Friday, 17th September 2021

Government announces Bad Bank

In News

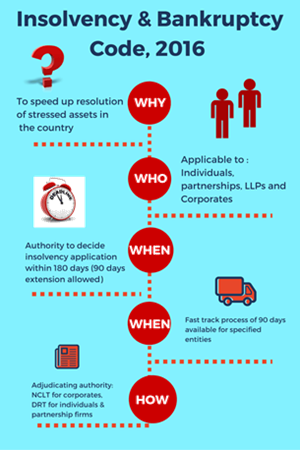

Finance Minister has announced the formation of India’s first-ever “Bad Bank”.

About the news

- As per the announcement, structure of the Bad Bank will consist of two entities to carry out two functions.

- National Asset Reconstruction Company Limited (NARCL), which has already been incorporated under the Companies Act, will acquire stressed assets worth about Rs 2 lakh crore from various commercial banks in different phases.

- Another entity, India Debt Resolution Company Ltd (IDRCL), which has also been set up — will then try to sell the stressed assets in the market.

- Need for Bad Bank: To fight the menace of increasing non-performing assets of commercial banks, the finance minister had announced the idea of setting up a new bad bank in the budget.

How will NARCL- IDRCL function?

Step 1: NARCL will first purchase bad loans from banks by paying 15% of the agreed price in cash and the remaining 85% will be in the form of Security Receipts.

- Security receipt means a receipt or other security, issued by an asset reconstruction company to any qualified buyer pursuant to a scheme, evidencing the purchase or acquisition by the holder thereof, of an undivided right, title or interest in the financial asset involved in securitization.

- They are issued under the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002.

Step 2: IDRCL will try to sell these bad loans.

Steps 3: If IDRCL fails to sell or makes a loss, the original bank will be paid from the corpus the government has created.

About the concept of Bad Bank

- Bad Bank: It is an entity which acquires bad loans from banks and sells them in the market.

- Objective: Relieve the banks of their bad loans so that they can focus on resuming normal banking operations. Realize maximum value of a bad loan by developing specialization to sell bad loans.

- Need:

- Improve profitability of banks: A bank with high bad loans becomes less profitable because it has to use some of its profits to make up for the loss on the bad loans.

- Increase credit flow in the market: The bank becomes more risk-averse by being extremely cautious while extending new loans such as lending.

- Benefits of Bad Bank:

- For Commercial Banks:

- Get rid of all bad loans

- Improves balance sheets when the recovery money is paid back

- It can start lending again

- For the Government the benefit is neutral because instead of spending money on recapitalization, it is now giving guarantees for security receipts.

Source:

New rating system downgrades India in terms of climate action

In News

Climate Action Tracker has downgraded India’s ratings from almost sufficient from November 2020 to highly insufficient category under their new stringent rating system.

About the News

- India was the only country among G-20 which was 2 Degree Celsius’ temperature rise compatible and in the category of almost sufficient.

- The push for achieving Net-Zero being a consideration in the rating has once again put a question on India’s stand on declaring Net Zero by 2050.

- The downgrading of the rating is a cause of concern for India especially ahead of COP26 to be held in Glasgow as it will call for target upgradation by India.

- COP26: The UK will host the 26th UN Climate Change Conference of the Parties (COP26) in Glasgow on 31 October – 12 November 2021.

Significance of these ratings for India

- The Rating can be seen as a nudge towards India to declare Net Zero Targets.

- India’s Ratings may improve on upgradation of its NDC’s (Nationally Determined Contributions such as decision to set 450GW of renewable energy by 2030.

- Indian can become 5 degree C compatible by Clean energy push through renewables and green hydrogen.

About the Climate Action Tracker (CAT)

- The Tracker is run by Germany based non-profit group Climate Analytics and research body New Climate Institute.

- It is an independent scientific analysis that tracks government climate action and measures it against the globally agreed Paris Agreement aim of "holding warming well below 2°C, and pursuing efforts to limit warming to 1.5°C."

- The rating is done for 37 countries. Gambia is the only country which is 5-degree climate compatible.

- Countries like UK though have 1.5 degree Climate Compatible domestic targets but no substantial policies and international support.

