Thursday, 8th February 2024

Daily News Paper Snippets - 08th February 2024

Bills to Include PVTGs of Odisha, A.P. in Scheduled Tribe Lists

In News: The Ministry of Tribal Affairs introduced and successfully steered through the Rajya Sabha the Constitution (STs) Order Amendment Bill 2024 and the Constitution (SCs and STs) Order Amendment Bill 2024.

Inclusions in the Bills

- Particularly Vulnerable Tribal Groups (PVTGs)

- Seven PVTGs, a subset of Scheduled Tribes (STs), added in Odisha and Andhra Pradesh.

- Independent names included as synonyms or sub-tribes of existing communities on the ST lists.

- PVTGs in Odisha

- Pauri Bhuyan and Paudi Bhuyan added as synonyms of the Bhuyan tribe.

- Chuktia Bhunjia included as a synonym of the Bhunjia tribe.

- Bondo designated as a sub-tribe of the Bondo Poraja tribe.

- Mankidia recognized as a synonym for the Mankirdia tribe.

- PVTGs in Andhra Pradesh

- Bondo Porja and Khond Porja included as synonyms of the Porja tribe.

- Konda Savaras added as a synonym for the Savaras tribe.

- After 75 Years of Independence

- These groups, belonging to PVTGs, added to scheduled lists after 75 years of independence.

Additional Changes in Odisha's ST List

- Shifts and Additions

- Tamadia and Tamudia moved from Scheduled Castes list to Scheduled Tribes list.

- Synonyms, phonetic variations, and sub-tribes of eight existing communities added.

- Two new entries: Muka Dora community and Konda Reddy community.

Understanding PVTGs

- Characteristics of PVTGs

- Defined by the Ministry of Tribal Affairs (MoTA).

- Characteristics include pre-agriculture technology, stagnant or declining population, low literacy, and subsistence-level economy.

- Recognized as a separate category based on the 1961 Dhebar Commission findings.

- PVTG Population Data

- India has 75 PVTGs across 18 states and Union Territories.

- Odisha has the largest PVTG population (8.66 lakh), followed by Madhya Pradesh (6.09 lakh), and Andhra Pradesh (including Telangana) (5.39 lakh).

- Recent Government Initiatives

- PM PVTG Development Mission

- Launched in Union Budget 2023-24.

- Aims to provide basic facilities to PVTG households and habitations.

- Rs. 15,000 crore allocated under the Development Action Plan for the Scheduled Tribes (DAPST).

- PM PVTG Development Mission

- PM-JANMAN (Pradhan Mantri Janjati Adivasi Nyaya Maha Abhiyan)

- Approved by the Union Cabinet in November 2023.

- Total outlay of Rs. 24,104 crore for FY 2023-24 to 2025-26.

- Focus on 11 critical interventions through 9 Ministries to enhance socio-economic conditions of PVTGs.

- Government's Concern for PVTG Populations

- Consistent follow-up with State governments regarding the declining populations of several PVTG communities nationwide.

Source: TH

Commercial Availability of Indigenous CAR-T Cell Therapy

In News: After obtaining approval from India's drug regulator for CAR-T cell therapy, Dr (Col) V K Gupta became among the initial recipients of this groundbreaking treatment.

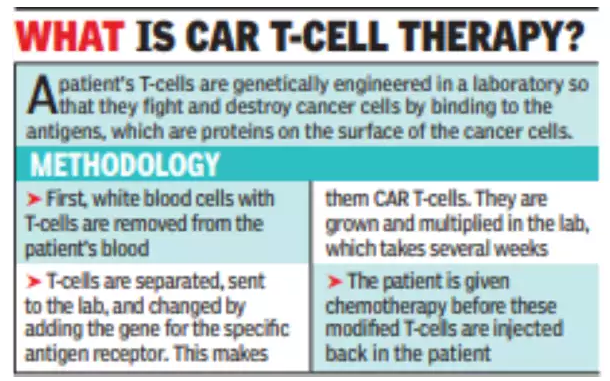

CAR-T Cell Therapy: Revolutionizing Cancer Treatment

- Introduction

- CAR-T therapy modifies immune cells, specifically T-cells, transforming them into potent cancer fighters.

- T-cells, with cytotoxic functions, are genetically modified into cancer-fighting cells for the therapy.

- How CAR-T Therapy Works

- Genetically modified T-cells are reintroduced into the body.

