Friday, 21st June 2024

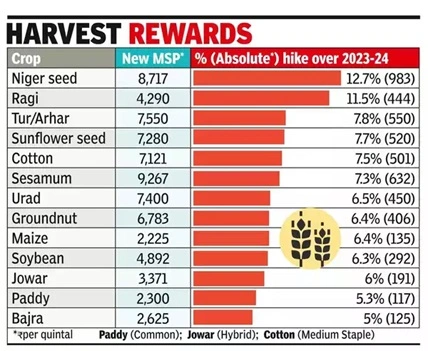

MSP Hikes for 14 Kharif Crops

Why in the news ?

- Recently, the Union Cabinet has given its approval for raising the minimum support prices (MSP) for all 14 kharif crops for the crop season of 2024-25.

What is the Minimum Support Price?

- MSP guarantees a set price paid to farmers by the government when it purchases their agricultural produce.

- The Commission for Agricultural Costs and Prices (CACP), established in January 1965 as an attached office of the Ministry of Agriculture and Farmers Welfare, determines MSP.

- It considers factors such as production costs, demand-supply dynamics, market price trends, and inter-crop price parity.

- The CACP has operated as an attached office under the Ministry of Agriculture and Farmers Welfare since its inception in January 1965.

- The final approval on MSP levels is decided by the Cabinet Committee on Economic Affairs (CCEA), chaired by the Prime Minister of India.

- MSP aims to ensure farmers receive fair prices for their produce, thereby fostering agricultural sustainability and promoting crop diversification initiatives

The government announces MSPs for 22 crops, categorised into:

- 14 kharif crops: paddy, jowar, bajra, maize, ragi, tur/arhar, moong, urad, groundnut, soyabean, sunflower, sesamum, niger seed, cotton

- 6 rabi crops: wheat, barley, gram, masur/lentil, rapeseed and mustard, safflower

- 2 commercial crops: jute and copra

- MSPs for Toria and de-husked coconut are determined based on the MSPs of rapeseed & mustard and copra, respectively.

Who decides what the MSP would be and how ?

- The MSP is determined by the Cabinet Committee on Economic Affairs (CCEA) at the onset of each sowing season, guided by recommendations from the Commission for Agricultural Costs and Prices (CACP).

- The CACP considers several factors when formulating MSP recommendations:

- Demand and supply dynamics of the commodity

- Cost of production

- Market price trends, both domestic and international

- Inter-crop price parity

- Terms of trade between agriculture and non-agriculture sectors

- Ensuring a minimum of 50% margin over the cost of production

- Potential impact of MSP on consumers of the product

Calculation Formula of MSP:

- The CACP utilises state-specific production cost estimates provided by the Directorate of Economics & Statistics within the Agriculture Ministry for its projections. It does not conduct its own field-based cost estimates.

- The CACP calculates three types of costs — A2, A2+FL, and C2 — for each mandated crop across different states.

- A2 cost: Covers all paid-out costs directly incurred by the farmer, including cash and kind expenditures on seeds, fertilisers, pesticides, hired labour, leased-in land, fuel, irrigation, etc.

- A2+FL cost: Includes A2 costs plus an imputed value of unpaid family labour.

- C2 cost: Represents the highest cost among the three, incorporating rentals and interest for owned land and fixed capital assets, in addition to A2+FL.

- The National Commission for Farmers, chaired by MS Swaminathan, recommended calculating MSP using the C2+50 percent formula, which includes total crop costs (C2) plus a 50% profit margin.

- However, the government announces MSP based on A2+FL costs.

Benefits of Minimum Support Price (MSP):

- Income Security: MSP guarantees farmers a minimum price for their crops, ensuring a stable income and protecting them from market price fluctuations.

- Price Stability: MSP helps stabilise the prices of agricultural products, preventing extreme fluctuations and ensuring affordable prices for consumers.

- Encourages Production: Minimum Support Price motivates farmers to increase their agricultural production by providing them with a fair price for their produce.

- Food Security: MSP promotes a steady food supply by encouraging farmers to produce staple crops, reducing dependence on imports, and enhancing domestic food security.

What are the Concerns Related to MSP in India?

