Thursday, 3rd February 2022

The Budget

In News

The Budget 2022-23 was presented by the Finance minister on February 1, 2022.

About Budget

- Under Article 112 of the Constitution, a statement of estimated receipts and expenditure of the Government of India has to be laid before Parliament in respect of every financial year which runs from 1st April to 31st March. This statement titled “Annual Financial Statement” is the main Budget document.

- The Budget gives the government’s blueprint on expenditure, taxes it plans to levy, and other transactions which affects the economy and lives of citizens.

- With pandemic looming over economy, the Budget for the year 2022 is expected to address concerns around growth, inflation and

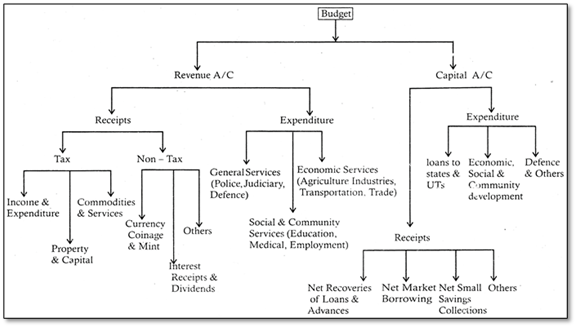

What are the various components of the Budget?

- Expenditure: Total expenditure is broadly divided into capital and revenue expenditure. Capital expenditure is incurred with the purpose of increasing assets of a durable nature or of reducing recurring liabilities.

- Revenue expenditure involves any expenditure that does not add to assets or reduce liabilities.

- Receipts: The receipts of the Government have three components —revenue receipts, non-debt capital receipts and debt-creating capital receipts.

- Revenue receipts involve receipts that are not associated with increase in liabilities and comprise revenue from taxes and non-tax sources.

- Non-debt receipts are part of capital receipts that do not generate additional liabilities. Recovery of loans and proceeds from disinvestments would be regarded as non-debt receipts since generating revenue from these sources does not directly increase liabilities, or future payment commitments.

- Debt-creating capital receipts are ones that involves higher liabilities and future payment commitments of the Government.

- Deficit indicators: Fiscal deficit by definition is the difference between total expenditure and the sum of revenue receipts and non-debt receipts. It indicates how much the Government is spending in net terms.

- Since positive fiscal deficits indicate the amount of expenditure over and above revenue and non-debt receipts, it needs to be financed by a debt-creating capital receipt.

- Primary deficit is the difference between fiscal deficit and interest payments. Revenue deficit is derived by deducting capital expenditure from fiscal deficits.

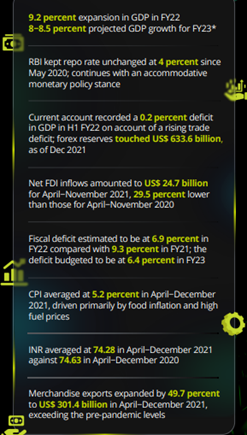

What are the major indicators of Budget?

- Debt-to-GDP: The debt-to-GDP ratio is the ratio of a country's public debt to its gross domestic product (GDP). The higher the debt-to-GDP ratio, the less likely the country will pay back its debt and the higher its risk of default. For India, debt is estimated to be at 62% of GDP at the end of FY22.

- Tax-to-GDP ratio: It is a measure of a nation's tax revenue relative to the size of its economy. This ratio is used with other metrics to determine how well a nation's government directs its economic resources via taxation. For India, it is envisaged to be 8% in FY22.

- Deficit-to-GDP ratio: In the 2021-22, the government pegged the fiscal deficit at 8 per cent of GDP or Rs 15.06 lakh crore.