- These supercharged cells target and eliminate cancer cells, particularly in blood cancers like leukemia and lymphomas.

- Comparison with Other Treatments

- Effectiveness

- CAR-T therapy aims for a cure and lifelong benefit.

- Contrasted with chemotherapy and immunotherapy, which may provide limited extensions to a patient's life.

- Effectiveness

- Treatment Convenience

- One-time therapy compared to multiple sessions of chemotherapy.

- Particularly beneficial for non-responsive cancer patients.

- NexCAR19: India's Indigenous CAR-T and Gene Therapy Platform

- Developed by ImmunoACT, incubated at IIT Bombay.

- Designed to target cancer cells carrying the CD19 protein, a marker on cancer cells.

- Eligibility for NexCAR19 Therapy

- For individuals with B-cell lymphomas unresponsive to standard treatments, leading to relapse or recurrence.

- B-cell lymphomas originate in lymphocytes, white blood cells that produce antibodies.

- Treatment Process

- Blood Sample

- Patients provide a blood sample at the clinic.

- Return in 7-10 days for reinfusion.

- Blood Sample

- Genetic Modification

- T-cells are genetically modified in the lab.

- Modified cells return to the clinic for patient reinfusion.

- Recovery

- Typically occurs within two weeks after one treatment cycle.

- Pediatric Eligibility

- CDSCO approval for patients aged 15 years and older.

- Ongoing pediatric trials at Tata Memorial Hospital in collaboration with IIT Bombay.

- Minimizing Side-Effects

- Lower drug-related toxicities.

- Minimal neurotoxicity and Cytokine Release Syndrome (CRS).

- Neurotoxicity risk reduced by minimizing entry of CAR-T cells into the brain.

- Cost Considerations

- Current Pricing

- Treatment costs in the range of Rs 30-40 lakh.

- Current Pricing

- Future Targets

- Aim to reduce costs to Rs 10-20 lakh.

- Anticipated cost reduction with technological advancements and improved manufacturing processes.

Source: IE

Mera Gaon, Meri Dharohar Programme

In News: The Indian government has chosen to undertake the mapping and documentation of all villages as part of the Mera Gaon, Meri Dharohar (MGMD) Programme.

Mera Gaon, Meri Dharohar (MGMD) Programme

The MGMD Programme, a crucial initiative under the National Mission on Cultural Mapping (NMCM) in collaboration with the Indira Gandhi National Centre for the Arts (IGNCA), aims to comprehensively document information about Indian villages. This includes aspects of life, history, and ethos, making it accessible to both virtual and real-time visitors. The MGMD initiative covers the cultural mapping of 6.5 lakh villages and is an integral part of the Azadi Ka Amrit Mahotsav (AKAM).

Under the MGMD Programme, information is gathered across seven categories:

- Arts and Crafts Village

- Ecologically Oriented Village

- Scholastic Village linked with Textual and Scriptural Traditions of India

- Epic Village linked with Ramayana, Mahabharata, and/or Puranic legends and oral epics

- Historical Village linked with Local and National History

- Architectural Heritage Village

- Any other characteristic that may need highlighting, such as fishing village, horticulture village, shepherding village, etc.

The initiative involves mapping and uploading data on a national portal, creating a comprehensive repository of cultural heritage.

Scheme of Financial Assistance for the Promotion of Art and Culture

The Scheme of Financial Assistance for the Promotion of Art and Culture is a central sector scheme designed to support various cultural activities and organizations in India. The scheme comprises eight components, each serving a distinct objective with allocated funding.

- Financial Assistance to Cultural Organizations with National Presence

- Objective: Provide financial support to reputed cultural organizations with a national presence for the dissemination and propagation of art & culture.

- Maximum Grant: Up to Rs. 1 crore.

- Cultural Function & Production Grant (CFPG)

- Objective: Support various cultural activities, including seminars, conferences, research, workshops, festivals, exhibitions, and productions.

- Maximum Grant: Rs. 5 lakh, extendable up to Rs. 20 lakh under exceptional circumstances.

- Financial Assistance for the Preservation & Development of Cultural Heritage of the Himalayas

- Objective: Promote and preserve the cultural heritage of the Himalayas through research, training, and dissemination.

- Funding: Rs. 10 lakhs per year for an organization, extendable up to Rs. 30 lakhs in exceptional cases.