- Distorted Crop Selection: The MSP regime often focuses on a few crops, such as rice and wheat, leading to imbalanced crop selection. This can result in overproduction of certain crops and neglect of others, affecting the overall diversity and sustainability of agriculture.

- Market Distortions: MSPs can create market distortions by influencing the cropping pattern and leading to surplus production of certain crops. This surplus can lead to storage challenges, market inefficiencies, and distortions in price signals.

- Limited Coverage: MSP officially covers 23 crops, but in practice, only rice and wheat are extensively procured under the National Food Security Act (NFSA). Most farmers growing non-target crops do not benefit from MSP due to ad-hoc and insignificant implementation.

- Storage and Logistics Challenges: MSP operations require effective storage and logistics infrastructure to handle the procurement of large quantities of crops. Inadequate facilities can lead to wastage and storage-related losses.

- Fiscal Burden: Implementing MSPs can impose a significant fiscal burden on the government. Procuring crops at guaranteed prices and managing surplus stocks require substantial financial resources, impacting the government’s budget and fiscal health.

Way forward:

- Diversify Agriculture: Promote investments in animal husbandry, fisheries, fruits, and vegetables for improved nutrition and higher income prospects.

- Encourage Private Sector Involvement: Incentivize the private sector to establish efficient agricultural value chains, using a cluster-based approach.

- True MSP Intervention: Implement genuine MSP interventions where the government steps in when market prices dip below a set threshold. Focus on scenarios of excess production, oversupply, or price collapse influenced by global factors.

|

UPSC Civil Services Examination Previous Year Question (PYQ) Prelims Q:1 Consider the following statements: (2020)

Which of the statements given above is/are correct? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2 Ans: (d) Q:2 Consider the following statements: (2023)

How many of the above statements are correct? (a) Only one (b) Only two (c) All three (d) None Ans: (c) |

Source: TH

Sri Lanka's constitution - Strides in the right direction

Why in the news ?

- Recently, interim report by a state government panel, over 45% of Sri Lankan Tamils in Tamil Nadu’s rehabilitation camps were born in India.

Reason of Tamilian Displacement:

- Ethnocentric Violence: Ethnocentric violence in Sri Lanka, particularly targeting the Tamil population, caused substantial displacement, resulting in loss of life and property, compelling Tamils to seek safety elsewhere.

- Proximity and Linguistic Commonality: Given India's geographical proximity and shared Tamil language, many Tamils sought refuge in Tamil Nadu, finding it accessible and culturally familiar.

Government Initiatives:

- Basic Amenities Provision: Refugees are provided with free housing, electricity, water, and monthly food rations. Additionally, they receive a monthly cash allowance.

- Educational Support: Refugee children have access to government schools, and those pursuing higher education receive a monthly stipend of ₹1,000. Arts and science students receive a one-time support of ₹12,000, while engineering students receive ₹50,000.

- Welfare Schemes: Refugees are entitled to various welfare schemes available to Tamil Nadu residents, including a women’s rights scheme that provides ₹1,000 per month.

- New Housing Initiatives: The Government of Tamil Nadu has recently constructed new homes for approximately 5,000 Sri Lankan Tamils.

- Camp Renaming: In an effort to reduce stigma, refugee camps were renamed as Sri Lankan Tamil Rehabilitation Camps by a government order dated October 28, 2021

Restoring Dignity:

- Educational Empowerment: Welfare initiatives have achieved full school enrollment and produced over 4,500 graduates from the camps.

- Overcoming Caste Barriers: Categorised as refugees, Sri Lankan Tamils have found liberation from caste constraints.

- Government Recognition: Renaming refugee camps as Sri Lankan Tamil Rehabilitation Camps marks a significant step in restoring dignity to displaced communities.

- Advocacy and Support: Ongoing advocacy by organisations like OfERR, donor support, and political backing have bolstered patronage from the Government of Tamil Nadu and Government of India.

- Future Potential: These efforts position refugees as potential contributors to nation-building upon their return to Sri Lanka.

Current Challenges:

- Legal Restrictions: Indian laws do not allow for local integration through citizenship for Sri Lankan refugees.

- Economic and Health Crises: The COVID-19 pandemic and economic challenges in Sri Lanka have hindered refugees' return to their homeland.

- Uncertainty: Despite improvements in living conditions and dignity, Sri Lankan Tamils in India face ongoing uncertainty about their long-term future.

