Tuesday, 6th February 2024

Uttarakhand's Proposed Uniform Civil Code: Draft Report Overview

In News: The Uttarakhand Cabinet recently gave its approval to the Uniform Civil Code (UCC) draft report. The draft is anticipated to be presented as a bill for enactment in the state assembly on February 6, 2024.

Uttarakhand's UCC Draft Report: Key Highlights

- Objective of UCC Draft

- Aims to replace distinct personal laws with a focus on marriage, divorce, adoption, and inheritance.

- Guided by Article 44 of the Constitution, a Directive Principle advocating for a uniform civil code.

- Article 44 of the Indian Constitution

- A Directive Principle emphasizing the establishment of a uniform civil code for all citizens.

- Code Application

- A single set of personal laws applicable to all citizens, irrespective of religion.

- Proposed Changes

- Prohibition of polygamy, halal, triple talaq, and child marriage.

- Uniform age for girls' marriage across religions.

- Mandatory registration of live-in relationships.

- Focus on Gender Equality

- Equal treatment of men and women in matters of inheritance and marriage.

- Potential extension of property share for Muslim women beyond the existing 25%.

- Minimum Age for Marriage

- Remains at 18 for women and 21 for men.

- Exemption for Scheduled Tribes (STs)

- STs excluded from the UCC draft, addressing concerns of the tribal population.

Concerns Regarding UCC Draft Report for Uttarakhand

- Potential Infringement on Fundamental Rights

- Critics argue it may violate constitutional guarantees of religious freedom and personal liberty.

- Critique on Uniformity

- Some argue that the draft disregards India's diversity, imposing a code unsuitable for different communities.

- Impact on STs

- Concerns raised about the UCC's effect on the rights and interests of Scheduled Tribes in Uttarakhand.

- Cultural Identity

- Activists claim insufficient attention to STs' issues may erode their cultural identity and autonomy.

Understanding the Uniform Civil Code

- Article 44 in the Constitution

- Part of the Directive Principles, advocating for a uniform civil code for all Indian citizens.

- Goa's UCC

- Goa is the only state in India with a UCC, following the Portuguese Civil Code of 1867.

Supreme Court of India's Stance

- Mohd. Ahmed Khan vs Shah Bano Begum Case, 1985

- Court regretted the non-implementation of Article 44, calling for its execution.

- Jose Paulo Coutinho v. Maria Luiza Valentina Pereira Case, 2019

- Court praised Goa's UCC and urged its pan-India implementation.

Law Commission's Stance

- 2018 Consultation Paper

- Recommended amendments to discriminatory practices within existing personal laws but deemed UCC unnecessary.

- 2022 Notification

- 22nd Law Commission sought opinions on UCC from stakeholders, including the public and religious organizations.

|

UPSC Previous Year Questions Prelims (2012) Q. Consider the following provisions under the Directive Principles of State Policy as enshrined in the Constitution of India:

Which of the above are the Gandhian Principles that are reflected in the Directive Principles of State Policy? (a) 1, 2 and 4 only Ans: (b) Prelims (2012) Q2. A legislation that confers on the executive or administrative authority an unguided and uncontrolled discretionary power in the matter of the application of law violates which one of the following Articles of the Constitution of India? (a) Article 14 Ans: (a) Mains (2015) Q. Discuss the possible factors that inhibit India from enacting for its citizens a uniform civil code as provided for in the Directive Principles of State Policy. |

