Tuesday, 6th July 2021

Freight Smart Cities

In News

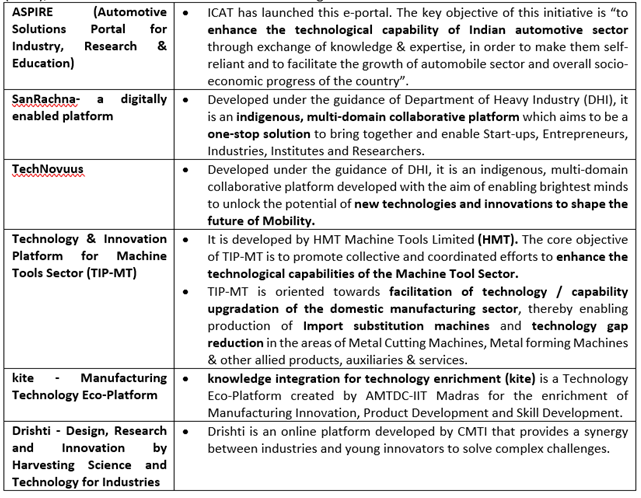

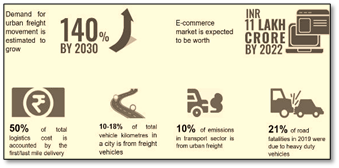

The commerce ministry unveiled plans for freight smart cities to improve urban freight efficiency, and create an opportunity for reduction in the logistics costs.

About the Freight Smart Cities initiative

- Aim: Government is envisioning the “75 Freight Smart Cities – India at 75” Initiative. The initiative aims to support 75 Indian cities in achieving freight smart status.

- Logistics Committees: Will create an enabling environment for the formulation, implementation and monitoring progress of City Logistics Plans.

- Identification of Ten Cities: The State Governments would identify ten cities, to begin with, to be developed as Freight Smart Cities and also to set up institutional mechanism for the same involving. From the ten cities to be identified on immediate basis, it is planned to expand the list to 75 cities in the next phase.

- State- Level work: The States/City Governments to focus on the quick-wins like developing peri-urban freight centres, night-time deliveries, developing truck routes, using Intelligent Transportation Systems & modern technologies, promoting electrification of urban freight, etc.

- Benefits: Efficiency improvements in freight movement can affect the economic competitiveness of a city, while providing opportunity to lower emissions, improve public health, road safety and traffic flow, and create jobs within the city. At a national scale, the initiative has the potential to improve India’s rank in the Logistics Performance Index (LPI)

Need for Freight Smart Cities

Sources: http://ittek.in/freightsmartcities/about.html#features

NIPUN Bharat Programme

In News

Union Minister for Education virtually launched a National Initiative for Proficiency in Reading with Understanding and Numeracy (NIPUN Bharat).

About the News

- The vision of the Mission is to create an enabling environment to ensure universal acquisition of foundational literacy and numeracy (FLN), so that by 2026-27 every child achieves the desired learning competencies in reading, writing and numeracy at the end of Grade 3 and not later than Grade 5

- The Mission has been launched under the aegis of the centrally sponsored scheme of Samagra Shiksha Abhiyan and is in line with the National Education Policy 2020.

- Current Status: According to the Annual Status of Education Report (ASER) released in January 2020, at least 25% of school children in the four-eight age group do not have age-appropriate cognitive and numeracy skills.

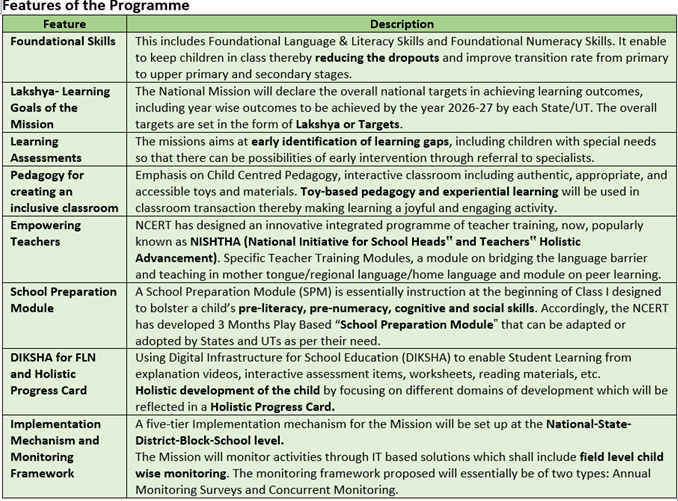

Features of the Programme

Sources: https://static.pib.gov.in/WriteReadData/specificdocs/documents/2021/jul/doc20217531.pdf