Way Forward:

- Policy Advocacy: Advocate for legal reforms in India to facilitate local integration options for Sri Lankan refugees, including pathways to citizenship or long-term residency.

- Regional Cooperation: Foster closer cooperation between India, Sri Lanka, and international organisations to address the economic and health challenges impacting the return of refugees.

- Livelihood Support: Enhance vocational training and employment opportunities for Sri Lankan Tamils in India to promote self-reliance and economic stability.

- Healthcare Assistance: Provide targeted healthcare support to address the health needs exacerbated by the COVID-19 pandemic and economic crises.

- Community Integration: Promote cultural exchange programs and initiatives that facilitate social integration and mutual understanding between Sri Lankan refugees and local communities.

- Durable Solutions: Work towards durable solutions that ensure the safety, security, and well-being of Sri Lankan Tamils, including voluntary repatriation under safe conditions or alternative legal statuses that respect their rights.

|

UPSC Civil Services Examination Previous Year Question (PYQ) Prelims Q1. Elephant Pass, sometimes seen in the news, is mentioned in the context of the affairs of which one of the following? (2009) (a) Bangladesh (b) India (c) Nepal (d) Sri Lanka Ans: (d)

Mains: Q:1 In respect of India-Sri Lanka relations, discuss how domestic factors influence foreign policy. (2013) Q:2 ‘India is an age-old friend of Sri Lanka.’ Discuss India’s role in the recent crisis in Sri Lanka in the light of the preceding statement.(2022) |

Source: TH

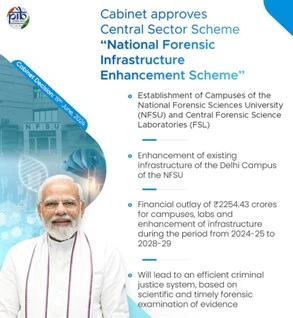

National Forensic Infrastructure Enhancement Scheme (NFIES)

Why in the news ?

- Recently, the Union Cabinet has approved the National Forensic Infrastructure Enhancement Scheme (NFIES) aimed at improving conviction rates in criminal cases.

About the NFIES :

About the NFIES :

- The Union Cabinet has approved the National Forensic Infrastructure Enhancement Scheme (NFIES), a Central Sector Scheme with a budget of Rs. 2254.43 crore allocated from 2024-25 to 2028-29.

- The scheme includes the following components:

- Establishment of Campuses of the National Forensic Sciences University (NFSU) across the country.

- Establishment of Central Forensic Science Laboratories (CFSLs) throughout the nation.

- Enhancement of the existing infrastructure of the Delhi Campus of NFSU to bolster its capabilities.

The need for the NFIES Schemes:

- Increased Workload Due to New Laws: The enactment of new criminal laws requiring forensic investigation for offences punishable by seven years or more is expected to significantly increase the workload of forensic science laboratories.

- Shortage of Trained Manpower: There is a notable scarcity of trained forensic professionals in the Forensic Science Laboratories (FSLs) across the country. This shortage hampers the timely and effective processing of forensic evidence.

- International Standards and Collaboration: Upgraded forensic infrastructure will enable India to align with international standards, fostering better collaboration with global forensic bodies and law enforcement agencies.

Advantages of Improved Forensic Investigation Facilities:

- Enhanced Crime Investigation: The establishment of new Central Forensic Science Laboratories (CFSLs) will bolster the scientific capabilities to analyse evidence, thereby improving the quality and reliability of forensic investigations.

- Speedier Justice Delivery: Efficient and timely forensic analysis facilitates quicker resolution of legal cases, ensuring swift justice delivery and reducing the backlog of pending cases.

- Job Creation: The creation of new campuses and laboratories under NFIES will generate employment opportunities across academic, administrative, and technical domains, contributing to economic growth and skill development.

- Addressing Manpower Shortage: NFIES aims to address the current shortage of trained forensic manpower. This will enhance the overall accuracy, efficiency, and credibility of forensic investigations and legal proceedings in India.

Source: IE

VGF Scheme for Offshore Wind Energy Projects

Why in the news ?

- Recently, the Union Cabinet approved the Viability Gap Funding (VGF) scheme for offshore wind energy projects.