Source: TH

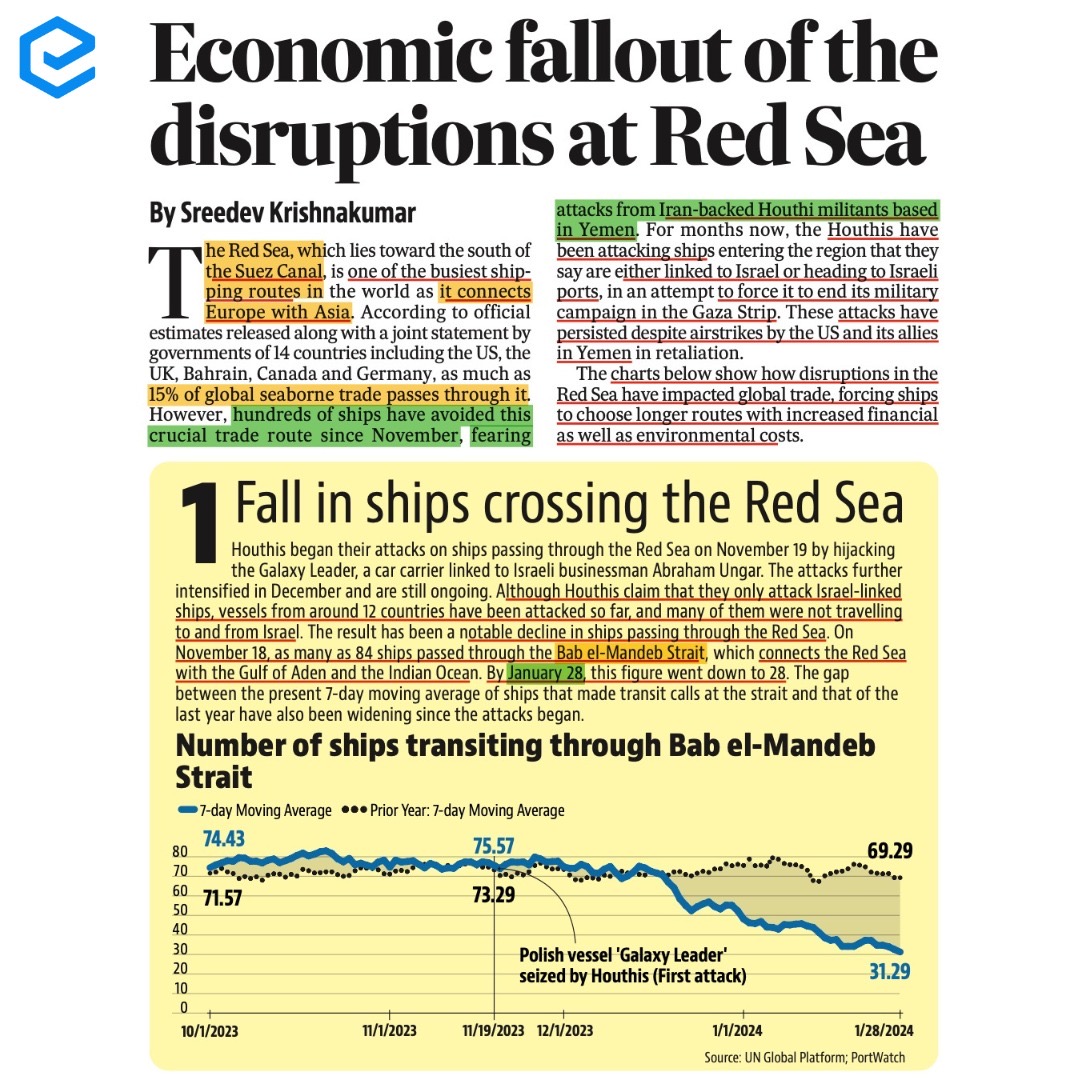

Interim Budget 2024-2025

In News: The Interim Budget 2024-25 was recently presented in the parliament, outlining a vision for 'Viksit Bharat' by 2047.

Understanding Interim Budget

- Definition of Interim Budget

- Presented during a government's transition or its last year before general elections.

- Aims to maintain government expenditure and essential services until a new government can present a comprehensive budget.

Major Highlights of Interim Budget 2024-25

- Capital Expenditure Increase

- Capital expenditure outlay for 2024-25 increased by 11.1%.

- Set at Rs 11,11,111 crore, constituting 3.4% of the GDP.

- Economic Growth Projections

- Projected real GDP growth for FY 2023-24 at 7.3%, aligning with RBI's revised projection.

- International Monetary Fund expects India to be the third-largest economy by 2027.

- Revenue and Expenditure Estimates (2024-25)

- Total Receipts: Estimated at Rs 30.80 lakh crore, excluding borrowings.

- Total Expenditure: Projected at Rs 47.66 lakh crore.

- Tax Receipts: Estimated at Rs 26.02 lakh crore.

- GST Collections: Surpassed ₹1.65 lakh crore in December 2023.

- Fiscal Deficit and Market Borrowing

- Fiscal deficit estimated at 5.1% of GDP in 2024-25.

