Tuesday, 22nd February 2022

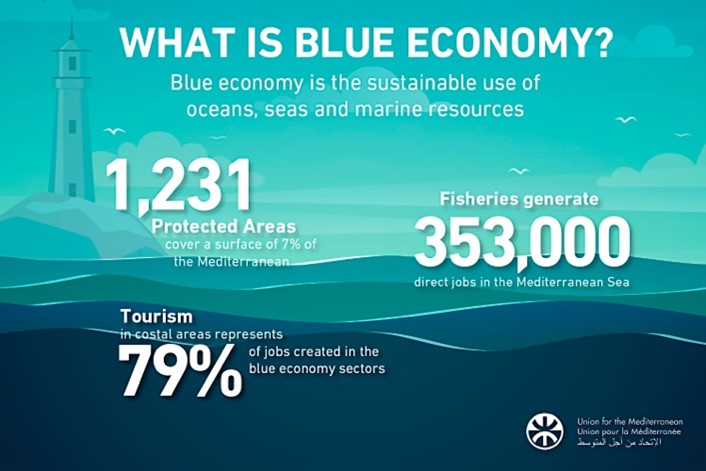

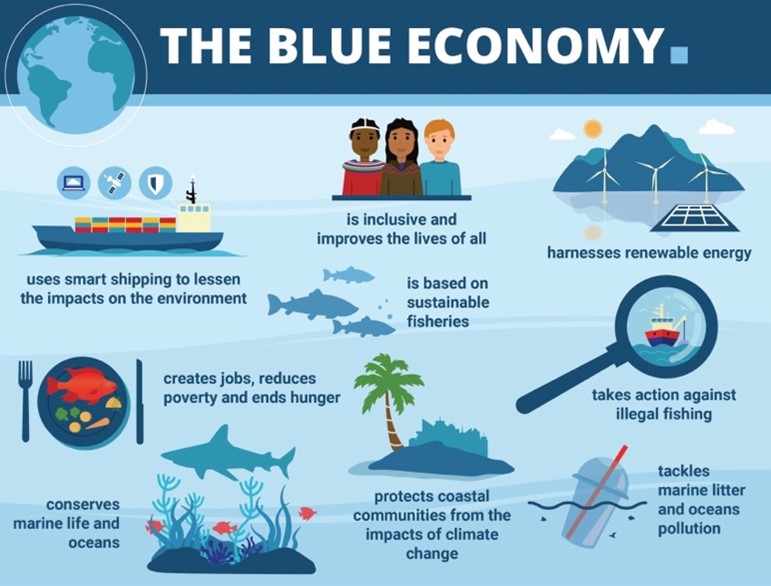

Agreement on Blue economy

In News

Ministry of External affairs have recently signed an agreement with France on roadmap to enhance bilateral exchanges on blue economy and ocean governance.

About the News

- The agreement also supports a common vision of ocean governance based on the rule of law and cooperate on sustainable and resilient coastal and waterways

- Besides, India and France are also committed to promoting cooperation between the European Union through “EU-India Strategic Partnership: A Roadmap to 2025” and the EU strategy for cooperation in the Indo-Pacific.

What are the major highlights of the agreement?

- Rule-based Sea: Both countries aim to contribute to scientific knowledge and ocean conservation and ensure that the ocean remains a global common.

- Contribution to SDG: Contribute to the Sustainable Development Goal in an attempt to conserve and sustainably use the oceans, seas and marine resources.

- Sustainable fishing: The two sides have called for a sustainable approach to fishing to ensure decent living conditions to professionals of the sector, while conserving the resource in the medium and long terms.

- Coordination on global platforms: India and France will coordinate their positions in multilateral bodies and negotiations to strengthen international law of the sea and adapt to new challenges including marine plastic waste and microplastic.

- Modern farming: France and India to work on commercial development of new farming technologies, joint development in the farming of marine organisms for food, and other products such as pharmaceuticals and jewellery, in a way that does not harm the environment.

- Resilient infrastructure: Both sides to encourage sharing of knowledge and methodologies for upgrading current infrastructure, increasing their resilience to climate change, increasing port capacity, developing storage facilities, plug and play infrastructure in the ports

- Cooperation in R&D: The two countries will seek private funding to establish an R&D Centre to support joint projects and will endeavour to spur and support projects on blue economy and knowledge about the ocean under the Indo-French Centre for the Promotion of Advanced Research (CEFIPRA/IFCPAR).

