Friday, 28th June 2024

Sri Lanka Seals Debt Deal with Official Creditor Committee

Why in the news?

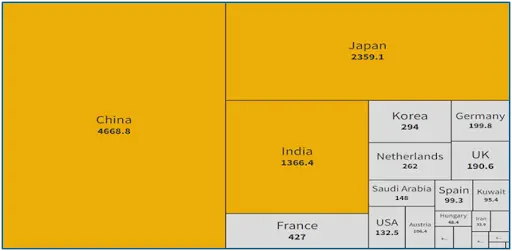

- Recently, Sri Lanka has finalised a restructuring agreement for $5.8 billion with its bilateral lenders’ Official Creditor Committee, headed by India, Japan, and France.

Official Creditor Committee (OCC) in Paris:

- Background

- OCC is a group formed to represent the collective interests of creditors during the debt restructuring or bankruptcy process of a debtor, typically a corporation or sovereign entity.

- It is often appointed in formal insolvency proceedings, such as those under the jurisdiction of bankruptcy courts, to ensure that creditors' interests are protected and that the restructuring plan is fair and equitable.

- The term OCC is used to describe any ad-hoc committee formed to represent official creditors during debt restructuring negotiations.

- It does not refer to a single, permanent organisation but rather to various committees formed for specific cases.

- About

- The OCC that signed a deal with Sri Lanka is an ad-hoc group of official bilateral creditors formed to address the debt restructuring needs of Sri Lanka.

- It was established in May 2023 to simplify Sri Lanka’s debt negotiations after the country defaulted on its external debt following a financial crash in 2022.

- Members

- The OCC includes 17 countries, such as India and members of the Paris Club like Japan, that have extended loans to Sri Lanka.

- Headquarters

- While not a permanent entity with a fixed headquarters, meetings for this OCC are typically held in Paris, especially if coordinated with the Paris Club, which has its secretariat there.

- Role and Function

- The OCC's primary role is to negotiate and coordinate the restructuring of Sri Lanka’s external debt, ensuring a fair and sustainable resolution for the country's debt crisis.

About the Paris Club:

- About

- It is an informal group of official creditors (primarily major industrialised countries) that coordinates solutions for debtor countries facing payment difficulties.

- Headquarters

- Paris, France.

- Members

- The Paris Club consists of 22 permanent member countries, primarily from Europe, North America, and Asia.

Recent Deal with Sri Lanka:

- Background

- In mid-April 2022, Sri Lanka declared its first-ever sovereign default since gaining independence from Britain in 1948.

- The International Monetary Fund made external debt restructuring conditional to a $2.9 billion bailout.

- Final Restructuring Agreement

- Sri Lanka reached a final restructuring agreement for $5.8 billion of debt with its bilateral lenders’ Official Creditor Committee in Paris.

- This agreement grants significant debt relief, allowing Sri Lanka to allocate funds to essential public services and secure concessional financing for development needs.

- Sri Lanka’s Bilateral Unpaid Debt

- Sri Lanka’s total bilateral unpaid debt amounts to $10,588 million.

- China Pact

- China, Sri Lanka’s largest bilateral lender, opted to stay out of the platform but attended the discussions as an observer.

- Colombo has been negotiating its debt treatment with Beijing bilaterally and has clinched a deal.

Significance of This Agreement for Sri Lanka:

- This agreement means that half of the government’s external debt by creditor countries and organisations has been restructured.

- Debt restructuring is used by entities facing financial distress to reorganise their outstanding debt obligations to make them more manageable and sustainable.

- This milestone demonstrates the strong progress made by Sri Lanka in stabilising its economy and moving towards reform and growth.

Role of India:

- As one of the Co-Chairs of the OCC, along with France and Japan, India has been committed to the stabilisation, recovery, and growth of the Sri Lankan economy.

- This commitment is demonstrated by India’s unprecedented financial support of $4 billion to Sri Lanka.

- India was also the first creditor nation to convey financing assurances to the IMF, paving the way for Sri Lanka to secure the IMF program.

Source: TH

Diseases Associated with Coal Mining

Why in the News?

- The study, titled “At the Crossroads: Marginalised Communities and the Just Transition Dilemma”, follows NFI’s 2021 report on the socio-economic effects of coal transitions in India.

- 75% of participants in focus groups suffer from chronic respiratory and skin ailments linked to coal mining pollutants.

Key Highlights of the National Foundation for India Reports:

- Study Coverage and Methodology:

- Geographical Focus: The study encompassed two districts each from Chhattisgarh, Jharkhand, and Odisha.

- Survey Scope: It surveyed 1209 households and conducted 20 Focused Group Discussions (FGDs).

- Health Concerns:

- Impact of Coal Mining Pollutants: Prolonged exposure has led to prevalent respiratory and skin ailments.

- Findings: 75% of FGD participants reported chronic bronchitis, asthma, and various skin conditions.

- Economic Impact:

- Dependency on Coal: Phasing down coal is predicted to cause substantial job losses and economic decline in coal-dependent regions.

- Affected Groups: Directly impacts coal miners, workers, and the broader local economy.

- Social Inequities:

- Caste-Based Disparities: Marginalised communities like Scheduled Castes (SCs), Scheduled Tribes (STs), and Other Backward Classes (OBCs) face disproportionate challenges.

- Access to Resources: Highlighted skewed access to resources and opportunities.

