Thursday, 20th May 2021

ISRO plans for nuclear energy use in space

In News

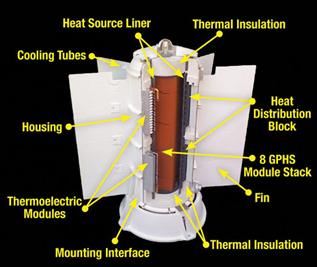

ISRO has recently invited proposals for the three-phase development of a 100-Watt Radioisotope Thermoelectric Generator (RTG). ISRO envisions using RTG for power generation and thermal management of ISRO’s deep space missions.

Radioisotope Thermoelectric Generator

Principles Relevant to the Use of Nuclear Power Sources In Outer SpaceThe following principles have been recognized ● Missions in outer space require the use of nuclear power due to their compactness and long life. ● Missions should focus on those applications that take advantage of the particular properties of nuclear power sources. ● It should be based on thorough safety assessment, probabilistic risk analysis with particular emphasis on reducing the risk of accidental exposure of the public to harmful radiation or radioactive material. |

Benefits of the use of nuclear energy for space missions

- Reliability and low maintenance: RTGs provide power by using thermocouples to convert thermal energy generated by the natural decay of radioactive isotopes into electrical energy. They are highly reliable and maintenance-free as the absence of moving parts in thermocouples reduces the chances of failure and wear out.

- Fuel efficient: Nuclear-propelled rockets are more fuel efficient and lighter than chemical rockets.

- Futuristic and alternative source: Nuclear or radioactive energy can be employed both as an alternative to and complement of other sources of energy. RTG’s are an alternative to solar power as solar power is not an option for space objects meant to operate on the dark sides of planets where sunlight is obscured.

- Complementing existing technology: Current research in the field is focused on developing radioisotope thermoelectric systems, which can provide thrust for interplanetary travel thereby complementing the chemical rocket thrusters that launch the spacecraft beyond low earth orbit.

Challenges regarding the use of nuclear energy

- Budget constraints: The budget constraints, complicated designs, and progress in alternative sources of energy have delayed the use of nuclear energy for space related projects.

- Safety challenge: Nuclear space reactors stir controversy due to the inherent safety challenges. There is a risk of radioactive contamination, with a rocket explosion, disintegration, or re-entrance into the atmosphere.

Sources:

https://www.orfonline.org/expert-speak/isro-plans-for-nuclear-energy-use-in-space/

https://defenceview.in/isro-plans-for-nuclear-energy-use-in-space/

SEBI Proposes Framework for Gold Exchange

In News: The Securities & Exchange Board of India (SEBI) has floated a consultation paper on the proposed framework for Gold Exchange in India.

What is Gold Exchange?

- Gold exchange is a platform that offers trading facilities in the precious metal.

- Entities like retail investors, banks, foreign portfolio investors (FPIs), jewelers and bullion dealers among others would be allowed to trade on the exchange.

- While existing commodity exchanges offer trading in gold contracts, they are derivative instruments. The proposed gold exchange would allow trading similar to the spot market (spot exchangeis where financial instruments (commodities, currencies, and securities) are traded for immediate delivery).

How can one trade on Gold Exchange?

- SEBI has proposed an instrument called Electronic Gold Receipt (EGR).

- The gold exchange, along with intermediaries like the vault manager and the clearing corporation, would facilitate the creation of EGR and its trading.

- Participants can convert their physical gold into EGR, which can then be bought or sold on the exchange like any normal equity share of a listed company.

- As part of the draft regulations, SEBI has proposed three denominations of EGR – 1 kg, 100 gm and 50gm. EGRs of 5gm or 10 gm can also be allowed for trading to increase the liquidity of the market and attract more participants.

How can one convert physical gold into EGRs?

- An entity that intends to convert physical gold into EGR will have to go to a Vault Manager.

- Any entity registered in India and with a net worth of at least Rs 50 crore can apply to become a vault manager.

- After the receipt of the gold, the vault manager would create an EGR for which the depository will assign an International Securities Identification Number (ISIN), a unique code to identify the specific security.

- Once the ISIN is issued, the EGR can be traded on the gold exchange just like any other tradable security.

Can EGRs be again converted into physical gold?

- To convert an EGR into physical gold, the owner of the EGR will have to surrender the EGR to the vault manager who will deliver the gold.