- Cabinet approves Rs 7453 crore funding for offshore wind projects in Gujarat, Tamil Nadu coast.

What is the Viability Gap Funding (VGF) Scheme:

- The VGF scheme marks a significant stride in advancing the National Offshore Wind Energy Policy, which was established in 2015 to harness the extensive offshore wind energy potential within India's exclusive economic zone.

- Objective:

- The scheme aims to exploit the vast offshore wind energy potential by installing and commissioning 1 GW (1000 MW) of offshore wind energy projects.

- This includes setting up 500 MW projects each off the coast of Gujarat and Tamil Nadu.

- Nodal Agency:

- The Ministry of New and Renewable Energy (MNRE) serves as the nodal agency responsible for coordinating with various Ministries and Departments to ensure the seamless implementation of the scheme.

- Implementation:

- The scheme aims to install and commission 1 GW (500 MW each off Gujarat and Tamil Nadu) of offshore wind energy projects.

- Additionally, two ports will be upgraded to meet logistical requirements for handling offshore wind energy projects, facilitating the transportation and assembly of wind turbines and related equipment.

- Significance:

- Government-backed VGF support will lower the cost of electricity generated by offshore wind projects, ensuring they become economically feasible for purchase by DISCOMs (Distribution Companies).

- The commissioning of 1 GW offshore wind projects is expected to generate approximately 3.72 billion units of renewable electricity annually.

- This will contribute to reducing CO2 equivalent emissions by 2.98 million tons per year over a span of 25 years.

- The initiative will foster the development of necessary ecosystems in India to support and enhance its ocean-based economic activities.

|

Offshore Wind Energy: ● Offshore wind power or offshore wind energy is the energy taken from the force of the winds out at sea, transformed into electricity and supplied into the electricity network onshore. ● It is a source of renewable energy which offers several advantages over onshore wind and solar projects, such as higher adequacy & reliability, lower storage requirement and higher employment potential. |

Advantages of Scheme:

- Enhanced Efficiency: Offshore wind turbines benefit from faster and more consistent wind speeds compared to onshore locations, leading to higher and more reliable electricity generation.

- Reduced Environmental Impact: Offshore wind farms are positioned far from populated areas, minimising visual and noise disturbances that are more common with onshore installations.

- Ample Space: Offshore sites provide larger and less constrained areas for deploying larger and more numerous turbines, potentially maximising electricity output per site.

- Minimal Interference: Turbines can be situated in deeper waters, reducing the likelihood of obstructing shipping lanes or conflicting with other land uses.

Disadvantages:

- Higher Costs: Installing and maintaining offshore wind farms is more expensive than onshore projects due to the complexities of marine construction and logistics.

- Environmental Concerns: Construction and operation can impact marine ecosystems and wildlife, although modern projects include rigorous environmental assessments and mitigation strategies.

Conclusion:

Hence, despite challenges, offshore wind energy has grown significantly worldwide due to rising energy demand, climate change awareness, and advancements in technology and policy supporting renewables. Leaders like the UK, Germany, and Denmark spearhead offshore wind deployment with ambitious global projects.

Source: TOI

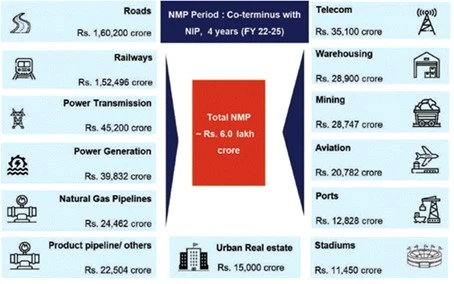

National Monetisation Pipeline

Why in the news ?

- Recently, NITI Aayog announced that the government has monetised assets worth Rs 3.85 lakh crore under the National Monetisation Pipeline during the first three years of the financial period from 2021-22 to 2024-25.

What is the National Monetisation Pipeline (NMP)?

What is the National Monetisation Pipeline (NMP)?

- The NMP aims to generate Rs 6 lakh crore by leasing core assets of the Central government across sectors like roads, railways, power, oil and gas pipelines, telecom, and civil aviation from FY 2021-22 to 2024-25.

- It excludes the monetization of non-core assets through disinvestment.