- Financial Assistance for the Preservation & Development of Buddhist/Tibetan Organisations

- Objective: Support voluntary Buddhist/Tibetan organizations, including monasteries, in propagating and developing cultural traditions.

- Funding: Rs. 30 lakhs per year for an organization, extendable up to Rs. 1 crore in exceptional cases.

- Financial Assistance for Building Grants including Studio Theatres

- Objective: Provide financial support for creating cultural infrastructure such as studio theatres, auditoriums, rehearsal halls, etc.

- Maximum Grant: Up to Rs. 50 lakh in metro cities and up to Rs. 25 lakh in non-metro cities.

- Financial Assistance For Allied Cultural Activities

- Objective: Support organizations in creating assets to enhance audio-visual spectacles for cultural activities during festivals and major events.

- Maximum Assistance: Audio: Rs. 1 crore, Audio+Video: Rs. 1.50 crore.

- Scheme for Safeguarding the Intangible Cultural Heritage

- Objective: Safeguard the intangible cultural heritage and diverse cultural traditions of India through revitalization and promotion.

- Domestic Festivals and Fairs

- Objective: Assist in holding the ‘Rashtriya Sanskriti Mahotsavs’ organized by the Ministry of Culture.

|

UPSC Previous Year Questions Mains (2018) Q. Safeguarding the Indian Art Heritage is the need of the moment. Discuss. |

Source: PIB

Managing Fiscal Deficit

In News: In addressing India's fiscal challenges related to national debts, the Ministry of Finance, as outlined in the Interim Budget 2024-25, has resolved to decrease the country's Fiscal Deficit to 5.1% of the Gross Domestic Product (GDP) for the fiscal year 2024-25.

Understanding Fiscal Deficit

- Definition

- Fiscal deficit signifies the disparity between a government's revenue and expenditure.

- Overview

- When government spending surpasses revenue, it resorts to borrowing or asset sales to cover the deficit.

- Taxes form a primary revenue source for governments.

- Current Scenario (2024-25)

- Estimated tax receipts: Rs 26.02 lakh crore.

- Total revenue projection: Rs 30.8 lakh crore.

- Fiscal Surplus

- Occurs when government revenues exceed expenditures.

- Rare occurrence; emphasis is typically on controlling fiscal deficit.

Projections and Management

- Government Targets (2025-26)

- Aim to reduce fiscal deficit to below 4.5% of GDP (Budget 2021-22).

- Revised estimate lowers fiscal deficit projection for 2023-24 to 5.8% of GDP.

- Relation to National Debt

- National Debt encompasses government obligations to lenders, including loans, provident funds, and special securities.

- Higher fiscal deficit impacts a government's ability to repay, with larger economies having more flexibility.

- Trends in National Debt

- Debt-GDP ratio: Peaked at 88.5% in 2020-21 due to Covid-19.

- Projected at 82.4% for 2024-25, posing challenges.

Funding Fiscal Deficit

- Borrowing from Bond Market

- Government borrows from the bond market by issuing bonds.

- Borrowing costs increase if fiscal health deteriorates.

- Role of Reserve Bank of India

- RBI facilitates government borrowing indirectly through Open Market Operations (OMO).

- OMO involves acquiring bonds from private lenders.

- Monetary Policy

- Central bank lending rates impact government borrowing costs.

- Post-pandemic rate increases contribute to higher government borrowing expenses.

Legislation and Responsibility

- Fiscal Responsibility and Budget Management (FRBM) Framework

- Instituted in 2003 with debt reduction targets.

- Review Committee recommends a 60% debt to GDP ratio by 2023.

Significance and Challenges

- Importance of Worrying About Fiscal Deficit

- Inflation impact due to persistent high fiscal deficit.

- Lower fiscal deficit enhances government bond ratings.

- Challenges and Management Strategies

- High fiscal deficit affects debt management.

- Strategies include fiscal discipline, revenue mobilization, expenditure rationalization, and debt management.

Long-Term Solutions

- Structural Reforms

- Implementing long-term reforms for economic efficiency.

- Addressing challenges in sectors like agriculture, manufacturing, and services.

Conclusion

- Balancing Act for Fiscal Sustainability

- Striking a balance between short-term stabilization and long-term structural reforms.