- Considering the logistics and delivery challenges, it has been proposed that conversion of an EGR into physical gold should be allowed only if a minimum of 50 grams of gold has been accumulated in electronic form.

Reason for Creating Separate Exchange for Gold:

- To create a vibrant gold ecosystem in Indiawhich is commensurate with its large share of global gold consumption.

- Indiais the second largest consumer of gold globally, after China with annual gold demand of approximately 800-900 tonnes and holds an important position in the global markets.

- The objective behind setting up gold exchanges is for India to have a better price discovery mechanism system for gold as a commodity.

- Setting up a new stock spot gold exchange has advantagessuch as maintaining delivery standard, reduced market fragmentation, improved liquidity, and single reference price.

India’s earlier efforts to mobilize Gold:

- Gold Monetisation Scheme: The scheme aims to mobilize the unused gold lying idle in the households and to reduce the current account deficit due to import of gold.

- Sovereign Gold Bond Scheme: Sovereign Gold Bonds are government securities denominated in grams of gold. They are substitutes for holding physical gold. The scheme was launched with an objective to reduce the demand and import for physical gold.

Primary source: https://www.business-standard.com/article/markets/sebi-proposes-framework-for-gold-exchange-suggests-electronic-receipts-121051701142_1.html

E-way bill integrated with FasTag, RFID

In News

In a move which will help curb tax evasion, GST authorities will now be able to track real-time data of commercial vehicle (CV) movement on highways by integration of the e-way bill (EWB) system with FASTag and RFID.

About the News

- Integration: GST officers have been armed with real-time data of commercial vehicle movement on highways with integration of the e-way bill (EWB) system with FasTag and RFID.

- Mechanism: A transporter is required to have a RFID tag in his vehicle and details of the e-way bill generated for goods being carried by the vehicle uploaded into the RFID.

- When the vehicle passes the RFID Tag reader on the highway, the details fed into the device get uploaded on the government portal.

- The information is later used by the revenue officials to validate the supplies made by a GST registered person.

Advantages of the Integration:

- Live vigilance: It will enable tax officers to undertake live vigilance in respect of e-way bill compliances by businesses and will aid in preventing revenue leakage.

- Reports within minutes: Taxmen can now access reports on vehicles that have passed the selected tolls without e-way bills in the past few minutes. Also, the vehicles carrying critical commodities specific to the state and have passed the selected toll can be viewed.

- Effective Vigilance: The officers can use of these reports while conducting vigilance and make the vigilance activity more effective. Also, the officers of audit and enforcement wing can use these reports to identify the fraudulent transactions like bill trading, recycling of EWBs.

What is the Electronic or e-way bill system?

- Under the Goods and Services Tax (GST) regime, EWBs are mandatory for inter-state transportation of goods valued over Rs 50,000 from April 2018, with the exemption to precious items such as gold.

- In the electronic way (e-way) bill system, businesses and transporters have to produce before a GST inspector the e-way bill. On an average, 25 lakh goods vehicle movements from more than 800 tolls are reported on a daily basis to the e-way bill system.

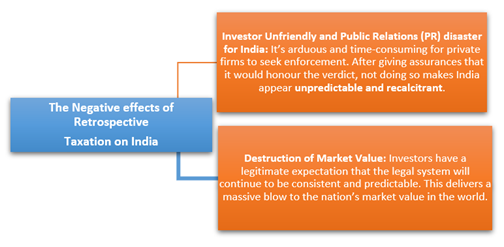

Retrospective Taxation

In News

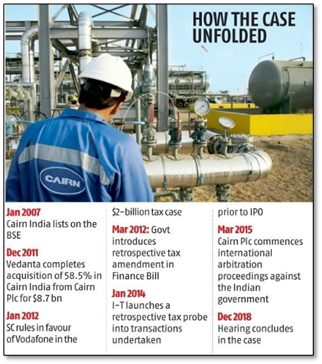

British oil company Cairn Energy Plc is suing Air India in New York to seize its assets to enforce the $1.2 billion arbitration award it won against the Indian government in a retrospective tax dispute.

About the News

- Cairn’s action: Cairn Energy has attached Air India’s assets in the US to enforce a $1.7 billion arbitration award (including $500 million of interest) it won in a tax dispute against India.