Sources:

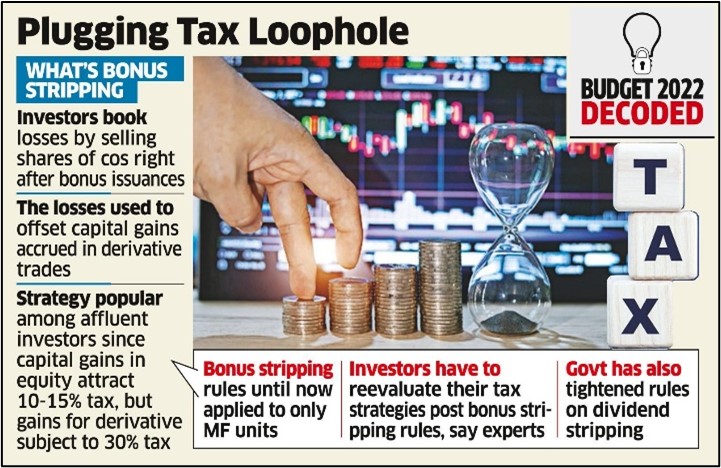

Bonus stripping

In News

Budget 2022 has proposed to include shares and units of Infrastructure Investment Trust (InvIT) or Real Estate Investment Trust (Reit) or Alternative Investment Funds (AIFs) in the anti-avoidance provisions of the Income Tax Act related to bonus stripping.

Bonus Stripping

- Bonus stripping is an act of buying the units of a fund with an intent to earn bonus units and thereafter sell original units at reduced prices. This is to use the loss incurred on sale of original units to set-off against other capital gains.

- Investors initially acquire units before company makes any bonus issue.

- For example, investor buys 500 shares, ₹100 per share, of a company which is going to issue bonus units in the ratio of 1:1. Total Cost of buying is ₹50,000.

- Once they issue the bonus units, the investors sell the original units, which they had held earlier. This can lead to short term capital loss.

- Investor gets bonus issue of 500 shares. Price per share falls to ₹50. Investor sells original 500 shares at a loss of ₹25000. This loss is claimed to reduce the income tax to be paid by the investor.

- Later, after holding the bonus units for a long time, they dispose of the bonus units. This is called Bonus stripping. The investors enjoy two-fold benefits.

- Investor sells bonus shares. Since the cost of acquisition of bonus units is Nil, the entire proceeds received from the sale of bonus units would be his long-term capital gains.

- Moreover, the capital held by the investor i.e., the bonus share is valued at the loss incurred, in this case ₹25000. Thus, the taxable income is further reduced.

Dividend Stripping

- This also works similar to bonus stripping but instead of selling stock ex-bonus, investors sell shares after dividend announcement to book losses that are set off against gains.

- Tax rules state that any capital losses can be used to offset capital gains made for eight years.

Existing Income Tax Rules

- Investors indulge in activities like tax stripping to optimize the total tax outgo.

- To check such activities by investors, the Income Tax Act has a section that disallows set-off of loss incurred through bonus stripping against other capital gains.

- Set off of Loss: Section 94 (8) of the Income Tax Act implies that when units are bought within three months prior to the record date of a bonus issue and sell some of the units within nine months after the record date, the loss incurred in such case will be ignored.

- The anti-avoidance section was applicable only for units of mutual fund.

Budget Proposal

- The Budget proposals are basically aimed at avoiding tax losses to the government in case of High-net-worth individuals (HNI), hedge funds, large overseas institutional investors, and family offices that usually follow this system to save on Income tax.

- Listed stocks and mutual fund (MF) units have been covered under the amended provisions of bonus stripping.

- Budget also proposed to revise the definition of units to include units of new pooled investment vehicles such as infrastructure investment trust (InvIT), real estate investment trust (REIT) and alternative investment Funds (AIFs).

- The revised definition of ‘units’ will also make dividend stripping provisions of income tax applicable to units of InvIT or Reit or AIFs.

- The money earned through bonus stripping will be assessed under the income tax from 2022-2023.

Sources:

Data Centres

In News

The Union Budget granted infrastructure status to the data center industry.

About the News

- The infrastructure status to the data centre industry will help companies in availing easier credit and managing resources as the industry seeks to expand outside top cloud regions.

- The massive regulatory need for data localization has fuelled the industry's growth leading to investments from top Internet firms like Microsoft and Google along with home-grown giants like the Adani group.