- Currently, it covers only assets of central government line ministries and CPSEs in infrastructure sectors.

- Non-core asset monetization, including land, real estate, and infrastructure, is transitioning from DIPAM to DPE within the Ministry of Finance to streamline operations.

- The NMP is aligned with the National Infrastructure Pipeline (NIP), supporting investments worth Rs 111 lakh crore over six years until FY25.

- Its timeline is strategically synchronised with the remaining period of the NIP

Status of NMP:

- The NMP aimed for Rs. 2.5 lakh crore in the first two years (2021-22 and 2022-23) and achieved around Rs. 2.30 lakh crore.

- In 2023-24, with a target of Rs. 1.8 lakh crore, the achievement was approximately Rs. 1.56 lakh crore, marking a 159% increase from 2021-22.

- All ministries achieved 70% of their monetisation targets, with the Ministry of Road Transport and Highways and the Ministry of Coal leading with Rs. 97,000 crore in achievements for 2023-24.

Need for NMP:

- Overcapitalisation: Government infrastructure projects often show overcapitalisation due to suboptimal input-output ratios.

- Resource Optimization: NMP introduces market-driven approaches to match resources more effectively with project requirements, reducing delays and cost escalations.

- Coordination Challenges: The NMP fosters collaboration among government departments and private firms to enhance project execution efficiency.

- Boost to Economy: Aligned with PM Gati Shakti, NMP aims to fund new projects by leveraging existing assets, contributing to comprehensive infrastructure development.

- Utilisation of Underutilised Assets: NMP targets the sale of unproductive government assets to fund new infrastructure and expand green initiatives

|

UPSC Civil Services Examination, Previous Year Question (PYQ) Prelims: Q:1 In India, the term “Public Key Infrastructure” is used in the context of (2020) (a) Digital security infrastructure (b) Food security infrastructure (c) Health care and education infrastructure (d) Telecommunication and transportation Infrastructure Ans: (a) Mains: Q.1 Account for the failure of the manufacturing sector in achieving the goal of labour-intensive exports. Suggest measures for more labour-intensive rather than capital-intensive exports. (2017) Q.2 The nature of economic growth in India in recent times is often described as jobless growth. Do you agree with this view? Give arguments in favour of your answer. (2015) |

Nalanda University

Why in the news ?

- Recently, the prime minister inaugurated the new campus of Nalanda University, close to the site of the ancient ruins of Nalanda in Rajgir, Bihar.

- The Parliament of India established the Nalanda University through the Nalanda University Act, 2010.

- It started functioning in 2014 from a makeshift location with 14 students, and construction work started in 2017.

Ancient Nalanda University:

- Establishment: Founded in the 5th century by Gupta ruler Kumaragupta I.

- Architectural Features: Includes stupas, shrines, viharas, and significant artworks in stucco, stone, and metal.

- Patronage: Supported by rulers like King Harshavardhana of Kannauj and the Pala rulers from the 7th to 12th centuries CE.

- Decline: Thrived for 800 years until it was destroyed by Bakhtiar Khilji in the 12th century.

- Archaeological Rediscovery: Rediscovered by Sir Francis Buchanan and later excavated by the Archaeological Survey of India.

Reviving’ Nalanda University:

- Then President APJ Abdul Kalam was the first to officially propose ‘reviving’ Nalanda in 2006 as a Bodhgaya Nalanda Indo-Asian Institute of Learning.

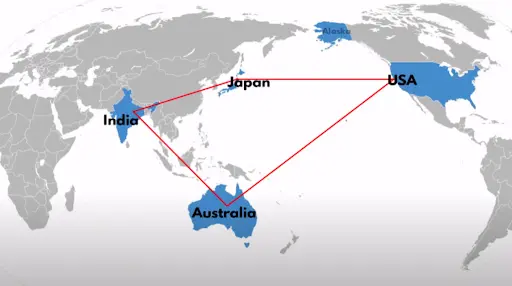

- It was endorsed at the 2007 East Asia Summit in Mandaue, the Philippines, and reiterated at the 2009 East Asia Summit in Hua Hin, Thailand.

- The university was established through a joint effort of 17 countries other than India: Australia, Bangladesh, Bhutan, Brunei Darussalam, Cambodia, China, Indonesia, Laos, Mauritius, Myanmar, New Zealand, Portugal, Singapore, South Korea, Sri Lanka, Thailand, and Vietnam.