For Article related to this topic, refer:

- https://edukemy.com/current-affairs/gazette/2022-02-15/one-ocean-summit

- https://edukemy.com/current-affairs/gazette/2021-06-17/deep-ocean-mission

- https://edukemy.com/current-affairs/gazette/2021-12-15/bringing-the-indian-and-pacific-oceans-together-on-iuu-fishing-orf

- https://edukemy.com/current-affairs/gazette/2021-06-04/developing-the-sister-islands-of-indian-ocean

- https://edukemy.com/current-affairs/kosmos/2021-12-04/strategic-importance-of-free-and-open-indo-pacific-foip-for-india

- https://edukemy.com/current-affairs/gazette/2021-11-29/o-smart-scheme

Sources:

EPR Rules for plastic packaging

In News

Environment Ministry has notified comprehensive guidelines on Extended Producer Responsibility (EPR) for plastic packaging under the new Plastic Waste Management (Amendment) Rules, 2022.

What is EPR?

- Extended Producer Responsibility (EPR) is a policy approach under which producers are given a significant responsibility – financial and/or physical – for the treatment or disposal of post-consumer products.

- Assigning such responsibility could in principle provide incentives to prevent wastes at the source, promote product design for the environment and support the achievement of public recycling and materials management goals.

Need for EPR in plastic packaging

- To eliminate single-use plastics: By holding the producer responsible for recycling, there will be an increased use of recyclable packaging, thereby moving towards the elimination of single-use plastic.

- To strengthen circular economy: The EPR guidelines provide a framework to strengthen the circular economy of plastic packaging waste.

- Alternatives to plastic: EPR will lead to investment in the development of new alternatives to plastics in India.

Details of the guidelines

- The new rules classify plastics into four categories:

- category 1: rigid plastic packaging;

- category 2: flexible plastic packaging of single layer or multilayer (more than one layer with different types of plastic), plastic sheets and covers made of plastic sheet, carry bags etc.

- category 3: Multi-layered plastic packaging (at least one layer of plastic and at least one layer of material other than plastic)

- category 4: plastic sheet or like used for packaging as well as carry bags made of compostable plastics.

- With respect to plastic packaging, the EPR covers reuse, recycling, use of recycled plastic content and end of life disposal by producers, importers and brand-owners.

- The entities covered under the EPR guidelines include plastic packaging producers, importers, brand owners, online platforms and marketplaces and supermarkets and MSME retail chains.

- A centralised online portal by Central Pollution Control Board (CPCB), for the registration as well as filing of annual returns by producers, importers and brand-owners, plastic waste processors of plastic packaging waste, would be established.

- It will act as the single point data repository with respect to orders and guidelines related to implementation of EPR for plastic packaging under Plastic Waste Management Rule, 2016.

- Environmental compensation shall be levied based upon polluter pays principle, with respect to non-fulfilment of EPR targets.

- The unfulfilled EPR obligations for a particular year will be carried forward to the next year for a period of three years even after payment of compensation.

- As per the new notification, the government has announced setting up of a committee which shall be constituted by the CPCB under chairpersonship of CPCB chairman, to recommend measures to the environment ministry for effective implementation of EPR, including amendments to EPR guidelines.

For Article related to this topic, refer:

- https://edukemy.com/current-affairs/gazette/2021-10-28/plastic-waste-management-pwm

- https://edukemy.com/current-affairs/gazette/2021-06-22/global-trade-and-marine-pollution

- https://edukemy.com/current-affairs/gazette/2021-11-11/plastic-waste-due-to-covid-19

- https://edukemy.com/current-affairs/gazette/2021-10-01/efforts-of-an-ifs-officer-in-curbing-plastic-waste

- https://edukemy.com/current-affairs/gazette/2021-09-13/plastic-waste-management-power-of-3

Sources:

Synthetic Biology - Edukemy Current Affairs

In News

The central government is working on a national policy on synthetic biology, an emerging science that deals with engineering life forms for a wide range of applications.

What is Synthetic Biology?

- Synthetic biology is the design and construction of new biological entities such as enzymes, genetic circuits, and cells or the redesign of existing biological systems.

- It is an emerging field which combines the advancements in biotechnology like CRISPR and next generation sequencing (NGS) technologies, biochemical engineering, genomics like Digital Sequence Information (DSI), information technology and others.

- Some examples of what scientists are producing with synthetic biology are:

- Yeast engineered to create natural products in a lab such as vanillin, a vanilla seed product.

- Making of natural compounds such as artemisinin used for the treatment of malaria and Car T cell therapy for cancer treatment.

- In Fashion sector like dyeing jeans without producing hazardous waste.

- To deliver fixed nitrogen to plants instead of using fertiliser and engineering microbes to create food additives or brew proteins.