- Achieving sustainable fiscal outcomes for economic growth and prosperity.

|

UPSC Previous Year Questions Prelims (2010) Q. In the context of governance, consider the following:

Which of the above can be used as measures to control the fiscal deficit in India? (a) 1, 2 and 3 Ans: D Prelims (2021) Q2. Which one of the following is likely to be the most inflationary in its effect? (a) Repayment of public debt Ans: (d) Prelims (2016) Q3. Which of the following is/are included in the capital budget of the Government of India?

Select the correct answer using the code given below: (a) 1 only Ans: (d) Mains (2017) Q1. One of the intended objectives of the Union Budget 2017-18 is to ‘transform, energise and clean India’. Analyse the measures proposed in the Budget 2017-18 to achieve the objective. Mains (2021) Q2. Distinguish between Capital Budget and Revenue Budget. Explain the components of both these Budgets. Mains (2019) Q.3 Do you agree with the view that steady GDP growth and low inflation have left the Indian economy in good shape? Give reasons in support of your arguments. |

Source: TH

World's First Melanistic Tiger Safari in Odisha

In News: Odisha is preparing to introduce the world's inaugural melanistic tiger safari in the vicinity of the Similipal Tiger Reserve (STR).

Odisha's Vision for Melanistic Tiger Safari

- Melanism and Melanistic Tigers

- Melanism is a genetic condition resulting in increased melanin production, leading to black or nearly black skin, feathers, or hair in animals.

- Similipal's Royal Bengal Tigers display pseudo-melanistic traits with black and yellow interspersed stripes due to elevated melanin levels.

- Tiger Population in Similipal

- As per the All India Tiger Estimation 2022, Similipal Tiger Reserve houses 16 tigers, with 10 exhibiting melanistic traits.

- Safari Location

- Spanning 200 hectares near Dhanbad-Balasore National Highway-18.

- Proximity to Simlipal provides a landscape akin to the reserve.

- Occupants in the Beginning

- Three melanistic tigers from Nandankanan Zoo, along with rescued or orphaned tigers, will occupy open enclosures initially.

- Objective of the Safari

- Raise awareness about the conservation needs of melanistic tigers.

- Provide a platform for researchers and enthusiasts to engage with these rare big cats.

- Approval Process

- Requires approvals from the Central Zoo Authority and other regulatory bodies overseeing wildlife initiatives.

- National Tiger Conservation Authority committee to conduct a feasibility study before granting final clearance.

Other Colour Variations in Tigers

- Orange with Black or Brown Stripes

- Most common and widely recognized tiger coloration, seen in the Royal Bengal Tiger.

- Unique stripe patterns serve as camouflage in their natural habitat.

- White Tigers

- Result of a genetic mutation called leucism.

- Leucism causes reduced pigmentation, resulting in white or pale-colored skin, fur, or feathers.

- Not considered a separate subspecies.

- Golden Tigers

- Golden coloration caused by the presence of a recessive gene called "wideband."

- The wideband gene reduces melanin production during the hair growth cycle.

- Recently spotted in Kaziranga National Park.

|

UPSC Previous Year Questions Prelims (2013) Q. Consider the following pairs: National Park - River flowing through Park

Which of the above pairs is/are correctly matched? (a) 1 and 2 Ans: (d) Prelims (2020) Q2. Among the following Tiger Reserves, which one has the largest area under “Critical Tiger Habitat”? (a) Corbett Ans: C Mains (2018) Q: “Policy contradictions among various competing sectors and stakeholders have resulted in inadequate ‘protection and prevention of degradation’ to environment.” Comment with relevant illustrations. |

Source: IE

Grammy Award 2024

In News: Shakti, with Zakir Hussain and Shankar Mahadevan, won the 66th Grammy for Best Global Music Album with "This Moment" in 2024.

Grammy Awards: A Brief Overview

- Origins of Grammy Awards

- Originally named Gramophone Award, the Grammy Awards are presented annually in the United States.

- Hosted by the National Academy of Recording Arts & Sciences (NARAS) or the Latin Academy of Recording Arts & Sciences (LARAS) for Spanish/Portuguese recordings.

- The awards were inaugurated in 1959 to honor musical achievements, recognizing performers for the year 1958.

- A golden statuette resembling a gramophone is presented to the honorees.

- India's Performance in the 2024 Grammy Awards

- Shakti, a collaboration featuring Zakir Hussain, Shankar Mahadevan, John McLaughlin, Ganesh Rajagopalan, and Selvaganesh Vinayakram, secured the 2024 Grammy for their album "This Moment."

