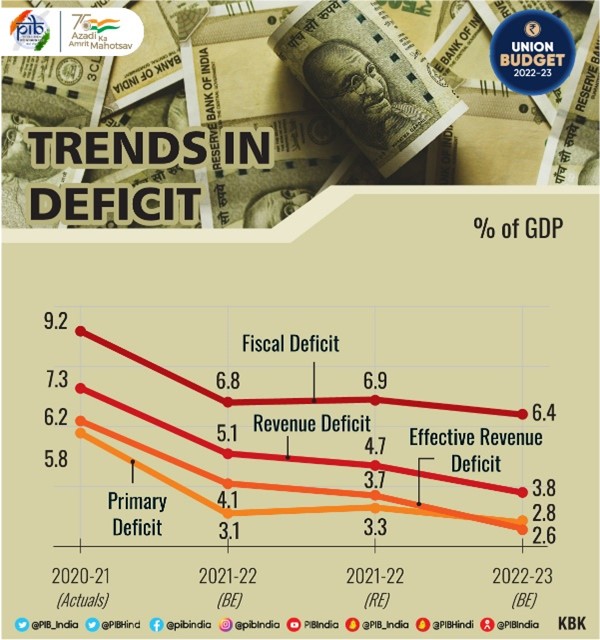

- Fiscal deficit in current year: 9% of GDP (against 6.8% in Budget Estimates)

- Fiscal deficit in 2022-23 estimated at 6.4% of GDP

Part B

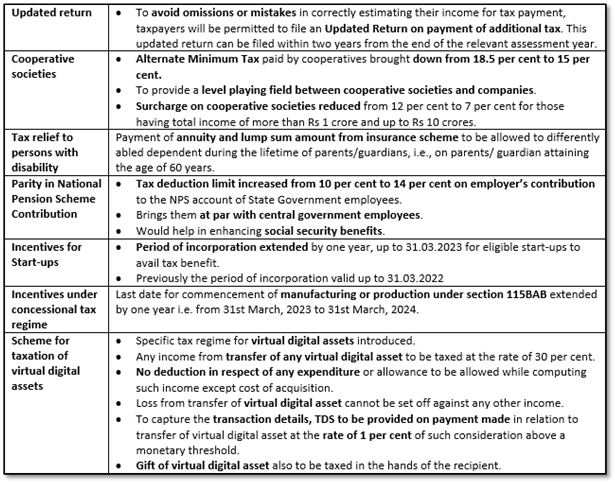

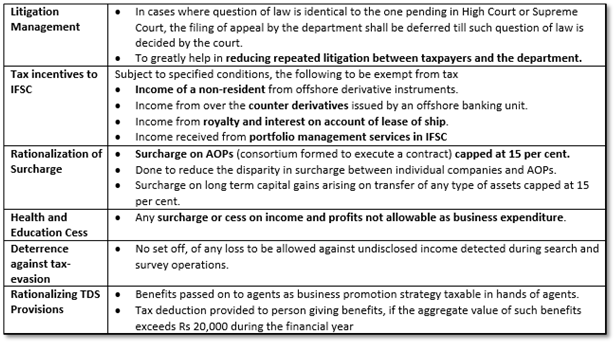

Direct Taxes

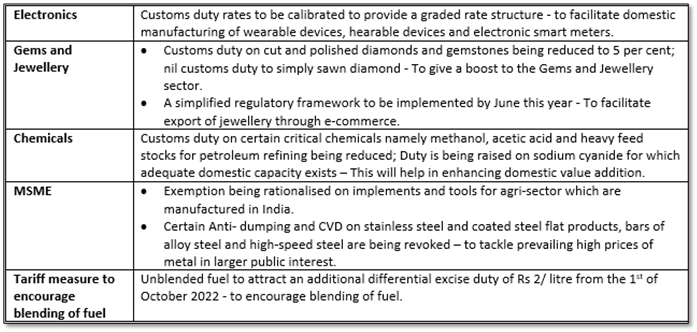

Indirect Taxes

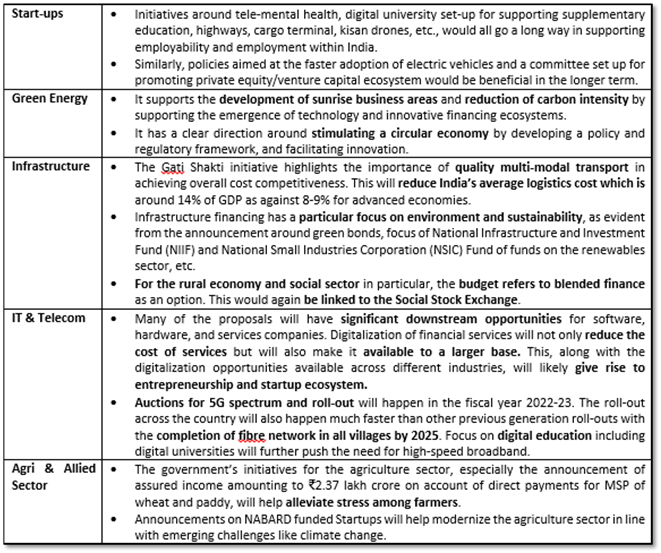

Sector specific proposals

Sources:

Budget 2022-23: Analysis

- This Budget, presented in the 75th year of Independence, sets the stage for an Amrit Kaal (time of nectar) over the next 25 years, culminating in a vision for India in 2047 as enunciated by Prime Minister in his Independence Day address last year.