India’s Dependence on Coal for Energy Supply:

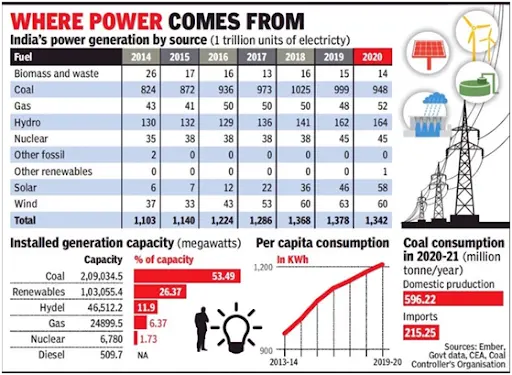

- Despite the rapid increase in renewable energy capacity, coal still supplies approximately 70 percent of India's electricity.

- By 2050, coal is projected to contribute at least 21 percent of India's electricity needs.

- Easily Available Source of Power:

- Coal can meet the country's energy requirements without relying on imports, as it is plentiful domestically.

- High costs and safety concerns have hindered alternatives like nuclear energy.

- India’s Developmental Needs:

- The International Energy Agency (IEA) forecasts that between 2020 and 2040, India will experience the largest energy demand growth globally.

- To satisfy this demand, India will need to utilise a mix of both conventional and renewable energy sources.

- Source of Employment:

- Coal provides essential energy and is a significant source of employment, economic growth, and industrialization, similar to developed countries.

- Approximately 4 million people in India are employed directly or indirectly in the coal sector.

- An additional 500,000 Indians depend on the coal sector for their pensions.

- Source of Revenue for the Government:

- Coal India Limited is the largest coal mining company globally.

- The coal sector is a significant revenue source for both State and Central Governments.

Present Challenges of Medical Expenses and Shift from Coal:

- Health Concerns:

- Proximity to coal mines correlates with higher medical costs due to elevated rates of respiratory illnesses, such as lung diseases and breathing-related issues, as well as skin infections.

- Economic Concerns:

- Global movement away from coal is anticipated to result in job losses and economic downturns in coal-reliant regions, affecting both coal miners and the broader local economy.

- Economic disparities persist, marked by varying income levels and irregular wage patterns across coal-dependent districts.

- Regions like Dhanbad and Koriya, heavily reliant on coal, report lower incomes compared to more diversified industrial districts.

Way Forward:

- Diversification of Local Economies:

- Foster alternative industries and economic activities in coal-dependent areas to reduce dependency on coal mining.

- Promote skill development initiatives to facilitate the transition of coal workers into emerging sectors like renewable energy, manufacturing, and services.

- Investment in Health Infrastructure:

- Enhance healthcare facilities in coal mining regions to address the heightened prevalence of respiratory and skin diseases.

- Implement comprehensive health monitoring and support programs for communities residing near coal mines.

- Promotion of Renewable Energy:

- Accelerate the adoption of renewable energy sources, capitalising on recent expansions in renewable energy capacity.

- Invest in renewable energy infrastructure to create new job opportunities that offset losses in the coal mining sector.

- Government and Policy Support:

- Implement supportive policies and provide financial assistance to ensure a ‘just transition,’ safeguarding the interests of workers and communities reliant on coal mining.

- Community Engagement and Participation:

- Involve local communities in decision-making processes concerning the transition from coal, fostering inclusive planning and sustainable development practices.

|

UPSC Civil Services Examination, Previous Year Question (PYQ) Mains: Q:1 In spite of adverse environmental impact, coal mining is still inevitable for Development”. Discuss. (2017) |

Source: TH

The rocks to improve India’s geological literacy

Why in the news?

- India’s rich geological history is encapsulated in its rocks and landscapes, constituting an essential part of our non-cultural heritage.

Scant Traction in India:

- Lack of Awareness and Importance: Despite global strides in geological conservation, India has yet to prioritise geo-conservation, resulting in the destruction of fossil-bearing sites due to urban development and real estate expansion.

- Destructive Activities: Stone mining, which covers over 10% of India’s land area, has caused significant damage to geological sites, jeopardising the preservation of these natural laboratories.

- Neglect of Geological Heritage: India paradoxically explores evidence of early life on Mars while neglecting crucial geological evidence within its borders, such as the Dhala meteoritic impact crater.

- Absence of Legislation: Despite international commitments to geological conservation, India lacks specific laws or policies safeguarding its geo-heritage, leaving these sites vulnerable.

Half-hearted Measures:

- Abandoned Legislation Attempts: A 2009 Bill proposing a National Commission for Heritage Sites was introduced and subsequently withdrawn, indicating inadequate commitment to geo-heritage conservation.

- Ineffective Notification by GSI: The Geological Survey of India (GSI) has identified 34 geological monuments but lacks authority to enforce preservation measures, leaving these sites susceptible to threats.

- Draft Bill with No Progress: In 2022, the Ministry of Mines drafted a Bill for the preservation of geo-heritage sites, yet little has been done since, highlighting a lack of urgency and follow-through.

- Recent Cliff Demolition Example: The partial demolition of the Varkala cliff, recognized as a geological heritage site, by local authorities citing landslide risks underscores inadequate protection and respect for such sit sites.

Impact:

- Loss of Scientific Knowledge:

- Destruction of fossil-bearing sites and geological features due to development and mining activities results in the permanent loss of crucial scientific data.

- This impedes the study and understanding of India’s geological history, limiting educational and research opportunities in earth sciences.

- Erosion of Cultural and Natural Heritage:

- Neglecting geological conservation undermines India’s natural heritage, essential to the country’s identity.