- Gross and net market borrowings through dated securities projected at Rs 14.13 and 11.75 lakh crore.

- Taxation Policies

- Maintenance of existing rates for direct and indirect taxes, including import duties.

- Corporate Taxes: 22% for existing domestic companies, 15% for certain new manufacturing companies.

- No tax liability for taxpayers with income up to ₹7 lakh.

- Priorities Emphasized

- Focus on Poor, Women, Youth, and Farmers.

- Successful movement of 25 crore people out of multidimensional poverty.

- Credit assistance to 78 lakh street vendors under PM-SVANidhi.

Development Plans in Key Sectors

- Infrastructure

- Implementation of three major economic railway corridor programs.

- Conversion of 40,000 rail bogies to Vande Bharat standards.

- Clean Energy Sector

- Viability gap funding for wind energy.

- Establishment of coal gasification and liquefaction capacity.

- Housing Sector Initiatives

- Subsidizing construction of 30 million affordable houses in rural areas.

- Launching the Housing for Middle Class scheme.

- Healthcare Sector Measures

- Encouraging Cervical Cancer Vaccination for girls (9-14 years).

- Expansion of the Ayushman Bharat scheme to include ASHA workers and Anganwadi workers.

- Agricultural and Fishery Sector Strategies

- Encouraging use of 'Nano DAP' for various crops.

- Formulating policies to support dairy farmers and combat Foot and Mouth Disease.

- Establishment of 'Matsya Sampada' department for fishermen.

- Support for States Capex

- Continuation of fifty-year interest-free loan scheme for capital expenditure.

- Total outlay of Rs 1.3 lakh crore, with Rs 75,000 crore provision for fifty-year interest-free loans.

- Research and Innovation Initiatives

- Establishment of a Rs 1 lakh crore corpus for research and innovation.

- Focus on boosting private sector participation in research.

- Population Growth and Demographic Shifts

- Formation of a high-powered committee to address rapid population growth and demographic shifts.

- Committee to provide recommendations aligned with 'Viksit Bharat' goal.

|

UPSC Previous Year Questions Prelims (2011) Q. What is the difference between “vote-on-account” and “Interim Budget”?

Which of the statements given above is/are correct? (a) 1 only Ans: (b) Prelims (2011) Q. When the annual Union Budget is not passed by the Lok Sabha, (a) the Budget is modified and presented again Ans: (d) Q. In the Union Budget 2011-12, a full exemption from the basic customs duty was extended to the bio-based asphalt (bioasphalt). What is the importance of this material?

Which of the statements given above are correct? (a) 1, 2 and 3 only Ans: (b) Prelims (2020) Q. Along with the Budget, the Finance Minister also places other documents before the Parliament which include ‘The Macro Economic Framework Statement’. The aforesaid document is presented because this is mandated by (a) Long standing parliamentary convention Ans: (d) Prelims (2015) Q. With reference to the Union Government, consider the following statements:

Which of the statements given above is/are correct? (a) 1 and 2 only Ans: (c) Prelims (2012) Q. Which of the following are the methods of Parliamentary control over public finance in India?

Select the correct answer using the codes given below: (a) 1, 2, 3 and 5 only Ans: (a) Prelims (2010) Q. Which one of the following is responsible for the preparation and presentation of Union Budget to the Parliament? (a) Department of Revenue Ans: (b) Prelims (2016) Q. There has been a persistent deficit budget year after year. Which action/actions of the following can be taken by the Government to reduce the deficit?

Select the correct answer using the code given below: (a) 1 only Ans: (c) Mains (2021) Q. Distinguish between Capital Budget and Revenue Budget. Explain the components of both these Budgets. Mains (2019) Q. The public expenditure management is a challenge to the Government of India in the context of budget-making during the post-liberalization period. Mains (2021) Q. How have the recommendations of the 14th Finance Commission of India enabled the States to improve their fiscal position? Mains (2013) Q. What were the reasons for the introduction of Fiscal Responsibility and Budget Management (FRBM) Act, 2003? Discuss critically its salient features and their effectiveness. GS – 2 Indian Constitution, Government Policies & Interventions GS – 3 Growth & Development, Planning, Government Budgeting, Fiscal Policy, Inclusive Growth In News: The Interim Budget 2024-25 was recently presented in the parliament, outlining a vision for 'Viksit Bharat' by 2047. Understanding Interim Budget

Major Highlights of Interim Budget 2024-25

Development Plans in Key Sectors

Source: PIB |

Source: PIB

National Terrorism Data Fusion & Analysis Centre

In News: The National Investigation Agency (NIA) has created the National Terrorism Data Fusion & Analysis Centre (NTDFAC) to collect and compile information on terrorists and associates from various sources.