- Described as an "unprecedented transcontinental collaboration," Shakti merges musicians from Eastern and Western traditions, pioneering the blueprint for world music.

- Zakir Hussain achieved additional victories, winning two more Grammys at the ceremony.

- Best Global Music Performance for 'Pashto.'

- Best Contemporary Instrumental Album for 'As We Speak.'

- 'As We Speak' features Indian flute player Rakesh Chaurasia, the nephew of renowned flautist Hariprasad Chaurasia.

|

UPSC Previous Year Questions Prelims (2009) Q. To integrate cultural leaders into its meetings, which one of the following gives “Crystal Award”? (a) Asia Pacific Economic Cooperation Ans: D |

Source: TH

Green Propulsion System

In News: A Green Propulsion System, developed through DRDO's Technology Development Fund (TDF) scheme, showcased successful in-orbit functionality during the PSLV-C58 Mission.

Green Propulsion System

- Development and Origin

- Bengaluru-based start-up Bellatrix Aerospace Pvt Ltd developed the Green Propulsion System.

- Utilizes a 1N Class Green Monopropellant designed for microsatellite altitude control and orbit maintenance.

- Components of the System

- Involves indigenously-developed elements such as propellant, fill and drain valves, latch valve, solenoid valve, catalyst bed, drive electronics, etc.

- Environment-Friendly Innovation

- Offers a non-toxic and environmentally friendly alternative for low orbit space propulsion.

- Contrasts with conventional hydrazine-based systems known for their hazardous and polluting nature.

- Ideal for High-Thrust Space Missions

- Particularly suited for space missions with high thrust requirements.

PSLV-C58 Mission

- Mission Overview

- Conducted by the Indian Space Research Organisation (ISRO), the PSLV-C58 mission launched the X-ray Polarimeter Satellite (XPOSAT) on January 1, 2024.

- X-ray Polarimeter Satellite (XPOSAT)

- First dedicated scientific satellite from ISRO for research in space-based polarization measurements of X-ray emission from celestial sources.

- Aims to investigate the polarization of intense X-ray sources.

- Significance of X-ray Polarization

- X-rays, with wavelengths of 0.01-10 nanometers, are electromagnetic radiation characterized by perpendicular electric and magnetic fields.

- Measurement of X-ray polarization aids astronomers in studying magnetic field orientations and strengths in celestial bodies.

- Crucial for understanding pulsars, black hole regions, and other X-ray-emitting cosmic phenomena.

|

UPSC Previous Year Questions Prelims (2018) Q. With reference to India’s satellite launch vehicles, consider the following statements:

Which of the statements given above is/are correct? (a) 1 only Ans: (a) Prelims (2010) Q.2 In the context of space technology, what is “Bhuvan”, recently in the news? (a) A mini satellite launched by ISRO for promoting the distance education in India Ans: (c) Mains (2017) Q.1 India has achieved remarkable successes in unmanned space missions including the Chandrayaan and Mars Orbiter Mission, but has not ventured into manned space mission. What are the main obstacles to launching a manned space mission, both in terms of technology and logistics? Examine critically. Mains (2016) Q.2 Discuss India’s achievements in the field of Space Science and Technology. How the application of this technology has helped India in its socio-economic development? |

Source: PIB

Child Safety Portals

In News: In a written response in the Lok Sabha, the Ministry of Women and Child Development shared significant details about the Track Child Portal and GHAR - GO Home and Re-Unite portal.

Track Child Portal: Enhancing Child Tracking

- Objective

- Facilitates tracking of missing and found children across states and Union Territories (UTs).

- Community Involvement with "Khoya-Paya" Feature

- "Khoya-Paya" feature encourages citizens to report missing or sighted children, promoting community engagement.

- Integration with Crime and Criminal Tracking Systems

- Integrated with the Crime and Criminal Tracking & Network Systems of the Ministry of Home Affairs.

- Allows interoperability for matching First Information Reports (FIRs) of missing children.

GHAR - GO Home and Re-Unite Portal

- Purpose

- Developed and launched by the National Commission for Protection of Child Rights.

- Aims to digitally monitor and track the restoration and repatriation of children as per the protocols under the Juvenile Justice (Care and Protection of Children) Act, 2015.