- Demolishing sites like the Varkala Cliff reflects a disregard for preserving unique geological formations integral to India’s natural legacy.

- Missed Economic Opportunities:

- Geo-heritage sites can attract tourism, benefiting local and national economies.

- Without legislative protection, these sites miss opportunities for sustainable tourism development, which could generate income, create jobs, and educate the public on geological conservation.

Way forward:

- Legislative Framework for Geo-Conservation:

- Enact specific legislation akin to the Biological Diversity Act, 2002, to protect and conserve geo-heritage sites.

- This framework should provide guidelines for their preservation, management, and sustainable use, shielding them from destructive activities and development pressures.

- National Geo-Conservation Authority:

- Establish a National Geo-Conservation Authority to oversee the identification, protection, and promotion of geo-heritage sites nationwide.

- Promotion of Geo-Tourism:

- Develop and market geo-heritage sites as sustainable tourism destinations.

- This involves investing in infrastructure, providing educational resources, and implementing marketing strategies to attract domestic and international tourists.

|

UPSC Civil Services Examination, Previous Year Question (PYQ) Mains: Q:1 Safeguarding the Indian art heritage is the need of the moment. Comment (10) (2018) Q:2 Do you agree that regionalism in India appears to be a consequence of rising cultural assertiveness? Argue. (2020) |

Source: TH

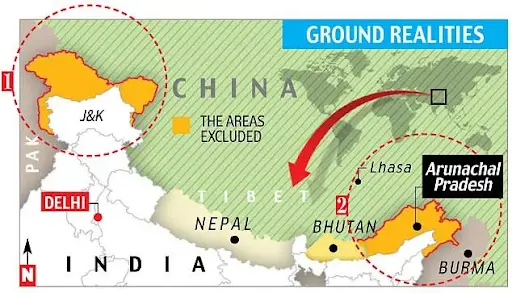

India to reclaim on Tibet

Why in the News?

- Recently, a delegation of U.S. lawmakers visited Dharamshala shortly after the U.S. Congress passed the ‘Promoting a Resolution to the Tibet-China Dispute Act,’ awaiting President Biden's approval.

About the Delegation on ‘Promoting a Resolution to the Tibet-China Dispute Act’:

- Legislative Background

- The U.S. Congress passed the ‘Promoting a Resolution to the Tibet-China Dispute Act,’ highlighting support for Tibetan autonomy and human rights.

- Delegation Composition and Purpose

- Bipartisan U.S. lawmakers, co-authors of the Act, were invited by the Central Tibetan Administration to Dharamshala.

- Their visit aimed to advocate for restarting dialogue between the Dalai Lama’s representatives and Beijing, stalled since 2010.

- India’s Diplomatic Calculus

- Hosting the U.S. delegation amidst ongoing tensions with China demonstrates India's nuanced diplomacy in managing relations with both nations.

- It reflects India’s sensitive stance on Tibet, balancing its traditional non-interference policy with increased international scrutiny.

- Geopolitical Implications

- The delegation’s visit raises questions about India’s sovereignty and diplomatic independence amid U.S.-China strategic competition.

- It underscores India’s role in regional stability, its commitment to global human rights, and influences its strategic partnerships and international stature

Future Scope (Way Forward):

- International Advocacy and Diplomatic Engagement:

- The U.S. delegation’s visit underscores ongoing international interest and support for Tibetan autonomy.

- Continued diplomatic efforts by global stakeholders are crucial to advocate for human rights and autonomy for Tibetans.

- These efforts could potentially influence China’s policies towards Tibet.

- India’s Strategic Positioning:

- India may adopt a nuanced approach to balance historical support for Tibetan refugees with current diplomatic relations with China.

- Future actions could involve India asserting its stance on Tibet in international forums.

- It should manage bilateral relations with China carefully to prevent escalation and preserve regional stability.

|

UPSC Civil Services Examination, Previous Year Question (PYQ) Mains: Q “The USA is facing an existential threat in the form of China, that is much more challenging than the erstwhile Soviet Union.” Explain. (2021) |

Source: TH

SEBI Tightens Norms on Financial Influencers

Why in the news?

- The Securities and Exchange Board of India (SEBI), India’s markets regulator, has instructed brokers and mutual funds to cease using unregulated financial influencers for marketing and advertising campaigns.

- SEBI has introduced a fixed price process for delisting frequently traded shares and established a delisting framework for Investment and Holding Companies (IHC).

Finfluencers (Financial Influencers)

- About Finfluencers:

- Finfluencers are individuals with public social media platforms who offer advice and share personal experiences about money and investments in stocks.

- Their content includes budgeting, investing, property buying, cryptocurrency advice, and financial trend tracking.

- Popularity of Finfluencers:

- The popularity of finfluencers is demonstrated by their massive subscriber counts, often surpassing those of leading broking firms.

- Successful finfluencers can earn between Rs 15 lakh to Rs 30 lakh per month.

- However, the low barriers to entry have led to increased exposure to potential bad actors and questionable advice.

Need to Regulate Finfluencers:

- The rise of unregistered investment advisors giving unsolicited stock tips on social media has been notable.

- India's low financial literacy rate (27%) and the influx of new investors during the Covid-19 pandemic have contributed to the popularity of influencers.

- The democratisation of trading through new-age broking apps and affordable smartphones led many first-time investors to seek guidance from influencers.

- Some companies have reportedly used social media to boost their share prices through influencers, with endorsements costing Rs 7 to 9 lakh per post.

- There are concerns about whether these influencers have the necessary educational or professional qualifications and the nature of monetary transactions between them and the entities they promote.