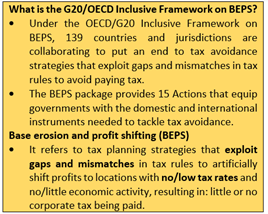

The G20/OECD Inclusive Framework

In News

India joined the G20-OECD inclusive framework deal that seeks to reform international tax rules

About the News

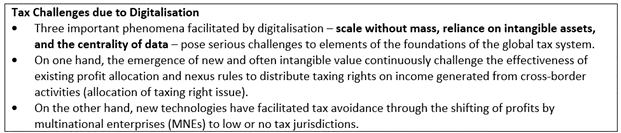

- India and majority members of the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting adopted a high-level statement outlining a consensus solution to address tax challenges arising from the digitalisation of the economy.

- The OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting (IF) has agreed a two-pillar solution to address the tax challenges arising from the digitalisation of the economy. A detailed implementation plan together with remaining issues will be finalised by October 2021.

- A total of 130 countries on agreed to an overhaul of global tax norms to ensure multinationals pay taxes wherever they operate and at a minimum 15% rate.

The two-pillar solution to address the tax challenges arising from the digitalisation of the economy

- Pillar One: It intends to expand the taxing rights of market jurisdictions (which, for some business models, is the jurisdiction where the user is located) where there is an active and sustained participation of a business in the economy of that jurisdiction through activities in, or remotely directed at, that jurisdiction.

- It also aims to significantly improve tax certainty by introducing innovative dispute prevention and resolution mechanisms.

- Pillar Two addresses remaining BEPS challenges and is designed to ensure that large internationally operating businesses pay a minimum level of tax regardless of where they are headquartered or the jurisdictions they operate in. It does so via a number of interlocking rules that seek to (i) ensure minimum taxation while avoiding double taxation or taxation where there is no economic profit, (ii) cope with different tax system designs by jurisdictions as well as different operating models by businesses, (iii) ensure transparency and a level playing field, and (iv) minimise administrative and compliance costs.

- The subject to tax rule (STTR) is a treaty-based rule that targets risks to source countries posed by BEPS structures relating to intragroup payments that take advantage of low nominal rates of taxation in the other contracting jurisdiction (that is the jurisdiction of the payee).

Potential Impact of the Pillars

- Effect of the proposals on tax revenues:

- Increase in tax revenues: They could increase global corporate income tax (CIT) revenues by about USD 50-80 billion per year. The exact gains could differ as they would depend on the final design and parameters of the Pillars, the extent of their implementation, the nature and scale of reactions by MNEs and governments, and future economic developments.

- Taxing Rights: Pillar One would involve a significant change to the way taxing rights are allocated among jurisdictions, as taxing rights on about USD 100 billion of profit could be reallocated to market jurisdictions. With regards to India, this outcome will have quantitative benefits since it will ensure India gets its fair share of corporate tax on earnings from massive market it provides to MNEs.

- Level Playing Field: Pillar Two would significantly reduce the incentives for MNEs to shift profits to low-tax jurisdictions, which would generate revenue gains in addition to the direct gains collected through the minimum tax itself. A global Min tax rule will ensure level playing field for countries like India that offers massive market for MNEs without providing a tax safe harbour

- Effect of the proposals on investment:

- Investment Variables: The proposals aim to increase tax certainty and could enhance the efficiency of global capital allocation by increasing the importance of non-tax factors (e.g. infrastructure, education levels or labour costs) in investment decisions.

- Low Negative impact: The two Pillars would lead to a relatively small increase in the average (post-tax) investment costs of MNEs. The ensuing negative effect on global investment is estimated to be very small, as the proposals would mostly affect highly profitable MNEs whose investment is less sensitive to taxes.

What can be the possible challenges to the Framework?

- Exemption Debate: Even before the framework can come into being, talks about exemptions from the consensus have been gathering pace. Countries like the UK, China are seeking exemptions for R&D, airline, shipping companies. According to experts, exemptions will define the shape the final global tax negotiations will undertake. In light of the consensus, India has raised two concerns: share of profit allocation and scope of subject to tax rules.

- Consensus on the Global tax rate: The 15 percent rate agreed is well below the UN Financial Accountability, Transparency and Integrity (FACTI) Panel recommendation, which called for a 20- to 30-percent global corporate tax on profits. The G7 and EU may gain more than two-thirds of new revenues that a global minimum corporate tax rate of 15 percent will yield. The world’s poorest countries will recover less than 3 percent, as they employ relatively low tax regime to attract MNCs.

- A 25 percent global minimum corporate tax rate would raise nearly $17 billion more for the world’s 38 poorest countries (for which data is available) than a 15 percent rate.