- This would also help Indian companies in this space to compete with its global peers and thus provide more choice and better service to end clients.

- Tremendous growth is expected in this segment, which would bring in more high-end technical jobs. This can also be a scope for states to attract data center industry, as presently most of it is concentrated in 2-3 regions only.

- The Union Budget-2020 outlined a national data policy, citing the truism that data is the new oil

What is the status of Data centre industry in India?

- Large Internet userbase: With India set to double its internet users from the current 750 million and data consumption from 110 exabytes (a very large unit of computer data storage) by 2025, the sector is set to see aggressive investments from global majors in the coming years driven by central and state government policies that aim to make India the next global data centre hub.

- Promising future: India’s data centre industry has around 499 megawatts (MW) of critical information technology

- As per NASSCOM, India has around 80 third-party data centres and is expected to see investments of around $4.5 billion by 2025.

What are the major challenges faced by this sector?

- Land availability: Problems of availing a land in proximity to a power substation and fibre path, safe distance from residential plots, oil terminals and the availability of quality mass-rapid transport systems. An inevitable rise in land prices in such areas is also a cause for concern.

- Skewed rise: Just seven cities alone account for 490 MW out of 499 megawatts (MW) of critical information technology

- Sustainability: According to the International Energy Agency, data transmission networks consume 260-340 TWh (terawatt-hour) now, or 1 to 1.4 per cent of global electricity use. This rising rate of electricity consumption is a major concern that environmentalists highlight in a country like India.

- Undersea Cables: As far as the availability of undersea cables (submarine cables) embedded with fibre-optics in concerned, Mumbai has an advantage with as many as nine cable landing stations (CLS), followed by Chennai with four, and Ernakulam, Tuticorin and Trivandrum with one each. Besides, five CLS are under construction at Mumbai, three at Chennai and one in Digha.

What can be done?

- Sunset clause: India should have a long-term plan based on Singapore model which had put the brakes on fresh investments when data centres started consuming 7 per cent of its power requirement and were on the road to touch 11 per cent by 2030.

- Tailored data Centres: States should learn from Telangana which was one of the first states to come up with a data centre policy in 2016 leveraging the large pool of IT ecosystem in Hyderabad.

- Sops for companies: States should line up more sops to compensate for this lack — including easy land availability, electricity tax exemption and power at existing industrial tariffs and subsidies to companies that meet at least 30 per cent of their power consumption via renewable energy sources.

- New Central policy: Government should facilitate Nasscom’s suggestions to providing uninterrupted power, enabling consumption of renewable energy 24x7, creating a separate building code for data centres and measures aimed at reducing cable breaks.

Sources:

India’s first Electric Train

On February 3, 1925, first ever electric train in India ran from then Bombay VT (now Chhatrapati Shivaji Terminus Mumbai) to Coorla (now Kurla) on harbour line. The train was electrified on 1500 Volt DC. The first Electric Multiple Unit service with 4-cars was flagged off by Bombay Governor Sir Leslie Orme Wilson. To keep up with Bombay’s (now Mumbai) burgeoning population, eight car rakes were introduced in 1927, nine-car rakes in 1961, 12-car rakes in 1986 and 15-car rakes in 2012. Electric traction was subsequently extended on Central Railway upto Igatpuri on Northeast line and Pune on Southeast line where heavy gradients on the Western Ghats compelled introduction of electric traction. In the post- Independence era, the work of electrification of Howrah - Burdwan section of Eastern Railway taken up on 3000 Volt DC during the Period of 1st Five year Plan was completed in 1958.

Sources:

Ecnomic Survey - Barbell Strategy & Agile Approach: A New Approach to Policymaking

In News

The Economic Survey 2021-22 sets out to explain the “Agile” approach that informed India’s economic response to the Covid-19 shock.

Setting up the Context for a new approach to policymaking

- The Covid-19 pandemic engendered a once-in-a-century global crisis in 2020 – a unique recession where majority of countries experienced a contraction in GDP per capita.

- Faced with unprecedented uncertainty at the onset of the pandemic, India focused on saving lives and livelihoods by its willingness to take short-term pain for long-term gain.