Criticism:

- Critics argue that influencers' advice falls under the Freedom of Expression guaranteed by the Constitution.

- Followers are not compelled to act on their recommendations.

- They compare influencers to celebrities who endorse products without expertise

- Claim that regulating influencers would be improper.

New Rules by SEBI:

- SEBI Tightens Norms on Financial Influencers

- Brokers and mutual funds are now prohibited from using unregulated financial influencers for marketing and advertising.

- Financial influencers engaged in investor education are exempt from these restrictions.

- Regulated entities must ensure their associates adhere to SEBI’s rules of conduct, including avoiding promises of assured returns.

- Changes to Derivative Trading Regulations

- SEBI has introduced new criteria for linking stocks to derivative products like futures and options.

- The total number of stocks eligible for derivative trading is expected to increase slightly.

- Eased Delisting Rules

- SEBI has approved changes to make it easier for companies to exit from stock exchanges.

- Companies can now offer shareholders fixed prices for shares, as an alternative to reverse book-building.

- The fixed price must be at least 15% above a floor price determined by SEBI rules.

- SEBI has decided to remove financial disincentives for managing directors and chief technology officers of exchanges and other market infrastructure institutions (MIIs) in the event of technical glitches.

|

What is SEBI?

|

|

UPSC Civil Services Examination, Previous Year Question (PYQ) Prelims: Q:1 Which of the following is issued by registered foreign portfolio investors to overseas investors who want to be part of the Indian stock market without registering themselves directly? (2019)

Ans: (d) |

Source: TOI

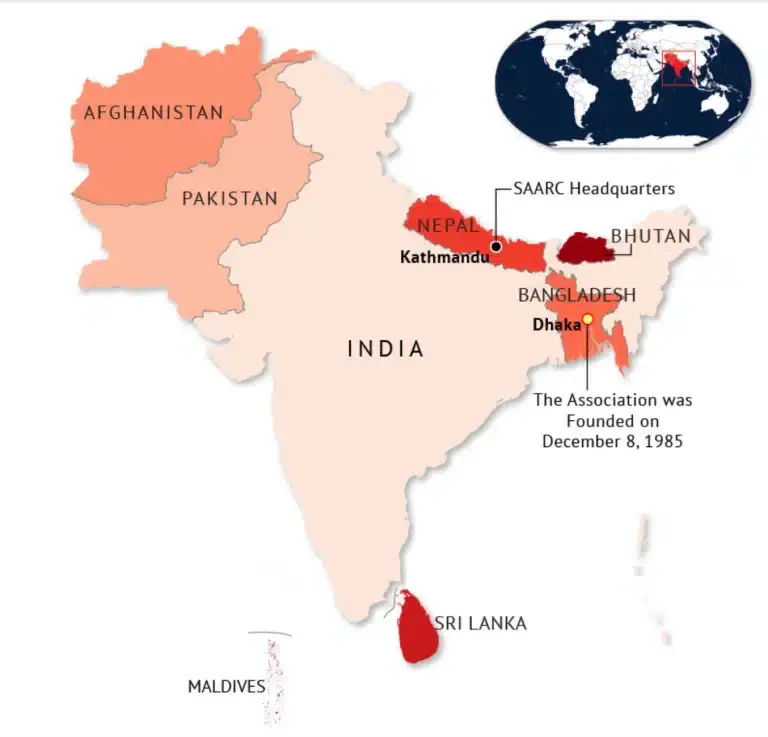

SAARC & Currency Swap Agreement

Why in the News?

- Recently, the Reserve Bank of India (RBI) has decided to put in place a revised Framework on Currency Swap Arrangement for SAARC countries for the period 2024 to 2027.

About the SAARC:

- SAARC is the regional intergovernmental organisation and geopolitical union of states in South Asia.

- Established with the signing of the SAARC Charter in Dhaka in 1985.

- Includes eight South Asian countries: Afghanistan, Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan, Sri Lanka.

- There are currently nine countries with ‘Observer’ status: Australia, China, European Union, Iran, Japan, South Korea, Mauritius, Myanmar, United States of America.

SAARC Structure:

- SAARC Summits

- The Meetings of the Heads of State or Government of Member States is the highest decision-making authority under SAARC.

- Summits are usually held biennially, hosted by a Member State in alphabetical order.

- The Member State hosting the Summit assumes the Chair of the Association.

- Council of Ministers

- Council of Ministers (CoM) comprises the Ministers of Foreign/External Affairs of the Member States.

- The Council meets preceding the Summit and between the two summits.

- The Council has also been meeting informally since 1997 on the side-lines of the United Nations General Assembly Sessions in New York.

- Secretariat

- The SAARC Secretariat was established in Kathmandu on 16th January 1987.

- Its role is to coordinate and monitor the implementation of SAARC activities.

- Decision-making

- Decisions at all levels are to be taken on the basis of unanimity.

- Bilateral and contentious issues are excluded from the deliberations of the Association.

About Currency Swap Agreement:

- Currency Swap Agreement:

- A currency swap agreement is a financial contract between two parties to exchange principal and interest payments in different currencies.

- The primary purpose of such an agreement is to secure more favourable loan terms or to hedge against currency risk.

- Features of Currency Swap Agreement:

- Exchange of Principal: At the start of the swap, the two parties exchange equivalent amounts of different currencies based on the prevailing exchange rate.

- Interest Payments: Throughout the duration of the swap, the parties exchange interest payments on the borrowed amounts. These payments are typically made at regular intervals and can be fixed or floating rates.