- Resistance from big MNCs: The framework is likely to face resistance from digital companies like Google & Amazon, who will have to pay higher taxes.

Conclusion

The tax deal seeks to address the concerns of both developed and developing countries regarding corporate taxes. The solution should result in allocation of meaningful and sustainable revenue to market jurisdictions, particularly for developing and emerging economies. The consensus would quicken ongoing efforts to reset the almost century-old international tax rules. But there is a conflict, on the one hand countries are looking at reallocation of taxing rights, MNCs on the other side want the certainty of taxes, and not any tax litigation. How will that consensus emerge will be very interesting to look at.

Model Question: Throw some light on the G20-OECD inclusive framework deal that India has recently joined. Examine the potential impact of this deal.

Sources: https://www.oecd.org/tax/beps/beps-actions/action1/

https://www.oecd.org/tax/beps/about/#mission-impact

Secondary Sources: https://www.bdo.global/en-gb/services/tax/taxation-of-the-digital-economy

https://iccwbo.org/publication/icc-comments-on-oecd-pillar-2-public-consultation-document/

This day in History - Shyama Prasad Mukherjee

On July 6th, Shyama Prasad Mukherjee was born. He was a barrister, an academician and a politician. At 33, he became the youngest Vice-Chancellor of the University of Calcutta and held office till 1938. Shyama Prasad Mukherjee was part of Minister for Industry and Supply in Prime Minister Jawaharlal Nehru's cabinet from 1947-1950. Shyama Prasad Mukherjee founded the Bharatiya Jana Sangh in 1951, which is a predecessor to the Bharatiya Janata Party (BJP).

Image of the Day – Solar Flare

This is image of the enormous solar flare, which appeared overnight, and disappeared even faster, can be seen emerging from the sun's upper right limb. The solar flare was classified as an X-1 class sun event. The categorisation of solar flares includes A, B, C, M or X--A being the smallest and X being the brightest and largest. A solar flare is an intense burst of radiation coming from the release of magnetic energy associated with sunspots. The primary method of monitoring flares is in x-rays and optical light. Besides, flares are sites where particles, including electrons, protons, and heavier particles are accelerated.

Project BOLD

- Context: Khadi and Village Industries Commission (KVIC) has launched a project named Bamboo Oasis on Lands in Drought (BOLD).

- Under the project 5000 saplings of special bamboo species – BambusaTulda and Bambusa Polymorpha from Assam have been planted over 16 acres of vacant arid Gram Panchayat land of village NichlaMandwa in Rajasthan.

- It is the first of its kind exercise in India. It seeks to create bamboo-based green patches in arid and semi-arid land zones.

- It has been launched as part of KVIC’s “Khadi Bamboo Festival” to celebrate 75 years of independence “Azadi ka Amrit Mahotsav”.

Picture source: https://english.lokmat.com/politics/khadi-project-bold-to-boost-tribal-income/

Harit Dhara

- Context: Indian Council of Agricultural Research (ICAR) has developed an anti-methanogenic feed supplement ‘Harit Dhara’ (HD).

- HD when given to bovines and sheep, not only cuts down their methane emissions by 17-20%, but also results in higher milk production and body weight gain.

- HD acts by decreasing the population of protozoa microbes in the rumen (stomach compartment), responsible for hydrogen production and making it available to the archaea (microorganisms similar to bacteria) for reduction of CO2 to methane.

- HD has been prepared using tannin-rich plant-based sources. Tropical plants containing tannins, bitter and astringent chemical compounds, are known to suppress or remove protozoa from the rumen.

Special Purpose Acquisition Companies (SPACs)

- Context: SPACs set up by Indian Sponsors are expected to raise close to $ 1 bn through Initial Public Offering (IPO) in US stock market.

- Special Purpose Acquisition Companies, or SPACs, are listed shell companies created with the sole purpose to acquire unlisted or private companies and then merge with the latter.

- SPACs don’t have business operations or any revenue of their own but are created to raise capital through Initial Public Offering (IPO).

- SPACs are currently not allowed to raise capital through IPO in India.

Primary source: https://www.business-standard.com/article/markets/decoded-what-is-spac-and-is-it-the-real-thing-or-a-misplaced-hype-121031101378_1.html

Picture source: https://washingtonindependent.com/everything-you-need-to-know-about-special-purpose-acquisition-company/

The evolution of India’s pragmatic policy on foreign aid - HT

Essence: Editorial is presenting analysis on India’s policy on foreign aid. Since Independence, India has had a love-hate relationship with accepting foreign aid. Till about 2003, it was clear that India needed aid but could not dictate terms with the donor. After 2003, India made it clear that it would no longer accept tied aid. Countries can route their assistance through non-governmental organisations (NGOs), the United Nations (UN) and multilateral institutions. These continue to be preferred even today.

