Wednesday, 10th February 2021

U.S. moves to rejoin UN rights council

In News

The Biden administration is set to announce this week that it will reengage with U.N. Human Rights Council that former President withdrew from almost three years ago.

Rationale behind the US’s withdrawal from the body earlier

· Due to its disproportionate focus on Israel, which has received by far the largest number of critical council resolutions against any country.

· It failed to meet an extensive list of reforms demanded by previous administration.

About the UN Human Rights Council

· It is a United Nations body whose mission is to promote and protect human rights around the world.

· It has 47 members elected for staggered three-year terms on a regional group basis from 5 groups. The members are elected for a period of three years, with a maximum of two consecutive terms.

· Procedures related to the UNHRC-

o Universal Periodic Review: Under this, UNHRC reviews all 192 UN member states every four years to "ensure universality of coverage and equal treatment of all Member States."

o Special Procedure: These are independent human rights experts with mandates to report and advise on human rights from a thematic or country-specific perspective. It covers all human rights: civil, cultural, economic, political, and social.

o Special Rapporteur: The titles Special Rapporteur, Independent Expert, and Working Group Member are given to individuals working on behalf of the United Nations (UN) within the scope of "special procedure" mechanisms.

Harmonising Ayush and Modern Medicine

In News

Government mentioned various initiatives undertaken by the Ministry of AYUSH for harmonization of both sectors of modern medicine and AYUSH system of medicine.

Various initiatives include

· The Government of India has adopted a strategy of Co-location of AYUSH facilities at Primary Health Centres (PHCs), Community Health Centres (CHCs) and District Hospitals (DHs), thus enabling choice to the patients for different systems of medicines under a single window.

· Ministry of AYUSH in collaboration with Directorate General of Health Services, Ministry of Health & Family Welfare has implemented National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases and Stroke (NPCDCS) for health promotion, prevention and management of Non-communicable diseases.

· The Central Council for Research in Ayurvedic Sciences conducts research utilizing integrated clinical research protocols adopting Ayurveda parameters & parameters of conventional bio-medicines. The protocols are developed with an expert consultation of allopathic and Ayurveda experts.

· To integrate Yoga in the mainstream medical care, Morarji Desai National Institute of Yoga under the Ministry of AYUSH is running 4 Yoga Therapy Centres at Government Medicine Hospitals in Delhi.

· To establish synergy between Siddha System and modern medicine, National Institute of Siddha, Chennai under the Ministry of AYUSH has entered into MoU with organizations such as National Institute of Epidemiology (ICMR), AIIMS Raipur etc.

Special Series – Budget, Survey and Finance Commission

Topic – 6 Counter-Cyclical Fiscal Policy

Context - Amidst the Covid-19 crisis, fiscal policy has assumed enormous significance across the world. Economic survey prescribes that the optimal stance of fiscal policy in India during a crisis should be counter cyclical.

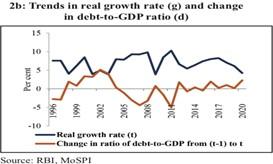

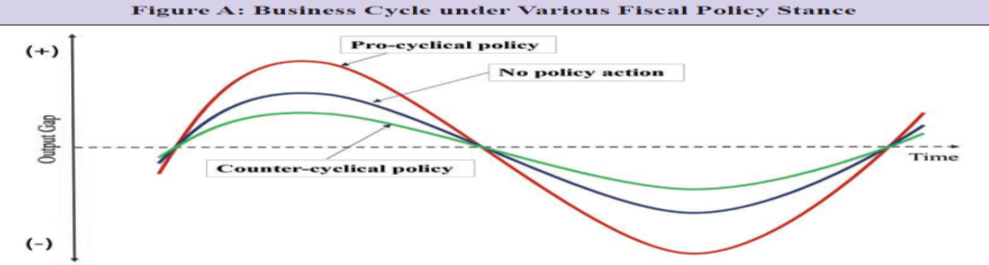

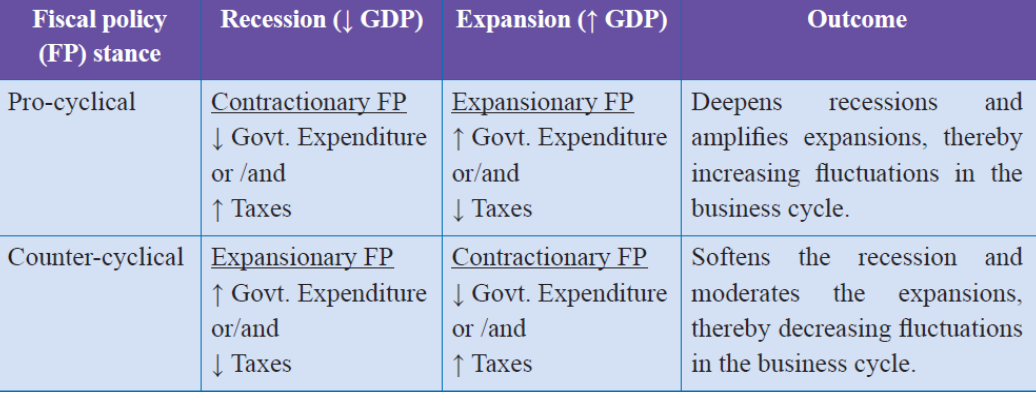

Fiscal Policy and Business cycle

Cyclicality of the fiscal policy simply refers to a change in direction of government expenditure and taxes based on economic conditions. These pertain to decisions by policymakers based on the fluctuations in economic growth. There are two types of cyclical fiscal policies - counter-cyclical and pro-cyclical.