- Parliament’s Nalanda University Act 2010 accorded it “national importance” status and laid down rules regarding its governance.

- It started functioning in 2014 from a makeshift location, and the construction work started in 2017.

- Nobel Prize-winning economist Amartya Sen became the University’s first Chancellor, and then-President Pranab Mukherjee became the first Visitor.

Academic Curriculum:

- Subjects: Covered major Buddhist philosophies (Madhyamaka, Yogachara, Sarvastivada), Vedas, grammar, medicine, logic, mathematics, astronomy, and alchemy.

- Xuanzang's Visit: Chinese scholar Xuanzang visited Nalanda in 637 and 642 CE, studying under Shilabhadra.

- I-Tsing: Visited in 7th century CE for studying at Nalanda. Emphasised rigorous academic environment. Contributed to understanding Nalanda’s curriculum and scholarly environment.

- Al-Biruni: Visited in 11th century CE and Introduced Nalanda’s achievements to the medieval Islamic world.

Significance:

- Global Attraction: Drew students from around the world, marking it as the oldest university in the Indian Subcontinent.

- World Heritage: Designated a UNESCO World Heritage Site in 2016

|

UPSC Civil Services Examination, Previous Year Questions (PYQs) Mains: Q:1 Pala period is the most significant phase in the history of Buddhism in India. Enumerate.(2020) Q:2 Assess the importance of the accounts of the Chinese and Arab travellers in the reconstruction of the history of India.(2018) Q:3 Taxila university was one of the oldest universities of the world with which were associated a number of renowned learned personalities of different disciplines. Its strategic location caused its fame to flourish, but unlike Nalanda, it is not considered as a university in the modern sense. Discuss. (2014) |

Source: TH

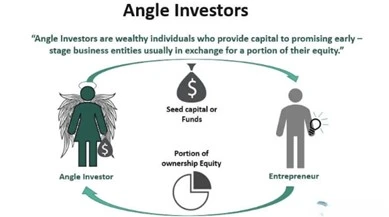

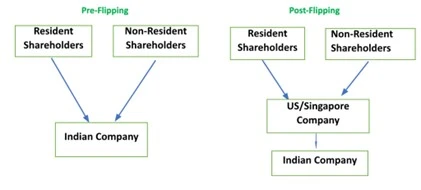

Angel Tax:

Why in the news ?

- Amid declining startup funding and job losses, Indian Inc. has urged the removal of the expanded Angel Tax from the Finance Bill 2023.

About the Angel tax:

About the Angel tax:

- Angel tax is an income tax (30.6%) levied on unlisted companies that issue shares to investors at a price exceeding the fair market value.

- The tax was introduced in 2012 to curb money laundering through inflated valuations of startup shares.

- The Finance Act 2023 amended Section 56(2)(VIIb) of the Income-tax Act, extending the Angel Tax to non-resident investors from April 2024.

Concerns raised by the Industry:

Concerns raised by the Industry:

- The industry argues that Angel Tax hinders startups’ growth and job creation, as taxes levied on the difference between the issue price and FMV have hurt funding for startups.

- Investors often fund startups based on their future potential, not just current valuation, and Angel Tax penalises this practice. Recent data shows a decline in startup funding and job losses linked to Angel Tax.

- CII recommended eliminating Section 56(2)(VIIb) of the Income-tax Act to boost capital formation.

Recent Developments:

- The government has partially addressed industry concerns by:

- Exempting DPIIT-recognised startups from Angel Tax.

- Excluding investors from 21 countries (US, UK, etc.) from Angel Tax on non-resident investments.

- However, key investment source countries like Singapore, Netherlands, and Mauritius are still not exempt.

|

UPSC Civil Services Examination, Previous Year Questions (PYQs) Prelims Q:1 What does venture capital mean? (2014) (a) A short-term capital provided to industries (b) A long-term start-up capital provided to new entrepreneurs (c) Funds provided to industries at times of incurring losses (d) Funds provided for replacement and renovation of industries Ans: (b) |

Source: IE

Snake Eel Discovered in Odisha

Why in the news ?