- In synthetic biology, scientists typically stitch together long stretches of DNA and insert them into an organism's genome. These synthesized pieces of DNA could be genes that are found in other organisms or they could be entirely novel.

Why are Regulations needed?

- Biosafety Concerns: Considering the multifarious applications of synthetic biology like energy, agriculture and biofuels, there is always a perceived threat of components releasing into the open environment raising concerns of biosafety and biosecurity.

- Patent and Trademark: Synthetic Biology products and related components are likely to attract protection on four of the mainstream forms of intellectual property rights (IP) such as patents, copyrights, trademarks and trade secrets at both national and international level.

- Ethical Concerns: There are concerns regarding the potential harms and benefits to society and environment if humans begin to manipulate entire genome sequences of organisms.

National and International Regulations related to the field

- With respect to biosafety, relevant international treaties that are applicable include the World Trade Organization’s (WTO) 1995 Agreement on the Application of Sanitary and Phytosanitary Measures (SPS) and the Convention on Biological Diversity’s (CBD) Cartagena Biosafety Protocol.

- In India, the 1989 Rules for manufacture, use, import, export and storage of hazardous microorganisms/genetically engineered organisms or cells is jointly implemented by the Ministry of Environment and Forests (MoEF) and the Department of Biotechnology (DBT) under the Ministry of Science and Technology.

- Due to opposition from several interest groups in India, the proposed Biotechnology Regulatory Authority of India Bill is pending approval in Parliament since 2013.

- Currently, approvals for such crops come from the Genetic Engineering Appraisal Committee (GEAC) under the Ministry of Environment, Forest and Climate Change and Review Committee on Genetic Manipulation (RCGM) under the Department of Biotechnology.

For Articles related to this topic, refer:

- https://edukemy.com/current-affairs/gazette/2021-08-02/biotech-pride

- https://edukemy.com/current-affairs/gazette/2021-08-05/driving-the-energy-economy-through-bio-fuels

- https://edukemy.com/current-affairs/gazette/2021-06-08/ethanol-blending

- https://edukemy.com/current-affairs/gazette/2021-09-11/methanol-economy

- https://edukemy.com/current-affairs/kosmos/2022-01-15/potential-and-advantages-of-biofuels-in-india

- https://edukemy.com/current-affairs/gazette/2021-11-09/no-scientific-basis-to-gm-crops-regulation-th

Sources:

First Cotton Mill

On 22 February 1854, Cowasji Nanabhai Davar started First Cotton Mill named “The Bombay Spinning Mills”. Prior to the middle of the nineteenth century, India used to export cotton to Britain and later re-imported the textile. The First Cotton Mill set the stage for the safety of industrial capital in India. Impressed by his entrepreneurship, a good number of people like Wadias and the Tatas started investing in industries. Additionally, by 1870 there were 13 mills, exclusively in Bombay. The cotton textile industry made rapid progress in the second half of the 19th century and by the end of the century, there were 178 cotton textile mills. It was also the second largest employment generator after agriculture in India. The Indian Textile Industry today has approximately 1,200 textile mills in India. Currently, India is the largest producer of cotton in the world accounting for about 22% of the world cotton production.

Source:

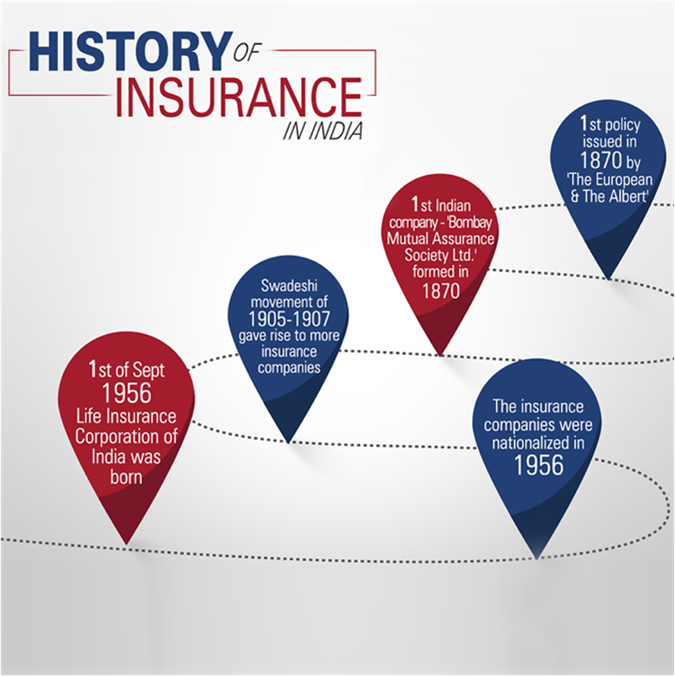

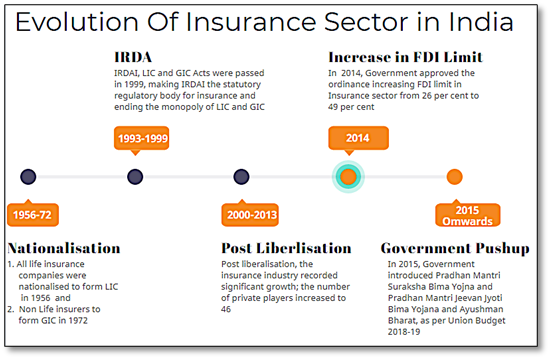

Insurance Sector in India

In News

As per the Economic Survey 2021-22, the insurance penetration India has steadily increased to 4.2 per cent in 2020 from 2.71 per cent in 2001.

Insurance Sector in India

- Insurance is a legal agreement or contract between an insured and insurer that offers protection against any kind of loss with the latter compensating for the loss the former has incurred.

- Origins of Insurance in India: Insurance has a deep-rooted history in India. It can be seen from the writings of Manu (Manusmrithi), Yagnavalkya (Dharmasastra) and Kautilya (Arthasastra). The writings mention the concept of pooling of resources that could be re-distributed in times of calamities and disasters such as fire, floods, epidemics and famine.

- Categories: The Insurance Sector in India is divided into two categories – Life Insurance and Non-life Insurance, also termed as General Insurance. Life insurance companies offer coverage to the life of the individuals, whereas the general insurance companies offer coverage with our day-to-day living like travel, health insurance, vehicles, home insurance and industrial equipment’s.

- Insurance Companies: Currently there are 57 insurance companies (24 life insurance and 33 non-life insurance) in India, out of which 46 are from the private sector.

- FDI in Insurance Sector: The government of India has allowed 100% FDI for insurance intermediaries and 74% FDI in insurance sector to liberalize the sector.

- Regulation: Both the Life Insurance and the Non-life Insurance is regulated by the IRDAI (Insurance Regulatory and Development Authority of India).

- It is an Autonomous body, setup in 1999, on the recommendations of R N Malhotra committee.

- It is tasked with the regulation of the insurance sector in India.

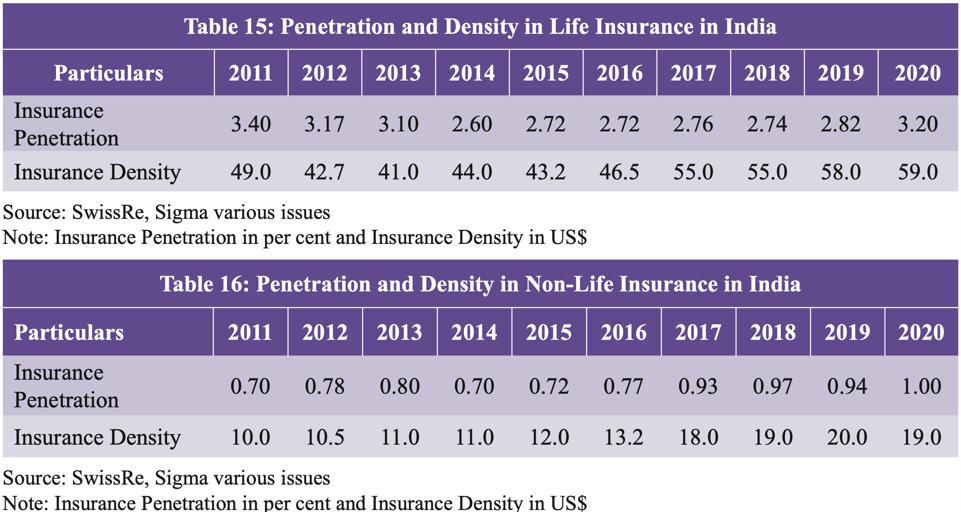

Status of Insurance Sector in India

Internationally, the potential and performance of the insurance sector are generally assessed on the basis of two parameters, viz., insurance penetration and insurance density.

- Insurance penetration is measured as the percentage of insurance premium to GDP.

- 2% is India’s insurance penetration compared to the global average of 7.4%.

- Insurance density is calculated as the ratio of premium to population (measured in US$ for convenience of international comparison).

- The insurance density in India increased from $11.5 in 2001 to $78 in 2020.