- Re-exchange of Principal: At the end of the swap agreement, the parties re-exchange the principal amounts at the initial exchange rate, regardless of the current exchange rate.

- Benefits of Currency Swap Agreements:

- Hedging: Companies can hedge against currency fluctuations and interest rate changes.

- Access to Capital: Firms can access capital in foreign currencies at more favourable rates.

- Cost Savings: It can lead to cost savings due to better loan terms in the foreign currency market.

India’s Currency Swap Agreements:

- The Commerce Ministry of India has finalised arrangements with some 23 countries for trade in local currencies.

- The importer or exporter in both countries quotes and receives settlements in their own currencies, eliminating the need to worry about exchange variations.

- This arrangement is particularly beneficial with countries where India has a substantial trade deficit, saving the need to settle in foreign exchange like US dollars or Euros.

- The Finance Ministry approves the countries for such arrangements, and the Commerce Ministry conducts bilateral talks to finalise the agreements.

Currency Swap Arrangement for SAARC Countries:

- The Reserve Bank of India (RBI) announced a revised Currency Swap Framework for SAARC countries, effective from 2024 to 2027.

- This framework enables bilateral currency swap agreements between the RBI and SAARC central banks to address short-term foreign exchange liquidity needs or balance of payments crises.

- A new INR Swap Window with concessions for Indian Rupee support, totaling ₹250 billion, has been introduced.

- Additionally, a US Dollar/Euro Swap Window with a corpus of $2 billion will continue.

- All SAARC member countries can access the facility, provided they sign the bilateral agreements

|

UPSC Civil Services Examination, Previous Year Questions (PYQs) Prelims Q:1 In the context of India, which of the following factors is/are contributor/contributors to reducing the risk of a currency crisis? (2019)

Select the correct answer using the code given below:

Ans: (b) |

Source: TH

eSakhsya App

Why in the news ?

- eSakhsya App is mobile-based application that helps police record the scene of crime, search for and seizure in a criminal case, and upload the file on the cloud-based platform.

About eSakhsya (e evidence) App:

- Development:

- Developed by the National Informatics Centre (NIC).

- Purpose:

- To help police record the scene of the crime.

- Facilitate search and seizure in criminal cases.

- Upload the recorded files to a cloud-based platform.

- Key Features:

- Selfie Verification: Police officials need to upload a selfie after completing the procedure.

- FIR Integration: Recorded files are to be uploaded with each First Information Report (FIR).

- Accessibility: The app will be available to all police stations that register and download it.

- Legal Requirement:

- The Bharatiya Nagarik Suraksha Sanhita (BNSS) mandates audio-video recording of all search and seizure operations in criminal cases.

|

About New Criminal Laws:

|

Source: (TH)

International Sugar Organisation

Why in the news ?

- Recently, India hosted the 64th Council Meeting of the International Sugar Organisation.

About the International Sugar Organization

- An intergovernmental body based in London, it was established under the International Sugar Agreement of 1968 and dedicated to enhancing the global sugar market.

- Membership of around 88 nations including India.

- The ISO is the only worldwide forum for the exchange of views by major producing, consuming and trading countries at an intergovernmental level.

- The ISO administers the International Sugar Agreement (ISA), 1992, which is related to international cooperation in sugar-related matters.

- Encourages expanded sugar use, especially in non-traditional applications.

- However, it lacks the authority to regulate the global sugar trade through price-setting or export quotas.

- Earlier, India hosted the 41st session of the ISO Council Meeting in 2012.

Status of the Sugar Industry in India:

- India is the largest consumer and second-largest producer of sugar globally.

- 15% share in global sugar consumption and a robust 20% production rate.

- Nearly 5 crore farmers are engaged in the cultivation of sugarcane.

- Two primary production regions:

- Northern belt encompassing Uttar Pradesh, Bihar, Haryana, Punjab and Bihar.

- Southern belt comprising Maharashtra, Karnataka, Tamil Nadu, and Andhra Pradesh.

- The southern region benefits from a tropical climate, which is conducive to higher sucrose content in crops, resulting in increased yields per unit area compared to northern India.

Government initiatives:

- The Government has encouraged sugar mills to divert sugar to ethanol and export surplus sugar so that mills may have better financial conditions to continue their operations.

- The National Policy on Biofuels 2018 provides an indicative target of 20% ethanol blending under the Ethanol Blended Petrol (EBP) Programme by 2025.

- Fair and Remunerative Price (FRP): The government has set the FRP for the 2023-2024 sugar season at Rs. 315 per quintal.

- The Global Biofuel Alliance (GBA) was recently launched by world leaders under India’s G20 presidency to expedite the global uptake of biofuels.

- The workshop on ‘Sugar and Bio-Energy: Emerging Vistas’ being organised during ISO includes various insightful sessions such as:

- Sustainability through Diversification.

- Mechanization & Modernization of the Sugar Sector.

- Digitization of the Sugar Sector.

- Global Demand and Supply of Sugar.

- Green Hydrogen.

|

Global Biofuel Alliance (GBA):

|

|

UPSC Civil Services Examination Previous Year Question (PYQ) Prelims Q:1 According to India’s National Policy on Biofuels, which of the following can be used as raw materials for the production of biofuels? (2020)

Select the correct answer using the code given below:

Ans: (a) Q:2 Given below are the names of four energy crops. Which one of them can be cultivated for ethanol? (2010)

Ans: (b) |

Source: (PIB)

Tajikistan Hijab Ban

Why in the news ?