Source:

68th “Crime in India 2020” Report

In News

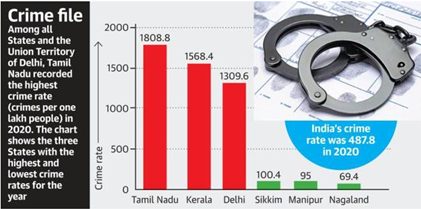

The National Crime Records Bureau (NCRB) has released the 68th edition of its annual report, “Crime in India 2020”

Highlights of the Report

- Traditional Crimes: The Covid-19 pandemic and subsequent lockdown has resulted in a drop in traditional crimes like theft, robbery, and assault on women and children in 2020.

- Murder/ fatalities/Rape: India reported an average 80 murders daily in 2020, with Uttar Pradesh topping the chart among states.

- Delhi accounted for nearly 40 per cent of all rape cases and almost 25 per cent murder cases among 19 metropolitan cities in India in 2020.

- Crime against Women: A dip of 3% has been noted in crimes against women in 2020. Majority of cases were registered under 'Cruelty by Husband or His Relatives', followed by 'Assault on Women with Intent to Outrage her Modesty', 'Kidnapping & Abduction of Women' and 'Rape'.

- Crimes against Scheduled Castes (SCs): An increase of 9.4% has been reported in cases registered under crimes against Scheduled Castes (SCs). Majority of cases were registered under simple hurt followed by cases under the SC/ST (Prevention of Atrocities) Act and Criminal Intimidation.

- Crimes against Scheduled Tribes (STs): A surge of 9.3% has been reported in cases registered under crimes against Scheduled Tribes (STs) and majority of cases were registered under simple hurt followed by rape and assault on women with intent to outrage her modesty.

- Crime against Children: A decline of 13.2% has been reported with crimes such as Kidnapping & Abduction and the Protection of Children from Sexual Offences Act, 2012 including child rape.

- Crime against Senior Citizens: A decrease of 10.8% has been reported in cases registered for committing crimes against Senior Citizens (aged above 60 years).

- Juveniles in Conflict with Law: A decline of 7.8% has been noted over 2019.

Sources:

Differentiated Banking in India

In News

Investors of small finance banks have had rough time so far in FY22 as the pandemic brought imbalance in the balance sheets.

About the News

- The Small Finance banks are in a tight spot because of the pandemic. The pressure of growing the balance sheet is immense, along with high attrition level.

- These banks saw a sharper deceleration in loan growth over the past few quarters compared to the industry wide performance.