- The Arbitration: In December 2020, the international arbitral tribunal had ruled unanimously that the Indian government was “in breach of the guarantee of fair and equitable treatment” which was against the India-UK bilateral treaty and that the breach caused a loss to the British energy company. It awarded Cairn $1.2 billion in compensation that India was liable to pay.

- Background: The tax demand relates to a transaction way back in 2007, when Cairn Energy had transferred its oil assets in India to a company that was independently incorporated in the country and got listed in its bourses. While Cairn Energy termed the transaction as part of an internal reorganisation process, the Indian tax authorities claimed that it had resulted in capital gains for the British parent. The tax demand was slapped in 2015.

- Bilateral investment treaties: First Vodafone and then Cairn Energy Plc have won arbitration cases in international tribunals, for violation of bilateral investment treaties. Both the cases have been challenged by the government, which has argued that taxation is the sovereign right of Parliament and is not dictated by commitments under investment agreements.

What is Retrospective taxation?

- Retrospective taxation allows a country to pass a rule on taxing certain products, items or services and deals and charge companies from a time behind the date on which the law is passed.

- Countries use this route to correct any anomalies in their taxation policies that have, in the past, allowed companies to take advantage of such loopholes. While governments often use a retrospective amendment to taxation laws to “clarify” existing laws, it ends up hurting companies that had knowingly or unknowingly interpreted the tax rules differently.

- Apart from India, many countries including the US, the UK, the Netherlands, Canada, Belgium, Australia and Italy have retrospectively taxed companies, which had taken the benefit of loopholes in the previous law.

What has been the trend in India w.r.t. Retrospective amendments of taxes?

- The retrospective tax amendments have backfired: The collection in revenue under the amendments was zero, and losses in terms of foreign direct investment and foreign institutional investors (FII) were substantial. However, the government refused to withdraw the retrospective amendments and promised to not raise any further demands under the amendments.

- Lack of consistency in India’s tax policy-making: It is visible in applicability of the Minimum Alternative Tax (MAT). In 2015, FIIs, by virtue of having bank accounts in India, received notices for MAT, which led to an exodus of FIIs in August 2015. Constrained by the exodus, amendments were made to exempt FIIs from MAT prospectively. But confusion regarding applicability of MAT to FIIs prior to 2015-16 persisted. The whole saga left a bitter aftertaste in the mouths of foreign investors.

- India’s reaction to international awards has always been reactionary: The recent amendments to the Arbitration and Conciliation Act, 1996, mandate a court to grant unconditional stay on enforcement of an arbitral award if a case of fraud or corruption has been made out in either the making of (a) award; or (b) in the underlying agreement that forms basis of the arbitral award. As the amendments are retrospective in nature, they appear reactive to the Devas award against India, in which its allegation of fraud was rejected by the Permanent Court of Arbitration. Such amendments raise fears of legal uncertainty.

Way Forward

- Improve on Retrospective taxation: Retrospective taxation has the undesirable effect of creating major uncertainties in the business environment and constituting a significant disincentive for persons who wish to do business in India. While the legal powers of a government extend to giving retrospective effect to taxation proposals, it might not pass the test of certainty and continuity. The government must act fairly and, in a manner, to ensure India has a stable and predictable legal environment.

- The Vivad Se Vishwas mechanism: There is a Vivad Se Vishwas scheme for dispute resolution and reducing pending litigation with respect to direct taxes. The same mechanism can well be used to settle, once and for all, not just with Cairn Energy, but all Vodafone-like cases.

Primary Sources: https://indianexpress.com/article/explained/cairn-energy-air-india-dispute-explained-7319804/

https://thediplomat.com/2021/01/the-unending-saga-of-indias-retrospective-tax-debacle/

Secondary Sources: https://www.business-standard.com/article/companies/india-loses-cairn-case-in-arbitration-asked-to-pay-rs-8-000-cr-in-damages-120122300289_1.html

This Day in History- NASA's Hubble Space Telescope took its first photo

On May 20, 1990, NASA's Hubble Space Telescope took its first photo. The Hubble photo is on right in the above composite image, while on the left is a picture of the same region of sky captured by the 100-inch telescope at Las Campanas Observatory in Chile. Hubble's photo is considerably sharper than the ground-based image. Mission scientists soon discovered that the telescope was launched with a flaw in its 7.9-foot-wide (2.4 meters) primary mirror. Later astronauts fixed the problem in 1993, giving Hubble the supersharp vision it is known for today. Between 1997 and 2009, Hubble was further repaired and upgraded, which is still returning and helping astronomers solve cosmic mysteries.