National Terrorism Data Fusion & Analysis Centre (NTDFAC)

- Overview

- Modeled after the US Global Terrorism Database (GTD), NTDFAC aims to be a centralized hub for terrorism-related information in India.

- The GTD, managed by START at the University of Maryland, is a publicly accessible database analyzing global terrorist incidents.

- Key Features

- Comprehensive Database: Includes case histories, fingerprints, videos, pictures, and social media profiles, offering a detailed overview of individuals involved in terrorism.

- Automated Fingerprint Identification System (AFIS): Integrates NAFIS with over 92 lakh fingerprint records, enabling swift and accurate identification based on fingerprint data.

- Face Recognition System: Employs facial recognition technology for scanning suspect pictures from CCTV footage, aiding in the identification and tracking of terrorists.

- Support for State Police Forces: Assists NIA officers and state police forces in identifying and gathering information on terrorists operating in their jurisdictions.

National Automated Fingerprint Identification System (NAFIS)

- Overview

- Managed by the National Crime Records Bureau (NCRB), NAFIS is a country-wide searchable database of crime- and criminal-related fingerprints.

- Serves as a central repository by consolidating fingerprint data from all states and Union Territories.

- Key Features

- Web-Based Application: Operates as a 24x7 web-based application, providing real-time access to and management of fingerprint data for law enforcement agencies.

- Unique Identifier: Assigns a 10-digit National Fingerprint Number (NFN) to each arrested person, offering a lifetime unique ID linked to multiple crimes.

- Integration with CCTNS: Connected to the Crime and Criminal Tracking Network & Systems (CCTNS) database, providing a unique identifier for every arrested person in CCTNS.

- Real-Time Data Upload and Retrieval: Enables law enforcement agencies to upload, trace, and retrieve fingerprint data in real time, enhancing the efficiency of criminal identification processes.

- Replacement for Previous Systems: NAFIS replaces the outdated FACTS 5.0 system, aiming to improve the effectiveness and lifespan of automated fingerprint identification in India.

|

UPSC Previous Year Questions Mains (2017) Q. The scourge of terrorism is a grave challenge to national security. What solutions do you suggest to curb this growing menace? What are the major sources of terrorist funding? Mains (2021) Q. Analyse the multidimensional challenges posed by external state and non-state actors, to the internal security of India. Also discuss measures required to be taken to combat these threats. |

Source: TH

Addressing Elevated Government Debt: Strategies to Consider

In News: At the conclusion of its second term, the National Democratic Alliance (NDA) government will have a total public debt surpassing 80% of India's gross domestic product (GDP) at current market prices.

Understanding Government/Public Debt

- Definition and Measurement

- Government debt encompasses domestic and foreign loans, including other liabilities, taken by the Center and states for development expenditure.

- Measured by the debt-to-GDP ratio, indicating the ratio between a country's government debt and its gross domestic product.

- Fiscal Responsibility and Budget Management (FRBM) Act 2003

- Set targets for reducing general government debt to 60% of GDP by 2024-25.

- Capped the Center's outstanding liabilities at 40% within the specified timeframe.

- Data on Public Debt in India

- According to the IMF, general government debt touched 84.4% of GDP in 2003-04.

- The debt-GDP ratio fluctuated, reaching a peak of 88.5% in 2020-21, easing to 81% in the subsequent two fiscal years.

- Center's total liabilities doubled from Rs 90.84 lakh crore to Rs 183.67 lakh crore from 2018-19 to 2024-25.

Factors Contributing to Debt Increase

- Covid-induced Disruptions: Governments borrowed more to fund health and safety net measures amid revenue constraints.

- Increased Public Investments: Government intensified spending on infrastructure, contributing to deficit widening.

- Fiscal Deficits: Center's fiscal deficit rose from 3.4% of GDP in 2018-19 to 6.8% in 2021-22.