- As of 2020, the penetration for life insurance in India is 3.2 per cent and non- life insurance penetration is 1 per cent. While India is at par with international average in terms of insurance penetration for life insurance, we lag behind in terms of non-life insurance. Globally, insurance penetration was 3.3 per cent for the life segment and 4.1 per cent for the non-life segment in 2020.

- Average growth rate of insurance sector in India is around 12%.

- Mortality protection gap in the insurance sector in India is 83%, indicating huge potential of this sector.

Inportance of the Insurance Sector

- Provide safety and security: Insurance provide financial support and reduce uncertainties in business and human life. It provides safety and security against particular event.

- Generates financial resources: Insurance generate funds by collecting premium. These funds are invested in government securities and stock. These funds are gainfully employed in industrial development of a country for generating more funds and utilised for the economic development of the country.

- Life insurance encourages savings: Life insurance enables systematic savings due to payment of regular premium. Life insurance provides a mode of investment. It develops a habit of saving money by paying premium.

- Promotes economic growth: Insurance generates significant impact on the economy by mobilizing domestic savings. Insurance turn accumulated capital into productive investments. Thus, insurance plays a crucial role in sustainable growth of an economy.

- Medical support: Medical Insurance is one of the insurance policies that cater for different type of health risks. The insured gets a medical support in case of medical insurance policy.

- Spreading of risk: Insurance facilitates spreading of risk from the insured to the insurer. The basic principle of insurance is to spread risk among a large number of people. A large number of persons get insurance policies and pay premium to the insurer. Whenever a loss occurs, it is compensated out of funds of the insurer.

Factors which led to the growth of insurance sector in India

- Important government policies and initiatives: The General Insurance Business (Nationalisation) Amendment Act, 2021 which promotes greater private sector participation.

- PM Jan Arogya Yojana: It is the largest health insurance/assurance scheme fully financed by the government.

- Atal Bimit Vyakti Kalyan Yojana: Unemployment relief being provided to the workers covered under the Employees’ State Insurance Scheme.

- PM fasal Bima Yojana: t is a government sponsored crop insurance scheme that integrates multiple stakeholders on a single platform.

- Mahatma Gandhi Bunker Bima Yojana: To provide enhanced insurance cover to the handloom weavers in case of natural as well as accidental death and also higher sum assured.

- Strong democratic and demographic factors: Younger working population proportion & rise in nuclear family structures is driving insurance coverage. It helps in creating robust demand.

- Conducive regulatory environment by IRDAI: Permitting insurers to conduct video-based KYC, launching standardized insurance products (Corona Rakshak, Corona Kavach, Saral Jeevan Bima) and issuance of Digital Insurance Policies via DigiLocker.

- IRDAI has allowed insurers to invest in debt securities issued by infrastructure investment trusts (InvITs) and real estate investment trusts (REITs). This will improve the overall yield of the portfolios held by these insurance companies and at the same time, provide more long-term funds to the realty sector.

- Product innovations: Different innovative customised products have been launched by insurance companies like emdowment plans, whole life plans, unit linked insurance plans, etc.

- Vibrant distribution channels: Bancassurance agreements (Bancassurance is an arrangement between a bank and an insurance company allowing the insurance company to sell its products to the bank's client base. ) and partnerships for cross-selling of products, insurance brokers, broker networks, digital platforms (web-aggregators currently originate 30-40% of digital insurance), common service centres, etc.

Challenges in India’s Insurance sector

- Huge Insurance Gap:Insurance penetration is low in comparison with global levels. Large sections of Indian population are uninsured and hence depicts an insurance gap.

- Domination of Public Sector:Although there has been a transition in the insurance sector from being an exclusive State monopoly to a competitive market, still public-sector insurance companies hold a greater market share even though they are fewer in number.

- Budding Non-life Insurance:The share of Life insurance sector is huge (74.7%) as compared to the non-life insurance sector (25.3%).

- Rural-Urban Divide: Rural participation of insurers remains deficient, and life insurers, especially private ones, gravitate towards the urban population.

- Capital Starved Insurers:Insurers in India lack sufficient capital, and their financial health, particularly that of the public-sector insurers, is in a precarious state. Further, the crisis in the overall banking and the NBFCs sectors affected the growth.

- Multiplicity, duplication and redundancy of government sponsored insurance schemes has resulted in the division of the risk pool.

- The ‘missing middle’ between the deprived poorer sections and the relatively well-off neither qualify under subsidised health insurance (for poor) nor social health insurance (for organized sector) schemes.

Way Forward

- Inclusive Approach:Insurance companies in India will have to show long-term commitment to the rural areas and urban poor to increase the penetration rates and will have to design products which are accustomed to their needs.