Source: PIB

Ancient Subika Painting

In News: Efforts are actively underway to revive Manipur's endangered ancient Subika painting style as part of a dedicated initiative to safeguard the state's cultural legacy.

Subika Painting Style: A Cultural Heritage

- Historical Connection with Meitei Community

- Inextricably linked to the cultural history of the Meitei community.

- Six surviving manuscripts associated with Subika painting style: Subika, Subika Achouba, Subika Laishaba, Subika Choudit, Subika Cheithil, and Thengrakhel Subika.

- Historical Value and Neglect

- Holds significant historical value in Meitei cultural heritage.

- Despite its importance, the painting style has faced neglect over the years, resulting in a decline in awareness.

- Medium and Materials

- Paintings executed on handmade paper.

- Manuscript materials, including handmade paper or tree bark, are locally prepared, emphasizing traditional and indigenous methods.

Source: IE

Himalayan Griffon - Edukemy Current Affairs

In News: The inaugural tri-State synchronized vulture survey revealed a count of 320 individual vultures across seven protected areas spanning Kerala, Karnataka, and Tamil Nadu.

Himalayan Griffon: A Majestic Old World Vulture

- Taxonomic Classification

- An Old World vulture belonging to the family Accipitridae.

- Among the two largest Old World vultures and classified as true raptors.

- Behavior and Nesting

- Exhibits monogamous behavior with pairs returning to the same nesting and roosting sites annually.

- A diurnal and predominantly solitary species in its habits.

- Distribution

- Found along the Himalayas and the adjoining Tibetan region.

- Also located in the Central Asian mountains.

- Occasional migration to northern India, primarily altitudinal.

- Conservation Status

- IUCN designation: Near Threatened.

Wayanad Wildlife Sanctuary: A Biodiversity Haven

- Geographical Location

- Situated in Kerala, forming an integral part of the Nilgiri Biosphere Reserve.

- Contiguous to the tiger reserves of Nagarhole, Bandipur (Karnataka), and Madhumalai (Tamil Nadu).

- River and Vegetation

- The Kabini River, a Kaveri tributary, flows through the sanctuary.

- Vegetation includes moist deciduous forests and West Coast semi-evergreen forests.

- Flora Composition

- Encompasses plantations of teak, eucalyptus, and Grewelia.

- Diverse Fauna

- Home to diverse wildlife such as elephants, gaur, tigers, panthers, sambar, spotted deer, barking deer, wild boar, sloth bear, and Nilgiri langur.

Source: TH

Fiscal Centralisation Concerns in India

In News: The article delves into the impact of the Union government's actions, which diminish the overall financial transfers to the States, on the diminishing strength of fiscal-cum-cooperative federalism in the nation.

Different Provisions Related to Centre-State Financial Relations

- Constitutional Framework (Part XII)

- Provisions in Articles 268 to 293 elaborate on tax and non-tax revenue distribution, borrowing powers, and grants-in-aid.

- Article 275 facilitates discretionary funds transfer from the Union to States.

- Role of Finance Commission (Article 280)

- The Finance Commission recommends tax revenue distribution, enhances state financial resources, and ensures fiscal stability.

- Empowered to address issues in the interest of sound finance beyond tax devolution.

- Taxing Powers Division (Seventh Schedule)

- Division of taxing powers between Parliament and state legislatures.

- Parliament for Union List, states for State List, and Concurrent List shared.

Steps of Union Government Affecting Financial Transfers

- Centralisation of Fiscal Powers

- Rise in non-shareable revenues, limiting state fiscal autonomy.

- States advocate for a larger share in all central taxes.

- Erosion of State Tax Autonomy

- Loss of autonomy in setting tax rates due to VAT implementation.

- States face challenges in defining tax policies.

- Constraints on State Expenditure Flexibility

- Conditional and tied grants limit state discretion in fund allocation.

- Grants focus on specific state list items, restricting flexibility.

- Uniform Fiscal Targets

- FRBM Act imposes uniform fiscal targets across states.

- Fails to consider diverse fiscal needs, impacting effective financial management.

- GST Implementation

- Shifts tax burden from manufacturing to consuming states.

- Alters power balance among states in indirect taxation.

Current Scenario of Fiscal Transfers:

- Declining Share in Gross Tax Revenue

- States' share in gross tax revenue decreases despite FC recommendations.

- Gross tax revenue of Union increases while the share to states declines.