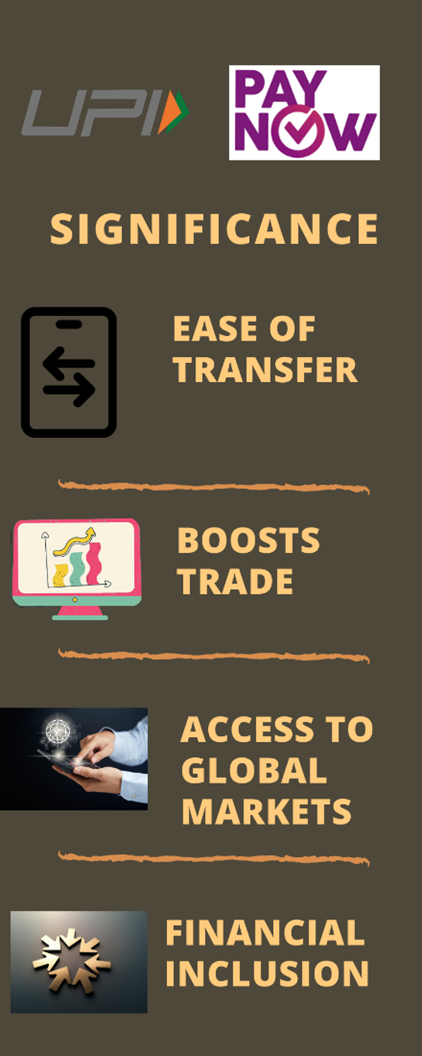

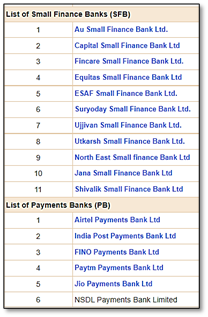

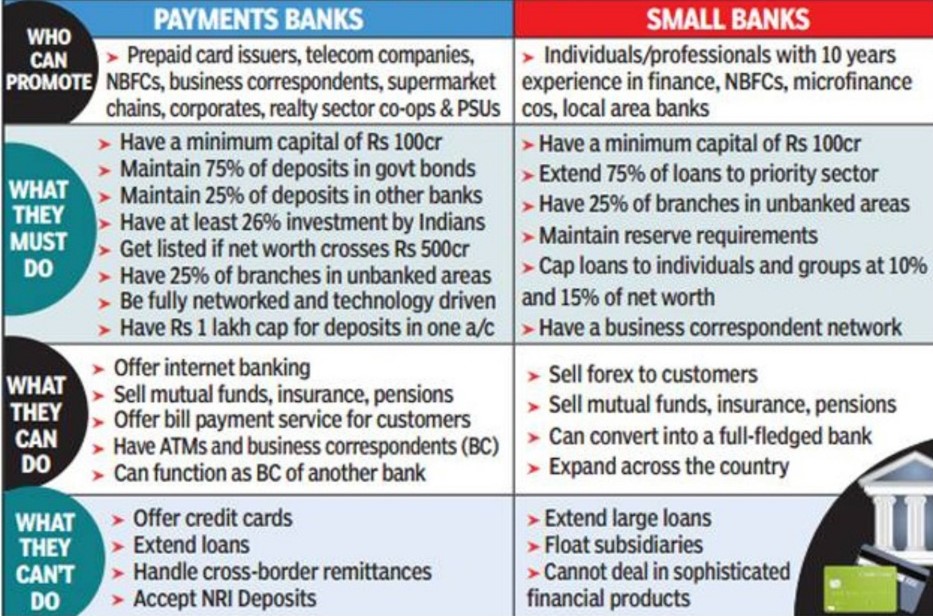

- Small Finance Banks and Payment Banks are examples of differentiated banks in India. Differentiated Banks (niche banks) were launched to serve the needs of financial inclusion.

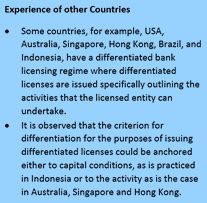

What are Differentiated Banks?

- Meaning: Differentiated banks are distinct from universal banks as they function in a niche segment. The differentiation could be on account of capital requirement, scope of activities or area of operations.

- Origins: RBI committee headed by Mr. Nachiket Mor suggested licensing of payments and small finance banks as differentiated banks.

- The Committee opined that it would to have the regulatory flexibility to approach payments, savings, and credit independently and to bring them together when efficiency gains are high and other costs are low.

- Functions: It can carry out most banking operations but can’t advance loans or issue credit cards. It can accept demand deposits (up to Rs 1 lakh), offer remittance services, mobile payments/transfers/purchases and other banking services like ATM/debit cards, net banking and third party fund transfers.

Why was Differentiated Banking introduced in India?

- The objectives of licensing small finance banks are furthering financial inclusion by

- provision of savings vehicles,

- supply of credit to small business units; small and marginal farmers; micro and small industries; and other unorganised sector entities, through high technology-low cost operations.

- Scope of Work: It is estimated that almost 40 per cent of the population do not have access to any form of formal banking. Spreading the banking habit, accompanied by financial literacy, is a priority. Launch of these niche banks is a step towards Financial Inclusion.

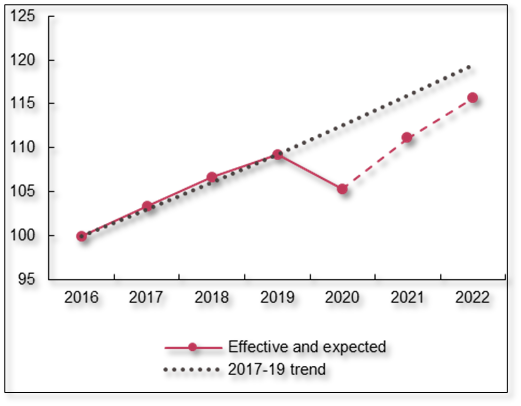

How Successful has the differentiated banking system been in India?

- Growth in Financial Inclusion: Small finance banks have managed to stick to their stated objective of improving financial inclusion by lending more to micro, small and medium enterprises.