- Government insurance schemes such as Pradhan Mantri Jan Arogya Yojana, Pradhan Mantri Fasal Bima Yojana, Pradhan Mantri Suraksha Bima Yojana, and Pradhan Mantri Jeevan Jyoti Bima Yojanaare steps in the right direction.

- Conducting Awareness Programs:There is a need for complementary thrust to spread awareness and improve financial literacy, particularly the concept of insurance, and its importance.

- Use of Technology:Another area that necessitates regulatory scrutiny is that of application of technology in insurance. An example is the emergence of ‘InsurTech’, designed to make the claim process simpler and more comprehensible.

- Expanding private voluntary insurance through commercial insurers.

- Multiple distribution channels: Linking insurance with allied finance productslike housing loan, mutual fund investment, banks credit cards etc are the new channels for life insurance.

- Huge potential: The demographics and macro-economic factors in India are diverseand insurance systems have to be aligned to other programmes in the country in order to target every section.

- Enabling Role of Regulator: It must ensure that insurance is not denied to lower-income people who make up the bulk of the population and have the most need for protection. It can facilitate a simple online process for direct buying of insurance products, bypassing intermediaries.

Conclusion: Demographic factors, coupled with financial literacy and awareness, are likely to enhance the growth of the sector. Increased partnerships and enhanced regulatory regime that focuses on increasing insurance coverage to tap the huge potential of the Indian population is the need of the hour. Increased awareness levels, enabling digitalised payments infrastructure, advent of ecosystems, big data, journey simplification and overall digital enablement will be some broad items which will drive the growth story.

For articles related to this topic, refer:

- https://edukemy.com/current-affairs/gazette/2021-09-24/cyber-insurance

- https://edukemy.com/current-affairs/gazette/2021-11-02/pradhan-mantri-jan-arogya-yojana-pmjay

- https://edukemy.com/current-affairs/gazette/2021-05-28/new-rules-for-increased-fdi-in-insurance-sector

- https://edukemy.com/current-affairs/gazette/2022-01-06/domestic-systemically-important-insurers

- https://edukemy.com/current-affairs/gazette/2021-11-12/time-to-step-up-cover-for-natural-calamities-bl

Question: Discuss the Status of Insurance sector in India and reasons for its rise in the country.

Sources:

- LIC, GIC, New India Assurance identified as D-SIIs:

- Insurance:

- Monetary Management and Financial Intermediation:

- Importance of Insurance:IRDAI:

- India’s insurance sector: challenges and opportunities:

- India’s insurance sector: challenges and opportunities:

- Indian Insurance Industry Overview & Market Development Analysis:

- Economically Vulnerable:

- The Role and Importance of Insurance – Explained!:

- BFSI – Insurance:

- Exploring Insurance Sector in 2021:

- Track the evolution of Insurance industry over the years in India!:

Aardvark

This is image of an aardvark that was born at a zoo in the United Kingdom for the first time in 90 years. It has been named Dobby. Dobby is a female aardvark who was born on January 4. The calf, born with large droopy ears, hairless wrinkled skin and giant claws, is currently being hand-reared every evening by zookeepers. Aardvark, also called antbear, are stocky African nocturnal, burrowing mammals found south of the Sahara Desert in savanna and semiarid areas. The name aardvark—Afrikaans for “earth pig”—refers to its piglike face and burrowing habits. The aardvark’s diet consists almost entirely of ants and termites. The animal is listed as "least concern" by the IUCN, although its numbers are decreasing.

Sources:

Plastic that is stronger than steel

- Context: MIT engineers invent plastic that is stronger than steel.

- The new type of plastic that is twice as strong as steel and could one day be used as a building material.

- Dubbed 2DPA-1, the material is light and mouldable like plastic but has a strength and resistance that the researchers behind the project liken to steel and bulletproof glass.

- Its yield strength, or the force it takes to break it, is twice that of steel, although it has only about one-sixth of the material density, making it light.

- 2DPA-1 is a polymer, a category of substance that encompasses all kinds of plastics. But whereas all other polymers grow in one-dimensional chains, with new molecules being added onto their ends, 2DPA-1 grows in two dimensions, forming a sheet called a polyaramide.

- Another promising quality of 2DPA-1 is that it can be easily made in large quantities. Similar to other plastics, 2DPA-1 is manufactured at room temperature, so it doesn't require vast amounts of heat.

- The most immediate commercial application for 2DPA-1, according to the researchers, is as an ultrathin barrier coating that could be applied to cars, phones or other objects to make them stronger and more durable.

Source:

Gobar-Dhan plant

- Context: The PM of India inaugurated a 550-tonne capacity 'gobar-dhan' Bio-CNG plant in Madhya Pradesh's Indore.