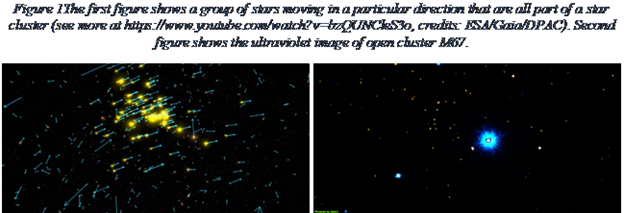

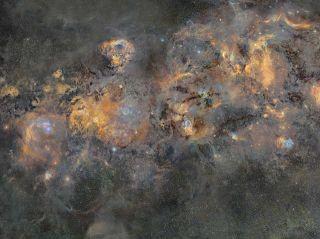

Image of the Day- Milky Way

This is a section of the 1.7-gigapixel image of the Milky Way created by Finnish astrophotographer. The astrophotographer spent 1,250 hours over the course of about 12 years creating a single image of the entire Milky Way galaxy. The image contains picture of the California Nebula, Bubble Nebula, Cave Nebula (Closest to earth), the Elephant's Trunk Nebula which is a concentration of interstellar gas and dust, and the Cygnus constellations which contains one of the brightest stars in the night sky called Deneb.

Creating a new district

Context: Malerkotla has been declared the 23rd district of Punjab.

- The power to create new districts or alter or abolish existing districts rests with the State government. This can either be done through an executive order or by passing a law in the State Assembly.

- States opine that smaller districts help in better administration and governance. For example, in 2016, the Assam government issued a notification to upgrade the Majuli sub-division to Majuli district for “administrative expediency”.

- The Centre has no role to play in the alteration of districts or creation of new ones. The Home Ministry comes into the picture when a state wants to change the name of a district or a railway station.

Primary source: https://www.thehindu.com/news/national/other-states/explained-the-why-and-how-of-creating-a-new-district/article34576952.ece

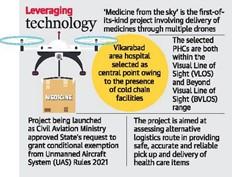

Medicine from the Sky Project

- Context: Telangana government has selected 16 PHCs for pilot testing the ambitious ‘Medicine from the sky’.

- To ensure healthcare equity especially in rural areas, the project involves delivery of medicines through multiple drones.

- The project is aimed at mapping the alternative logistics route network in providingsafe, accurate and reliable pickup and delivery of health care items like medicines, Covid-19 vaccines, units of blood and other lifesaving equipment from the distribution centre to specific locations.

- The collaborators include Telangana government, World Economic Forum and HealthNet Global.

Primary source: https://www.thehindu.com/news/national/telangana/medicine-from-the-sky-pilot-at-vikarabad-area-hospital/article34590408.ece

Picture source: https://www.thehindu.com/news/national/telangana/1z07ps/article34590423.ece/alternates/FREE_615/hy19dronecol

US Global Entry Program

Context: Over 9,000 Indians’ details checked for U.S. entry scheme.

- Global Entryis a US Customs and Border Protection (CBP) program that allows speedy clearance for low-risk travelers upon their arrival in the US.

- Though the pilot project started in 2008, India became a member of Global Entry in 2017.

- The travelers are pre-approved for the program after a rigorous background check from both USA and parent country.

- The Crime and Criminal Tracking Network and Systems (CCTNS)is used for antecedent verification.

Primary source: https://www.thehindu.com/news/international/us-global-entry-program-over-9000-indians-past-checked-in-last-2-years/article34588322.ece

International Council of Museums

- Context: International Museum Day is observed on 18thMay to raise awareness among people about the museums.

- International Council of Museums (ICOM) is an association of organizationswhich establishes professional and ethical standards for museum activities. It was created in 1946 and is headquartered in Paris, France. It serves as a network of museum professionals around the world.

- The ICOM Red List of Cultural Objects at Riskis a practical tool to curb the illegal traffic of cultural objects (Red Lists present the categories of cultural objects that can be subjected to theft and traffic).

- The theme for International Museum Day 2021 is ‘The Future of Museums: Recover and Reimagine’.