- Growth in Assets: A study, published by the RBI, about the business of small finance banks between financial years 2017-18 and 2019-20, reflected that assets of these banks have grown 150% annually during the period.

- However, this growth came on a low base. The growth in assets was largely supported by agriculture, trade and professional services segments.

- Rise in Deposits: Small finance banks have also seen a rapid rise in their deposit base. Since microfinance institutions were largely the entities which converted to small finance banks, their focus has been to get access to cheaper funding by raising deposits.

- Increase in Spread: There has been rise in the number of Payment Banks and small finance bank branches. However, these banks may need a better strategy to grow their network to penetrate underserved areas.

- These branches display concentration with about 65% of the total branches in the urban and semi-urban centres. Only three small finance banks had more than 25% of their branches in rural areas.

But, the Success story of the Differentiated Banks has its share of challenges too

- Managing public perception: One major challenge is to build trust in the minds of depositors and public in general. Considering that in India we have been only licensing universal banks which engage in all types of financial activities, it is a challenge to provide enough confidence to the public to enable them to place deposits in differentiated banks.

- Asset Liability mismatches: Sector-specific banks run the risk of asset-liability mismatches. Asset liability mismatches will be posing a challenge to liquidity management by differentiated banks.

- Absence of cross subsidization: Universal banks function by engaging in cross-subsidizing loss making business in one segment with earnings from another which will not be possible for specialized banks thereby, impacting their revenues. The localized operations or restriction on the banks to engage in a particular activity could lead to non-availability of cross-subsidization impacting the viability of such models.

- Internet and Technological illiteracy: Medium of operation for these banks is the internet. India is struggling with very low internet speeds, which hinders the growth of these banks.

- Furthermore, since they are entirely technology-based without any significant physical presence, people from the rural areas and small towns in India will find it difficult to participate in this type of banking facility.

Way Forward

- Awareness and Facilitation: The perception and trust of people in new systems is of utmost importance. There will be a need for creation of awareness through proper communication strategy and depositor education.

- In a country like India where there exists differentiated markets and consumer groups, the differentiated banking concept may have to be contextualized according to the needs of the customers.

- The Balancing Act: As regards the health of the differentiated banks, there is a need for creating a balance between long term sustainability and the financial inclusion

- Specialization in Banking: Diverse opportunities in the banking sector reflecting significant macro-economic growth potential could be utilized by niche banking by facilitating specialization thereby enhancing optimal use of resources.

- Each of the niches has the potential to be individually large to sustain significant balance sheets and specialized entities can play a major role in all of them.

- Given the Success of the Differentiated Banks, the RBI is contemplating to explore of creating new kinds of differentiated banks, such as custodian and wholesale financing banks.

Question: Discuss the Differentiated Banking System in India. What are the challenges being faced by these banks?

Sources:

- Differentiated banks: has their time come?

- List of Private Sector Banks in India

- RBI’s Differentiated Banking Strategy Starts Paying Off: Study

- Differentiated Banks: Design Challenges

- New categories of differentiated banks under consideration

- Differentiated banking - Is India really prepared?

- Explainer: India’s payments banks

This Day in History - Michiyo Tsujimura

On September 17, 1888, Michiyo Tsujimura was born in the city of Okegawa in the Saitama Prefecture, Japan. Michiyo Tsujimura, the Japanese chemist who did in-depth research on green tea. While working at this lab, Tsujimura and her colleague discovered green tea to be a natural source of vitamin C. As Tsujimura further explored green tea, she was able to isolate more of its chemical composition, including catechin (a bitter ingredient of tea) and tannin. She went on to patent in 1935 a method of extracting crystallized Vitamin C from plants.

Source:

Image of the Day - Igatpuri Twin Tunnel

This is image of the twin tunnels at Igatpuri will reduce travel through Kasara Ghat to five minutes from 35 minutes. It will be India’s widest and fourth longest tunnel. Part of the Samruddhi Mahamarg in Maharashtra, this is the state’s longest tunnel. The feat of completing the work in two years was achieved by the Austrian tunnelling method of sequential excavation by infrastructure major Afcons. Igatpuri is also known to be an area with heavy rainfall. According to reports, the tunnel will have water hydrants, supervisory control and data acquisition for fast communication and monitoring.