- Global Scenario

- Other countries, including the US, France, and China, also experienced a surge in general government debt during the pandemic.

- Debt-to-GDP ratios increased in response to fiscal stimulus and relief programs.

Strategies to Address High Government Debt

- FRBM Act Provisions: Envisaged limiting the Center's gross fiscal deficit to 3% of GDP by 2020-21.

- Union Budget 2021-22: Aims for a fiscal deficit-to-GDP ratio of "below 4.5%" by 2025-26.

- Denominator Effect: High nominal GDP growth can mitigate debt concerns by raising the denominator faster than the numerator.

- Combination Approach: India may need a blend of fiscal consolidation and real output-driven growth to address current debt challenges arising from the pandemic.

Source: IE

Exercise Vayu Shakti- 2024

In News: Exercise Vayu Shakti-24 is scheduled to take place on February 17, 2024, at the Pokhran Air to Ground Range near Jaisalmer, conducted by the Indian Air Force.

Exercise Vayu Shakti Highlights

- Comprehensive Display of IAF Prowess

- Illustrates the Indian Air Force's offensive and defensive capabilities.

- Operates seamlessly during both day and night.

- Joint Operations with Indian Army

- Emphasizes collaborative manoeuvres with the Indian Army.

- Demonstrates their combined operational capabilities.

- Showcasing Precision and Long-Range Operations

- Highlights IAF's expertise in precision and long-range weapon delivery.

- Conducts effective operations from various air bases.

- Diverse Participation of Aircraft

- Involves 121 aircraft, including Tejas, Prachand, Dhruv, Rafale, Mirage-2000, Sukhoi-30 MKI, Jaguar, Hawk, C-130J, Chinook, Apache, and Mi-17.

- Showcases the versatility of the Indian Air Force's fleet.

- Special Missions and Collaborative Elements

- Engages in special missions with transport and helicopter fleets.

- Includes collaborative efforts with Garuds and Indian Army elements.

- Focus on Indigenous Weapon Systems

- Demonstrates the capabilities of indigenous Surface to Air Weapon systems Akash and Samar.

- Highlights their effectiveness in tracking and intercepting intruding aircraft.

Source: HT

Dusted Apollo Butterfly

In News: The rare high-altitude butterfly, Dusted Apollo (Parnassius stenosemus), was recently observed and photographed for the first time in Chamba, Himachal Pradesh.

Discovery of Dusted Apollo Butterfly

- Origin and Exploration

- Discovered in 1890, the Dusted Apollo butterfly has been known since then.

- Its distribution spans from Ladakh to West Nepal, specifically flying within the altitude range of 3,500 to 4,800 meters in the inner Himalayas.

- Taxonomic Classification

- Belongs to the snow Apollo genus (Parnassius) within the swallowtail family.

- Appearance and Resemblance

- Closely resembles the Ladakh Banded Apollo (Parnnasius stoliczkanus).

- Distinguished by the complete discal band on the upper fore wing, extending from costa to vein one in the Dusted Apollo, while the Ladakh Banded Apollo's discal band is incomplete, reaching only up to vein four.

- Additional Rare Species

- The sighting also included another protected species, the Regal Apollo (Parnnasius charltonius).

- Recognized under Schedule II of the Wildlife Protection Act, 1972.

Source: TH

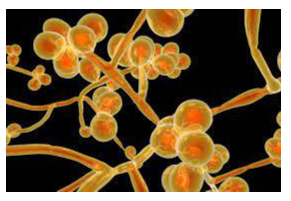

Candida auris (C. auris)

In News: A highly lethal fungal infection named Candida auris has been rapidly spreading in the United States in recent times.

Candida auris (C. auris): Overview

- Emerging Threat

- C. auris is an emerging multidrug-resistant yeast (fungus) posing a global health threat.

- Capable of causing invasive infections, particularly in individuals with weakened immune systems.

- Discovery and Global Spread

- First discovered in Japan in 2009, C. auris has rapidly spread to various countries.

- Represents a significant challenge due to its resistance to multiple drugs.

- Transmission

- Primarily contracted in healthcare settings like hospitals and nursing homes.

- Can exist on the skin or other body parts without causing illness, referred to as being “colonized.”

- Transmission occurs through contact with contaminated surfaces, equipment, or infected/colonized individuals.