- Reduction in Grants-in-Aid

- Decline in grants-in-aid to states impacts financial transfers.

- Statutory financial transfers' share in Union gross tax revenue drops.

- Tax Collection Under Cess and Surcharge

- Increasing reliance on revenue collection through cess and surcharge.

- GST cess not considered in the calculation.

- Financial Centralisation Concerns

- Union government retains over 50% of gross tax revenue.

- Limited expenditure responsibilities despite fiscal deficit.

Steps for Better Devolution of Finances:

- Re-Examine Tax-Sharing Principles

- Direct FCs to review tax-sharing principles considering changing fiscal federalism.

- Align terms of reference on indirect tax base consolidation.

- Redesign Statutory Sharing of Indirect Taxes

- Re-examine and redesign vertical and horizontal sharing of indirect taxes.

- Define divisible pool and revisit distribution criteria.

- Calculating and Allocating Cost of Collecting

- Task FCs to recommend methods for calculating and allocating collection costs.

- Propose measures for tax reduction and efficiency improvement.

- Redesign Grant Mechanism

- Redesign CSS and CSS shared schemes based on changing circumstances.

- Examine the need for compensation in post-GST scenarios.

- New Institutional Structure of Federal Finance

- Formally align GST Council and Finance Commission for cohesive decision-making.

- Investigate the role of GST Council as a Fiscal Council during non-operational periods.

Conclusion

The substantial reduction in financial transfers to states poses a threat to cooperative federalism. Despite increased gross tax revenue, state shares have not risen accordingly. The reliance on CSS and CS exacerbates inter-state inequality. Reforms are needed to ensure equitable distribution of financial resources among states and strengthen cooperative federalism.

|

UPSC Previous Year Questions Prelims (2021) Q. Which one of the following in Indian polity is an essential feature that indicates that it is federal in character? (a) The independence of judiciary is safeguarded. Ans: (a) Prelims (2017) Q. Which one of the following is not a feature of Indian federalism? (a) There is an independent judiciary in India. Ans: (d) Prelims (2017) Q. Local self-government can be best explained as an exercise in (a) Federalism Ans: (b) Prelims (2018) Q. Consider the following items:

Which of the above items is/are exempted under GST (Good and Services Tax)? (a) 1 only Ans: (c) Prelims (2017) Q. What is/are the most likely advantages of implementing ‘Goods and Services Tax (GST)’?

Select the correct answer using the code given below: (a) 1 only Ans: (a) |

Source: TH

"Library Campaign: Education for Change" - Case Study of the Day

Sitamarhi in Bihar has launched a two-phase Library Campaign, establishing 1,431 Model Libraries in Phase-I and aiming for 600 more in Phase-II to provide education for all, fostering a mass movement embraced by teachers and individuals of all age groups.

Share the article

Edukemy’s Current Affairs Quiz is published with multiple choice questions for UPSC exams

MCQ

Get Latest Updates on Offers, Event dates, and free Mentorship sessions.

Get in touch with our Expert Academic Counsellors 👋

FAQs

UPSC Daily Current Affairs focuses on learning current events on a daily basis. An aspirant needs to study regular and updated information about current events, news, and relevant topics that are important for UPSC aspirants. It covers national and international affairs, government policies, socio-economic issues, science and technology advancements, and more.

UPSC Daily Current Affairs provides aspirants with a concise and comprehensive overview of the latest happenings and developments across various fields. It helps aspirants stay updated with current affairs and provides them with valuable insights and analysis, which are essential for answering questions in the UPSC examinations. It enhances their knowledge, analytical skills, and ability to connect current affairs with the UPSC syllabus.

UPSC Daily Current Affairs covers a wide range of topics, including politics, economics, science and technology, environment, social issues, governance, international relations, and more. It offers news summaries, in-depth analyses, editorials, opinion pieces, and relevant study materials. It also provides practice questions and quizzes to help aspirants test their understanding of current affairs.

Edukemy's UPSC Daily Current Affairs can be accessed through:

- UPSC Daily Current Affairs can be accessed through Current Affairs tab at the top of the Main Page of Edukemy.

- Edukemy Mobile app: The Daily Current Affairs can also be access through Edukemy Mobile App.

- Social media: Follow Edukemy’s official social media accounts or pages that provide UPSC Daily Current Affairs updates, including Facebook, Twitter, or Telegram channels.