Source:

Florence Nightingale Award

- Context: Recently, the nursing personnel were awarded the National Florence Nightingale.

- This Award is given to outstanding nursing personnel employed in Central, State/UTs, Private, Missionary and Voluntary

- The Indian Nursing Council, a statutory bodyunder the Ministry of Health & Family Welfare, grants the award as a mark of recognition for exemplary service in areas of public health and nursing education.

- It is the highest national distinction awarded to nurses or nursing aides. The award consists of a cash amount of Rs 50,000, a certificate and a medal.

- Florence Nightingale (1820-1910), known as “The Lady With the Lamp,” was a British nurse, social reformer and statistician best known as the founder of modern nursing.

Sources:

Transparent Ceramics

- Context: Indian Researchers have developed transparent ceramics (magnesium aluminate spinel ceramics) for the first time in India.

- The Transparent Ceramic is among the class of advanced material that exhibits unique transparency and splendid mechanical properties.

- The transparency of the Ceramics is identical or close to standard glass. It has optical properties of transmission – more than 75 % in the visible and more than 80% in the infrared range.

- The material can be used for thermal imaging applications, especially in harsh service conditions and personal protection systems such as helmets, face shields, and goggles for the armed forces and law enforcement agencies.

Sources:

UNCTAD Trade and Development Report 2021

- Context: UNCTAD has projected India's economy to outpace all other major economies in the next year.

- As per the Trade and Development report 2021 of UNCTAD, after a 3.5% fall in 2020, the world output is expected to grow 5.3% this year and 3.6% in 2022.

- India's economic growth rate is expected to hit a four-year high of 7.2 per cent for 2021 against a contraction of 7 per cent in 2020.

- India will clock an economic growth of 6.7% in 2022, slower than the country’s expected 2021 growth rate.

- Inflation based on the Consumer Price Index (CPI) moderated to a four-month low of 5.3 per cent in August from 5.59 per cent in the previous month.

- Income and wealth inequalities have widened and social unrest has increased in the country.

- Globally, international trade in goods and services has recovered, after the overall flow dropped by 5.6% in 2020 and is set to hit 9.5% in 2021.

Source:

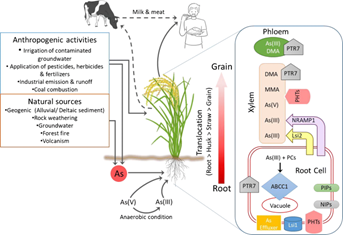

Arsenic Contamination

- Context: A recent study in Bihar has reported Arsenic contamination

- The Contamination has been observed in groundwater and also inthe food chain- mainly rice, wheat and potato. It can originated from either natural or anthropogenic sources.

- Arsenic is an odourless and tasteless metalloidwidely distributed in the earth’s crust and groundwater.

- Arsenic and its compounds occur in crystalline, powder, amorphous or vitreous It usually occurs in trace quantities in all rocks, soil, water and air.

- It is highly toxic in its inorganic form. Arsenic poisoning causes Arsenicosis, which occurs due to accumulation of large amounts of arsenic in the body which leads to adverse health effects through inhibition of essential enzymes leading to death from multi-system organ failure.

Sources:

The Greatest Game: The Indo-Pacific

Essence: The article talks about the shift of equilibrium of geopolitical importance from Central Asia to the Indo-Pacific. According to USA, Indo-Pacific is the new Greatest Game. USA administration says that Afghanistan was the type of war in which the US would not want to engage and it claims that vital interests of the US lie in the connection to the Indo-Pacific, Europe, and the Western Hemisphere. The article also mentions the “Biden Doctrine” which according to the analysts has several implications like an existential threat from China. By the “Biden Doctrine” the White House is justifying its withdrawal move from Kabul and now even aligning itself with West Asia. Every step taken by the US president in recent days is an approach to overcome discontent from past elitist politics and restore trust in the government system. India’s concern should be whether the US accelerates its engagement with the Indo-Pacific. Announcement of ANKUS justifies that US investment will not be restricted to Indo-Pacific.

Why you should read this article?

- To understand the geopolitical importance of Indo-Pacific region.

- To understand how India could benefit from the US’s investment in the Indo-Pacific.