- The budget largely stuck to the strategy of scaling up the wager on public capital spending to revive private investments and job creation through a virtuous growth cycle, while keeping an eye on the country’s macro fiscal health.

Key Positive Takeaways

- This Budget is an articulation of ambition

- Union Budget 2022 has signalled that mere recovery is not enough — India is aspirational, hungry for growth and ready for a quantum leap. To support that leap, the Budget has put in place a blueprint for the next two and a half decades. In that sense, this Budget is an articulation of ambition.

- Identification of priority areas — Gati Shakti, inclusive development, sunrise opportunities, energy and climate action, and financing of investment —demonstrated that the future of India will be built on twin pillars — strengthening our traditional backbone and building the models of the future.

- A roadmap for economic revival: The substantial increase in CapEx outlay of 35% to ₹7.5 lakh crore during FY2022-23 would help pump-prime the economy and demand not only in this year but also in the years ahead.

- It does so not just by creating new jobs but also by creating new productive assets that boost future productivity.

- Prudent Expenditure Strategy: The government has chosen to significantly ramp up capital expenditure (capex) while largely restricting revenue expenditure (revex), which is budgeted to rise by a mere 0.9% in FY2023.

- The relatively larger hike in capex vis-à-vis revex is expected to lead to an improvement in the Government’s spending quality. Indian fiscal data shows that capital expenditure has multiplier of ~2.5 while revenue expenditure has less than 1.

- The Budget hopes to trigger a virtuous investment-led output and employment growth by arguing in favour of the “crowding-in” effect of public investment on private investment.

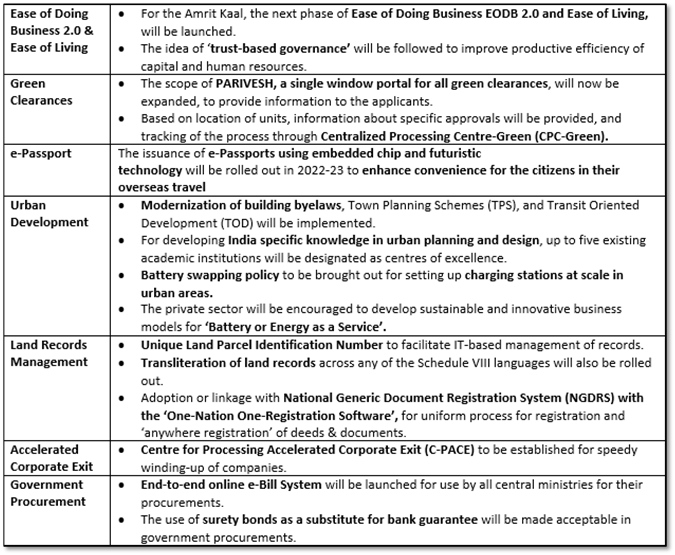

- This Budget’s reform-oriented approach of improving the business environment by introducing EODB 2.0 — which has its foundations in trust-based governance, and aims to digitalize manual processes while at the same time targeting integration of central and State-level compliances.

- A catalyst for inclusive growth: The Budget has focused on inclusivity by targeting the bottom of the pyramid through welfare schemes. The increased allocation to the PM Awas Yojana to benefit the weaker section of the population and the launch of new schemes like PM-DevINE, Prime Minister’s Development Initiative for North East (PM-DevINE), Aspirational Blocks, and Vibrant Villages Programme are inspiring for achieving all-rounded, inclusive growth.

- Laying the foundation for Digital India 2.0: From recognizing virtual assets as a taxable asset class, issuing digital currency, e-passports, Digital University, Council for AVGC (Gaming, Animation Sector), emphasis on digital banking, land record digitization, facilitating payment platforms, auctioning 5G spectrum, building optical fibre network are efforts that will build up digital capacity of the country, improve efficiency and further boost employment in the services sector.

- Attempts to reduce federal friction: Finance Minister also announced a ₹1 lakh crore 50-year interest-free loan for States to pursue critical capital spending projects, aligned with the PM Gati Shakti programme, digitisation or urban reforms. A similar ₹10,000 crore window announced for 2021-22 has been enhanced to ₹15,000 crore in deference to State CMs’ requests.

How Budget 2022 proposals will affect various sectors?

What did the Budget miss?