- Recently, the Zoological Survey of India (ZSI) has identified a new species of snake eel in Odisha.

- The new species has been named ‘Ophichthus Suryai’ to honour Surya Kumar Mohanty, former joint director of the state fishery department.

- The new species can be distinguished from its closely related congeners by having the dorsal fin origin (DFO) just above or slightly anterior to the gill opening.

- It also has a unique vertebral count and teeth patterns on both jaws (maxilla and mandible).

Snake Eels:

Snake Eels:

- Snake eels belong to the fish family Ophichthidae.

- They have an elongated, snake-like body with no pectoral and pelvic fins.

- Their dorsal fin runs along the back, beginning just behind the head and continuing to the tail.

- Snake eels are found in tropical and subtropical marine environments.

- Many species live in shallow coastal waters, coral reefs, and estuaries.

- There are over 200 species of snake eels. E.g. Shortfin snake eel (Ophichthus brevis), Longfin snake eel (Ophichthus cruentifer), Indian Ocean snake eel (Ophichthus rugosus), etc.

- Snake eels are nocturnal predators that feed on crustaceans and small fish.

Zoological Survey of India:

Zoological Survey of India:

- The Zoological Survey of India (ZSI) is a premier Indian organisation in zoological research and studies.

- It is under the Ministry of Environment, Forest and Climate Change.

- Established in 1916; Headquarter: Kolkata.

- The objectives of the ZSI are to promote survey, exploration and research leading to the advancement of our knowledge on various aspects of animal life.

- ZSI’s main focus areas are faunal exploration, taxonomic studies, status surveys of endangered species, environmental impact assessment, conservation, and training.

- It has 16 regional centres located across different geographic regions of the country.

Source: DH

Complexities of Indian Federalism

Context:

- In recent years, disputes between the Union government and the States have become increasingly common.

Federalism in India:

- Meaning:

- Federalism involves a vertical division of power in a political system, where authority is distributed between a central government and other constituent units.

- For instance, in India, political power is divided among the Central government, state governments, and local governance institutions.

- Features of a federal system:

- Multiple levels of government: Federalism necessitates the functioning of multiple levels of government within their respective jurisdictions.

- Division of Power: Power is distributed among different entities according to the division of subjects, minimising chances of conflict.

- Written Constitution: A written and rigid constitution ensures clarity in the allocation of powers and stability in governance.

- Independent Judiciary: The judiciary acts as a mediator to resolve disputes between various levels of government.

- Interdependence of state and Central Government: India adopted a form of federalism where the Union and State governments are interdependent, with states more reliant on the Union government, contrary to the autonomous spheres characteristic of federal constitutions.

- ‘Holding together’ Federalism:

- India's centralised federal structure was established through 'holding together' and 'putting together' processes, rather than the 'coming together' process typical of federal systems.

- Indestructible & Flexibility:

- R. Ambedkar termed India's federation a Union because it is indestructible, hence the Constitution avoids using explicit federal terms.

- He also noted the Constitution's flexibility to function as federal or unitary based on necessity.

Types of Federalism:

- Cooperative Federalism:

- Cooperative federalism involves the horizontal relationship between entities within a federal structure.

- It emphasises cooperation between different levels of government to achieve unified socio-economic development.

- Competitive Federalism:

- Competitive federalism promotes healthy competition among states to encourage economic development.

- Lagging states are incentivized to improve, while leading states strive to maintain their position in various indices.

- Fiscal Federalism:

- Fiscal federalism deals with the division of financial powers and functions between different levels of government.

- It includes the imposition and division of taxes, as well as joint tax collections with fair fund allocation based on objective criteria.

- Institutions like India's Finance Commission ensure equitable distribution.

About the Increasing Federal Frictions:

- Dependence on Public Expenditure:

- Despite economic reforms since 1991 granting some autonomy, state governments still rely on the central government for revenue.

- This dependency often leads to friction between the Centre and states, limiting negotiation space.

- Other Areas of Conflict:

- Apart from resource allocation, conflicts arise in social sector policies, regulatory institution functioning, and the powers of central agencies.

- States ideally should have discretion in these matters, but central bodies sometimes seek to extend influence over state decision

Economic Consequences of Federal Frictions

- Dilemma of Investments:

- The expanding role of the Centre often results in crowding out state investments, particularly in infrastructure development.