- The plant, named as Govardhan plant, is based on the concept of waste-to-wealth innovation.

- It is expected to produce around 17,000 kg per day of CNG and 100 tonnes per day of organic compost.

- The plant is based on zero-landfill models, whereby no rejects would be generated.

- The project is expected to yield multiple environmental benefits- reduction in greenhouse gas emissions, providing green energy along with organic compost as fertilizer.

- Indore Municipal Corporation will purchase a minimum of 50 per cent of CNG produced by the plant and in a first-of-its-kind initiative, run 400 city buses on the CNG. The balance quantity of CNG will be sold in the open market.

- Indore Clean Energy Pvt Ltd, a Special Purpose Vehicle created to implement the project, was set up by Indore Municipal Corporation (IMC) and Indo Enviro Integrated Solutions Ltd. (IEISL) under a Public-Private Partnership model, with a 100 per cent capital investment of Rs 150 crores by IEISL.

Source:

ICRISAT

- Context: International Crops Research Institute for the Semi-Arid Tropics (ICRISAT) is celebrating its 50th year of establishment.

- ICRISAT was established on March 28, 1972, as part of a global institutional framework to share scientific agricultural breakthroughs and innovations that help overcome poverty, malnutrition and environmental degradation in the harshest dryland regions of the world.

- The International Crops Research Institute for the Semi-Arid Tropics (ICRISAT) is a non-profit, non-political organization that conducts agricultural research for development in the drylands of Asia and sub-Saharan Africa. Covering 6.5 million square kilometers of land in 55 countries, the semi-arid or dryland tropics has over 2 billion people, and 644 million of these are the poorest of the poor.

- The ICRISAT global headquarters is located in Patancheru near Hyderabad, Telangana, India. The Institute collaborates closely with the Indian Council of Agricultural Research (ICAR).

- In 2007 ICRISAT’s early advocacy for climate resilient crops and climate awareness delivered the Noble Peace Prize to ICRISAT. In 2011 – ICRISAT launched Agribusiness and Innovation platform.

Source:

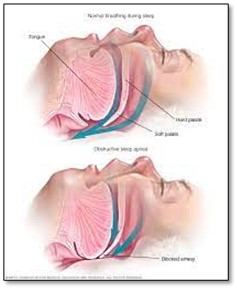

Obstructive sleep apnea

- Context: Singer and music composer Bappi Lahiri, who passed away recently, was was suffering from obstructive sleep apnea (OSA).

- Obstructive sleep apnea is the most common sleep-related breathing disorder. It causes one to repeatedly stop and start breathing while asleep.

- Obstructive sleep apnea occurs when the muscles that support the soft tissues in your throat, such as your tongue and soft palate, temporarily relax. When these muscles relax, your airway is narrowed or closed, and breathing is momentarily cut off.

- In adults, the most common cause of obstructive sleep apnea is excess weight and obesity, which is associated with the soft tissue of the mouth and throat.

- Roughly 34 million Indians suffer from obstructive sleep apnea and the prevalence rate is at 14 per cent in men and 12 per cent in women.

Source:

India’s Ukraine dilemma: IE

Essence: The article discusses the current Ukrain crisis and analyses India’s position w.r.t. to this situation. As per the author, India cannot view Central Europe through the prism of Russia’s conflict with the West. Central Europe is no longer just a piece of land but has its own identity and the potential to reshape the European geopolitics.

As per the author, for any deal between the West and Russia to work it must be acceptable to Ukraine. India has not yet publicly cautioned Russia against invasion of Ukraine, repeating its early stance of not denouncing Soviet invasion of Hungary in 1956 and Czechoslovakia in 1968.

India is dependent on Russia`s military supplies in its conflict with China. However, it would be difficult to justify not denouncing if Russia chooses to invade Ukraine and at the same time condemn China`s violation of territorial sovereignty of its Asian neighbours.

Five factors which need to determine the geopolitics of Central Europe are

- Russia’s claim for a broad sphere of influence has no takers in Central Europe.

- Legitimate security interests of Russia in Central Europe can only be realised through political accommodation.

- Central Europeans bet that NATO, led by the US, is a better option than a Europe that is independent of US.

- Central Europeans resent any attempt by the US and EU to impose political values that run against their traditional cultures.

- Central Europeans are eager to develop sub-regional institutions (Visegrad Four and Three Seas Initiative) that can enhance their identity.

Why should you read this article?

- To understand India`s position and changing strategic significance of Central Europe.

- To know about the demands of Putin to the US and NATO and the reasons.

- To know about India`s position towards Soviet invasion of Hungary in 1956 and Czechoslovakia in 1968.