- The Tajikistan government has passed a bill to formally ban the wearing of the hijab, aligning with President Emomali Rahmon's views on minimising public religiosity.

Tajikistan Hijab Ban: Background

- The bill to ban the hijab was approved by the lower house (Majlisi Namoyandagon) and received approval from the upper house (Majlisi Milli) post-Eid celebrations.

- This move formalises years of unofficial curbs on religious clothing, in line with President Emomali Rahmon’s view that the hijab is “foreign clothing”.

- Tajikistan’s population is approximately 90% Muslim, raising questions about the rationale behind the ban in a predominantly Muslim country.

What Does the New Law Say?

- Amendment Details: The new bill amends the existing law ‘On Regulation of Holidays and Ceremonies’. It forbids the “import, sale, promotion, and wearing of clothing deemed foreign to the national culture”, focusing on the hijab and other garments associated with Islam.

- Penalties for Violations: Individual offenders may face fines of 7,920 somonis ($747). Higher fines of up to 39,500 simonis ($3,724) may be imposed according to Radio Liberty’s Tajik Service.

- Additional Bans: The bill also bans Eidi, the custom of gifting money to children during Eid and Navroz. Festivities around Eid-al-Fitr and Eid-al-Adha are also prohibited.

Why is the Hijab deemed “foreign”?

- Context and Motivation: The hijab ban is part of President Rahmon’s efforts to promote “Tajiki” culture and minimise public religiosity. Rahmon heads a secular government and has been in power since 1994, marking one of the longest rules in the region.

- Political Background: Rahmon’s early political career saw him positioned against more religious political parties. Post-Soviet Union collapse in 1991, Tajikistan faced a civil war between Soviet sympathisers (including Rahmon) and ethnoreligious clans of the United Tajik Opposition.

- Rise to Power: Rahmon emerged as the winner of the 1994 presidential elections after widespread protests against poverty and lack of economic opportunities. Over the years, Rahmon has amended the constitution to solidify his rule, including removing presidential term limits in 2016, and has banned faith-based political parties that could challenge his authority.

- Religious Restrictions: Rahmon’s concern with religious clothing stems from rising religiosity post-Soviet Union breakup. Despite this, some analysts believe the threat from radical Islam is exaggerated in Central Asia. Islamic practices were part of local cultures even during Soviet control.

Similar Rules Introduced Earlier in TajikistanL

- Initial Legislation: In 2007, a law regulating holidays and ceremonies was passed, prohibiting Islamic clothing and Western-style miniskirts. This led to a ban on the hijab for students and eventually in all public institutions.

- President Rahmon’s Campaign: Rahmon intensified his campaign against the hijab in 2015, calling it “a sign of poor education.” In 2024, he reiterated his stance, criticising “xenophobia in clothing” and foreign clothes, including the hijab.

- Government Initiatives: In 2017, the government launched a campaign with automated phone calls urging women to wear Tajiki dresses. In 2018, a 376-page handbook titled ‘The Guidebook Of Recommended Outfits In Tajikistan’ was released, detailing acceptable garment materials, lengths, colours, and shapes.

Conclusion The hijab ban exemplifies President Rahmon’s drive to promote “Tajiki” culture, despite the predominantly Muslim population, highlighting ongoing religious and cultural tensions in Tajikistan.