- Symptoms

- Causes infections in different body parts, including the bloodstream, open wounds, and ears.

- Symptoms vary based on the location and severity of the infection.

- No specific set of symptoms; may resemble bacterial infections.

- Persistent high fever with chills may indicate a C. auris infection.

- Treatment

- Most C. auris infections are treatable with antifungal drugs.

- Some infections, however, are resistant to all three main classes of antifungal medications.

- Treatment challenges may necessitate the use of combination therapies.

Source: NDTV

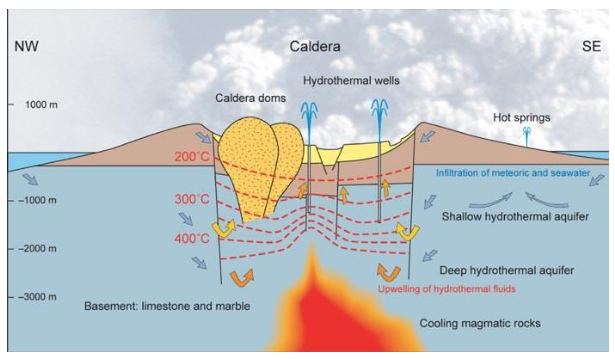

Hydrothermal Systems

In News: Recently unveiled maps have exposed a concealed hydrothermal system beneath Lake Rotorua, situated at the core of an inactive volcano in New Zealand.

Hydrothermal Systems: Overview

- Occurrence and Location

- Hydrothermal systems are present in areas with high heat fluxes on continents, near convergent plate boundaries, and on the ocean floor, particularly near mid-ocean ridges.

- Commonly found where tectonic plates diverge, leading to the creation of new seafloor.

- Formation Components

- Formation necessitates three crucial components: fluids, heat, and permeability through rocks for fluid circulation.

- Proximity to Mid-Ocean Ridges

- Frequently located near mid-ocean ridges, where tectonic plates separate, facilitating the emergence of hydrothermal systems.

- Working Mechanism

- Seawater percolates through fractures in the oceanic crust, heating up as it approaches the Earth's hot interior.

- Interaction with the oceanic crust at depths of 350-400 degrees Celsius results in the removal of chemicals from the rocks.

- This interaction produces hydrothermal fluid, a chemically modified slurry of gases and dissolved elements, including metals.

- The superheated fluid is ejected back to the seafloor, where it rapidly cools in near-freezing ocean bottom waters.

- Chemicals dissolved in the fluid precipitate at the vent, forming chimney-like deposits.

- These deposits support deep-sea chemosynthetic communities, organisms relying on chemicals instead of photosynthesis for metabolism.

Source: LS

Mekong River

In News: The ongoing multibillion-dollar dam project along the Mekong River in Laos has raised apprehensions about the potential loss of UNESCO World Heritage Site status for Luang Prabang city.

Mekong River: Overview

- Length and Rankings

- The Mekong River holds the title of the longest river in Southeast Asia, ranking as the 7th longest in Asia and the 12th longest globally.

- It spans an impressive length of about 2,700 miles (4,350 km).

- Course Details

- Originating in southeastern Qinghai province, China, it begins at Sanjianyuang in the Tibetan Plateau.

- The source area is a designated national nature reserve to protect the headwaters of the Yangtze, Yellow, and Mekong Rivers.

- Drainage and Countries Flowing Through

- The river covers a drainage area of approximately 795,000 square kilometers.

- It traverses six Asian countries: China, Vietnam, Laos, Myanmar, Thailand, and Cambodia, where it assumes different names.

- Capitals like Vientiane in Laos and Phnom Penh in Cambodia are situated along its banks.

- Outlet

- The Mekong River empties into the South China Sea, located south of Ho Chi Minh City in Vietnam.

- Tributaries

- Left-bank tributaries include Nam Ou, Tha, and Nam Khan, draining high rainfall areas.

- Right-bank tributaries consist of Ruak, Kok, Tonle Sap, and Mun, draining the lower relief region.

- Biodiversity

- The Mekong River boasts remarkable biodiversity, second only to the Amazon River Basin.

- Home to approximately 20,000 plant species, 1,200 birds, 430 mammals, 800 amphibians and reptiles, and 850 fish species.