· Counter-cyclical fiscal policy refers to the steps taken by the government that go against the direction of the economic or business cycle.

· In a pro-cyclical fiscal policy, the government reinforces the business cycle by being expansionary during good times and contractionary during recessions.

Need of counter-cyclical fiscal policy during recession

· Savings increases as average life expectancy increases in a country. Thus, in an economy operating below full capacity, the supply of savings may grow from greater government spending through demand creation and thereby greater employment.

· While counter-cyclical fiscal policy is necessary to smooth out economic cycles, it becomes critical during an economic crisis. This is because fiscal multipliers, are unequivocally greater during economic crises when compared to period of economic boom.

|

Reason for higher Fiscal Multipliers During Economic Slowdown: · Easing financial constraints: o Larger fraction of households and firms will consume the extra income generated following an unanticipated tax cut or government spending increase, leading to greater impact on consumption (wealth effect) and hence output. o It encourages more borrowing and spending, which further expands the economy private savings increase through the precautionary motive to save. · Enhanced consumer sentiment for future productivity increases due to higher fiscal spend. |

How can counter-cyclical fiscal policy help India?

During economic crises, a well-designed expansionary fiscal policy stance can contribute to better economic outcomes in two ways.

· First, it can boost potential growth with multi-year public investment packages that raise productivity. For e.g., through National Infrastructure Pipeline (NIP). At a time of excessive risk aversion in the private sector, which is characteristic of any economic crisis, risk taking via public investment can catalyse private investment and unleash a virtuous circle. It will crowd in private investment, rather than crowd it out.

· Second, there is a risk of the Indian economy falling into a low wage-growth trap, as has happened in Japan during the last two decades. Implementing the NIP via front-ended fiscal spending could generate higher-paying jobs and boost productivity.

Model Question - How does counter cyclical fiscal policy work? Examine how a counter cyclical fiscal policy can help India recover from Covid-19 induced economic slowdown.

Retail investors to get direct access to G-sec market: RBI

In News

In a major reform to deepen the bond market in India, Reserve Bank of India (RBI) announced that retail investors can open Gilt Accounts, allowing them direct access to invest in the primary and secondary government bond market.

Government securities (G-secs)

· These are debt instruments issued by the government to borrow money. The two types are:

o Treasury bills: short-term instruments which mature in 91 days, 182 days, or 364 days,

o Dated securities: long-term instruments, which mature anywhere between 5 years and 40 years

· The Union government issues both, while states issue only bonds, called state development loans.

· The g-sec market is dominated by institutional investors such as banks, mutual funds, and insurance companies. These entities trade in lot sizes of Rs. 5 crore or more.

· So, there is no liquidity in the secondary market for small investors who would want to trade in smaller lot sizes.

About the Proposal

· Retail investors will get online access to the government securities market – both primary and secondary – directly through the Reserve Bank.

· Retail investors will be allowed to open gilt investment accounts directly with RBI. The account will be called RBI retail direct.

o Gilt Account can be compared with a bank account, except that the account is debited or credited with treasury bills or government securities instead of money.

· The direct participation of retail investors in the bidding process will be enabled through the core banking solution of Reserve Bank of India- E-kuber.

Significance of the move

· Broaden Investor Base: It will provide retail investors with enhanced access to participate in the government securities market.

· Deepen the bond market: This move could change the dynamics of the bond market in India and could obviate the need for the country to chase foreign investors by listing Indian bonds in global bond indices.

· Facilitate Government Borrowings: This measure together with relaxation in mandatory hold to Maturity (securities that are purchased to be owned until maturity) provisions will facilitate smooth completion of the large government borrowing programme of 12 lakh crore in 2021-22 as with more demand interest cost for government will come down.

· Financialise Domestic Savings: Allowing direct retail participation in the G-Sec market will promote financialisation of domestic savings and could be a game-changer in India’s investment market.

Risks in investing directly in G-Secs

· G-Secs are vulnerable to interest rate risk. Any change in interest rates in the economy can impact the value of the G-Secs you hold.

· Like bank fixed deposits, g-secs are not tax-free. It may be difficult for a retail investor to grasp the nuances of the return that G-Secs will fetch and compare them with other fixed income instruments in the market.