- This strategy was also tailored to India’s unique vulnerabilities to the pandemic.

- First, as the pace of spread of a pandemic depends upon network effects, a huge population inherently enables a higher pace of spread.

- Second, as the pandemic spreads via human contact, high population density, especially at the bottom of the pyramid, innately aids the spread of the pandemic at its onset.

- Third, although the average age is low, India’s vulnerable elderly population, in absolute numbers, exceeds significantly that of other countries.

- Finally, an overburdened health infrastructure exposed the country to a humongous supply-demand mismatch that could have severely exacerbated fatalities.

- Given the ‘black swan event’ marked by sheer uncertainty and once in a century crisis, Indian policymakers followed an approach similar to the Barbell strategy in finance – hedging for the worst outcome initially, and updating its response step-by-step via feedback.

What is Barbell Strategy?

- It is a common strategy used in financial markets to deal with extreme uncertainty by combining two seemingly disparate legs.

- The Barbell strategy combines different safety-nets to cushion the blow on vulnerable sections of society or businesses. It entails a flexible policy response based on a “Bayesian updating of information”.

- In simple words, it uses real-time data to identify, realise and mitigate the risk.

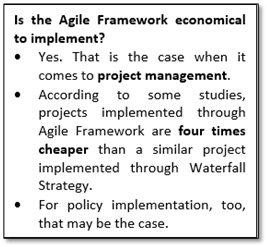

- It is essentially same as the widely-used 'Agile' framework that uses feedback-loops and real-time adjustments. In an uncertain environment, the Agile framework responds by assessing outcomes in short iterations and constantly adjusting incrementally.

What is an Agile Framework?

- It is a framework for project and policy implementation that is considered highly efficient for getting work done.

- It was developed in 2001 and is based on 12 principles which include customer satisfaction, collaboration, adapting to change, feedback loops, breaking project silos, etc.

What was the framework that India followed earlier?

- India and most countries across the world typically follow the Waterfall Approach. This involves analysis of the issue, detailed planning and meticulous implementation. India’s earlier five-year plans were based on this.

- Waterfall Framework is linear and is developed systematically from phase to phase.

- It is said that this approach works best for projects with concrete timelines, well-defined deliverables and little uncertainties.

How did government put Barbell Strategy to use?

- The intensity of Covid-19 pandemic called for a rapidly changing policy approach to cater to the needs of the people. The ever-mutating course of the virus made the Waterfall approach unfit to meet the needs of this unforeseen exigency.

- Understanding the threat posed the virus, the government decided to shift from 'Waterfall' framework to Barbell strategy.

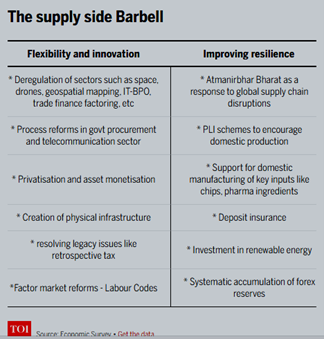

- Hence, the government adopted the two pillars of supply side Barbell Strategy where on one hand it focused on creating flexibility in the economy through deregulation and reforms, thereby allowing the economy to better respond to uncertainty. On the other hand, it focused on improving resilience through various measures like Atmanirbhar Bharat Abhiyan, PLI and more.

Measures adopted

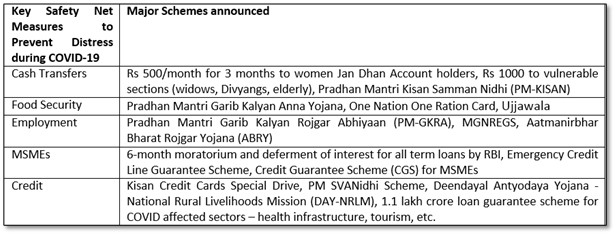

- The flexibility of Agile approach improves responsiveness and aids evolution, but it does not attempt to predict future outcomes. This is why the other leg of the Barbell strategy is also needed. It cushions for unpredictable negative outcomes by providing safety nets.