- Large Fish Species

- Known for hosting the highest number of large fish species, including giant freshwater stingrays, giant pangasius, Mekong giant catfish, and giant barb.

- Delta Formation

- The Mekong River creates an expansive delta in southern Vietnam, known for its rich soil and significant rice production on a global scale.

Source: TH

eNAM

In News: The increased participation of states in enabling the trade of agricultural commodities on eNAM has led to a surge in trading activities among different markets within the state and at the inter-state level.

eNAM: Overview

- Introduction

- eNAM is an online trading platform dedicated to agricultural commodities in India.

- Launched on April 14, 2016, it operates with complete funding from the Government of India.

- The Small Farmers Agribusiness Consortium (SFAC) oversees e-Nam implementation under the Ministry of Agriculture and Farmer’s Welfare.

- Objective

- Aims to provide improved marketing opportunities for farmers through competitive and transparent price discovery, coupled with online payment facilities for buyers.

- Market Integration

- Connects existing APMC (Agriculture Produce Marketing Committee) / Regulated Marketing Committee (RMC) market yards, sub-market yards, private markets, and unregulated markets.

- Establishes a central online platform for nationwide agricultural commodity price discovery.

- Key Features

- Enables farmers to showcase products in local markets while allowing traders from any location to quote prices.

- Offers a single-window platform for APMC-related services, covering commodity arrivals, quality, prices, buy-and-sell offers, and e-payment settlements.

- License Procurement

- Traders, buyers, and commission agents can obtain licenses from state-level authorities without a prerequisite of physical presence or possession of a shop in the market yard.

- Quality Standards

- Ensures harmonization of quality standards for agricultural products.

- Facilitates access to Soil Testing Laboratories in selected markets for farmer convenience.

- Stakeholder Benefits

- Designed for the benefit of various stakeholders, including farmers, mandis, traders, buyers, FPOs (Farmer Producer Organizations), processors, and exporters.

- Benefits to Stakeholders

- Facilitates transparent online trading with enhanced market accessibility.

- Enables real-time price discovery, ensuring better and more stable price realization for producers.

- Reduces transaction costs for buyers.

- Provides commodity price information on the e-NAM mobile app.

- Sends SMS notifications detailing commodity prices and quantities sold.

- Offers quality certification.

- Streamlines supply chains and supports warehouse-based sales.

- Facilitates online payments directly to farmers' bank accounts.

Source: FE

Exposing India’s Financial Markets to the Vultures

In News: Recently, the global financial landscape has experienced notable advancements, especially in the inclusion of government bonds from emerging economies into global indices.

Opening Local Bond Markets to Foreign Investors

- Initiative by Emerging Economies

- Emerging economies aim to enhance global financial integration.

- India began this journey in 2019, making significant progress by introducing the Fully Accessible Route (FAR) by 2020.

- Obstacles and Policy Commitment

- Obstacles included delays related to capital gains taxes and local settlement.

- Despite challenges, the fundamental policy remained unchanged, demonstrating a commitment to global financial inclusivity.

J.P. Morgan's Recognition of Indian Local Currency

- Key Catalyst

- J.P. Morgan's announcement in September 2023 to include Indian LCGBs in its Government Bond Index-Emerging Markets (GBI-EM) Global index suite served as a catalyst.

- This move signalled recognition of India's financial standing and elevated expectations in the Indian financial landscape.

- Subsequent Developments

- Bloomberg Index Services in January 2024 decided to include India's FAR bonds in the Bloomberg Emerging Market Local Currency Index.

- Anticipation now focuses on FTSE Russell, indicating growing influence and anticipation of reforms in India's government bond market.

Benefits of Internationalising Bond Markets

- Reduced Dependence on Domestic Institutions

- Integration aims to diminish dependence on domestic financial institutions.

- Diversified funding base contributes to financial stability.

- Stability in Funds Tracking Indices

- Inclusion in global indices leads to a stable influx of funds with a longer investment horizon.

- Mitigates volatility in local financial markets, ensuring a secure environment for investors.

- Decline in Cost of Public Borrowing

- Increased demand for local bonds may lead to a decline in domestic interest rates.

- Global investors' participation reduces the cost of public borrowing for the government.

- Relief for Local Financial Institutions

- Foreign investors' participation provides liquidity, relieving local institutions' balance sheets.

- Enhanced liquidity may lead to increased lending and private investment.