In March 2008, a position paper prepared by department of economic affairs set out the fundamental parameters of India’s policy on receiving foreign aid. Mentioning that, India was no longer reliant on external assistance or foreign aid for financing its plan outlays or for gross capital formation, not accepting aid in areas where it had substantial control, because of debt servicing concerns & the idea is to gradually reduce dependence on foreign aid.

Why you should read this article?

- To understand the evolution of India’s policy on foreign aid & its underlying reason.

- To know about tied aid & how it hamper India’s sovereignty.

- To understand the present status of India’s way of accepting aid.

Leaders need to display both grit and grace to beat the crisis- Hindu BusinessLine

Essence: How did Covid get the better of us? One insight provided by WHO’s Independent Panel for Pandemic Preparedness and Response, is that this crisis is the result of a colossal leadership failure. This article highlights the importance of Leadership in effectively managing the crisis and list out the characteristic features which are essential to get things done.

Why you should read this article?

- Understand the importance of leadership in effective crisis management.

- Identify the important traits of leadership such as grit and grace, agility, a high level of resilience, communication skills, empathy, investing in meaningful relationships and leveraging social capital, and credibility.

Link - https://www.thehindubusinessline.com/opinion/leadership-during-covid-times/article35154874.ece

Zoonotic diseases: A neglected public and planetary health frontier - HT

Essence: This article is written in backdrop of scale and spread of zoonotic diseases every year resulting in socio- economic disruption like recently done by COVID-19. 75% of infectious diseases comes under category of Emerging Infection Diseases, against which neither we nor our immune system are fully prepared. Despite repeated warnings about the possibility of zoonotic diseases causing large scale disruptions in human lives and activities, it is unfortunate that a problem of such devastating potential has so far failed to elicit the required support from policymakers and resource allocators. According to several studies, increased incidences of zoonotic diseases in recent times are a direct consequence of the ongoing abuse of nature. Hence, if we need a comprehensive approach, recognized as One-Health, to target all our preparedness and responses and also, need to start repairing our fractured relationship with nature to minimise the risk of future pandemics.

Why should you read this article?

- To get an overview of how zoonotic diseases have impacted humankind since the beginning of its association with animals.

- To understand the reasons for increase in scale and spread of the same.

- To know what possible steps should be taken to minimise the risk of future pandemics and mitigate its impact.

Innovative example to combat desertification: Eriteria

Background

- A social leader in Eriteria has combatted desertification on rugged terrain and converted it into an oasis with different agricultural products.

Methods deployed

- Check dam: Methods like levelling of land and check dams were deployed to conserve soil and water.

- Innovative usage of land: Breaking the hillsides into series of strips of land using bench terraces and planting around 10,000 seedlings of trees in the upper catchment.

- Underground recharge of water via construction of water retention structures which also increased the yield of the wells downstream.

- Better distribution of water: Engineering structures like pumping mechanisms were used to distribute water to the different plots of land.

Lesson to be learnt

- With increasing issues like land degradation and desertification of land in India, it is important to learn from the global best practises to combat desertification

Things to link with the concept

- Bonn Challenge, UNCCD’s effort to combat desertification

Share the article

Get Latest Updates on Offers, Event dates, and free Mentorship sessions.

Get in touch with our Expert Academic Counsellors 👋

FAQs

UPSC Daily Current Affairs focuses on learning current events on a daily basis. An aspirant needs to study regular and updated information about current events, news, and relevant topics that are important for UPSC aspirants. It covers national and international affairs, government policies, socio-economic issues, science and technology advancements, and more.

UPSC Daily Current Affairs provides aspirants with a concise and comprehensive overview of the latest happenings and developments across various fields. It helps aspirants stay updated with current affairs and provides them with valuable insights and analysis, which are essential for answering questions in the UPSC examinations. It enhances their knowledge, analytical skills, and ability to connect current affairs with the UPSC syllabus.

UPSC Daily Current Affairs covers a wide range of topics, including politics, economics, science and technology, environment, social issues, governance, international relations, and more. It offers news summaries, in-depth analyses, editorials, opinion pieces, and relevant study materials. It also provides practice questions and quizzes to help aspirants test their understanding of current affairs.

Edukemy's UPSC Daily Current Affairs can be accessed through:

- UPSC Daily Current Affairs can be accessed through Current Affairs tab at the top of the Main Page of Edukemy.

- Edukemy Mobile app: The Daily Current Affairs can also be access through Edukemy Mobile App.

- Social media: Follow Edukemy’s official social media accounts or pages that provide UPSC Daily Current Affairs updates, including Facebook, Twitter, or Telegram channels.