- Hence the government announced multiple measures, especially catering to the poor and vulnerable sections of the society.

- The survey said imposing stringent lockdown when cases were in March 2020 was the first step towards this approach. It provided the necessary time to ramp up testing infrastructure, create quarantine facilities and so on. Most importantly, it gave time to understand the Covid-19 virus, its symptoms and how it spread.

Why is the Agile Framework preferred today?

- Some form of feedback loop based policy-making was arguably always possible, but the Agile framework is particularly relevant today because of the explosion of real-time data that allows for constant monitoring.

- Over the last 2 years, government leveraged a host of high frequency indicators (HFIs) from departments/agencies as well as private institutions that enabled constant monitoring and iterative adaptations.

- Such information includes GST collections, digital payments, satellite photographs, electricity production, cargo movements, internal/external trade, infrastructure roll-out, delivery of various schemes, mobility indicators, to name just a few.

- These HFIs helped policy makers tailor their responses to an evolving situation rather than rely on pre-defined responses of a Waterfall framework.

Conclusion: While HFIs have the advantage of being real-time and frequent, they need to be used with care. Each indicator provides, at best, a partial view of developments. Moreover the data can be slow moving or can have inaccuracies. In a rapidly evolving situation, policy-makers can pick up useful signals that allow for faster response and better targeting. Thus, using HFIs for gauging trends in the economy to follow an Agile Policy Framework is as much an art as a science.

Question: Explain the Barbell strategy and the Agile framework used by the government of India to overcome the challenges posed by the pandemic.

Sources:

- State of the Economy

- Saving Lives and Livelihoods Amidst a Once-in-a-Century Crisis

- Agile approach, key to India’s economic response to the Covid-19 shock

- Expert Speak: India’s sui generis ‘Agile’ economic policy response

- What is Barbell Strategy?

- Economic Survey: How govt used 'Barbell' strategy, 'Agile' framework to mitigate Covid risk

- How Barbell Strategy, mentioned in last year's Economic Survey, was put to work

- Economic Survey 2021-22 Offers A New Approach To Policymaking

- BL Explainer: What is the ‘Agile Framework’ used in this year’s Economic Survey

Pandya period inscriptions

This is image of inscriptions, which were found at a Vishnu temple in Velankudi village, Tamil Nadu. They are in Tamil and Vattezhuthu language. The Tamil inscriptions belong to the period of early Pandyas. It could be the late 9th Century or the beginning of the 10th Century. The Tamil words are deeply engraved. The inscription talks about ‘Poonguntra Naatu Poongunrathu Kaatanpalli Aivar’. Kaatanpalli could be a Jain school. The message of the inscriptions is that a person, named Thennavan Santhan, from the village made a contribution of ‘Avi Kinaru’. ‘Avi’ is the food offered to god. A well had been dug to supply water to the kitchen of the Jain school. The vattezhuthu inscriptions, comprising 16 lines, explain the donation of a lamp and goats made by Sree Valluvan Kuntrakizhavanaana Anukkan. The ghee produced from the milk of the goats was used for lighting the lamp. It says the shepherds met the local leader and handed over the contribution.

Source:

Buddhavanam Project

- Context: Buddhavanam Project on the banks of River Krishna has been completed and awaits inauguration.

- Buddhavanam Project is a Buddhist tourism project of the Telangana government spread over 275 acres at Nandikonda village of the Nalgonda district, near Nagarjunasagar dam.

- The project is divided into eight segments

- Buddhacharitavanam: It is a themed garden that displays the major events from the life of Gautam Buddh.

- Bodhisattva Park (Jataka Park): Displays the Jataka tales revealing previous births of Buddha symbolically visualizing the six perfections

- Dhyanavanam (Meditation Park): It provides a calm and serene atmosphere with huts and Buddhist architecture. Here, the government of Sri Lanka has erected a 27 ft. high statue of Avukana Buddha.

- Miniature Stupa Park: It has the replicas of famous Buddhist stupas from India and south-east Asia representing regional styles of Buddhist architecture.