- Mitigating Original Sin

- Addresses the "original sin" problem by allowing borrowing internationally in local currencies.

- Shifts exchange rate risk onto international lenders, potentially avoiding private insolvencies during currency declines.

Risks Associated with Internationalisation of Bond Markets

- Loss of Autonomy and Interest Rate Risks

- Potential loss of control over long-term interest rates.

- Exposure to global interest rate fluctuations impacting domestic bond markets.

- Exchange Rate Volatility and Spillover Effects

- Foreign investors' participation exposes local currency bond markets to exchange rate volatility.

- Adverse spillover effects during global risk aversion or liquidity challenges.

- Volatility in Local Currency Bond Inflows

- Examples from Malaysia and Türkiye demonstrate unpredictable capital flows.

- Rapid exits by investors can result in reserve losses and currency declines.

RBI's Efforts and IDG Report

- Integration into Global Bond Indices

- RBI's journey started in October 2022 with an IDG report.

- A broader effort to integrate Indian LCGBs into global indices.

- Diversification of Funding Sources

- Inclusion in global indices aims to attract foreign capital and diversify funding sources.

- Reducing dependence on domestic institutions is a key focus.

- Enhancing Stability and Investment Allocation

- Benefits include stability in funds tracking global indices.

- A more predictable investment environment attracts long-term investors, improving investment allocation.

- Rupee Internationalisation Beyond Bonds

- The IDG report emphasizes rupee internationalization beyond bonds.

- Encompasses permitting banking services in the rupee outside the country.

Way Forward

- Balancing Act

- Striking a balance between attracting foreign capital and managing risks is crucial.

- Lessons from Malaysia and Türkiye underscore the importance of a balanced approach.

- Regulatory Vigilance and Interventions

- Regulatory vigilance and timely interventions are necessary to prevent excessive speculation.

- Balancing internationalization efforts while safeguarding macroeconomic stability is essential.

Conclusion

- Pivotal Step for Emerging Economies

- Opening local bond markets is a crucial step for greater integration into the global financial landscape.

- Recent developments highlight growing recognition of India's financial market potential.

- Navigating Complexity

- India must navigate complexities, balancing risks and benefits.

- Adapting to the evolving global financial landscape ensures long-term success and stability.

Source: TH

Daily News Paper Snippets - 06th February 2024

kanya taru yojana - Case Study of the Day

In Hailakandi's Government Hospitals, parents of newborn girls were gifted saplings, symbolically linking the care of trees to nurturing their daughters; the initiative aimed to celebrate girl births as 'Ghar ki Lakshmi,' utilizing tree profits for education and environmental improvements, promoting the theme "Girlforce–Unstoppable" in 2019.

Share the article

Edukemy’s Current Affairs Quiz is published with multiple choice questions for UPSC exams

MCQ

Get Latest Updates on Offers, Event dates, and free Mentorship sessions.

Get in touch with our Expert Academic Counsellors 👋

FAQs

UPSC Daily Current Affairs focuses on learning current events on a daily basis. An aspirant needs to study regular and updated information about current events, news, and relevant topics that are important for UPSC aspirants. It covers national and international affairs, government policies, socio-economic issues, science and technology advancements, and more.

UPSC Daily Current Affairs provides aspirants with a concise and comprehensive overview of the latest happenings and developments across various fields. It helps aspirants stay updated with current affairs and provides them with valuable insights and analysis, which are essential for answering questions in the UPSC examinations. It enhances their knowledge, analytical skills, and ability to connect current affairs with the UPSC syllabus.

UPSC Daily Current Affairs covers a wide range of topics, including politics, economics, science and technology, environment, social issues, governance, international relations, and more. It offers news summaries, in-depth analyses, editorials, opinion pieces, and relevant study materials. It also provides practice questions and quizzes to help aspirants test their understanding of current affairs.

Edukemy's UPSC Daily Current Affairs can be accessed through:

- UPSC Daily Current Affairs can be accessed through Current Affairs tab at the top of the Main Page of Edukemy.

- Edukemy Mobile app: The Daily Current Affairs can also be access through Edukemy Mobile App.

- Social media: Follow Edukemy’s official social media accounts or pages that provide UPSC Daily Current Affairs updates, including Facebook, Twitter, or Telegram channels.