- To understand the concept of limited sovereignty and its practise by Russia.

- To know about the factors to evaluate the geopolitics of Central Europe.

Source:

India’s maritime security coordinator has his mission cut out: ORF

Essence: The editorial talks about the roles and responsibilities of the newly appointed India’s National Maritime Security Coordinator. The post of NMSC was recommended since Kargil war times and further cemented during the 2008 Mumbai terrorist attacks. Though the mandate of NMSC has not been clearly mentioned, their prime responsibility would be to ensure coordination and harmonized functioning of state organs in maritime security- Coast Guard, Indian Navy, State Marine Police and possibly a new Central Marine Police Force. Another guiding light for this institution would be the SAGAR mantra and five principles for marine safety- removing barriers to maritime trade, peaceful settlement of disputes, readiness to collectively face natural disasters, threats from non-state actors, preserving maritime environment and resources, encouraging responsibly maritime connectivity.

What India needs is increase in number of marine police stations, patrol boats, shore-based infrastructure alongside focus and crackdown on human trafficking, illegal fishing, marine pollution and climate-change issues and terrorism. Coastal radars, automatic identification system (AIS) on small boats for better marine traffic awareness and data sharing, intelligence gathering is the need.

Why should you read this article?

- To understand the role of newly appointed National Maritime Security Coordinator.

- To know the various kinds of threats and possible alternatives for India in maritime domain.

Source:

Digital ecosystems: Who should finance what?: HT

Essence: India Enterprise Architecture 2.0 report released by Ministry of electronics and information technology (MeitY) is notable for its omission of discussion on financing model for digital platforms. Most civil society debates and government critique tend to avoid in-depth discussions on how digital public infrastructure should be financed — largely because the conceptual framework for financing is not fully developed. There are arguments in favor of and against all three models i.e government led model, market financed model and philanthropy.

Author is of the opinion that in the absence of “one size fit for all” solutions, different parts of the ecosystem should be financed differently. More dynamic technologies should be privately funded to allow for faster decision making while public financing should be preferred for technologies whose immediate profit prospect is less visible.

Why should you read this article?

- To understand different financial models available for developing digital platforms.

- To understand opportunities and challenges associated with all.

Source:

Public toilet in new light

Background

Public toilets and sanitization in slum areas are urgent and important issues that need attention, especially in the times of pandemic.

Development of largest public toilet in India

- Recently, a two-storey building has been constructed in Dharavi, a slum area of Mumbai, over a span of 6000 sq. feet.

- Named as the Suvidha Centre, it is the largest public toilet block in India.

- It consists of 111 toilet seats, shower rooms, washing machines, cold and hot water dispensers, sanitary napkin vending machines, and night-time facilities.

- The well-lit corridors of the facility, which is lacking in most of the public toilets, makes the Suvidha Centre a secure place for women.

- The rates of usage is minimal and token cards can be generated for the families on monthly basis.

- Cleaning of the toilet is given utmost importance to keep the zone sanitized and cleaned.

Quote: “The city shall be cleared of any dirt, if every community acts collectively.”― Lailah Gifty Akita

Source:

Share the article

Get Latest Updates on Offers, Event dates, and free Mentorship sessions.

Get in touch with our Expert Academic Counsellors 👋

FAQs

UPSC Daily Current Affairs focuses on learning current events on a daily basis. An aspirant needs to study regular and updated information about current events, news, and relevant topics that are important for UPSC aspirants. It covers national and international affairs, government policies, socio-economic issues, science and technology advancements, and more.

UPSC Daily Current Affairs provides aspirants with a concise and comprehensive overview of the latest happenings and developments across various fields. It helps aspirants stay updated with current affairs and provides them with valuable insights and analysis, which are essential for answering questions in the UPSC examinations. It enhances their knowledge, analytical skills, and ability to connect current affairs with the UPSC syllabus.

UPSC Daily Current Affairs covers a wide range of topics, including politics, economics, science and technology, environment, social issues, governance, international relations, and more. It offers news summaries, in-depth analyses, editorials, opinion pieces, and relevant study materials. It also provides practice questions and quizzes to help aspirants test their understanding of current affairs.

Edukemy's UPSC Daily Current Affairs can be accessed through:

- UPSC Daily Current Affairs can be accessed through Current Affairs tab at the top of the Main Page of Edukemy.

- Edukemy Mobile app: The Daily Current Affairs can also be access through Edukemy Mobile App.

- Social media: Follow Edukemy’s official social media accounts or pages that provide UPSC Daily Current Affairs updates, including Facebook, Twitter, or Telegram channels.