Why Invest In G-Secs?

· G-Secs offer maximum safety as they carry the government’s commitment for payment of interest and repayment of principal. Bank fixed deposits, on the other hand, are guaranteed only to the extent of Rs 5 lakh by the Deposit Insurance and Credit Guarantee Corporation (DICGC).

· Pensioners and low risk-takers can opt for investing in G-Sec as it is a safe investment option that can give them assured long-term returns.

· G-Secs can be sold easily in the secondary market to meet cash requirements. They can also be used as collateral to borrow funds in the repo market where financial institutions borrow cheaply from banks.

Eco-Sensitive Zones (ESZs)

§ They are Ecologically Fragile Areas are areas within 10 kms around Protected Areas, National Parks and Wildlife Sanctuaries which can also cover areas beyond 10kms in case of sensitive corridors.

§ ESZs are notified by MoEFCC, Government of India under Environment Protection Act 1986 in order to regulate activities around National Parks and Wildlife Sanctuaries and minimise their impacts on the fragile ecosystem encompassing the protected areas.

Energy Island

· An energy island is based on a platform that serves as a hub for electricity generation from surrounding offshore wind farms.

· Recently, the Danish government approved a plan to build an artificial island in the North Sea as part of its effort to switch to green energy.

· The idea is to connect and distribute power between Denmark and neighbouring countries.

· The move has come after the EU announced its plans to transform its electricity system to rely mostly on renewables within a decade and to increase its offshore wind energy capacity by over 25-fold by the year 2050.

Continuity in India’s ties with Central Asia - ORF

Essence - Editorial is providing inputs on kind of sustained, balanced, long-term strategy — which New Delhi will have to capitalise on to achieve its policy goals in the Central Asian region.

Why you should read this article?

· To understand the major agendas with trajectory of engagement which held in past 5 years in India - Central Asia ties.

· To know the factors which make Central Asia important from economic, geo-strategic & security point of view.

· To understand importance of central Asian region for Afghan peace process & projects like International North-South Transport Corridor (INSTC), BRI.

· To know the weight of Russia & China on diplomatic scale in this region, & how India can advance its interests with due coordination.

Link - https://www.orfonline.org/expert-speak/continuity-india-ties-central-asia/

To make the urban water mission work, fix institutional structures - HT

Essence - The government recently announced Jal Jeevan Mission-Urban (JJM-U) to address the huge gap in water supply and sewage infrastructure in cities. The article argues that the government must expand its focus from infrastructure provision to the comprehensive management of urban water to ensure sustainable urban growth and enhanced quality of life of millions of city-dwellers.

Why you should read this article?

· It identifies the barriers to comprehensive management of urban water - statutory and administrative frameworks and compartmentalization of water into distinct entities.

· It talks about what can be done to make sure JJM-U delivers and also mentions the need for adopting Integrated Urban Water Management (IUWM) approach.

Library Campaign: Education for Change

· Aspirational District of Sitamarhi in Bihar has initiated a Library to enhance the imagination of kids and making them ready to face the world

· It will motivate and encourage individuals of all age groups to overcome all the other social barriers and benefit from the Libraries.

· It has converted into a mass movement with teachers wholeheartedly participating in it.

· It has also launched Main Saksham Hoon Campaign, specifically targeted at motivating parents to send their kids to schools.

· It will further encourage the trend of Padhega Bharat Tabhi To Badega Bharat.

Share the article

Get Latest Updates on Offers, Event dates, and free Mentorship sessions.

Get in touch with our Expert Academic Counsellors 👋

FAQs

UPSC Daily Current Affairs focuses on learning current events on a daily basis. An aspirant needs to study regular and updated information about current events, news, and relevant topics that are important for UPSC aspirants. It covers national and international affairs, government policies, socio-economic issues, science and technology advancements, and more.

UPSC Daily Current Affairs provides aspirants with a concise and comprehensive overview of the latest happenings and developments across various fields. It helps aspirants stay updated with current affairs and provides them with valuable insights and analysis, which are essential for answering questions in the UPSC examinations. It enhances their knowledge, analytical skills, and ability to connect current affairs with the UPSC syllabus.

UPSC Daily Current Affairs covers a wide range of topics, including politics, economics, science and technology, environment, social issues, governance, international relations, and more. It offers news summaries, in-depth analyses, editorials, opinion pieces, and relevant study materials. It also provides practice questions and quizzes to help aspirants test their understanding of current affairs.

Edukemy's UPSC Daily Current Affairs can be accessed through:

- UPSC Daily Current Affairs can be accessed through Current Affairs tab at the top of the Main Page of Edukemy.

- Edukemy Mobile app: The Daily Current Affairs can also be access through Edukemy Mobile App.

- Social media: Follow Edukemy’s official social media accounts or pages that provide UPSC Daily Current Affairs updates, including Facebook, Twitter, or Telegram channels.