- Mahastupa: It has similar dimensions, shape and design of Amravati Stupa

Others: Buddhist University, Buddhist Monasteries from South- East Asian countries and modern museum on the revival of Buddhism in India.

- At the Centre of Buddhavanam is a replica of the original Amaravati Stupa in its original dimensions, shape, and design in the Amaravati School of Art after 1,700 years.

- The project site also has several Mesolithic and Neolithic age grooves hidden in the vast greenery and mountains.

Source:

- Yadadri done, now Maha Stupa takes shape at Buddhavanam

- Buddhavanam project unveils an exciting prospect

- This Buddhist heritage theme park coming up near Hyderabad is a must-visit

Image Source:

CHIRU-2Q22

- Context: China has sent its naval missile destroyer Urumqi to the Gulf of Oman as part of CHIRU-2Q22 exercise.

- CHIRU-2Q22 exercise is a joint naval exercise between Russian, Iranian and the Chinese navies in the Gulf of Oman.

- This maritime drill conducted in the northern parts of the Indian Ocean aimed at deepening the maritime and practical cooperation among the navies of the three countries.

- The joint drill involved 140 vessels, around 60 planes and roughly around 10,000 military troops.

- The countries conducted military artillery fire against the sea targets and took part in tactical manoeuvering alongside the anti – piracy drills during the exercise.

Source:

- China sends destroyer for Russia, Iran naval drill in Gulf of Oman

- Chiru naval drills ongoing Russian ministry

- Iran, China and Russia hold naval drills in north Indian Ocean

Image Source:

Indian Environment Services

- Context: The Supreme Court has sought the Centre’s response on a plea for creation of “The Indian Environment Service” on the lines of All India Service for environment safeguards at the ground level.

- A report that recommended the creation of the “Indian Environment Service” was submitted by the High-Level Committee formed under the chairmanship of T S R Subramanian in 2014.

- This was in the backdrop of the constant degradation of our ecosystem and the pressing need for special attention from the Civil Services to address the issue as there was lack of a specialized cadre for implementation of environmental policies and regulations.

- The other recommendations of the report included:

- Changes to almost all laws related to environment, forest and coastal areas.

- Creation of an “umbrella” law that subsumes the existing environmental laws

-

- Protected areas and forests with over 70% of the tree coverage should be declared as ‘No GO’ areas.

-

- More expertise and time to review environmental laws and its enforcement for better outcome etc.

- All the recommendations were aligned with Government’s sustainable economic development agenda.

Source:

- Parliamentary Standing Committee rejects TSR Subramanian report on environmental laws

- SC seeks govt. response on creation of ‘independent’ Indian Environment Service

- What is a writ of mandamus?

-

Image Source:

https://www.business-standard.com/article/current-affairs/sc-notice-to-centre-on-plea-for-creating-indian-environment-service-122012100889_1.html

Brain Mimicking Chip

- Context: A startup designing chips that mimic the way the brain works and aims to serve companies using artificial intelligence (AI) algorithms.

- The concept is based on Neuromorphic computing. It is a method of computer engineering in which elements of a computer are modelled after systems in the human brain and nervous system. The term refers to the design of both hardware and software computing elements..

- A per the startup Rain Neuromorphics Inc., while most AI chips on the market today are digital, this company's technology is analogue.

- Digital chips read 1s and 0s while analogue chips can decipher incremental information such as sound waves.

- Neuromorphic approach could vastly reduce the costs of creating powerful AI models and will hopefully one day help to enable true artificial general intelligence.

- This company’s chip is designed by adding a circuit called a memristor on top of silicon wafers.

- Memristors serve as 'artificial synapses' that allow for the processing and memory to happen in the same place, making it possible to run AI algorithms much faster and more energy-efficiently than existing digital AI chips.