- For instance, initiatives like PM Gati Shakti integrate schemes across Ministries and States under a national master plan, limiting state flexibility in planning and implementation.

- Concentrated Spending:

- Between 2021-22 and 2023-24, nearly half of the total expenditure by 16 states was concentrated in Uttar Pradesh, Maharashtra, and Gujarat.

- This concentration affects regional economies, as investments by these states generate significant local linkages compared to national projects that focus on global economic ties.

- Data for 25 States shows that a total of ₹7.49 lakh crore was budgeted for by these States but they spent only ₹5.71 lakh crore which is 76.2% of the total.

- Limited Competition:

- Frictions with the Centre reduce competitive dynamics among states and between states and the Centre, particularly in welfare provisioning.

- The Centre's larger fiscal space allows it greater spending power, while states face constraints in raising non-tax revenues due to the Centre's direct provision of many services.

- Inefficiencies of Parallel Policies:

- Federal tensions often lead to duplication of policies between the Centre and states, resulting in parallel schemes and a trust deficit within the federal system.

- These inefficiencies impose long-term fiscal costs on the economy, impacting overall efficiency and development outcomes.

Way Forward

- Securing Implementation:

- The Centre relies on states, especially in concurrent areas, to effectively implement laws and policies.

- This interdependence underscores the need for collaborative governance frameworks that enhance coordination and mutual support.

- Executive Functions:

- States, with the Centre's consent under Article 258A, delegate their executive functions to central government agencies or bodies. #

- This mutual delegation acknowledges the practical necessity of cooperation and coordination between different levels of governance.

- Preserving Interdependence:

- Given India's vast size, diversity, and developmental challenges, maintaining and nurturing interdependence between the Centre and states is crucial.

- This ensures efficient governance, effective policy implementation, and equitable development across the country.

|

UPSC Civil Services Examination Previous Year’s Question (PYQs) Prelims: Q:1 Which one of the following is not a feature of Indian federalism? (2017) (a) There is an independent judiciary in India. (b) Powers have been clearly divided between the Centre and the States. (c) The federating units have been given unequal representation in the Rajya Sabha. (d) It is the result of an agreement among the federating units. Ans: (d) Q:2 Local self-government can be best explained as an exercise in (2017) (a) Federalism (b) Democratic decentralisation (c) Administrative delegation (d) Direct democracy Ans: (b) Mains: Q:1 Though the federal principle is dominant in our constitution and that principle is one of its basic features, but it is equally true that federalism under the Indian Constitution leans in favour of a strong Center, a feature that militates against the concept of strong federalism. Discuss. (2014) |

Source: IE

Share the article

Edukemy’s Current Affairs Quiz is published with multiple choice questions for UPSC exams

MCQ

Get Latest Updates on Offers, Event dates, and free Mentorship sessions.

Get in touch with our Expert Academic Counsellors 👋

FAQs

UPSC Daily Current Affairs focuses on learning current events on a daily basis. An aspirant needs to study regular and updated information about current events, news, and relevant topics that are important for UPSC aspirants. It covers national and international affairs, government policies, socio-economic issues, science and technology advancements, and more.

UPSC Daily Current Affairs provides aspirants with a concise and comprehensive overview of the latest happenings and developments across various fields. It helps aspirants stay updated with current affairs and provides them with valuable insights and analysis, which are essential for answering questions in the UPSC examinations. It enhances their knowledge, analytical skills, and ability to connect current affairs with the UPSC syllabus.

UPSC Daily Current Affairs covers a wide range of topics, including politics, economics, science and technology, environment, social issues, governance, international relations, and more. It offers news summaries, in-depth analyses, editorials, opinion pieces, and relevant study materials. It also provides practice questions and quizzes to help aspirants test their understanding of current affairs.

Edukemy's UPSC Daily Current Affairs can be accessed through:

- UPSC Daily Current Affairs can be accessed through Current Affairs tab at the top of the Main Page of Edukemy.

- Edukemy Mobile app: The Daily Current Affairs can also be access through Edukemy Mobile App.

- Social media: Follow Edukemy’s official social media accounts or pages that provide UPSC Daily Current Affairs updates, including Facebook, Twitter, or Telegram channels.