Source: IE

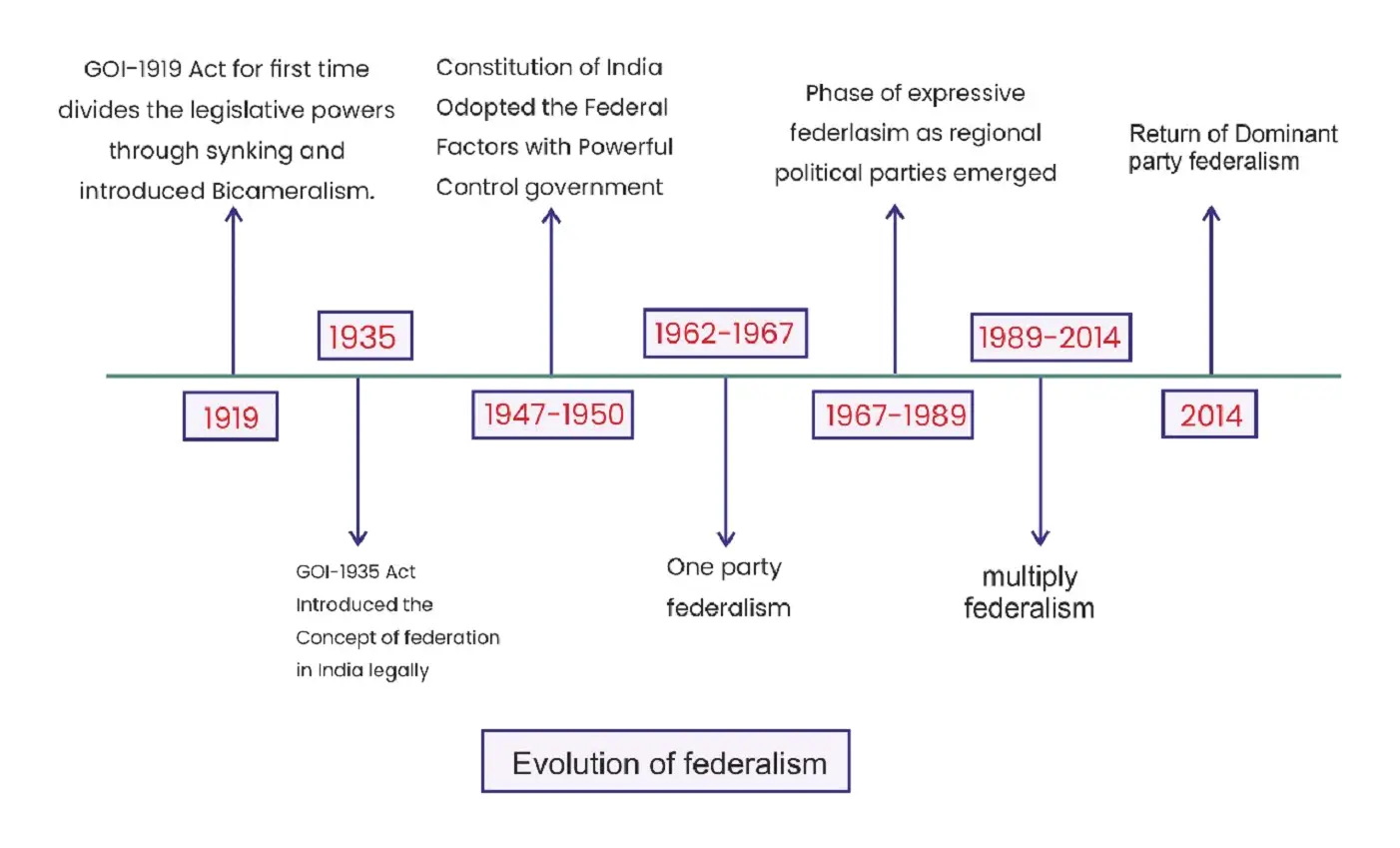

Fiscal Federalism future in India

Why in the news ?

- Kerala recently filed a suit in the Supreme Court under Article 131 of the Constitution, urging the court to direct the Union government to lift the ceiling on state borrowing limits.

- This case has spotlighted Article 293 of the Indian Constitution, which governs state borrowing powers and Union regulation thereof.

- Kerala seeks greater autonomy in borrowing, while the Union government stresses macroeconomic stability through debt regulation.

Constitutional Interpretation by Supreme Court:

- Given the first-time interpretation of Article 293, the matter has been referred to the Constitution bench under Article 145, comprising five judges.

- The upcoming decision by the Supreme Court holds significant implications for fiscal federalism in India.

Provisions of Article 293: Provisions:

- State Borrowing Power: States can borrow within India against their Consolidated Fund of State, under limits set by their legislature.

- Union Guarantees: The Union government may guarantee state loans within limits set by Parliament.

- Consent Requirement: States must seek Union government consent for loans if they owe any previous loans to or guaranteed by the Union. Conditions can be imposed on this consent.

- Exception: Temporary overdrafts or arrangements with the Reserve Bank of India do not require prior consent.

- Continuation of Existing Loans: Loans taken by states before the Constitution's commencement remain valid under the same terms.

Limitations of Article 293:

- Article 293's authority is contingent upon states owing money to the Union, creating a gap if states clear their Union debts. The article lacks provisions for regulating state borrowing in the absence of such debts.

- Economically stronger states could potentially clear Union debts and then borrow without Union oversight.

- States increasingly use Public Sector Undertakings (PSUs) to circumvent Article 293, as seen in Kerala's argument that PSU debts should not count towards state debt calculations.

- Growing reliance on non-central sources for borrowing may render Article 293 irrelevant for some states, complicating fiscal transparency and accountability.

Key Questions for the Constitution Bench:

- Does Article 293 confer a state with an inherent right to borrow, and can the Union government regulate this right?

- Are debts raised by state PSUs within the scope of Article 293's regulation?

Recent Trends in State Borrowing from the Union:

- Recent data from the RBI indicates a significant decline in states' reliance on Union loans, plummeting from 57% in 1991 to merely 3% by FY 2020.

- This shift underscores states' increasing preference for market borrowings and alternative financing sources.

- The diminishing Union loans impact the relevance of Article 293, as its regulatory scope hinges on states owing money to the Union.

- During the Covid-19 pandemic, state borrowing from the Union temporarily rose from 3% in FY 2020 to 8.6% in FY 2024 due to economic pressures and revenue shortfalls.

- However, this uptick is expected to be transient, with states likely reverting to pre-pandemic borrowing patterns as the economy rebounds.

Arguments For and Against State’s Right to Borrow Uninterruptedly: Arguments in Favor:

- Fiscal Autonomy: State borrowing empowers fiscal independence, aligning with federal principles. It allows states to finance development projects and address local needs without sole reliance on Union grants, promoting self-reliance.

- Economic Development: Borrowing enables financing of large-scale infrastructure projects, stimulating economic growth and providing continuity in essential services during revenue shortfalls.

- Flexibility in Financial Management: It buffers states against economic shocks and revenue fluctuations, enhancing financial resilience without resorting to politically challenging tax hikes.

- Accountability to Electorate: Borrowing makes state governments accountable to voters for financial decisions, promoting transparency and informed electoral choices.

- Competitive Federalism: Allows states to compete for investments and innovate in development strategies, potentially leading to national best practices and overall development.

Arguments against:

- Risk of Fiscal Indiscipline:

- Unrestricted borrowing may lead states to accumulate unsustainable debt levels, jeopardising their long-term fiscal health.

- Political considerations, like short-term electoral gains, might override economic prudence, leading to misallocation of resources.