Primary source: https://icom.museum/en/about-us/

Rework social security code for informal workers- HBL

Essence: The Code on Social Security 2020 (SS Code) was passed in Parliament in September 2020 and obtained presidential assent. Its implementation has been postponed due to States not issuing notifications. Now, due to the Covid crisis, implementation of all the four new Codes on labour is to be postponed to next year. This article discusses the problems and ambiguities that remain in the SS code.

Why you should read this article?

- Know about the existing labour laws which will be merged under SS Code

- Learn about the lacunae and ambiguities in the SS code such as absence of universal social security, lack of clarity between self-employed and gig workers, dual authority of Centre and State for an individual unorganised worker, limited scope of proposed Central Board, among others.

Article Link: https://www.thehindubusinessline.com/opinion/rework-social-security-code-for-informal-workers/article34599616.ece

The basics of an effective vaccine policy- TH

Essence- As it appears that COVID-19 is not going away any time soon, vaccination seems to be the only solution to protect people from severe infection. Due to shortage of vaccines because of several reasons, India is facing an unpleasant reality of to whom to priorities for vaccinating its population. But issue of vaccine hesitancy seen in people which need to be addressed by behavioral scientists to ensure population is covered. India needs to design its vaccine policy carefully because breaking the chain of transmission is not an option currently as repeated lockdowns only slow down the spread of the virus for a period but the virus surfaces again once lockdown is lifted. But now the government must take it upon itself to enhance the supply and formulate a transparent logical policy that are based on science, in order to allocate the resource so that trust in governance and social harmony remain maintained.

Why you should read this article?

- To get an overview of challenges related to vaccination in India and how it can be overcome.

- To understand the need of logical and science-based vaccination policy which need to work on.

Article Link: https://www.thehindu.com/opinion/op-ed/the-basics-of-an-effective-vaccine-policy/article34600357.ece

Compassionate Kozhikode

- Kozhikode District Collector Prashant Nair mobilised youth to come forward and contribute their time at local mental health centre and to implement the various projects like 'Operation Sulaimani' under 'Compassionate Kozhikode' to help fellow citizens.

'Operation Sulaimani'

- It was launched in association with the hotels and restaurants with an aim at providing meals to the hungry in Kozhikode.

- It also includes offering a plate of Kozhikode Biryani in exchange for volunteering to clean a pond.

- It aims to make Kozhikode hunger free and compassionate with the tag line: "How disproportionately fortunate are we?! Shall we share our fortunes...?”

- 'Compassionate Kozhikode' has been selected one of the 50 most inspirational projects from around the world. It was the only project from India at the international world travel trade fair.

Values Upheld:

- Altruism, Antodaya concept given by Mahatma Gandhi, Compassion, Selflessness as given by Nolan Committee

Where can we us this case study:

- Contribution of civil servants towards public welfare, Foundational Values for Civil Services, Ethics in Public Administration.

Share the article

Get Latest Updates on Offers, Event dates, and free Mentorship sessions.

Get in touch with our Expert Academic Counsellors 👋

FAQs

UPSC Daily Current Affairs focuses on learning current events on a daily basis. An aspirant needs to study regular and updated information about current events, news, and relevant topics that are important for UPSC aspirants. It covers national and international affairs, government policies, socio-economic issues, science and technology advancements, and more.

UPSC Daily Current Affairs provides aspirants with a concise and comprehensive overview of the latest happenings and developments across various fields. It helps aspirants stay updated with current affairs and provides them with valuable insights and analysis, which are essential for answering questions in the UPSC examinations. It enhances their knowledge, analytical skills, and ability to connect current affairs with the UPSC syllabus.

UPSC Daily Current Affairs covers a wide range of topics, including politics, economics, science and technology, environment, social issues, governance, international relations, and more. It offers news summaries, in-depth analyses, editorials, opinion pieces, and relevant study materials. It also provides practice questions and quizzes to help aspirants test their understanding of current affairs.

Edukemy's UPSC Daily Current Affairs can be accessed through:

- UPSC Daily Current Affairs can be accessed through Current Affairs tab at the top of the Main Page of Edukemy.

- Edukemy Mobile app: The Daily Current Affairs can also be access through Edukemy Mobile App.

- Social media: Follow Edukemy’s official social media accounts or pages that provide UPSC Daily Current Affairs updates, including Facebook, Twitter, or Telegram channels.