- Missing Focus on Health: Healthcare was expected to get a greater share of allocation. The pandemic has exposed the deficiencies in hospital capacity. National Health Mission allocations in FY22 were lower than in FY20. One would have expected a public-private initiative with PLI type of incentives to be thrown open to this sector.

- On the employment crisis: The Budget does not directly address the employment crisis. The crisis would call for enhanced allocation for the MGNREGA and initiating a similar scheme for meeting urban unemployment. Instead, the Government has slashed the allocation for MGNREGA by 25% over last year.

- Premature on PLI scheme: The Budget has mentioned the overwhelming response to the scheme. However, evidence on the number of such projects that have taken off, their investment and employment generation and rise in domestic content in such industrial units is too sparse. Hence, it is premature to claim the success of the PLI scheme.

- No income tax changes: After a difficult financial year, working-class citizens in the country were expecting some form of tax relief. However, the budget for the next fiscal did not propose any major income tax changes, besides a push to make the tax filing process more compliant.

- Debt market woes: With the government plan to borrow more in the next fiscal, it is expected to widen the fiscal deficit further. This is likely to put more pressure on the bond market and the RBI may need to step in for a balancing act.

- Not much for rural economy: Before the budget, many economists had asked the government to prioritise spending on infrastructure development and alleviating the difficulties of the poorer population in rural India through direct fiscal measures. However, the government has cut back the budgetary allocation for rural development, including the MGNREGA, spending for rural roads and pension for widows, by 10% to Rs 1.95 lakh crore.

- Other Misses: The Finance Minister failed to give account of what happened to all the targets set up for employment, smart cities, Skill India, double income of farmers, relief to poor and middle income groups, improvement in health infrastructure etc.

Conclusion

To sum up, the Budget for 2022-23 is a bold effort at public investment-led growth. The widely discussed concerns of the unemployment crisis, fall in the share of private consumption in GDP, and rising economic inequality (caused by the pandemic and the lockdown) could have been tackled in a better manner with specific initiatives. So, the ultimate outcome of the initiatives introduced in the budget will depend on the timely release of the funds, money spent for the purpose it was sanctioned and effective assessment of the plans.

Soruce:

- Budget 2022: Significant Agricultural Reforms for Resilient Growth and Recovery:

- Union Budget 2022 | Medium Wave:

- Union Budget 2022 | Trade unions term it ‘anti-people’:

- A growth-oriented, pragmatic Budget 2022:

- Union Budget 2022 | Making India future ready:

- Union Budget 2022 | Laying the foundation for Digital India 2.0:

- Union Budget 2022 | Best spending mix in 18 years:

- Union Budget 2022 | A roadmap for economic revival:

- Budget 2022: The call – spend to grow:

- Explained: What is the Digital Rupee announced by Sitharaman in Budget?:

- The right voices are missing from the budget:

- Explained: What's missing in Nirmala Sitharaman's Budget 2021:

- A bold effort at public investment-led growth:

- The end of the doing business rankings:

- Union Budget 2022: Budget Analysis:

- Budget 2022 analysis: Impact on FMCG:

- The good, bad and ugly of Budget 2022 for investors, companies & common man:

- Budget focuses on digital and capital investment to make a better India:

- Budget 2022: Did FM just make cryptocurrencies legal by taxing them?:

- Budget 2022: Full list of winners and losers from Nirmala Sitharaman's plan:

- View: The big positives and one vital negative in Budget 2022:

Share the article

Get Latest Updates on Offers, Event dates, and free Mentorship sessions.

Get in touch with our Expert Academic Counsellors 👋

FAQs

UPSC Daily Current Affairs focuses on learning current events on a daily basis. An aspirant needs to study regular and updated information about current events, news, and relevant topics that are important for UPSC aspirants. It covers national and international affairs, government policies, socio-economic issues, science and technology advancements, and more.

UPSC Daily Current Affairs provides aspirants with a concise and comprehensive overview of the latest happenings and developments across various fields. It helps aspirants stay updated with current affairs and provides them with valuable insights and analysis, which are essential for answering questions in the UPSC examinations. It enhances their knowledge, analytical skills, and ability to connect current affairs with the UPSC syllabus.

UPSC Daily Current Affairs covers a wide range of topics, including politics, economics, science and technology, environment, social issues, governance, international relations, and more. It offers news summaries, in-depth analyses, editorials, opinion pieces, and relevant study materials. It also provides practice questions and quizzes to help aspirants test their understanding of current affairs.

Edukemy's UPSC Daily Current Affairs can be accessed through:

- UPSC Daily Current Affairs can be accessed through Current Affairs tab at the top of the Main Page of Edukemy.

- Edukemy Mobile app: The Daily Current Affairs can also be access through Edukemy Mobile App.

- Social media: Follow Edukemy’s official social media accounts or pages that provide UPSC Daily Current Affairs updates, including Facebook, Twitter, or Telegram channels.