- Excessive state debts, such as Punjab's debt-to-GSDP ratio of 53.3% in 2021-22 due partly to borrowing for populist schemes, could destabilise the national economy and impact other states.

- Macroeconomic Stability Concerns:

- Uncoordinated state borrowing can interfere with national monetary and fiscal policies, complicating economic management at the Union level.

- It may negatively affect the country's credit rating and borrowing costs in international markets, impacting the entire nation's financial standing.

- For instance, the increase in states' gross market borrowings by 55% in 2020-21 led to higher yields on state development loans, potentially affecting overall interest rates and Union government borrowing costs.

- Inter-State Disparities:

- Variations in states' economic strengths can lead to significant differences in their borrowing capacities, exacerbating regional inequalities.

- Economically stronger states may secure loans at more favourable terms, while poorer states face higher borrowing costs, straining their finances.

- This dynamic may require increased Union intervention to balance regional development, potentially complicating federal relations.

- Complexity in Debt Management:

- Independent state borrowings complicate national public debt management.

- Monitoring and regulating diverse state borrowings pose administrative challenges and require sophisticated oversight mechanisms.

- There's a risk of overlapping or conflicting debt obligations between states and the Union, creating legal and financial complexities.

- For instance, the Ujwal DISCOM Assurance Yojana (UDAY) introduced in 2015 added complexity by transferring power distribution companies' debts to states, blurring lines between state and PSU borrowings.

- Potential for Default and Bailouts:

- States in financial distress might default on loans, impacting creditors and the broader financial system.

- There's an implicit expectation that the Union government would bail out states in such cases, creating a moral hazard that encourages irresponsible borrowing.

- State defaults or bailouts could undermine investor confidence in the Indian market, affecting overall economic stability.

|

What are the Other Federal Systems of Managing Subnational Debts?

|

Measures Can be Adopted to Improve Fiscal Health of States:

- Incentive-Based Fiscal Responsibility Framework:

- Implement a tiered system of borrowing limits based on comprehensive fiscal performance metrics.

- Beyond traditional indicators like debt-to-GSDP ratio, include metrics such as revenue generation efficiency, development outcomes, and fiscal transparency.

- For example, states improving their own tax revenue by 10% annually could be allowed to borrow an additional 0.5% of GSDP.

- This approach creates a positive incentive for states to enhance fiscal management continually.

- Technology-Driven Fiscal Monitoring System:

- Develop a real-time, AI-powered fiscal monitoring system for all states to revolutionise fiscal management.

- Track revenue, expenditure, and borrowing patterns to provide early warnings of fiscal stress.

- Implement blockchain technology for transparency and immutability of fiscal data to prevent manipulation and build trust.

- Fiscal Insurance Pools:

- Establish collective insurance funds where states contribute based on their fiscal health.

- These funds would provide temporary relief during economic shocks, reducing reliance on excessive borrowing.

- Incentivize fiscal prudence by linking contributions and payouts to long-term fiscal performance metrics.

- Cross-State Fiscal Mentorship Programs:

- Pair fiscally stronger states with weaker ones in mentorship programs.

- Mentor states would provide expertise and guidance on effective fiscal management.

- Consider granting additional borrowing rights to mentor states as a reward for successful mentorship.

- Foster inter-state cooperation and spread best practices in fiscal management organically through peer-to-peer learning.

- Independent Fiscal Councils:

- Establish independent fiscal councils at the state level to ensure unbiased analysis of state budgets.

- These non-partisan bodies would assess fiscal health objectively and recommend sustainable debt management practices.

- Provide transparency and accountability in fiscal decision-making to promote responsible fiscal behaviour among states.

|

UPSC Civil Services Examination, Previous Year Questions (PYQs) Prelims: Q:1 Consider the following statements: (2018)

Which of the statements given above is/are correct?

Ans: C Mains: Q:1 Public expenditure management is a challenge to the Government of India in the context of budget-making during the post-liberalization period. Clarify it. (2019) |

Source: EP

Share the article

Edukemy’s Current Affairs Quiz is published with multiple choice questions for UPSC exams

MCQ

Get Latest Updates on Offers, Event dates, and free Mentorship sessions.

Get in touch with our Expert Academic Counsellors 👋

FAQs

UPSC Daily Current Affairs focuses on learning current events on a daily basis. An aspirant needs to study regular and updated information about current events, news, and relevant topics that are important for UPSC aspirants. It covers national and international affairs, government policies, socio-economic issues, science and technology advancements, and more.

UPSC Daily Current Affairs provides aspirants with a concise and comprehensive overview of the latest happenings and developments across various fields. It helps aspirants stay updated with current affairs and provides them with valuable insights and analysis, which are essential for answering questions in the UPSC examinations. It enhances their knowledge, analytical skills, and ability to connect current affairs with the UPSC syllabus.

UPSC Daily Current Affairs covers a wide range of topics, including politics, economics, science and technology, environment, social issues, governance, international relations, and more. It offers news summaries, in-depth analyses, editorials, opinion pieces, and relevant study materials. It also provides practice questions and quizzes to help aspirants test their understanding of current affairs.

Edukemy's UPSC Daily Current Affairs can be accessed through:

- UPSC Daily Current Affairs can be accessed through Current Affairs tab at the top of the Main Page of Edukemy.

- Edukemy Mobile app: The Daily Current Affairs can also be access through Edukemy Mobile App.

- Social media: Follow Edukemy’s official social media accounts or pages that provide UPSC Daily Current Affairs updates, including Facebook, Twitter, or Telegram channels.