- To understand the diplomatic move of US withdrawal from Kabul.

Source:

This call won’t drop

Essence: The recent telecom package/reforms will improve the financial health and re-energize the telecom sector. The relaxation of spectrum pay-outs and Adjusted Goss Revenue (AGR) for four years will help the operators to invest in infrastructure. The package will have a domino effect empowering consumers with improved coverage, quality of service, technological shift from 2g to 4g, embracing 5g and ease of adoption. These measures help in fast tracking digital spread.

Self-app based know your customer process will help in empowering customers and ensuring faster onboarding. Faster roll out of 5g services will enable India to be a global innovation hub and will unleash innovative services to the consumers. They have the potential to change the socio-economic character of India in remote areas in sectors such as education and health sector.

Why should you read the article?

- To understand the issues associated with the telecom sector and the significance of the telecom package.

- To understand the potential of the 5g services in India.

Source:

Challenge of getting back to learning track as schools reopen

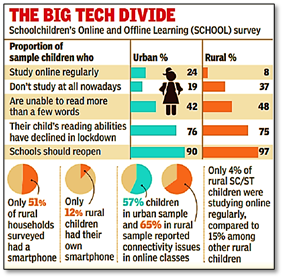

Essence: With students slowly returning to schools after about 70 weeks of COVID induced closer, loss of learning, particularly loss of foundational abilities like reading, writing and basic arithmetic among primary level students, is emerging among the most explicit and worrying aspects.

While cautioning policy makers of the pit fall of deceptively simple solutions, article points out complex nature of problem because of students coming from different classes and socio-economic backgrounds and having widely different experience of the pandemic.

The author advises against hasty steps and hopes that focus on psychological aspects of learning and capacity building of students and teachers will compensate not only for the learning loss but also to change our schools for the better.

Why should you read this article?

- To understand deeper impact pandemic had over learning ability of children.

- To appreciate different ways in which children learn and how this understanding can be utilized in devising a way to get back on learning track.

Source:

Fisheries as the new nursery of Shazadpur

Background

- Low-lying flooded land: Shahzadpur in Samastipurdistrict of Bihar has always been troubled due to flooding.

- Barren land: led to people becoming jobless and idle.

Nursery of fisheries

- Pilot Project: for fishery development started in the village

- Government initiative: 30%-50% subsidy was provided for digging up ponds in the region.

- Training: Special training was facilitated to farmers to better understand the fisheries ecosystem.

Outcome

- Independence: Bihar has replicated the model and accelerated the state’s movement towards self-reliance in fisheries sector.

- Income generation: Higher income generated by fishery owners due to fruitful produce.

- Social flexibility: Upper caste people ventured into what was previous seen as a low-caste occupation.

Quote

“In the middle of difficulty lies opportunity”.- Albert Einstein

Source:

Share the article

Get Latest Updates on Offers, Event dates, and free Mentorship sessions.

Get in touch with our Expert Academic Counsellors 👋

FAQs

UPSC Daily Current Affairs focuses on learning current events on a daily basis. An aspirant needs to study regular and updated information about current events, news, and relevant topics that are important for UPSC aspirants. It covers national and international affairs, government policies, socio-economic issues, science and technology advancements, and more.

UPSC Daily Current Affairs provides aspirants with a concise and comprehensive overview of the latest happenings and developments across various fields. It helps aspirants stay updated with current affairs and provides them with valuable insights and analysis, which are essential for answering questions in the UPSC examinations. It enhances their knowledge, analytical skills, and ability to connect current affairs with the UPSC syllabus.

UPSC Daily Current Affairs covers a wide range of topics, including politics, economics, science and technology, environment, social issues, governance, international relations, and more. It offers news summaries, in-depth analyses, editorials, opinion pieces, and relevant study materials. It also provides practice questions and quizzes to help aspirants test their understanding of current affairs.

Edukemy's UPSC Daily Current Affairs can be accessed through:

- UPSC Daily Current Affairs can be accessed through Current Affairs tab at the top of the Main Page of Edukemy.

- Edukemy Mobile app: The Daily Current Affairs can also be access through Edukemy Mobile App.

- Social media: Follow Edukemy’s official social media accounts or pages that provide UPSC Daily Current Affairs updates, including Facebook, Twitter, or Telegram channels.