Source:

Strengthen state-level elementary education architecture: HT

Essence: According to the author, the New Education Policy (NEP), 2020 has provided an enabling environment and the states must act on it. At present, there is variation in the extent of integration among administrative bodies overseeing school administration at the state level. For example, due to lack of integration between the Department of Education and the State Council of Educational Research and Training (SCERT) in Himachal Pradesh teachers are subjected to multiple training modules. Except for Meghalaya, no other state has an education policy of their own. Hence, there is lack of clarity on state specific education-related problems and resources needed to overcome them.

Thus, the author recommends that in order to achieve the goals of the NEP 2020, the states need to work on a cohesive, well-integrated administrative architecture and a state level education policy with clearly stated state specific priorities and resource-based implementation plan.

Why should you read this article?

- To know about the aims of the NEP 2020 with respect to elementary education.

- To understand the present challenges to achieve these goals along with examples and what needs to be done.

Source:

Artificial intelligence technologies have a climate cost: IE

Essence: Budget speech of 2022 describes Artificial Intelligence (AI) as sunrise technology with promises of economic prosperity and global competitiveness. But it is high time that dimensions of ethics and sustainability associated with AI must also be discussed in more detail.

Few developed countries have a definite head start in AI research and availability of skilled manpower. This gives them the capability to set rules from which they are most benefited while challenges of AI like its footprint on climate change because of its energy intensive nature is faced by developing and underdeveloped world also. Author concludes that Governments of developing countries like India should assess their technology-led growth priorities in these contexts.

Why should you read this article?

- To understand interaction of AI with ethical issues and sustainability.

- To understand the divide between developed and developing countries in their ability to reap benefits of AI.

- Since AI is always important for both GS and Essay papers, this article will give you much needed critique of AI.

Source:

The Roti Bank

Background

- Covid-19 impacts have led to severe and widespread increases in global food insecurity, affecting vulnerable households all over the country.

- When the entire nation was fighting with Covid-19 virus, a Kolkata-based consultancy Padrea started a food drive by the name of Roti Bank for the residents of the city.

How it all started?

- In the effort to provide relief to the poor amid the pandemic, Roti Bank made sure that every person in Kolkata can afford a decent hot meal.

- As going out in search of food during the pandemic was difficult, especially for the poor and old people, Roti Bank served hot meals to about 15000 people. The initiative also catered to orphanages that are under-privileged.

- The food service is provided to the doorstep for those who were infected with the virus.

- The initiative made sure that the packaging was Environment-friendly.

- The organisation is also dealing with women development activities like distribution of sanitary pads, vocational training, and self-defense, having touched more than 1,000 women.

- The organization hopes to continue with the endeavours of serving people and the society at large, while stressing their social responsibilities.

Quote:

“One deed of kindness noticed is worthy forty that are told”- Edgar Guest

Source:

Share the article

Get Latest Updates on Offers, Event dates, and free Mentorship sessions.

Get in touch with our Expert Academic Counsellors 👋

FAQs

UPSC Daily Current Affairs focuses on learning current events on a daily basis. An aspirant needs to study regular and updated information about current events, news, and relevant topics that are important for UPSC aspirants. It covers national and international affairs, government policies, socio-economic issues, science and technology advancements, and more.

UPSC Daily Current Affairs provides aspirants with a concise and comprehensive overview of the latest happenings and developments across various fields. It helps aspirants stay updated with current affairs and provides them with valuable insights and analysis, which are essential for answering questions in the UPSC examinations. It enhances their knowledge, analytical skills, and ability to connect current affairs with the UPSC syllabus.

UPSC Daily Current Affairs covers a wide range of topics, including politics, economics, science and technology, environment, social issues, governance, international relations, and more. It offers news summaries, in-depth analyses, editorials, opinion pieces, and relevant study materials. It also provides practice questions and quizzes to help aspirants test their understanding of current affairs.

Edukemy's UPSC Daily Current Affairs can be accessed through:

- UPSC Daily Current Affairs can be accessed through Current Affairs tab at the top of the Main Page of Edukemy.

- Edukemy Mobile app: The Daily Current Affairs can also be access through Edukemy Mobile App.

- Social media: Follow Edukemy’s official social media accounts or pages that provide UPSC Daily Current Affairs updates, including Facebook, Twitter, or Telegram channels.